Comparatively low shares of value promotions have been the norm till early this 12 months, however that won’t be a profitable technique for Black Friday 2022 or This fall normally. With sharp falls in demand, and no let-up within the strain on customers’ wallets, extra substantial promotions could push customers to spend greater than deliberate on and round Black Friday – however it isn’t the one issue I’d think about, having delved into present client drivers.

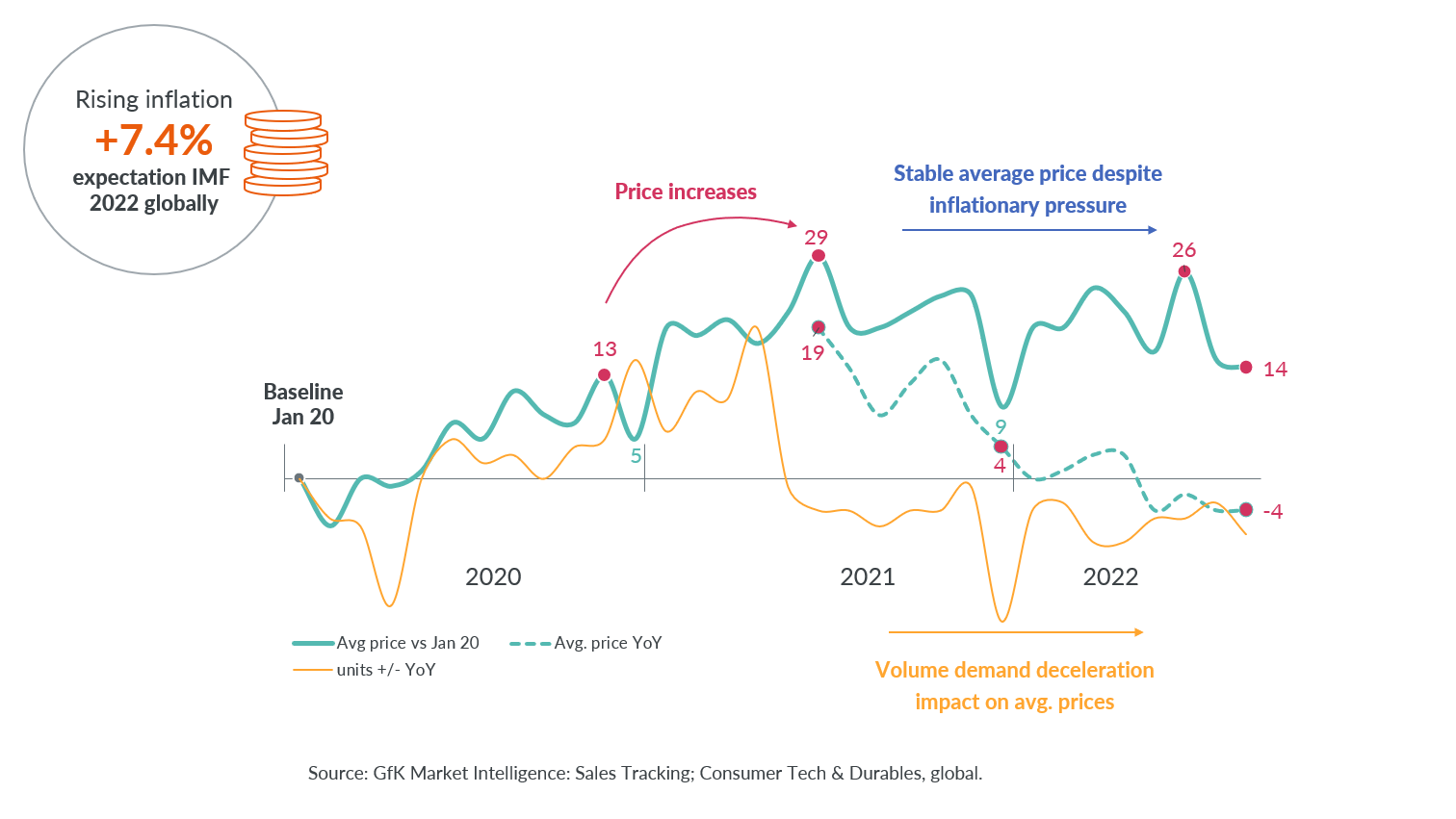

After a gradual rise in costs all through the final two years, 2022 has seen common costs (thought of in US {dollars}) maintain degree within the broad view – regardless of the impacts of inflation. This is because of a major drop within the quantity of demand seen since mid-2021.

Tech Shopper Items common value development (USD) and unit development 12 months on 12 months (versus January 2020)

As quickly as this grew to become seen, common value will increase halted, and like for like costs even declined. For instance, throughout main home home equipment, the typical value in USD on section degree decreased by 3% in August 2022 versus the earlier 12 months, whereas common TV costs throughout the primary half of the 12 months fell by 5% total, and 14% for 75+inch screens.

With elevated client value sensitivity fuelled by rising inflation and vitality price, retail has little room for value will increase. Consequently, producers are dealing with sturdy headwinds when aiming to offset rising prices of manufacture and supply.

Compounding this example, excessive inventory ranges in classes with significantly low quantity demand have compelled retailers into rising value promotions.

Outlook for Black Friday 2022 and This fall

Non-must-have (luxurious Small Home Home equipment (SDA), luxurious Main Home Home equipment (MDA), wearables, photograph) merchandise on this space are prone to see the strongest declines in total quantity gross sales, nevertheless, premium segments will proceed to promote in key markets.

Quantity gross sales might be beneath larger strain than common, because the mass market delay or cancel non-essential spending. Already 43% of individuals globally assume that now’s a greater to delay purchases that to make them (up 3.4 share factors in comparison with 2020). Nonetheless, premium merchandise in these classes will stay in demand. It’s because the standard premium patrons (excessive earnings) will stay comparatively unaffected by the rising price of residing and proceed their typical shopping for habits. In the event that they do scale back spend, they’ll flip to “inexpensive premium” – and that is prone to change into an rising matter as value sensitivity grows in 2023.

Necessities (Good Cellular Telephones, TVs, commonplace Main Home Home equipment, primary Small Home Home equipment) merchandise’ quantity gross sales are prone to be extra secure. Nonetheless, common costs might be beneath strain because the product combine suffers

Entry-price segments will change into extra related as lower-income purchasers scale back their spend, even on important objects, to remain inside a given and reducing budgets.

Some extent to notice is the particular scenario for IT and, to some extent, SDA. These have been the quickest rising segments for the reason that pandemic and so market saturation is now fairly excessive. Particularly for IT, which means that we don’t anticipate an uptick within the entry-price market in This fall, although IT is a “will need to have”, as the same old alternative demand is low because of latest market saturation.

What are the expectations for heavy reductions throughout peak gross sales season akin to Black Friday 2022?

It’s apparent that product teams which have skilled significantly weak demand over the previous months are most certainly to be discounted extra strongly – to filter inventories.

TVs are essentially the most outstanding class for this, with heavy strain to unload quantity through promotion affords. This pattern is already strongly seen within the Jan-Aug knowledge, which exhibits the share of value promotions (value minimize 15%) greater than doubled in comparison with the identical interval final 12 months.

An extra instance is cordless vacuum cleaner handsticks. After sturdy gross sales in 2021, there was clear deceleration in demand this 12 months. Therefore value promotion gross sales (15%+ value minimize) for this product group have grown by virtually 30% in comparison with final 12 months. I additionally anticipate to see sturdy discounting for these merchandise in the course of the coming This fall peak season 2022.

A third instance is decrease priced IT merchandise; the IT product group has suffered demand drops this 12 months, after saturation in recent times. Promotion exercise has due to this fact greater than doubled throughout Jan-Aug this 12 months in comparison with final, however largely for objects promoting beneath USD1000.

The place can we anticipate reasonable or no reductions throughout Black Friday 2022?

Merchandise which might be nonetheless having fun with secure or sturdy demand will naturally see far much less drive for discounting. A chief instance is robotic vacuum cleaners with grime extraction (docking station). Gross sales of those have greater than doubled this 12 months in comparison with final – leading to a drop within the share of value minimize promotions.

Apparently, premium IT merchandise – these above USD1000 – haven’t seen the rise in value promotions that I discussed above for lower-priced IT. Discounting exercise has been restricted to the decrease priced merchandise.

How one can drive premium gross sales in 2022 peak season

The cut up scenario for lower-price versus premium IT merchandise proven above is probably going all the way down to the polarization of customers that has been accentuated by the mounting cost-of-living disaster.

Decrease-income buyers who would normally purchase within the entry or commonplace value bands are closely decreasing or suspending their spend. However higher-income buyers who habitually purchase premium merchandise are extra ‘disaster resistant’ and proceed to purchase within the top-end of the markets, and at a comparatively secure degree of spend. Whereas there are some early indications of a transfer to ‘inexpensive premium’, we however anticipate this client section to proceed to buy within the premium finish in the course of the peak season.

The query is, how can retailers and producers make it even simpler for buyers to make the psychological sum that triggers them to resolve on a extra premium product, quite than a primary one, this Black Friday?

Our #1 advice: present customers how you can reduce the “whole lifecycle price” by investing extra upfront.

Focus your promoting on how your higher-end merchandise ship far larger sturdiness, or eco-credentials, or upgradeability and repair-ability and vitality effectivity than the cheaper fashions. Present buyers that, by spending a bit extra now, they get a far larger financial return over the total lifecycle of the product.

Take TVs and laptops (in addition to most non-essential SDAs) as examples. Vitality effectivity performs a really low half in customers’ decision-making when selecting which mannequin to purchase on this space – whether it is even thought of in any respect. However a transparent winner is when you may present that the elevated sturdiness, repair-ability and upgradability / updateability of 1 mannequin over one other delivers long-term cash financial savings for the proprietor. Because of this sturdy {hardware} and upgradable software program, in addition to highly effective efficiency options, will set off extra premium purchases, even amongst customers battling with inflation.

For MDA, nevertheless, the vitality effectivity of a mannequin performs an particularly essential function for customers when deciding which merchandise to purchase. Finest-in class vitality labels, in addition to low absolute vitality consumption, will be leveraged simply within the face of hovering family vitality payments. That is particularly so for fridges and freezers, that are operating always evening and day, in addition to Tumble Dryers, which use the best common quantity of vitality. In washing machines, shopping for an A-rated mannequin quite than a C-rated one might save 100kwh/12 months over 12 years (the typical alternative cycle for MDA). Retailers ought to urge customers that the long-term saving in vitality payments greater than offsets the elevated preliminary buy price of shopping for a higher-end mannequin – particularly if the value of vitality retains rising into 2023 and past.

Plan with precision in 2023 with GfK State of Shopper Tech & Durables Report