As a marketer working in monetary providers, you understand that navigating financial institution social media accounts could be tough. Balancing compliance rules with artistic concepts for efficient content material advertising and marketing isn’t any small feat. It will get even trickier in case you’re managing a number of channels.

Fortuitously, we’ve acquired some useful tricks to make the job simpler. Whether or not you’re searching for new methods to interact prospects on Instagram, construct model consciousness on TikTok, or simply attempting to determine what tactic will work finest on Twitter, these seven ideas will assist you get began.

Bonus: Get the free social promoting information for monetary providers. Discover ways to generate and nurture leads and win enterprise utilizing social media.

Why social media is completely different for banks and credit score unions

Banking is a closely regulated trade. Your banking social media technique goes to wish a special contact from, say, a TikTok teen posting their mall haul.

As a marketer or social media supervisor who runs social media for a financial institution (or credit score union), there are some things you want to pay attention to. Most significantly, your content material and technique should meet federal rules. Or, relying on the place you’re working, the rules of your governing physique.

Monetary sector legal guidelines usually deal with the web as a advertising and marketing channel. This implies the whole lot out of your web site to your social media accounts should adjust to the advertising and marketing rules particular to your trade.

Stringent legal guidelines and rules are sufficient to consider. On high of that, as a social media marketer working in banking, you need to take into account social media-specific compliance and social technique as effectively.

Constructing a social media technique for banks and monetary establishments: 7 ideas

Constructing a social media advertising and marketing technique can usually really feel daunting for banks and monetary establishments. You must navigate the complexities of digital advertising and marketing. And create content material that resonates.

Listed here are just a few ideas that can assist you kick off your social media technique.

A platform that may assist you mitigate threat, save time, and keep organized? If that isn’t a simple sure, I don’t know what’s.

Utilizing one central, managed platform for your whole social media channels goes that can assist you function extra effectively and securely, centralize your compliance oversight, shield investor and shopper data, and make it simpler to your group to navigate your social channels.

In fact, we’re biased, however we might be remiss if we didn’t counsel Hootsuite to your monetary social media wants.

Hootsuite’s a preferred social media administration platform for extremely regulated industries, due to our operational efficiencies, sturdy ecosystem of accomplice apps, customized permissions and approval workflows, and complete compliance options.

Plus, Hootsuite is compliant with trade rules, together with FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, and MiFID II necessities.

E book a free Hootsuite demo at this time

2. Educate your inside group

Embrace a part in your technique devoted to educating your inside social media group in your trade’s rules and your personal social media tips.

In case your group members perceive what compliance appears like, they are going to be far much less prone to by chance submit one thing which will get you in hassle.

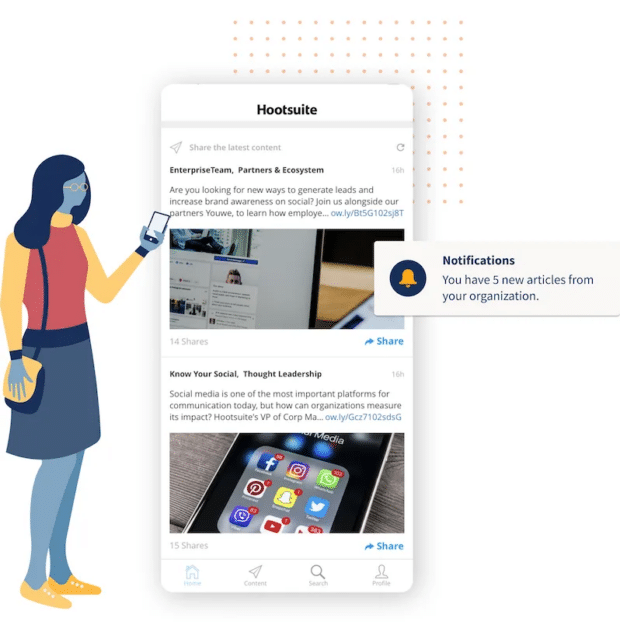

Hootsuite could make this simpler, too. Amplify, our worker advocacy platform, permits content material admins to push a gradual stream of pre-approved, curated content material that your staff can share to their very own social accounts.

Amplify’s an effective way to increase your group’s attain whereas decreasing threat with on-brand, compliant content material.

E book your free demo of Amplify by Hootsuite

A social media governance coverage lays out the principles of engagement for all staff. This generally is a doc outlining the entire ‘must know’ to your content material creators. It ought to align together with your tips for e-mail, textual content, and all different communications with purchasers and the general public. Your governance coverage will assist you function inside your trade’s rules.

Since social media administration is a part of the corporate’s total safety and compliance insurance policies, the chief data officer and chief threat officer could also be concerned in creating your social media governance coverage.

Hootsuite may even accomplice with you to ship customized social media governance coaching to your staff.

Social media promoting is a good equalizer, particularly for these within the monetary sector. You’re not restricted by space code, occasion invites, or every other space-driven barrier. You possibly can attain all individuals of all financial statuses who’ve entry to the platform.

This implies you may spearhead Variety, Fairness, and Inclusion (DE&I) initiatives that may attain all method of individuals. Maybe this can be a “Monetary Literacy for All” marketing campaign designed to stage the investing taking part in subject. Or perhaps you’ve observed you’re not reaching a sure demographic and so select to focus on them with a marketing campaign.

TD, for instance, executed a marketing campaign that used cricket, a preferred South Asian sport, to attach with a wider South Asian demographic.

DE&I initiatives will inherently assist you to remain compliant with (and even have a good time) rules like Regulation B, the Equal Credit score Alternative Act.

The Equal Credit score Alternative Act states that as a creditor, you could “affirmatively solicit or encourage members of historically deprived teams to use for credit score, particularly teams that may not usually search credit score from that creditor.” A correctly managed DE&I marketing campaign can do precisely that.

5. Create content material pillars related to your viewers

Creating content material pillars gives a strong basis to your technique. It offers you an thought of what your total web page ought to appear like and a place to begin for creation.

By centering in on themes that resonate together with your viewers, you’re offering tips that preserve your posts centered, artistic, and related.

It’s vital to have in mind the assorted platforms you employ when deciding which content material goes the place, comparable to informative how-tos or enjoyable polls.

If you wish to streamline the method even additional, arrange content material libraries stocked with pre-approved templates, media property, and ready-to-publish content material.

6. Arrange a verify system

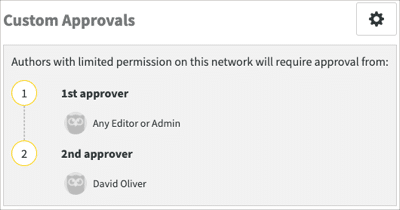

Having just one particular person accountable for creating and publishing social media content material is an efficient technique to make a mistake. Create a system the place individuals or groups are wanted to approve new posts, feedback, or replies earlier than they get revealed.

With Hootsuite, you may outline approval workflows for every of your social accounts, so nothing goes out the door with out first being checked by your compliance officers or an permitted member of your group.

You possibly can learn to do that by means of the Arrange an approval course of.

Supply: Hootsuite

7. Have a backup to your backup plan

Within the age of social media, having a monetary establishment with no disaster administration plan is like setting sail with no life raft: ill-advised and susceptible to catastrophe.

Making a disaster administration plan isn’t simply sensible; it’s important. It’s additionally good apply to have plans A, B, and even C, as you may by no means be fairly certain when Murphy’s Legislation would possibly rear its ugly head.

When coping with tough buyer inquiries or defamatory posts on social media, having a disaster administration plan will assist stop the damaging unfold of knowledge and reassure your prospects that their cash is in protected palms.

Nice methods to make use of social media for monetary establishments

Sure, there could also be a variety of guidelines in place, however that doesn’t imply there aren’t nonetheless a ton of how to entertain your viewers. Listed here are 5 methods you may inject some enjoyable into your financial institution or credit score union social media technique.

Have fun your viewers’s triumphs

Who doesn’t like to be celebrated? You possibly can shout out your viewers on their milestones or accomplishments. You are able to do this in just a few other ways.

If somebody tags your account in a celebration submit (like a profitable mortgage software!), ask for permission, then repost it. We’ll go over extra on user-generated content material (UGC) under.

You possibly can usually shout optimistic affirmations into the social media abyss, like Chime. Whereas this may increasingly indirectly affect buyer relationships, it would assist to form your model as a caring one.

It’s also possible to take a extra lively function in celebrating your viewers, just like the Royal Financial institution of Canada (RBC) did with The Black Atlantic Expertise.

The Black Atlantic Expertise shares the tales, challenges, and triumphs of a few of Atlantic Canada’s rising Black leaders. It celebrates the individuals on the middle of the tales’ narratives whereas exploring and addressing the problems they face, notably systemic and overt racism. By not shying away from heavy topics, these tales give extra energy to the themes’ triumphs.

Educate your viewers

Use your social media platform as a technique to elevate monetary literacy. You possibly can supply your followers a novel alternative to stage up their monetary methods. Provide precious recommendation and make it in order that staying up-to-date together with your posts may also help them to be higher knowledgeable.

You’ll need to present useful steerage about budgeting or saving for the long run in an easy-to-digest format. Take Chime, for instance. They created a brightly-designed carousel devoted to serving to you perceive your taxes.

Use UGC to assist your viewers really feel seen

Manufacturers all over the place capitalize on UGC to make audiences really feel seen. It has the additional advantage of implying social belief in your viewers. Earlier than you repost your viewers’s content material, be sure you ask for permission. It’s simply good manners.

Right now we participated within the ribbon slicing for the brand new US Financial institution situated in downtown Hamilton! Thanks for having us @usbank 💙 pic.twitter.com/KXDQBj9ABi

— Hamilton Excessive Cheer (@HHSBigBlueCheer) November 16, 2022

Don’t be afraid of humor

Let’s face it: Monetary content material could be dry. However that doesn’t imply your voice must be stiff {and professional}.

We will really feel your worry by means of the pc; you’re saying, “There isn’t a approach I’ll get approval to submit memes on my financial institution’s Twitter feed.” Don’t fear. We’re not telling you to make use of the platform for something off-brand.

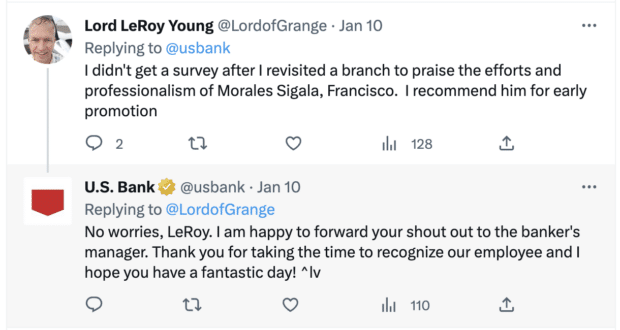

Apart from, if one thing looks like an excessive amount of to your model, then it’s most likely going to come back throughout as attempting too laborious. However there are such a lot of ranges of humor; you could be lighthearted with out sacrificing skilled integrity. Take the U.S. Financial institution on Twitter, for instance. They use gentle, family-friendly humor that doesn’t come throughout as an excessive amount of.

Look out Bob the Builder!😁 https://t.co/ce98DeI8a2

— U.S. Financial institution (@usbank) November 17, 2022

Now, take the Plum cash app on TikTok, for instance. They’ve a special (seemingly youthful) viewers and take a special tone than the U.S. Financial institution. Each are light-hearted however meant for various audiences.

@plumapp it takes minutes 👀

The takeaway right here is to know your viewers and your model, then adapt your social media voice to enchantment to each.

Interact together with your viewers

The attractive factor about social media is that it’s a two-way avenue. Individuals are reaching out to you who need to interact. Good customer support isn’t nearly fielding complaints, both. Being open and receptive to conversations humanizes your establishment and helps construct buyer loyalty.

Supply: U.S. Financial institution on Twitter

Hootsuite makes social advertising and marketing straightforward for monetary service professionals. From a single dashboard, you may handle all of your networks, drive income, present customer support, mitigate threat, and keep compliant. See the platform in motion.

E book a customized, no-pressure demo to see how Hootsuite helps monetary providers:

→ Drive income

→ Show ROI

→ Handle threat and stay compliant

→ Simplify social media advertising and marketing