What precisely is MRR? Whether or not you’re a gross sales chief, supervisor, or rep, metrics are key to your success. They aid you consider the efficiency of the enterprise, group, and particular person contributors.

One metric that it is best to analyze is month-to-month recurring income (MRR). It tells you and your vp of gross sales how a lot revenue is generated every month. You’ll be able to take a look at income tendencies over time and examine MRR to the month-to-month sign-up price to your services or products, month-to-month account development price, and buyer retention.

An MRR evaluation will let you know in case your income is shrinking or rising. Plus, it informs gross sales leaders to allow them to make educated enterprise selections. Let’s get into the nitty-gritty of MMR.

Desk of Contents

What’s MRR?

MRR stands for month-to-month recurring income. It’s a normalized measure of a enterprise’ predictable income that it expects to earn every month. For instance, for example you’ve got 10 prospects, and so they pay you $50 per thirty days. Your MRR can be $500.

Earlier than we get began, let’s outline some phrases.

- Income — the revenue what you are promoting earns in return for the gross sales of products and providers.

- Recurring income. That is the revenue you’ll be able to count on to earn recurrently. Recurring income will be measured on a month-to-month or yearly foundation (e.g., MRR: month-to-month recurring income, ARR: annual recurring income).

.webp)

So, what does MRR appear to be in follow?

Image this: You’re employed for a cloud computing firm that sells a cloud picture storage platform. Clients signal a contract for a yearly subscription, and so they pay a month-to-month charge to make use of the picture storage service.

Let’s say the shopper has agreed to pay $1,200 per yr. Primarily based on their buy, you’ll be able to count on to earn $100 ($1,200/12 months) in revenue every month. The month-to-month recurring income (MRR) for this buyer is $100.

When you’ve calculated the MRR for every buyer, you’ll be able to calculate the overall MRR for what you are promoting.

MRR System

Common Income Per Account (ARPA) is the essential metric when calculating MRR. You arrive at that determine by taking the common of how a lot your whole prospects are paying and dividing it by the overall variety of prospects that month.

To find out your MRR, you multiply that determine by your whole variety of prospects. So, in case you have 100 prospects paying a mean of $50 per thirty days, your MRR can be $5,000.

Easy methods to Calculate MRR

- Calculate the overall income generated by all prospects in the course of the month

- Decide the common month-to-month quantity paid by all prospects

- Multiply the common by the overall variety of prospects

There are different strategies you need to use to calculate MRR. Relying on which one what you are promoting chooses, the components will range.

As an example, what you are promoting can use the customer-by-customer technique. With this components, you mix the month-to-month funds of all of your prospects. When you had 90 prospects that paid you $10 every month, the MRR can be $900.

The shopper-by-customer technique is likely to be much less environment friendly than the ARPA technique, however each equations ought to nonetheless carry you to the identical determine.

However, what does that determine imply? And the way can or not it’s utilized? There’s no single reply to both of these questions. That’s as a result of MRR will be partitioned, dissected, and analyzed in several contexts for various functions.

Sorts of MRR

Breaking MRR down even additional will aid you take a look at income development and tendencies to see if there are any areas you possibly can enhance upon.

1. New MRR

New MRR is the month-to-month recurring income that’s generated from brand-new prospects. Let’s say you’ve got 10 new prospects in a month. Half of them pay $50 a month, and the opposite half pay $100 month-to-month. The brand new MRR can be $750.

2. Enlargement MRR

This quantity represents extra month-to-month recurring income out of your current prospects. Enlargement MRR is often known as an improve and may result from an upsell or cross-sell. Utilizing the instance above, if 4 prospects improve their contracts from $50 to $100 month-to-month, the growth MRR can be $200.

3. Churn MRR

Churn MRR is the income that’s been misplaced as a result of prospects canceling or downgrading. So if one buyer cancels their $50 subscription and three downgrade their month-to-month subscription from $100 to $50 month-to-month, the churn MRR can be -$200. And this implies you’ll have much less MRR to work with within the upcoming months.

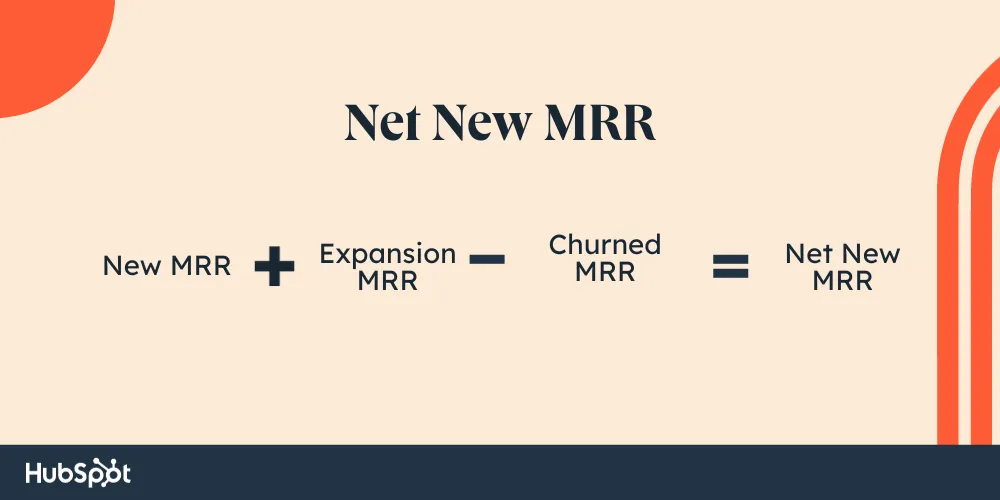

4. Web New MRR

This quantity is calculated utilizing the three MRR varieties above. Right here is the web new MRR components:

The results of the calculation will let you know how a lot MRR you’re gaining or dropping. If the sum of recent MRR and growth MRR is lower than churned MRR, you then lose cash. But when they’re better than churn MRR, you’ve gained cash.

Why is MRR essential?

Whereas MRR would possibly look like a big-picture metric that impacts the enterprise at a excessive stage, it’s simply as essential to particular person gross sales reps as it’s for administration.

.webp)

“MRR is a very powerful metric for monetary development. There are different essential metrics like development price, retention, common gross sales worth, and rep productiveness, however on the finish of the day, a very powerful metric is the quantity of month-to-month recurring income prospects are keen to placed on their bank card or pay by an bill,” says Dan Tyre, an government at HubSpot.

“We decide the efficiency of our corporations, divisions, and groups, right down to the person performer primarily based on MRR attainment. It’s a foundational metric for inspecting group and gross sales rep efficiency.”

Furthermore, it will possibly assist companies in these 3 ways:

1. Monitoring Efficiency

How massive are the offers that you just’re closing? MRR permits salespeople to see the scale of the accounts they handle. When you earn a fee primarily based on the month-to-month recurring income you shut, your take-home pay could possibly be impacted relying on the proportion of excessive and low MRR prospects you’ve offered to.

Are you struggling to hit your MRR quota every month? Check out the offers with excessive MRR you’ve closed.

- Are there any similarities between the purchasers which have bought from you?

- Was there something you probably did all through the gross sales cycle that positively impacted the sale?

Reflecting on these particulars will aid you modify your gross sales method for the alternatives in your pipeline. And hopefully, your evaluation will lead to you closing high-MRR offers.

2. Gross sales Forecasts

Simply as reps can take a look at their particular person efficiency, gross sales managers and leaders can take a look at the massive image and see how the group is doing as a complete. By trying on the whole MRR, they’ll make extra correct gross sales forecasts and projections.

This helps the gross sales group plan for development within the brief time period and long run. There are all kinds of instruments at your disposal that may aid you monitor this data, equivalent to HubSpot’s gross sales Reporting and Dashboard instruments.

3. Budgeting

And not using a regular revenue stream, it’s troublesome to run a profitable enterprise. MRR tells enterprise leaders how a lot cash is coming in every month that may be reinvested.

Will you be capable to rent extra enterprise growth representatives this month? Are you able to run that lead era marketing campaign? The quantity of income you’re bringing in is likely one of the deciding elements in these conditions. Managing these metrics won’t solely aid you keep a gentle course for what you are promoting but in addition present an overview for what must be addressed.

MRR is a key metric for enterprise planning and decision-making. To study extra, take a look at the opposite most essential gross sales metrics subsequent.

Getting Began

By monitoring MRR, gross sales groups can establish tendencies in buyer acquisition and retention. It’s also possible to analyze the efficiency of various pricing tiers and assess the general well being of your gross sales funnel. This data allows them to establish areas for enchancment. Quickly, you’ll be in your strategy to optimizing gross sales methods and maximizing recurring income.

Editor’s be aware: This put up was initially printed on March 3, 2019 and has been up to date for comprehensiveness.