Low-cost places and an costly inventory arrange for a put play in Microsoft (MSFT).

Each the S&P 500 and NASDAQ 100 closed proper at latest highs on Friday. The equally weighted S&P 500 and NASDAQ 100 nonetheless have a solution to go earlier than nearing latest highs, nevertheless.

The mega-cap shares like Apple, Nvidia and Microsoft have been the massive outperformers this 12 months which accounts to the divergence between cap weighted QQQ and equal weighted QQQE.

Friday, although, lastly confirmed some struggles for a few of these mega-cap names even with the indices closing larger. Microsoft (MSFT), one of many mega-cap leaders, was truly down with each the S&P 500 and QQQ sharply larger.

Has the time arrived to start to fade the rally in these red-hot names? Let’s check out Microsoft utilizing the POWR Choices course of to see if the manic melt-up could also be beginning to stall in MSFT.

POWR Choices likes to make use of a mix of elementary and technical evaluation together with implied volatility to uncover commerce concepts which have a probabilistic edge. This fusion method helps put the percentages in your favor. No assure (that is buying and selling, in any case) however an edge.

Let’s take a fast stroll by means of the method utilizing Microsoft for instance.

Valuation

Microsoft inventory is getting dear as soon as once more on a valuation foundation. Present Worth/Gross sales (P/S) ratio now stands on the highest stage this 12 months and the best since January 2022.

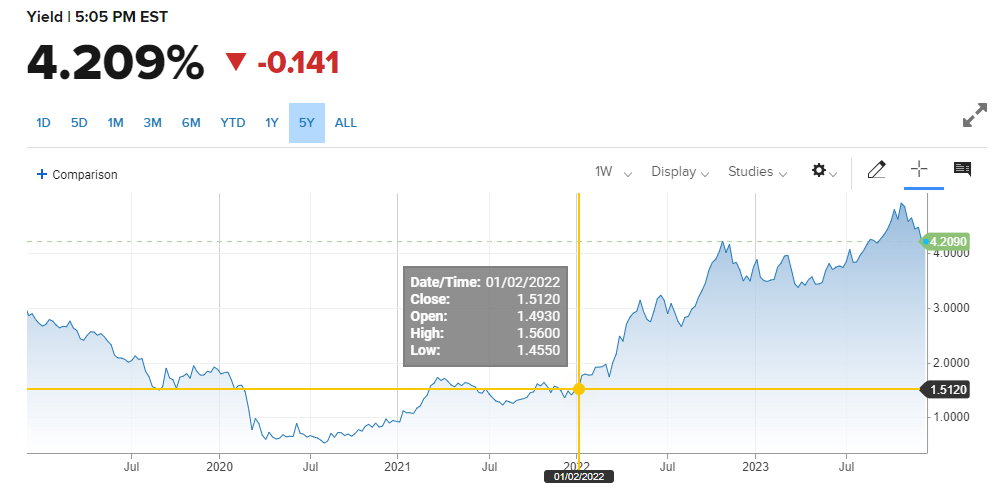

This regardless that the 10-year Treasury yield continues to be over 4% and the Fed Funds charge is at 5.25% to five.5%. Again in January 2022 (the final time MSFT carried such lofty multiples) the Federal Reserve hadn’t even begun to lift charges off zero and the 10-year yield was at simply over 1.5%.

To me, such historic will increase in rates of interest ought to dampen valuation multiples in a big means. Plus, a 2.78 trillion greenback market cap firm like Microsoft carrying a virtually 13x P/S ratio is troublesome to justify since progress charges will essentially be lessened merely because of the regulation of huge numbers.

Technicals

MSFT inventory can also be displaying some weak spot (lastly) from a technical perspective. Shares are struggling to interrupt previous the $380 space. 9-day RSI reached an excessive at 80 however has since fallen again to 56. Bollinger % B exceeded 100 and is now at 61. MACD additionally reached an excessive however simply generated a promote sign by going adverse. A break beneath the 20-day transferring common might result in additional draw back because it has achieved previously.

Implied Volatility

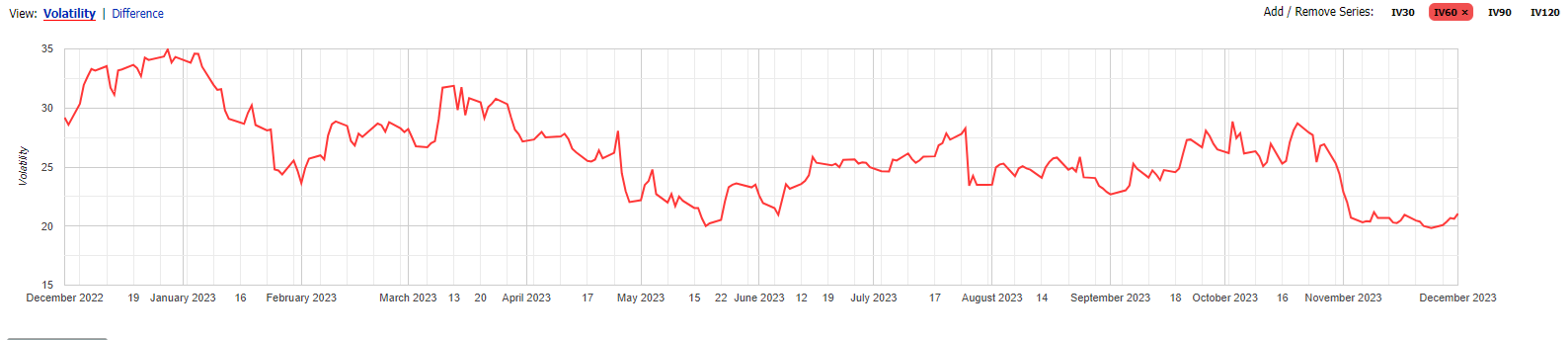

Implied volatility (IV) is hovering on the lowest ranges of the previous 12 months. This implies possibility costs are low-cost. A 12 months in the past, the 75-day at-the-money places had been buying and selling at simply over a 30 IV. Now the identical 75-day at-the-money places are buying and selling at only a 23 IV.

To place the places in perspective, the MSFT $255 places had been priced at $13.10 on 12/4/2022 with MSFT inventory at $255.02. Now, comparable $375 places are priced at $14.40 with MSFT inventory at $374.51. So, the 75-day places are solely $1.30 larger now regardless that Microsoft inventory is $120 factors larger! The share price of put protection-and put prices-has dropped significantly to say the least. From over 5% a 12 months in the past to underneath 4% now.

That is the commerce concept technology course of we use each day for the POWR Choices Portfolio. Mix elementary, technical and implied volatility evaluation in a fusion format.

Buyers and merchants alike might need to look to purchase places on an overvalued and overbought MSFT inventory. The inventory worth hasn’t ever been this costly and the put costs this low-cost in a really very long time.

POWR Choices

What To Do Subsequent?

In the event you’re searching for the most effective choices trades for immediately’s market, it’s best to try our newest presentation Methods to Commerce Choices with the POWR Scores. Right here we present you how one can persistently discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you need to study extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Methods to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices Publication

MSFT shares closed at $374.51 on Friday, down $-4.40 (-1.16%). 12 months-to-date, MSFT has gained 57.55%, versus a 21.38% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up 3 Large Causes Why Microsoft Might Not Be A Purchase After Going To Excessive appeared first on StockNews.com