🖤

Rachel Pereyra started freelancing as a digital assistant in January of 2020 to earn more money to assist her and her spouse repay their debt and save for a home. By that summer time, she had confirmed she may safe a gradual stream of shoppers and cost sufficient for her work that she may truly make cash working for herself.

Later in 2020 when the pandemic required her to go away her company job and care for his or her kids, she began leaning extra closely on freelancing work, and Mastermind Enterprise Companies was born. Her consultancy helps scaling businesses optimize their inner processes and tech instruments. She has collaborated with over 50 shoppers throughout her three years in enterprise, and people shoppers have achieved exceptional outcomes.

Now the first breadwinner in her household as her spouse modifications careers, she doesn’t have the luxurious of not having the ability to convey dwelling the required earnings. This actuality has required her to take a position as little as attainable (she began her firm with solely a $400 laptop computer and has bootstrapped her development at each step). Plus, she’s needed to be worthwhile from the beginning. Beneath, she shares precisely how she made it occur.

Years in enterprise: 3

Variety of workers: 7 contractors

Location: Austin, Texas, with crew members throughout the U.S. and in Europe and Canada

Preliminary capital invested: $400

Monetary assist for enterprise: I’ve leveraged bank cards and $25k in enterprise loans to get capital to put money into instances of growth

Income streams:

- Company and consulting shoppers on a undertaking and retainer foundation

Development Journey

What’s been your proudest monetary achievement as a enterprise proprietor?

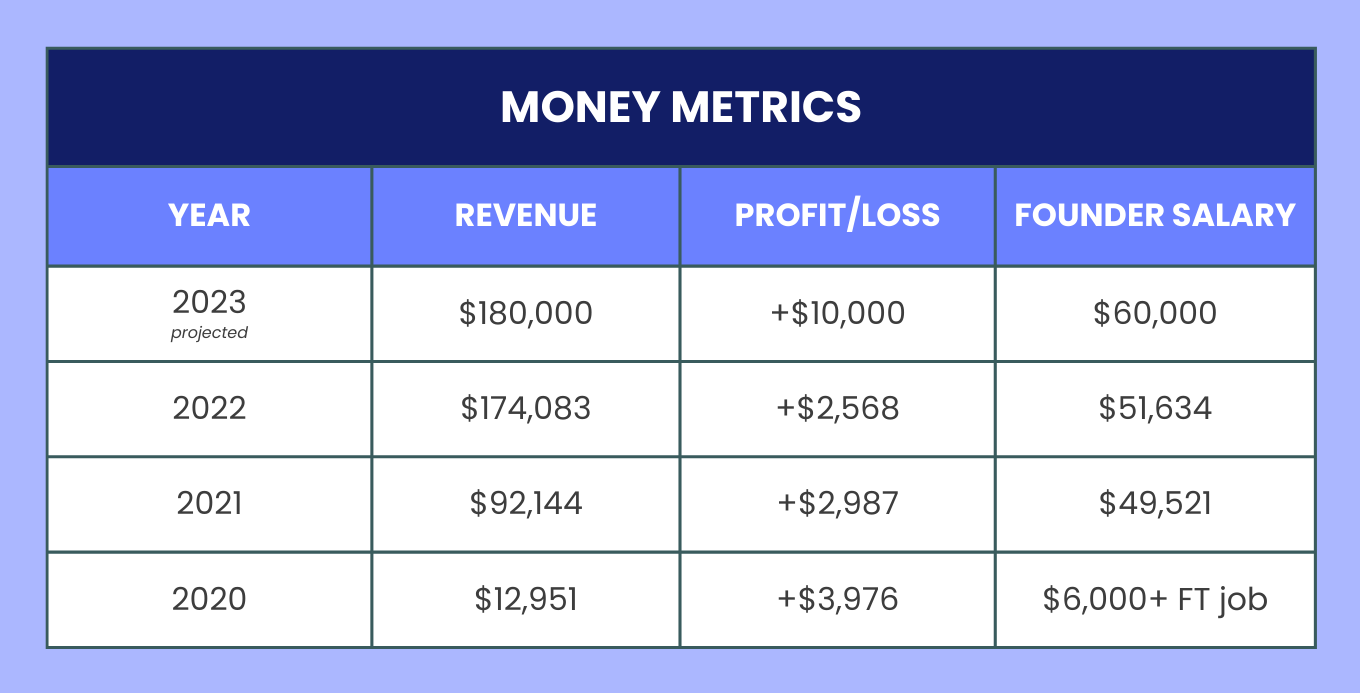

I’ve been in a position to keep a revenue yearly I’ve been in enterprise whereas additionally paying myself. I can’t even start to elucidate how deeply moved I’m to have the ability to assist my household and keep profitability in my enterprise.

After I was a senior in highschool, I used to be working full-time hours whereas taking twin credit score courses and attending highschool. I had discovered a job I beloved on the native grocery retailer and labored my method as much as entry-level administration. All of this modified once I received pregnant with my first little one 4 months earlier than highschool commencement and needed to transfer in with my now ex-husband and his household.

These instances have been the roughest of my life—our first 12 months submitting taxes as a married couple, we made $12,067 complete. After we received divorced in 2012, I hustled to offer my children the childhood I had rising up, working a full-time job in finance, nights as again workplace admin for a florist and wedding ceremony coordinator, weekends flyering for a realtor, and lunch breaks driving for Uber Eats.

I started freelancing as a digital assistant in January of 2020 to earn more money to assist my spouse and I repay our debt and save for a home, however I shortly realized that I’m not an important assistant. I’m a extra strategic and big-picture thinker, so I started working with shoppers as a web-based enterprise supervisor in the summertime of 2020. By the top of the summer time, I had demonstrated to myself that I may safe shoppers and doubtlessly assist my household with this work.

I don’t faux to have every little thing found out—there may be at all times room to extend margins, increase charges, or scale back bills—however a starvation for work and shopper satisfaction has been my greatest secret to success. My shoppers love working with me and really belief me. This, paired with the fervent networking I’ve finished over time, has led to constant work and higher-level shoppers.

I’m additionally at all times in search of methods so as to add to my income. One purpose my company has stayed afloat in instances of transition is as a result of I’ve been prepared to select up a contract as a undertaking supervisor, a fractional COO, a recruiter, or principally something that permits me to proceed investing in my enterprise.

How do you resolve how a lot to pay your self versus make investments again within the enterprise?

In my first 12 months of enterprise, I invested nearly all the a reimbursement within the enterprise through certifications, teaching, crew members, software program, and {hardware}. I used to be ready to do this as a result of I nonetheless had my full-time company job till October 2020.

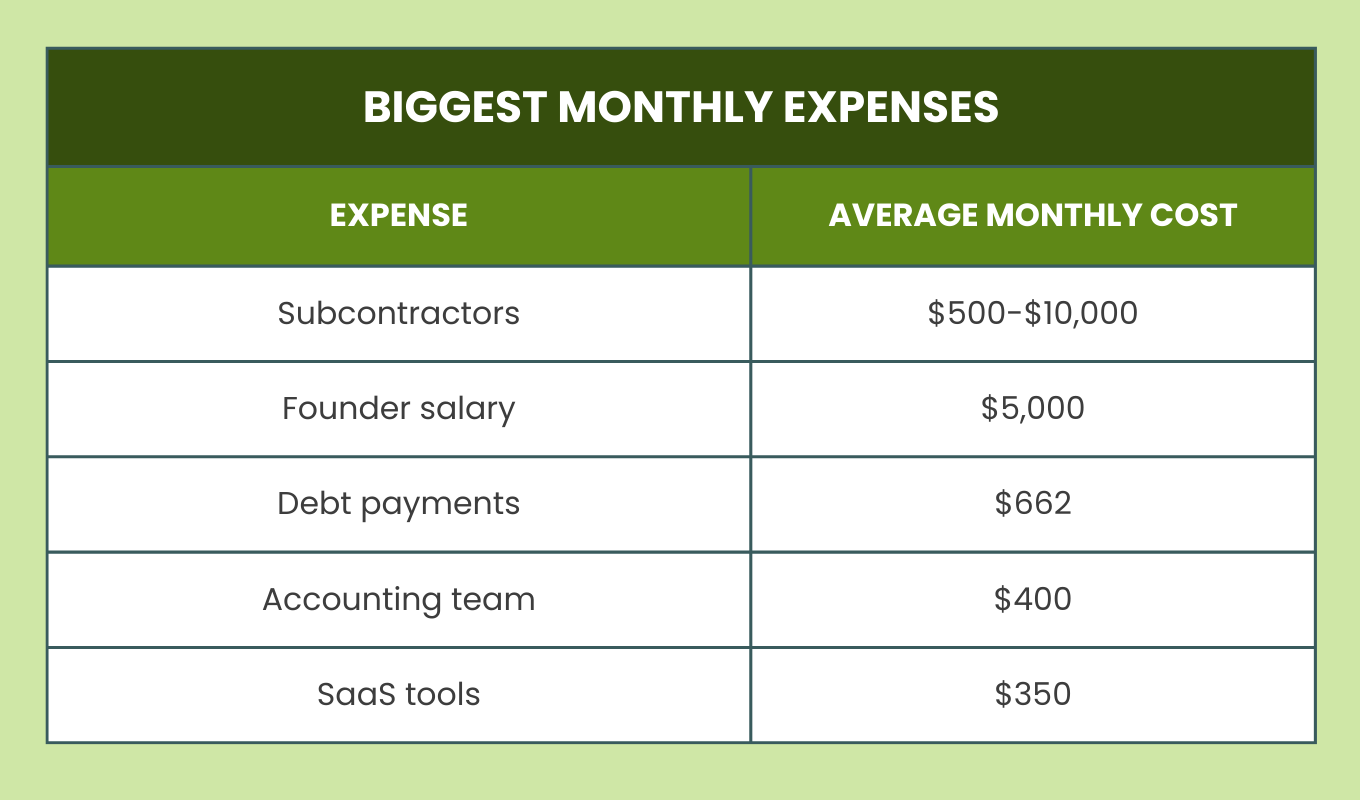

Since I went full-time on my firm, the choice of how a lot to pay myself comes out of necessity. I’m at the moment the first breadwinner in my household, so the enterprise has to assist that first. This implies I have to convey dwelling at the very least $5,000 a month for our household obligations whereas my spouse is rising her personal profession. Generally doing this implies investing much less into enterprise development to place household first.

Leveraging debt has additionally been very useful for me in balancing these priorities. I don’t see debt as a detrimental factor, however you will need to pay attention to the dangers. I’ve positively pulled out the bank card to put money into development at instances when the money move wouldn’t enable for it, resembling paying for a company gross sales program. Not all of my debt has resulted in a greater state of affairs or payoff for me, and in hindsight there are issues I want I had waited and saved for as a substitute. However I nonetheless assume leveraging debt to develop as a enterprise proprietor is sensible when you have a stable plan for the way you’re going to get an ROI again from the funding and a backup for methods to repay the debt in case you don’t see the deliberate ROI.

What particular methods or advertising strategies did you utilize to draw your first clients or shoppers? What are a couple of of your most impactful development methods now?

I received my first shoppers from Upwork and Fb teams. In case you are simply beginning out or are in a troublesome time financially, spending the vitality on these assets might be fruitful and yield dividends, nevertheless it isn’t a simple path.

After I was beginning on Upwork, I used to be making as little as $10 an hour as I constructed my fame. I used to be in a position to make this work as a result of I used to be nonetheless in my company job, however that price wouldn’t assist my life now. I nonetheless submit proposals on Upwork as a result of extra giant firms are utilizing it to search out fractional or contract expertise in my line of labor. Profile movies, testimonials, instance tasks, and being conscious of market charges will allow you to stand out from the gang.

Fb teams might be profitable, although they require quite a lot of outreach. I discover teams run by individuals I love so the folx in there are values-aligned or teams my superb shoppers are hanging out in. Then, I watch the posts for individuals scuffling with one thing I supply and remark with some recommendation or an invite to debate a bit within the DMs, and if we’re match hop on an preliminary session name.

Since then I’ve finished quite a lot of networking, together with becoming a member of skilled platforms like Dreamers & Doers and The tenth Home, discovering area of interest Slack channels my colleagues or shoppers are spending time in, and attending occasions with native enterprise teams.

I method networking from a perspective of relationship-building and never gross sales so I’m extra prone to come throughout as real. I’ve discovered to not be afraid to inform individuals about what I do, with out treating each dialog like a gross sales pitch. For instance, I wish to share about a few of my profitable shoppers, my favourite trade tendencies, or precisely what sort of enterprise I’m trying to assist proper now.

I ship stellar shopper providers, which makes it extra seemingly that my shoppers will refer me to others. In the course of the financial turmoil of 2023, my enterprise has been sustained purely via referrals from earlier shoppers and other people I’ve met through networking. That is reflective of the way in which I deal with my shoppers past the top of the undertaking: maintaining with birthdays, checking on how their enterprise is doing, and having common catch up calls.

What’s a turning level that basically impacted how you considered your online business or approached development?

Early on, I spent rather a lot on applications to study expertise I didn’t have to assist me run my enterprise—a lot that I needed to tackle debt to make it attainable. I ended up with tons of data, however then by no means used quite a lot of it as a result of I didn’t have the bandwidth to use it.

I noticed I used to be utilizing teaching and studying as a crutch to prop up my inner self-worth and cash mindset points. If I may return, I’d have spent that cash on hiring consultants (and a few further remedy to work via why I felt like I wanted extra certifications and coaching). Now, I delight myself on bringing different individuals in to assist me once I want totally different expertise to develop the enterprise.

What have been the best development or cash challenges you’ve skilled? How have you ever labored via them?

One among my greatest struggles as an entrepreneur has been staying out of my shoppers’ pockets. After I began out, I so badly needed to assist early-stage and micro companies, so would worth myself low with their budgets in thoughts. This meant the primary two iterations of my enterprise weren’t sustainable—irrespective of how I sliced my bills, not sufficient income was coming in. But, I used to be scared to pitch shoppers who may truly afford me, as a result of I felt in the event that they rejected my enterprise they have been rejecting me as an individual. This stunted my development and created extra monetary battle for me each personally and professionally.

Working via this has taken a mix of nice shoppers singing my praises, a crew who’s supportive and prepared to verify me when wanted, and common remedy as a lot of that is reflective of my very own traumas and previous experiences.

What are your subsequent development objectives? What do you intend on investing in that will help you obtain them?

I’m working to refine my revenue margins to make the enterprise extra sustainable for the long-term. I’ve realized I have to work with shoppers who’re bringing in $1 million or extra in annual income so they’re ready to put money into our bigger tasks.

I additionally am engaged on fostering month-to-month recurring income through retainer assist for small- to mid-sized companies. We have now already began providing this to present and former shoppers, and it’s been thrilling to convey again retainer assist in a extra holistic method.

I additionally know I would like to extend the variety of leads in my pipeline past simply referrals. I’m engaged on creating a chilly outreach technique to companies and bigger nonprofits, however this pipeline takes longer to shut than single-founder companies, so I plan to take care of our smaller assist providers whereas we develop to maintain the money move coming in.

As we develop and stabilize within the subsequent few years, I wish to co-found a brand new enterprise. I’m very a lot a visionary and have numerous concepts that don’t make sense to launch via my present enterprise. With higher revenue margins, I hope to have the ability to develop my inner crew and put money into a fractional CMO so we are able to tackle extra shoppers with out me having to be concerned in every nitty gritty element.

Based mostly in your expertise, what recommendation would you give somebody who had a enterprise like yours for rising efficiently?

The perfect recommendation I received early on was that my very own cash mindset would restrict my enterprise and that I wanted to be cognizant of the ceilings and hurdles I’m creating for myself and the corporate financially.

Rising up comfortably center class after which being beneath the poverty line from ages 18 to 23 positively left a everlasting influence on the way in which I take into consideration cash and make choices. This isn’t one thing mantras alone can repair—for me, this can be a deeply rooted trauma I’m nonetheless working via. I see a therapist usually and have discovered to ask for assist and determine my monetary triggers to assist my journey.