Social media is form of magical, proper? With just some faucets on the keyboard, you’ll be able to share any message you need with the entire broad world.

However with nice energy… comes nice potential to get your self in bother with the SEC. Gulp.

Even should you don’t take your social media content material too significantly, the U.S. Securities and Trade Fee (SEC) does. The SEC can — and can! — maintain companies accountable for the issues they are saying on social media platforms.

So earlier than you submit that hilarious meme about investing in crypto or share an impromptu TikTok vid about splitting your inventory, take a beat to be sure you actually perceive the right way to adjust to SEC laws on social media.

In spite of everything, you’re utilizing social media to construct your model, not commit fraud. (Proper?) So learn on for the whole lot it is advisable to know to remain within the SEC’s good books.

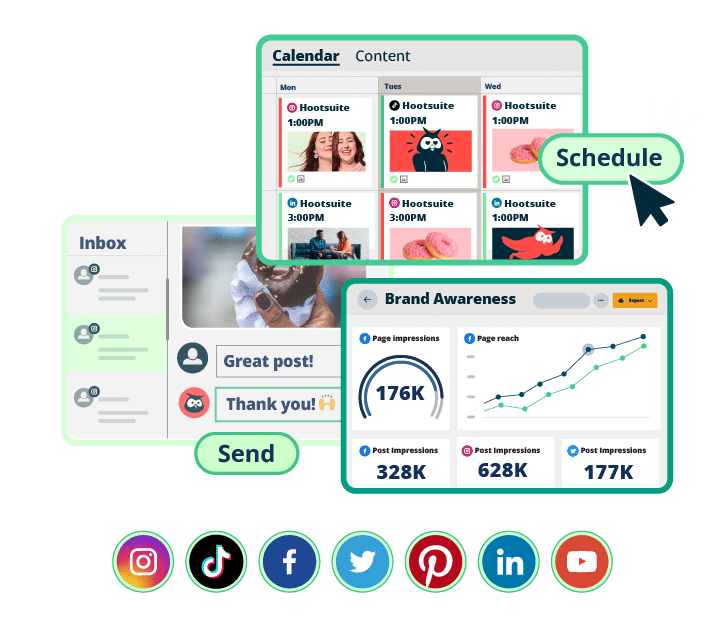

#1 Social Media Instrument for Monetary Providers

Develop your shopper base with the instrument that makes it straightforward to promote, interact, measure, and win — all whereas staying compliant.

What’s the SEC?

The U.S. Securities and Trade Fee (SEC) is an unbiased company of the federal authorities accountable for imposing federal securities legal guidelines and regulating the securities business.

Its three-pronged mission is to guard buyers, facilitate capital formation, and preserve honest and environment friendly markets. In different phrases: the SEC is attempting its perfect to make the American financial system an excellent taking part in discipline.

Listed below are the rules the SEC is working to uphold, in accordance with SEC.gov:

- “Firms providing securities on the market to the general public should inform the reality about their enterprise, the securities they’re promoting, and the funding dangers.”

- “Those that promote and commerce securities and provide recommendation to buyers — together with, for instance, brokers, sellers, funding advisers, and exchanges — should deal with buyers pretty and actually.”

There are numerous alternative ways the SEC regulates and enforces their mission.

One key exercise, in fact, is monitoring social media platforms for potential fraud.

What’s the position of the SEC on social media?

With the rise of social media’s affect on funding choices (we see you, #cryptotok), the SEC has needed to adapt its regulatory oversight to incorporate social platforms.

In different phrases: the SEC could very properly be watching your Instagram Reels.

The SEC is looking out on each social platform to determine potential violations, monitor fraudulent actions, and make sure the honest disclosure of knowledge.

It’s a proactive method that goals to guard buyers from misinformation and market manipulation. (However, hopefully, they don’t neglect to love and subscribe whereas they’re there.)

The SEC additionally has just a few social accounts of its personal, in case you had been questioning: Twitter, Fb, Youtube, and LinkedIn.

Who ought to care in regards to the SEC and social media?

Whereas the SEC’s laws on social media have an effect on a variety of individuals and organizations, these concerned within the monetary companies business ought to pay notably shut consideration.

Social media managers, monetary advisors selling their companies, wealth administration advisors, and public firms sharing funding and monetary info ought to be hyper-aware of SEC guidelines to keep away from potential infractions.

However even an enthusiastic Lindsay Lohan can get into bother for selling shares with out disclosing that she acquired compensation to take action. Nobody is secure.

SEC guidelines for social media

To ensure everyone seems to be speaking about investments with equity and transparency, the SEC has established advertising and marketing guidelines concerning what you’ll be able to and can’t do on social media platforms.

What you CAN’T do

Make deceptive statements: It’s prohibited to make false or deceptive statements about an organization’s monetary situation, efficiency, or future prospects.

For example, tweeting a lie that your car-manufacturing firm is about to place out a flying automotive could be an actual no-no.

Share insider info: Sharing personal, materials info that might affect funding choices is strictly prohibited.

For example, if you recognize you’re about to fireside your entire government group, don’t announce it on LinkedIn first. That’s info that might give your followers an unfair heads-up that they need to dump their inventory.

Interact in manipulative practices: Partaking in manipulative practices to artificially inflate or deflate securities costs is illegitimate.

For example, training what’s known as a “pump and dump” scheme: colluding with your mates to essentially hype up an “superb” new cryptocurrency known as “Barbiecoin” so that everyone else buys it too, and you may then promote it for greater than its precise value.

What you CAN do

Make disclaimers: Together with applicable disclaimers when sharing funding recommendation or opinions on social media may also help make clear that the data shouldn’t be supposed as monetary recommendation.

For instance, earlier than you share your pleasure a few new inventory you’ve simply bought, remind your followers that that is simply your opinion and never assured monetary recommendation.

Provide clear and balanced info: Be certain that all materials info shared on social media platforms is correct and balanced and doesn’t omit essential information which will impression funding choices.

In different phrases: do your homework earlier than you begin speaking a few new mutual fund in your Instagram Tales and be sure you discuss it objectively, together with each professionals and cons.

Present well timed disclosures: Public firms should adhere to the identical guidelines concerning the well timed disclosure of fabric info on social media platforms as they might with conventional communication channels.

When a chunk of knowledge is taken into account “materials,” it signifies that it has the potential to affect an investor’s decision-making course of or the market worth of a safety. This contains details about monetary outcomes, mergers and acquisitions, important contracts, regulatory developments, or another knowledge that might impression buyers’ notion of the corporate’s prospects.

How does the SEC have an effect on influencers?

Influencers have develop into a very highly effective power on social media platforms with regards to monetary info. Content material creators have the flexibility to form public opinion and affect shopper habits — for higher or for worse.

It’s essential to know that the SEC’s laws apply to influencers as properly, notably when an influencer endorses or approves funding alternatives or supplies monetary recommendation.

In December 2022, the SEC charged eight social media influencers for his or her participation in a $100 million securities fraud scheme. These people have been accused of sharing misinformation with followers on Twitter and Discord so as to increase the value of inventory they deliberate to dump. (Hey, Adam McKay: is that this the proper plot for The Large Quick 2?)

If these fees are true, this looks like this case includes some fairly intentional fraud habits, however even well-intentioned influencers can get into bother in the event that they aren’t crystal clear about conflicts and objectivity.

TLDR: At all times be clear! Influencers should disclose any potential conflicts of curiosity and make it clear when their statements are opinions relatively than goal monetary recommendation.

Suggestions for stopping SEC infractions

All of us wish to play by the foundations, proper? We wish to keep out of bother and guarantee past a shadow of a doubt that we’re not negatively impacting anybody else’s monetary well-being. To remain compliant with SEC laws and scale back the danger of infractions, think about the next methods:

Educate your group

Be certain that all workers who handle social media accounts or interact in any communication associated to investments or financials are well-informed about SEC laws.

That might imply sharing this weblog submit (bless you) or a extra formal information sesh.

Coaching classes and tips may also help everyone get conversant in the do’s and don’ts of social media compliance.

It’s actually step one in cultivating an organization tradition that prioritizes compliance and moral practices on social media. Encourage open communication, reporting of potential violations, and ongoing training to make sure everybody understands their duties.

Create a transparent social media coverage for workers

Even should you’ve had one million coaching classes along with your group, it doesn’t harm so as to add SEC laws to your organization’s social media coverage.

And should you don’t have a social media coverage but, there’s no time like the current. There’s actually no higher manner to make sure constant and compliant messaging throughout social media platforms. Take a look at our social media coverage template right here.

Bonus: Get a free, customizable social media coverage template designed particularly for banks to shortly and simply create tips on your monetary establishment.

Seek the advice of a compliance officer

Who higher to ask for assist than an skilled?

It’s properly well worth the funding to have interaction a compliance officer or authorized counsel with experience in securities legal guidelines to assessment social media actions and supply steering on compliance finest practices. Then you definately’ll by no means have any lingering doubts about whether or not or not you truly perceive what “materials info” is.

Free Course for Monetary Establishments

Take this free 45-minute course and develop into a social media skilled. Discover ways to drive leads, shield your model, show your impression, and extra.

Arrange a social listening program

An awesome social listening instrument will assist you monitor and detect any transmission of insider info from workers, influencers, or others related along with your group.

Might we humbly advocate Hootsuite’s superior social listening options? See what individuals are saying about your model, business, and opponents with probably the most highly effective social listening instrument round, and catch potential violations earlier than they go public.

Maintain messaging on model with an worker advocacy instrument

An worker advocacy instrument like Hootsuite Amplify may also help empower workers or contractors to share pre-approved content material whereas sustaining model consistency and compliance. It’s a strategy to scale back threat whereas nonetheless encouraging your group to share branded messages

Professional tip: You can too disable the modifying function to make sure that messages are precisely conveyed each time they’re shared.

Evaluate influencer partnerships

Should you collaborate with influencers or model ambassadors who endorse monetary services or products, conduct due diligence to make sure they’re conscious of SEC laws.

It’s a good suggestion to determine clear tips and contractual obligations concerning compliance and disclosure to guard your model and mitigate potential dangers proper from sq. one.

Archive the whole lot

If there’s ever a query about your compliance, the SEC goes to wish to dig again in time, so hold these receipts.

It’s essential to archive all your model’s social media communications to take care of a whole report of interactions, making certain compliance with record-keeping necessities.

Sizzling collab alert: Hootsuite integrates with Proofpoint, providing seamless archiving capabilities and enhanced safety.

Conduct common audits

Sorry to be the bearer of dangerous information, however SEC compliance shouldn’t be a one-day affair — it’s an ongoing course of.

Meaning manufacturers ought to usually assessment and audit social media actions to determine any potential gaps or areas of non-compliance. Pop it in your calendar to do yearly to be sure you’re catching points promptly and implementing corrective measures earlier than issues go too far.

Learn extra about social media compliance and the right way to arrange a social media compliance course of on your group right here.

Implement assessment processes

Getting two units of eyes on each tweet is the best strategy to catch drawback content material earlier than it goes out into the world.

Set up inner assessment processes to assessment and approve content material earlier than it’s revealed on social media. This may also help guarantee compliance with SEC laws and (bonus!) lets your group preserve consistency in messaging throughout platforms.

One straightforward manner to do that? Arrange an approval workflow utilizing Hootsuite’s social media dashboard.

Leverage social media administration instruments

Okay, we all know we’re a damaged report right here, however significantly: social media administration platforms like Hootsuite, which provide superior options for compliance monitoring and administration, may also help streamline your social media actions, guarantee model consistency, and supply archival capabilities for regulatory functions.

We’ve bought a free trial for you right here!

Keep up to date on SEC steering

We’re all rising and altering on a regular basis… and so is the SEC.

Maintain abreast of any updates or steering issued by the SEC concerning social media websites and securities laws so that you simply don’t by accident put your self in sizzling water, breaking a rule you didn’t know existed.

Comply with the SEC on social, and watch their press launch web page intently in an effort to adapt your methods and practices accordingly, making certain ongoing compliance.

FAQs in regards to the SEC and social media

Does the SEC regulate social media?

Sure, the SEC actively regulates social media pages to forestall fraud, guarantee honest disclosure, and shield buyers.

Keep away from sharing deceptive statements or insider info, and all the time disclose any conflicts of curiosity.

Share materials info in a well timed matter, and don’t interact in manipulative habits. Let’s create an web with no extra pump-and-dump schemes, please and thanks.

Which influencers had been charged by the SEC?

In recent times, a number of influencers have confronted fees by the SEC for violating securities legal guidelines over social media, together with circumstances involving undisclosed endorsements and fraudulent funding schemes. These fees underscore the significance of transparency and compliance for influencers working within the monetary realm.

Notably, in December 2022, eight influencers had been charged in a $100-million securities fraud case. The defendants had been accused of feeding a gradual stream of misinformation to their social media followers so as to falsely inflate the worth of shares they held.

Save time managing your social media presence and keep compliant with Hootsuite. From a single dashboard you’ll be able to publish and schedule posts, join with new purchasers, measure outcomes, and get your posts authorized by managers and compliance officers.

Guide a personalised, no-pressure demo to see how Hootsuite helps monetary companies:

→ Drive income

→ Show ROI

→ Handle threat and stay compliant

→ Simplify social media advertising and marketing