One of many first steps when working with dwelling sellers is setting a house’s itemizing value. When working with patrons, that first step is normally checking the worth of a house earlier than making a suggestion to buy.

A house’s present price will be tough to pinpoint, and the perfect and commonest method to learn how a lot a house is definitely price is by working a comparative market evaluation. And on this submit, we’ll outline a CMA, and stroll you thru how one can conduct one in every of your individual.

What’s a CMA report?

A Comparative Market Evaluation (CMA) is an in-depth report on a house’s present worth. It’s ready by actual property professionals by inspecting the sale costs of comparable properties within the space. It tells householders what their house is price within the present market, and helps homebuyers buy at good worth.

Why run a CMA report?

A CMA report is critical to find out the correct worth of a property within the present market, so your shopper can get probably the most bang for his or her buck. As well as, It supplies essential data for each actual property brokers and their purchasers to make knowledgeable choices concerning pricing and negotiations.

A CMA report helps guarantee a good and aggressive itemizing value by contemplating comparable properties, resulting in a profitable sale. So let’s soar into how one can run your individual.

Methods to Do a Comparative Market Evaluation

1. Know the neighborhood.

A comparative evaluation entails extra than simply doing the maths on costs for homes in your space. In actual fact, an agent’s familiarity and expertise with the native market can considerably have an effect on a CMA’s accuracy.

To set the appropriate value, you have to be acquainted with the neighborhood and educated in regards to the historic, present sale, and rental worth of actual property in that space.

There’s been rising recognition of single-family leases in North America over the previous decade — nearly 50,000 of them constructed to hire in 2020, in comparison with about 14,000 in-built 2010. For those who’re not already acquainted with the neighborhood, test it out in particular person or by way of Google Road View.

Assess the general high quality of the neighborhood and establish the engaging and not-so-attractive blocks. Study its proximity to parks, college districts, and different facilities.

Take a look at the curb enchantment of houses within the space and establish any detrimental traits akin to proximity to a loud freeway or dilapidated business buildings.

2. Pre-assess the itemizing property on-line.

If the property in query is already listed, browse the itemizing on-line earlier than viewing it together with your shopper. This offers you a preliminary thought of what to anticipate earlier than visiting it in particular person.

Collect as a lot data as you possibly can in regards to the property, together with the 12 months it was constructed, dwelling dimension, lot dimension, building kind, structure, and situation. Being knowledgeable offers you a bonus in your first assembly with the vendor.

3. Assess the property in particular person.

Go to the property in particular person to collect detailed data wanted to organize an correct report.

Observe its most vital metrics, akin to dimension, format, age, situation, finishes, and landscaping, in addition to any options that may add worth, together with a pool, completed basement, giant storage, or outsized lot.

And, be looking out for points that may have an effect on the value negatively, like a roof in want of restore, poor total situation, lack of central air con, or different hidden points.

4. Choose comparable properties within the space.

Selecting the perfect three or 4 comparable properties within the space is essential for the accuracy of a comparative market evaluation.

To select, scan MLS, Zillow, Property Shark, or Redfin for properties not too long ago offered or closed on, energetic listings, pending gross sales, and expired listings.

Then, take into account these three vital components:

- When the comparable property offered: In a sizzling actual property market the place costs rise quick, the value of a house offered a 12 months prior could also be irrelevant right now. The CMA report ought to look at properties with a date of sale as present as attainable — ideally inside the last few weeks. If it’s a gradual market and also you’re utilizing comps offered a number of months prior, you would possibly want to regulate the costs based mostly on how the market has developed.

- The place it’s positioned: The situation of the comps chosen ought to be as near the topic property as attainable. It’s finest in the event that they’re in the identical neighborhood, subdivision, and faculty district, or inside one mile of the listed property. Residential areas can fluctuate from one block to the subsequent. Some properties are positioned subsequent to a quiet park, whereas others in the identical neighborhood may be subsequent to a busy street. These delicate modifications can result in important value variations.

- What its essential options are: You must evaluate your itemizing towards houses with traits as related as attainable to the one you’re reviewing. This is applicable notably to the variety of bedrooms, baths, sq. footage, and lot dimension. Use properties with related building varieties and architectural types if the choice dimension is beneficiant. Houses with related options are ultimate, however this won’t all the time be attainable until the house is positioned in a developed subdivision the place all houses look the identical.

5. Put together the comparative market evaluation report.

Utilizing a template report type supplied together with your MLS or different software program options, enter the knowledge you gathered for the comparable properties chosen and in your topic property.

Some value changes may be essential to compensate for the structural variations and higher match the topic property. For instance, if the property you’re pricing has three bedrooms and the one you’re evaluating it to solely has two, you’ll want to regulate the value accordingly.

Now it’s time to do the maths. After making the mandatory changes, divide every property’s offered (adjusted) value by its sq. footage to seek out the offered value per sq. foot.

Offered value of every property / sq. footage of every property = offered value per sq. foot

Then, multiply the calculated common value per sq. foot in your comparable properties by the sq. ft of your topic property to acquire its present market worth.

Common value per sq. foot of comparable properties x sq. footage of topic property = present market worth

To recap, your CMA report ought to comprise:

- The addresses of the topic and comparable properties

- Info and traits of every property

- Offered costs of the comparables

- The overall sq. footage of every dwelling

- The adjustment values for lot sizes, bedrooms, baths, and garages

- The adjusted offered costs

- The dollar-per-square-foot worth

- The topic property worth

The ultimate calculated itemizing value would possibly have to be additional modified, relying on how aggressive the market is on the time. A excessive stock of houses on the market might drive costs down, whereas a low stock would possibly push your asking value upward.

Comparative Market Evaluation Report Pattern

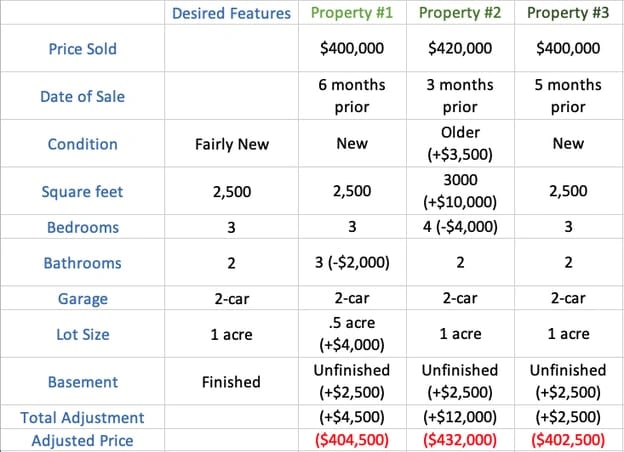

When you will have recognized about three properties which were offered in the identical space with related options, it’s time to place them right into a spreadsheet for evaluation. The next instance is simplified and never based mostly on true market information:

With every property itemized, an agent can present a breakdown of the price of every function and the way it impacts every dwelling’s total worth.

The gross sales value of every of the three properties is adjusted to be practically similar to the worth of your required property worth. The extra fascinating options are deducted from the gross sales value of every property, whereas the much less fascinating are added.

The adjusted gross sales costs present the vary of an acceptable supply of $402,500-$432,000. This vary will mirror the supply value of the specified property with the options they need.

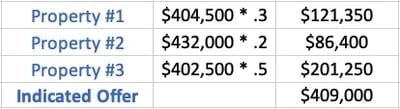

Throughout this a part of the evaluation, it’s vital to weigh every property based mostly on its similarity to the specified options. Property #2 had probably the most changes, so it’s given the bottom weight. Property #3 had the least quantity of changes and was given the best weight. As soon as the weights are recognized, the adjusted costs are multiplied by the weighted worth and added collectively to find out the supply.

The extra correct estimation for an asking value on this state of affairs is $409,000 based mostly on related houses within the space you discovered in the marketplace.

Use a CMA to Your Benefit

Studying and understanding the aim of comparative market evaluation can prevent cash throughout your subsequent home hunt — or earn you extra once you determine to promote. Both manner, doing all of your analysis and having the numbers to again it could actually allow you to negotiate a value extra successfully.

Editor’s Observe: This submit was initially posted in November 2018 and has been up to date for comprehensiveness.

.png#keepProtocol)

![Download Now: 10 Competitive Analysis Templates [Free Templates]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)