Many builders particularly goal Apple machine homeowners as a result of they’re identified to spend extra on in-app purchases than individuals who personal an Android machine.

However Mode Cell has a really completely different target market in thoughts: budget-conscious Android customers seeking to generate a bit of further earnings.

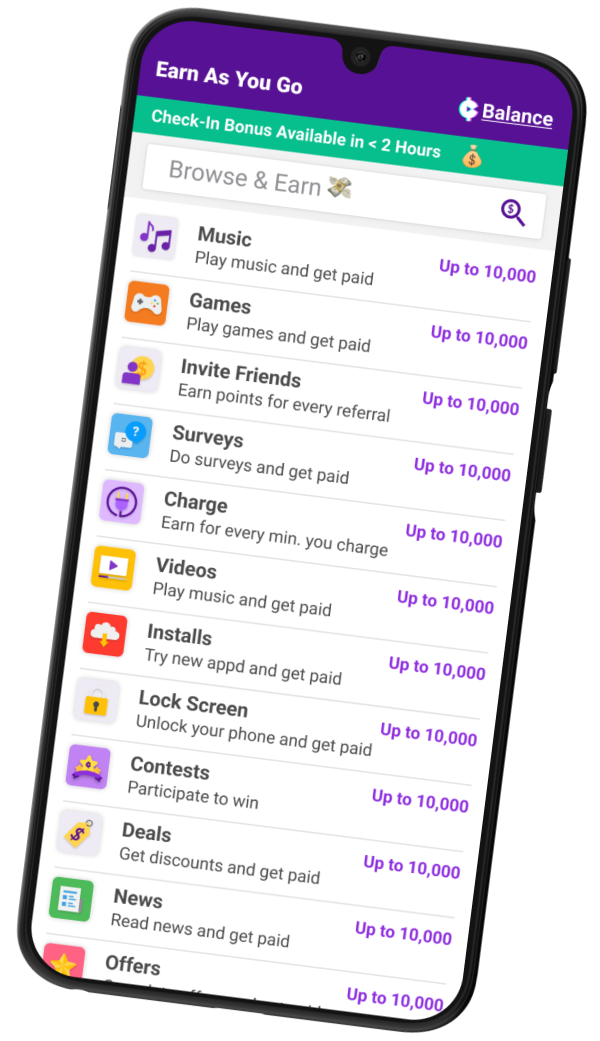

Mode owns an app referred to as Earn that lets folks acquire in-app factors in change for participating in on a regular basis actions on their smartphone, like taking part in video games, listening to music, monitoring their health, taking surveys and even charging their machine. Factors can later be redeemed for money payouts or present playing cards.

As a result of Earn monetizes primarily by third-party advertising and marketing and promoting companions, Mode generates extra income the longer folks spend in its app.

However, like all builders, Mode is itself on a funds of types.

The price of operating a consumer acquisition (UA) marketing campaign can’t be greater than the customers themselves find yourself being value.

Waft

In an off-the-cuff gaming app, the cues for what actions will result in excessive lifetime worth (LTV) are comparatively easy. If somebody watches the sport’s tutorial video, then shortly progresses by the primary few ranges, that’s signal they’ll stick round.

However consumer habits in a non-gaming app like Mode’s “isn’t fairly as linear and predictable,” stated Steve Dunkley, the corporate’s director of consumer acquisition.

There are lots of completely different flows customers can undergo within the Earn app. Folks can dip out and in and interact with options in no matter order they need.

Mode has to determine which flows are essentially the most useful to its personal backside line. Is it a greater indicator of sturdy LTV if somebody watches a video, reads a information story and listens to a track earlier than cashing out? Or do customers who surf the online, learn a information story and observe a exercise generate extra income for Mode over time?

“Our problem has been to pinpoint occasions that signify habit-forming habits in our customers and in what mixture,” Dunkley stated.

Final 12 months, Mode began testing AppLovin’s cell consumer acquisition platform, AppDiscovery, to find out which in-app occasions are most dear and goal new cost-conscious Android customers with a excessive probability to have interaction with the Earn app.

AppDiscovery is constructed on Axon 2.0, an AI-powered engine that makes use of predictive machine studying to focus on app set up adverts to customers with the best chance to obtain. The Axon algorithms have been skilled utilizing first-party information from AppLovin’s personal portfolio of video games, together with trillions of each day in-app occasions.

Fast research

Sometimes, it may possibly get expensive for consumer acquisition managers to collect sufficient sign to optimize a marketing campaign effectively, Dunkley stated.

Apps need to spend cash to be taught what concentrating on parameters work, and the longer it takes to be taught, the extra it prices. On the flip aspect, a shorter studying curve means an app can run extra exams at a decrease value and in addition check extra particular behaviors.

Utilizing AI helps shorten the curve.

Mode’s most dear customers often hit a sequence of nonlinear milestones earlier than changing into extra engaged within the Earn app. Somebody who listens to music thrice over three days, as an illustration, might finally show kind of useful than a consumer who reads 4 information tales earlier than taking part in a track – and on and on by myriad completely different habits combos.

In a latest marketing campaign, Mode focused a really particular and extremely useful consumer cohort that it refers to internally as “core redeemers,” that means individuals who unlock 3,000 reward factors, redeem them for a present card and go on to make use of the cardboard to purchase stuff throughout the Earn app.

It is a very customized – and in addition very fascinating – in-app occasion that’s specific to Mode Cell, Dunkley stated, “and with a slower, extra conventional calibration curve, we wouldn’t be capable of check and goal such distinctive behaviors.”

Utilizing AppDiscovery, Mode was in a position to cut back its studying curve and, because of this, decrease its acquisition prices by 29% from $2.69 to $1.90. Mode additionally elevated its return on advert spend by 92.5% between Could and June for individuals who have been nonetheless utilizing the Earn app after 90 days.

With the ability to goal much less frequent behaviors which can be vital to Mode however might not occur fairly often “opens up plenty of new concentrating on prospects for us,” Dunkley stated.

“And the deeper we are able to go into our funnel,” he stated, “the extra useful the occasions turn into.”