You‘re good, however beginning a small enterprise doesn’t make you a finance knowledgeable. Accounting 101 is essential for each enterprise proprietor due to the money and time it might prevent sooner or later.

It does not matter for those who love crunching numbers or think about your self the extra artistic sort. Entrepreneurs have to pay attention to the monetary well being of their companies and have a superb grasp of accounting fundamentals.

We wrote this accounting information to ease you into the world of enterprise accounting. By the tip, you’ll really feel able to deal with your individual enterprise’s accounting (or discover somebody who may also help).

Hold studying, or use the chapter hyperlinks under to leap to the part you are on the lookout for.

Desk of Contents

What do accountants truly do?

Accountants oversee the monetary data of a enterprise and ensure the info is appropriate. Then, they use this information to create budgets, monetary paperwork, and stories. They’ll ensure that the cash coming into the enterprise works with the bills required to function. B

Past that, they guarantee compliance with the regulatory aspect of funds.

Accountants may evaluation money circulate statements for operations or an earnings assertion for an upcoming board assembly. They’ll additionally attend conferences to supply recommendation on the corporate’s funds. Different widespread actions embody:

- Accumulating new monetary information.

- Reviewing or updating previous data.

- Accumulating proof for audits and different authorized proceedings.

- Computing taxes.

- Checking on compliance with related legal guidelines.

- Ensuring tax funds are on time.

- Forecasting and danger evaluation.

Kinds of Accounting

When you studied enterprise, you realize that accounting is greater than gazing stability sheets all day. There are lots of several types of accounting that require totally different talent units. Your online business could have to work with a sure specialty based mostly on their wants. Under, we’ll talk about some widespread types of accounting you may encounter.

Tax Accounting

Tax accounting includes sustaining and holding observe of what you are promoting’ taxes. This will embody submitting yearly taxes, monitoring spending and tax charges, in addition to aiding staff with establishing tax types.

To do such a accounting, you’ll must have a stable understanding of tips on how to file taxes and of your tax code. You’ll have to adjust to each federal laws and the states by which you use what you are promoting.

Monetary Accounting

Monetary accounting focuses on the worth of the corporate’s property and liabilities. These accountants guarantee that an organization’s accounting follows the Usually Accepted Accounting Rules, which we are going to describe under. These accountants additionally work with money circulate statements and stability sheets.

Administration Accounting

Administration accountants current monetary information to stakeholders and senior management at an organization. They play a better function in reviewing what services or products an organization wants, in addition to how these efforts might be financed.

Forensic Accounting

If forensics convey up photos of NCIS crime scenes, your deductive expertise are as much as par! Forensic accounting does require a sure diploma of digging and detective work.

This kind of accountant investigates and analyzes monetary info for companies. They’re looking out for compliance breaches or criminal activity. Forensic accountants are utilizing their data to audit organizations for monetary misconduct.

Value Accounting

Value accountants create a continuing file of all prices incurred by the enterprise. This information is used to trace the place the corporate spends and enhance the administration of those bills. They’ll discover redundancies and locations the place the corporate may reduce prices.

Auditing

Auditors are accountants who specialise in reviewing monetary paperwork to see in the event that they adjust to tax legal guidelines, laws, and different accounting requirements. These professionals consider organizations’ monetary paperwork to guarantee that they’re correct and comply with authorized pointers.

Worldwide Accounting

Worldwide accountants give attention to working with companies that function across the globe. They learn about commerce legal guidelines, international forex charges, and the accounting rules of different international locations.

Bookkeeping

.webp)

Bookkeeping is a tactical monetary course of that features recording and organizing monetary information. That features what’s being spent and what cash the enterprise is making. This work might be accomplished both by an accountant or a bookkeeper. Bookkeepers give attention to monitoring spend. Accountants transcend, advising leaders on what to do with this information.

An accountant is usually a bookkeeper, however not all bookkeepers are accountants.

Accounting Expertise

Being a rockstar accountant is extra than simply being good with numbers. You want an unlimited array of data on tax codes, monetary laws, and the perfect practices for sustaining a wholesome stability sheet. Then, you want the comfortable expertise to use your data to the actual world. Listed below are some important expertise accounting requires.

Listening

When you’re on the prowl for an accountant, you wish to discover one which listens. They need to perceive what what you are promoting does, the bills required so that you can function, and any monetary challenges you might need in your radar.

If you’re the accountant offering providers, you’ll want to supply a listening ear. You’ll be able to higher apply your data in case you have a transparent understanding of a shopper’s wants.

Time Administration

Whether or not you are utilizing in-house accounting providers or working with exterior accountants, time administration is a necessary talent. Your group is confronted with inside deadlines and audits. Opinions of your monetary well being have to be accomplished in a well timed manner.

When you’re an accountant, keep in mind lots of your shoppers could have the identical deadlines. Tax day and the monetary 12 months are massive markers for the organizations you’re employed with. Be sure to can handle your ebook of enterprise so nobody’s wants fall via the cracks.

Group

As an accountant, you want to have the ability to provide well timed solutions and proposals to your shoppers. So, you’ll have to be organized. Hold observe of the place info is for all your totally different shoppers. That ought to embody safe storage methods for all of their paperwork.

As an accountant, you are coping with delicate info. You must have secure channels for transferring these paperwork so the info is secure from unhealthy actors.

Important Pondering

Generally, you’ll have to suppose in your ft. There could also be a lapse within the month-to-month income or too excessive a payout for workers. You’ll be anticipated to research info, holding observe of the story your cash tells and offering steerage on what to do subsequent. Irrespective of the case, essential considering is important.

Whereas math expertise are useful, information and methods evaluation are keys to success on this function. An accountant is commonly an investigator. Because of this curiosity and deductive reasoning expertise are additionally helpful.

Understanding these expertise may also help enterprise house owners. If in case you have these talents, you could possibly do loads of your accounting your self. When you want exterior assist, understanding these expertise will aid you select a precious enterprise accomplice.

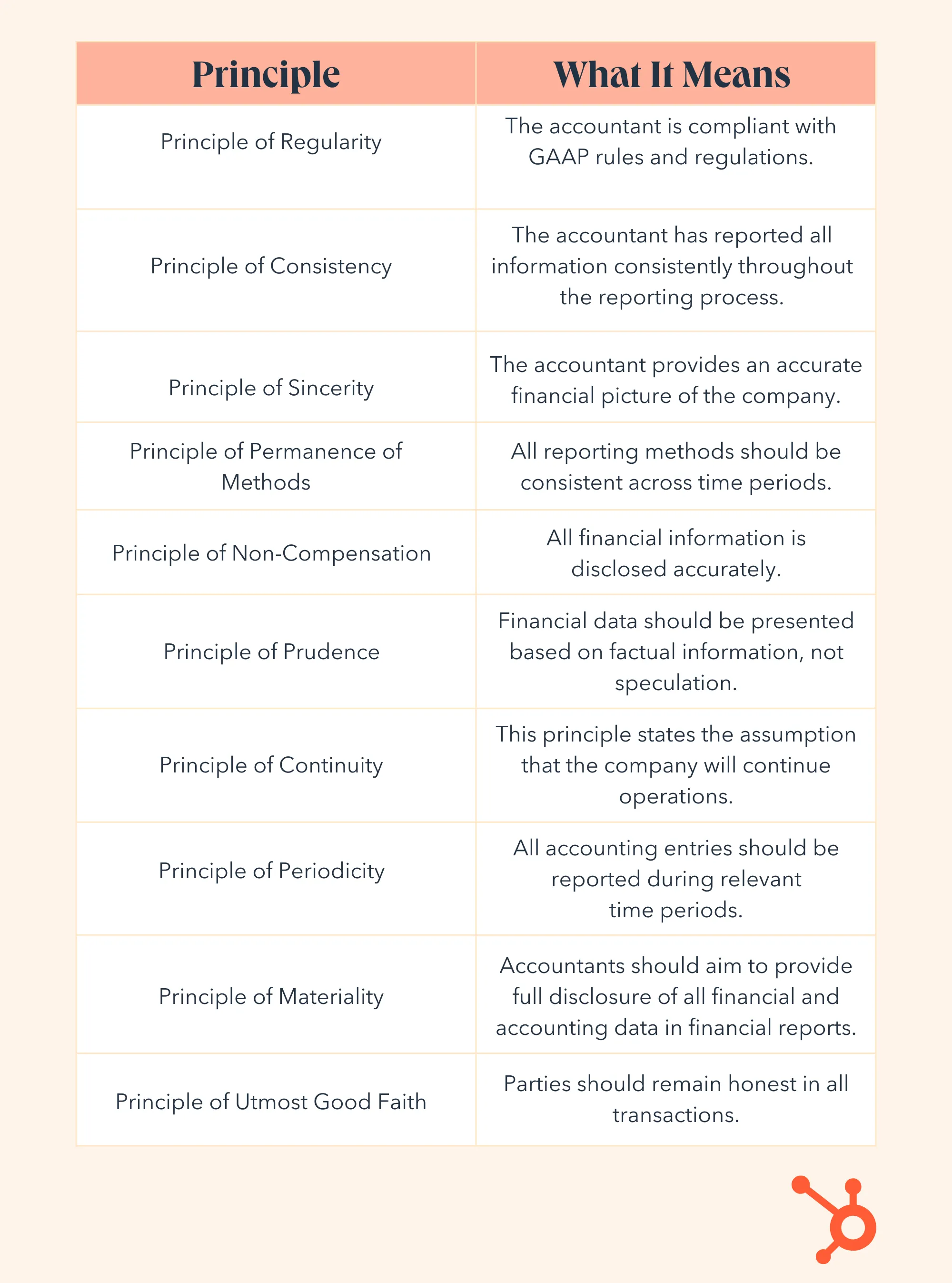

Accounting Rules

The Usually Accepted Accounting Rules (GAAP) are a blueprint for accounting throughout sectors within the U.S. These rules affirm that publicly traded firms share their funds precisely.

By legislation, accountants for all publicly traded firms should adjust to GAAP. Let’s break down these rules.

1. Precept of Regularity

The working accountant is compliant with GAAP guidelines and laws.

Why This Accounting Precept Issues

This precept regulates how accounting works as a career. With out it, each firm would handle funds in its personal manner. This may make it powerful to maintain enterprise dealings truthful.

Methods to apply this precept: Observe all Monetary Accounting Requirements Board (FASB) laws.

2. Precept of Consistency

This precept states that the accountant has reported all info persistently all through the reporting course of. Below the precept of consistency, accountants should clearly state any adjustments in monetary information on monetary statements.

Why This Accounting Precept Issues

It makes certain which you can evaluate monetary reporting throughout an organization. Say you are evaluating two departments, however they file the identical transactions in numerous methods. This may make it troublesome for stakeholders to check them.

Methods to apply this precept: Create clear processes for recording transactions and occasions as quickly as you begin what you are promoting. Upon getting a set course of for documenting and reporting your funds, persist with it.

3. Precept of Sincerity

The accountant offers an correct monetary image of the corporate.

Why This Accounting Precept Issues

It is a promise from the accountant that they‘re not attempting to mislead anybody. This helps buyers belief that the knowledge what you are promoting presents is correct. It’s additionally a dedication to presenting information within the fairest and most correct manner doable.

Methods to apply this precept: Keep your monetary data truthfully and precisely.

4. Precept of Permanence of Strategies

All monetary reporting strategies ought to be constant throughout time durations.

Why This Accounting Precept Issues

That is one other precept of regularity and consistency. It makes it simpler to check monetary data.

Methods to apply this precept: Clearly arrange your every day bookkeeping operations. It is also a good suggestion to create processes in order that your reporting stays constant over time.

5. Precept of Non-Compensation

All monetary info, each damaging and constructive, is disclosed precisely. The right reporting of monetary information ought to be carried out with no expectation of efficiency compensation.

Why This Accounting Precept Issues

It says that accountants should not alter reporting. As an alternative, accountants should decide to reporting each good and unhealthy efficiency.

This sounds simple, however accounting can affect each inside and exterior opinions. Due to this, many publicly traded firms report each GAAP and non-GAAP earnings. Generally, this additional information may also help the general public picture of an organization or make clear the worth of an organization’s investments.

Methods to apply this precept: Create monetary stories which can be clear and correct.

6. Precept of Prudence

Monetary information ought to be offered based mostly on factual info, not hypothesis.

Why This Accounting Precept Issues

It makes certain that monetary statements are a sensible overview of revenues and liabilities. It reminds firms to not over or understate their monetary danger.

Methods to apply this precept: Enterprise strikes quick, and lots of firms depend on in-progress tasks and earnings to fulfill targets. However even when this is applicable to what you are promoting, proceed to take care of correct and well timed data.

Typically, do not count on income, however put together for any doable losses.

7. Precept of Continuity

This precept states the belief that the corporate will proceed operations.

Why This Accounting Precept Issues

That is one other information in your reporting timeline. It makes it simpler for stakeholders to know and evaluate efficiency as a result of it separates it into quick durations of time. It additionally makes it simpler for them to see essentially the most present monetary info.

Methods to apply this precept: As what you are promoting plans for and makes adjustments, keep a constant course of for monetary reporting and record-keeping.

8. Precept of Periodicity

All accounting entries ought to be reported throughout related time durations.

Why this accounting precept is necessary:

That is one other information in your reporting timeline. It makes it simpler for stakeholders to know and evaluate efficiency as a result of it separates it into quick durations of time. It additionally makes it simpler for them to see essentially the most present monetary info.

Methods to apply this precept:

Report in your funds yearly, quarterly, and month-to-month. It is also a good suggestion to set your fiscal 12 months if you begin what you are promoting.

9. Precept of Materiality

Accountants ought to intention to supply full disclosure of all monetary and accounting information in monetary stories.

Why this accounting precept is necessary:

Your online business can determine which transactions are “materials” and which aren’t. Enterprise firms will method what’s and isn’t “materials” otherwise than a small enterprise would. If one thing isn‘t “materials,” it’s one thing the enterprise feels is simply too small to say.

When you restrict your accounting to materials transactions, it can save you time for what you are promoting. On the similar time, you wish to guarantee that monetary info that is necessary to stakeholders is simple to entry and evaluation. This idea comes up most frequently throughout an audit.

Methods to apply this precept: You may begin what you are promoting accounting by recording each transaction. However as what you are promoting grows or circumstances change, you might wish to revisit the way in which you file and report small transactions.

10. Precept of Utmost Good Religion

In accordance with this precept, events ought to stay trustworthy in all transactions.

Why this accounting precept is necessary:

This precept establishes belief. It reinforces that you’ll share necessary info with stakeholders earlier than you enter right into a contract collectively. This offers every individual a full and clear image of what you are promoting earlier than they make an settlement.

Methods to apply this precept: Be clear and share important particulars as you make agreements.

Fundamental Accounting Phrases

Whether or not you’re doing the accounting your self or working with an exterior social gathering, these phrases will come up. Speaking the discuss will aid you make higher selections for what you are promoting. These 15 phrases will create the inspiration on which you’ll construct your data.

A few of these phrases may not apply to what you are promoting proper now. Nonetheless, you’ll want a holistic understanding of the topic as what you are promoting grows.

1. Debits & Credit

To not be confused together with your private debit and bank cards, debits and credit are foundational accounting phrases to know.

A debit is a file of all cash anticipated to return into an account. A credit score is a file of all cash anticipated to return out of an account. Primarily, debits and credit observe the place the cash in what you are promoting is coming from and the place it’s going.

Many companies function out of a money account – or a enterprise checking account that holds liquid property for the enterprise. When an organization pays for an expense out of pocket, the money account is credited as a result of cash is transferring from the account to cowl the expense. This implies the expense is debited as a result of the funds credited from the money account are masking the price of that expense.

Right here’s a easy visible that will help you perceive the distinction between debits and credit:

|

Debits |

Credit |

|

Enhance property |

Lower property |

|

Lower liabilities |

Enhance liabilities |

|

Lower income |

Enhance income |

|

Enhance the stability of expense accounts |

Lower the stability of expense accounts |

|

Lower the stability of fairness accounts |

Enhance the stability of fairness accounts |

2. Accounts Receivable & Accounts Payable

Accounts receivable is cash that individuals owe you for items and providers. It’s thought-about an asset in your stability sheet. For instance, if a buyer fulfills their bill, your organization’s accounts receivable quantity is decreased as a result of much less cash is now owed.

Accounts payable is cash that you simply owe different individuals and is taken into account a legal responsibility in your stability sheet. For instance, let’s say your organization pays $5,000 in hire every month. Right here’s how that may be recorded in your monetary data earlier than that quantity is paid out.

|

Date |

Account |

Debit |

Credit score |

|

7/31/21 |

Lease |

5000 |

|

|

7/31/21 |

Accounts Payable |

5000 |

As soon as that worth is paid, right here’s how that may be recorded in your organization’s monetary data.

|

Date |

Account |

Debit |

Credit score |

|

8/1/21 |

Accounts Payable |

5000 |

|

|

8/1/21 |

Money Account |

5000 |

3. Accruals

Accruals are credit and money owed that you simply’ve recorded however not but fulfilled. These might be gross sales you’ve accomplished however not but collected fee on or bills you’ve made however not but paid for.

(Why not wait to file the exercise till the fee is full? We’ll reply this query after we clarify the accrual accounting technique later.)

4. Property

Property are every part that your organization owns — tangible and intangible. Your property may embody money, instruments, property, copyrights, patents, and logos.

5. Burn Charge

Your burn fee is how shortly what you are promoting spends cash. It’s a essential element when calculating and managing your money circulate.

To calculate your burn fee, merely choose a time interval (akin to 1 / 4 or a 12 months). Subtract your on-hand money quantity on the finish of that interval out of your on-hand money at the start, then divide that quantity by the variety of months within the interval (or by your chosen cadence).

6. Capital

Capital refers back to the cash you must make investments or spend on rising what you are promoting. Generally known as “working capital,” capital refers to funds that may be accessed (like money within the financial institution) and don’t embody property or liabilities.

7. Value of Items Offered

The price of items bought (COGS) or price of gross sales (COS) is the price of producing your product or delivering your service.

COGS or COS is the primary expense you’ll see in your revenue and loss (P&L) assertion and is a essential element when calculating what you are promoting’s gross margin. Decreasing your COGS may also help you improve revenue with out rising gross sales.

8. Depreciation

Depreciation refers back to the lower in your property’ values over time. It’s necessary for tax functions, as bigger property that affect what you are promoting’s skill to earn money might be written off based mostly on their depreciation. (We’ll talk about bills and tax write-offs afterward.)

9. Fairness

Fairness refers back to the amount of cash invested in a enterprise by its house owners. It’s also called “proprietor’s fairness” and might embody issues of non-monetary worth, akin to time, vitality, and different assets. (Ever heard of “sweat fairness”?)

Fairness will also be outlined because the distinction between what you are promoting’s property (what you personal) and liabilities (what you owe).

A enterprise with wholesome (constructive) fairness is engaging to potential buyers, lenders, and consumers. Traders and analysts additionally take a look at what you are promoting’s EBITDA, which stands for earnings earlier than curiosity, taxes, depreciation, and amortization.

10. Bills

Bills embody any purchases you make or cash you spend in an effort to generate income. Bills are additionally known as “the price of doing enterprise.”

There are 4 major sorts of bills, though some bills fall into multiple class.

- Fastened bills are constant bills, like hire or salaries. These bills aren’t usually affected by firm gross sales or market traits.

- Variable bills fluctuate with firm efficiency and manufacturing, like utilities and uncooked supplies.

- Accrued bills are single bills which have been recorded or reported however not but paid. (These would fall below accounts payable, as we mentioned above.)

- Working bills are obligatory for an organization to do enterprise and generate income, like hire, utilities, payroll, and utilities.

11. Fiscal 12 months

A fiscal 12 months is the time interval an organization makes use of for accounting. The beginning and finish dates of your fiscal 12 months are decided by your organization; some coincide with the calendar 12 months, whereas others fluctuate based mostly on when accountants can put together monetary statements.

12. Liabilities

Liabilities are every part that your organization owes within the lengthy or quick time period. Your liabilities may embody a bank card stability, payroll, taxes, or a mortgage.

13. Revenue

In accounting phrases, revenue — or the “backside line” — is the distinction between your earnings, COGS, and bills (together with working, curiosity, and depreciation bills).

You (or what you are promoting) are taxed in your web revenue, so it’s necessary to proactively plan in your tax legal responsibility. Do that by staying on prime of your web revenue quantity, setting apart a few of your income in a separate financial savings account, or paying your estimated taxes each quarter (like employer withholding).

14. Income

Your income is the full amount of cash you acquire in trade in your items or providers earlier than any bills are taken out.

15. Gross Margin

Your gross margin (or gross earnings), which is your complete gross sales minus your COGS — this quantity signifies what you are promoting’s sustainability.

Accounting Fundamentals

No matter the way you handle what you are promoting accounting, it‘s sensible to know accounting fundamentals. When you can learn and put together these fundamental paperwork, you’ll perceive what you are promoting’s efficiency and monetary well being — because of this, you will have better management of your organization and monetary choices.

Listed below are the paperwork and calculations we advocate choosing up, even for those who work with knowledgeable consulting company or have employed an authorized public accountant (CPA). They supply precious snapshots and measures of what you are promoting efficiency.

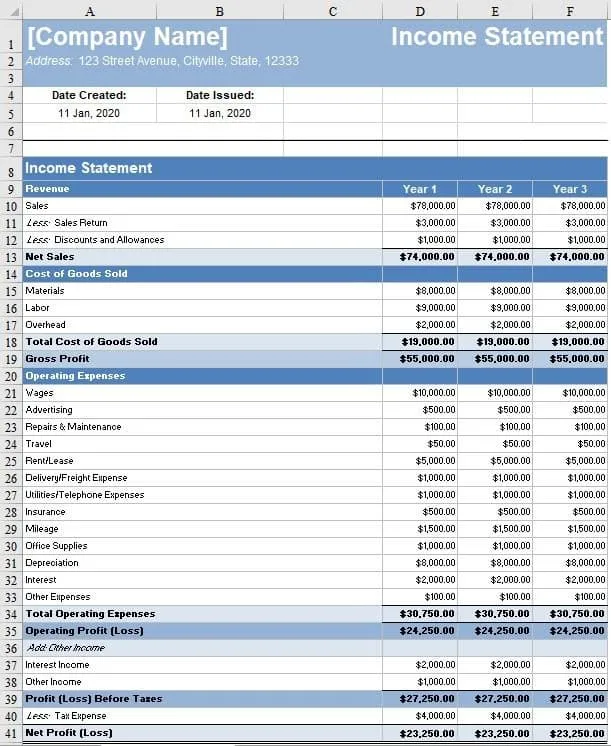

1. Earnings Assertion

An earnings assertion exhibits your organization’s profitability and tells you ways a lot cash what you are promoting has made or misplaced. This lets you see the place your cash is coming in.

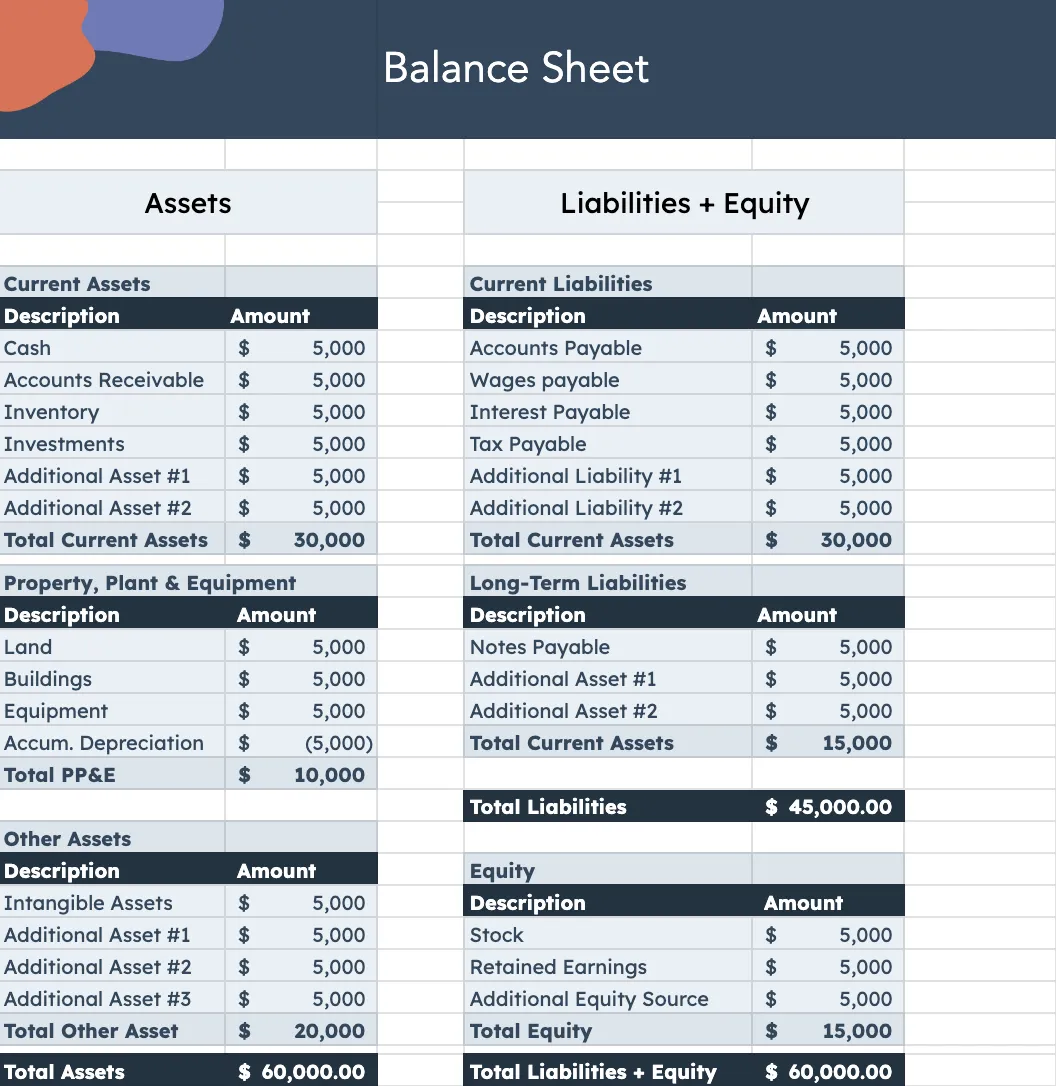

2. Steadiness Sheet

A stability sheet is a snapshot of what you are promoting’s monetary standing at a single cut-off date. A stability sheet can even present you what you are promoting’s retained earnings, which is the quantity of revenue that you simply’ve reinvested in what you are promoting (slightly than being distributed to shareholders).

Many small enterprise house owners do a mix of bookkeeping and accounting.

3. Revenue and Loss (P&L) Assertion

A revenue and loss (P&L) assertion is a snapshot of what you are promoting’s earnings and bills throughout a given time interval (like quarterly, month-to-month, or yearly). This calculation can even be mirrored on what you are promoting’s Schedule C tax doc.

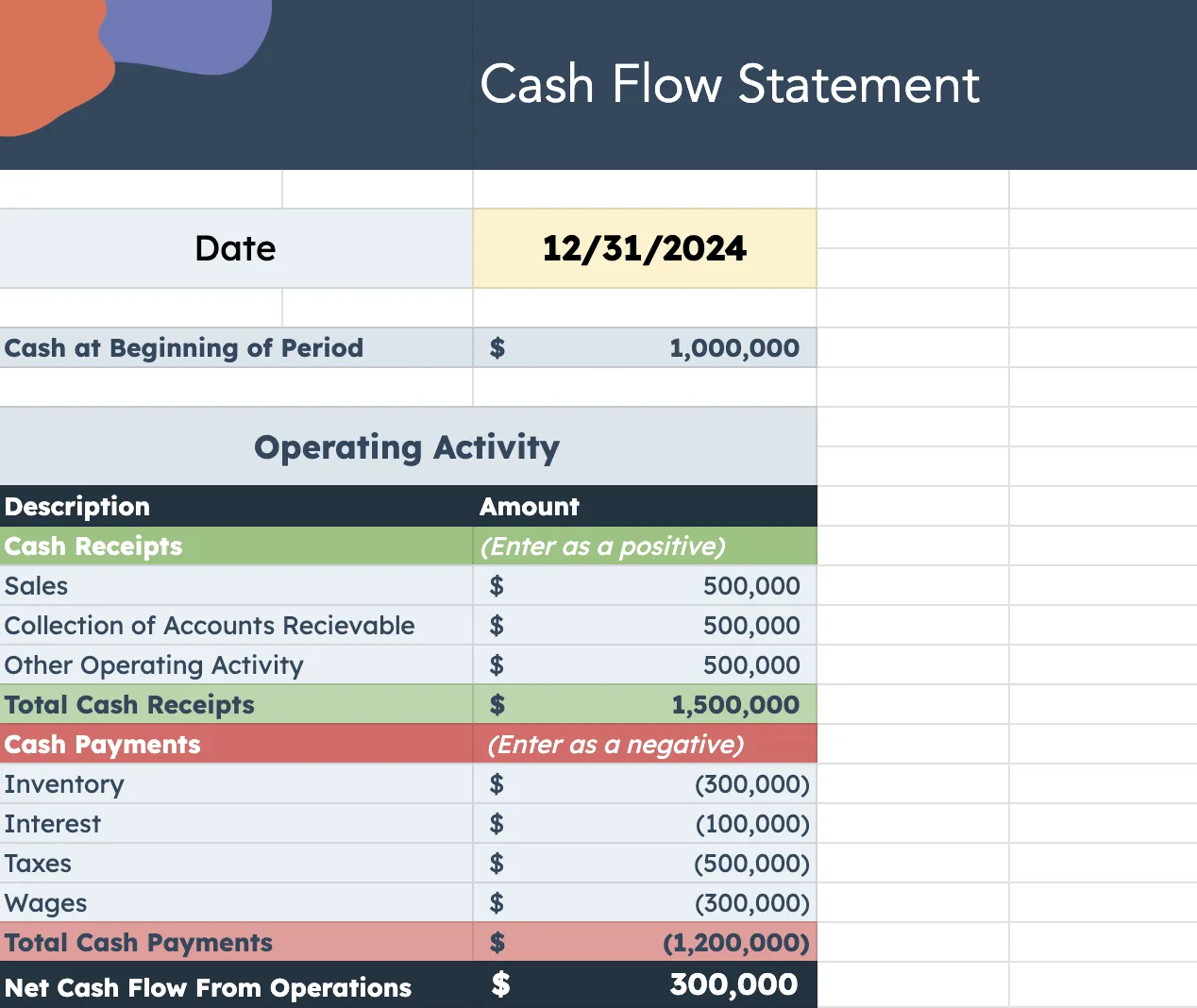

4. Money Circulation Assertion

A money circulate assertion analyzes what you are promoting’s working, financing, and investing actions to indicate how and the place you’re receiving and spending cash. Preserving observe of spending and sustaining the enterprise bills in an in depth and arranged trend permits for deeper appears into the corporate’s spending and helps decrease prices in areas that won’t want as a lot consideration.

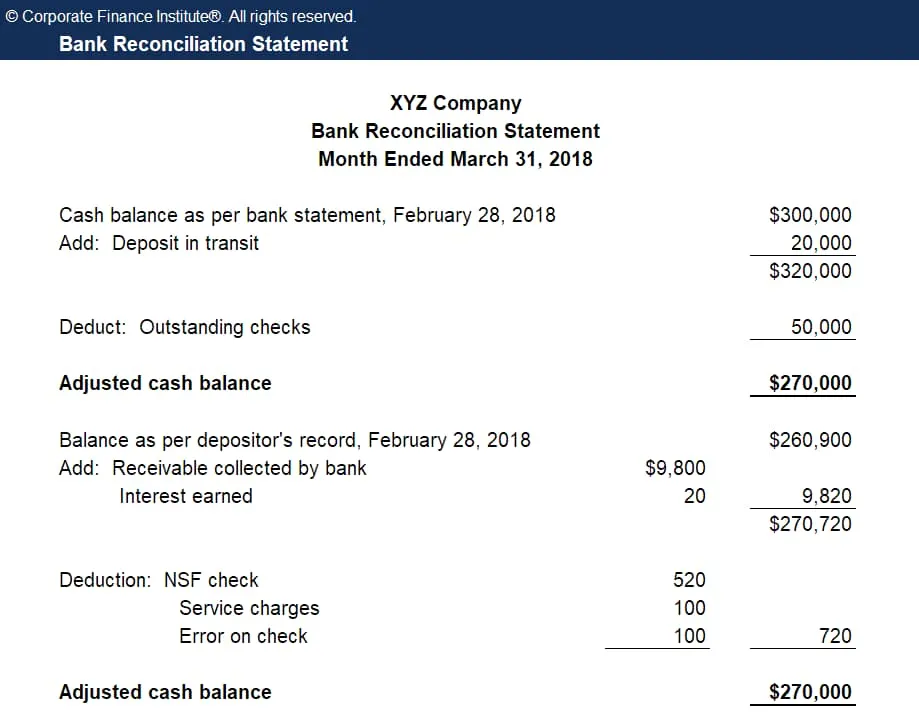

5. Financial institution Reconciliation

A financial institution reconciliation compares your money expenditures together with your total financial institution statements and helps hold what you are promoting data constant. (That is the method of reconciling your ebook stability to your financial institution stability of money.)

Small Enterprise Accounting

When you run a enterprise by yourself, you might do some or the entire following duties:

- Open a checking account

- Observe earnings, bills, property, liabilities, and fairness

- Put together monetary statements

- Develop a system for bookkeeping

- Create a payroll system

- Work out tax laws and funds

Generally, a enterprise will do that analysis and work as a part of an preliminary marketing strategy. Different occasions, they find out about these necessities a little bit bit at a time because the enterprise grows.

Accounting is a posh self-discipline. However for those who’re not an accountant your self, you don’t have to know every part about accounting — solely the practices and elements that must do together with your monetary operations, authorized obligations, and enterprise choices.

Nonetheless, you seemingly already do a big portion of what you are promoting’ accounting your self. Even in case you have a CPA help you come tax season, you continue to have to handle your accounts, observe incomes and assessments, and handle payroll.

In accordance with Statista, 64% of small companies use accounting software program for his or her funds. One other 43% use software program for his or her taxes. Automated accounting software program consists of instruments like QuickBooks, Xero, and different well-liked accounting functions.

These instruments are how most small companies handle their accounting, typically supported by different necessary enterprise software program options, like a CRM or automation instruments. Automation instruments save companies and accountants time by limiting the period of time they spend on information entry. This offers them extra time to research information to enhance the enterprise.

Generally, a enterprise will do that analysis and work as a part of an preliminary marketing strategy. Different occasions, they find out about these necessities a little bit bit at a time because the enterprise grows.

My suggestion? Begin early. When you’re simply getting began, think about including your accounting technique to your marketing strategy. How do you count on to handle your funds? Will you employ Quickbooks, a CPA, or make an accountant your first rent? You’ll be able to then adapt your plan as wanted.

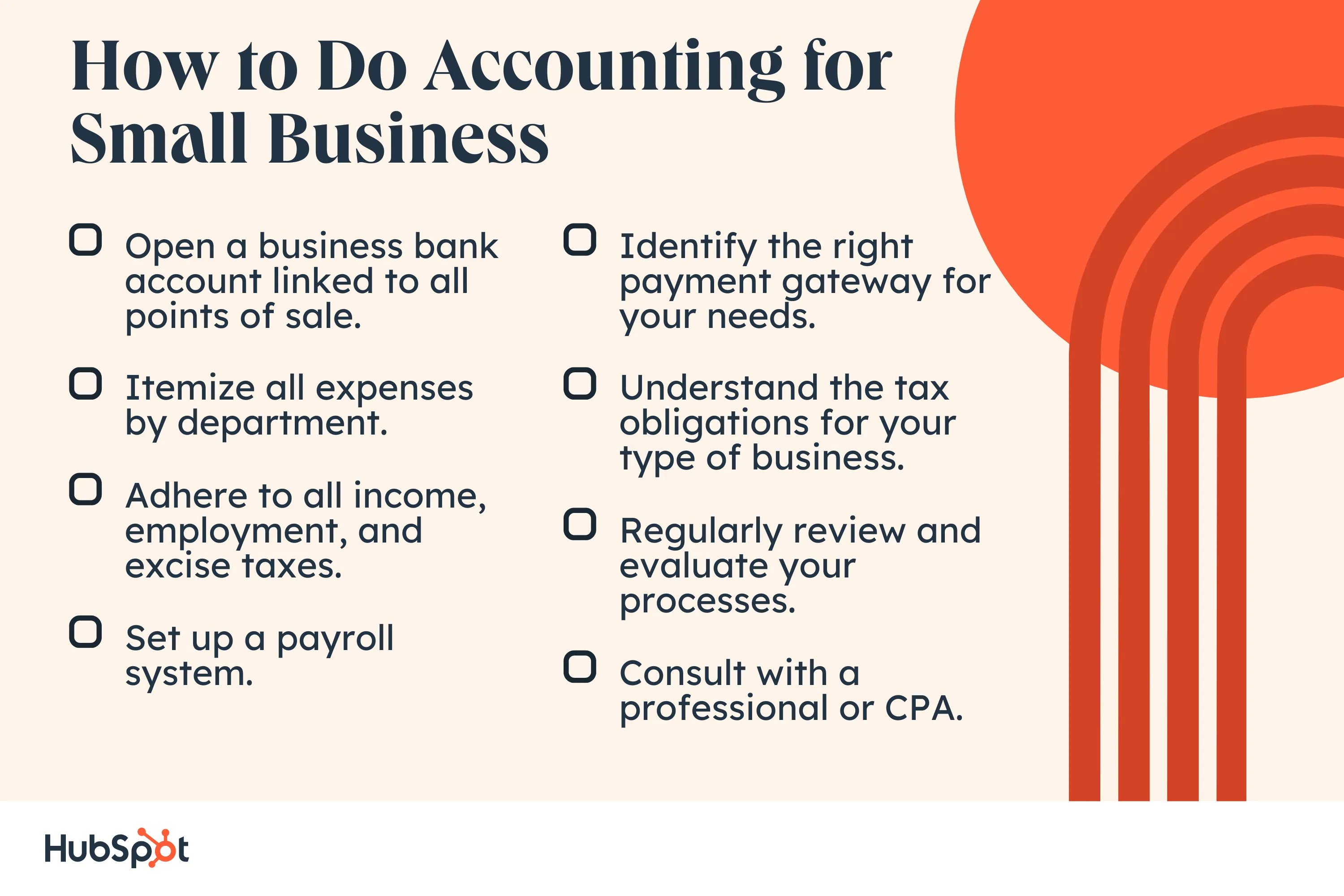

Methods to Do Accounting for Small Enterprise

- Open a enterprise checking account linked to all factors of sale.

- Itemize all bills by division.

- Adhere to all earnings, employment, and excise taxes.

- Arrange a payroll system.

- Establish the precise fee gateway in your wants.

- Perceive the tax obligations in your sort of enterprise.

- Often evaluation and consider your processes.

- Seek the advice of with knowledgeable or CPA.

Whether or not you’ve simply launched what you are promoting or are a startup veteran, the next part is necessary. These eight steps will introduce you to the accounting course of (for those who’re not but aware of it) and set you as much as scale what you are promoting in a sustainable manner.

Be aware: That is merely an outline of the self-discipline of accounting. We advocate conducting extra analysis and doubtlessly hiring knowledgeable accountant (which we’ll speak about under) to make sure you don’t miss any monetary or authorized obligations.

1. Open a enterprise checking account linked to all factors of sale.

On your first order of enterprise, determine the place to maintain your cash. This will likely fluctuate based mostly on what you are promoting’s authorized construction. If what you are promoting is an LLC, Partnership, or Company, you might be required to have a separate enterprise checking account. When you’re a Sole Proprietorship, you don’t must — however we nonetheless advocate it.

Having a separate checking account for what you are promoting earnings and bills will make your accounting simpler. You’ll solely have one account to observe for bookkeeping and tax functions, and your private earnings and bills gained’t get entangled with what you are promoting ones. Imagine me — solely having to take a look at one set of financial institution statements is a lifesaver throughout tax season.

Search for a financial institution that has an area department in addition to sturdy on-line banking. Additionally, be certain the financial institution can combine together with your point-of-sale (POS) system and different technological wants. Enterprise financial institution accounts usually cost greater than private accounts and infrequently have the next minimal stability. Examine these numbers earlier than committing to a financial institution and a enterprise account.

We advocate opening two accounts — one checking account and one financial savings account, the latter by which you’ll stash cash for taxes and unexpected bills. And keep in mind, earlier than you may open any enterprise accounts, you need to have a registered enterprise identify.

Lastly, think about opening a enterprise bank card. Not solely will this assist offset some upfront bills, however it’ll additionally contribute to what you are promoting’s total credit score. Additionally, Companies and LLCs are required to have a separate line of credit score exterior their private accounts.

2. Itemize all bills by division.

Elevate your hand for those who’ve heard anybody say, “Hey, I can write that off.” I heard my mother and father say that quite a bit after I was youthful — they’re each entrepreneurs — and I had no thought what it meant.

It wasn’t till I began my very own enterprise in school that I got here to know tax deductions: they’re a beautiful but pesky good thing about proudly owning a enterprise.

Many enterprise bills are tax deductions — bills that deduct from what you owe in taxes. For instance, if I spent $500 to fly to and attend a advertising convention, that’s $500 much less I owe in taxes for that 12 months. The catch? With a view to declare a deduction, it is advisable to hold a file of that expense.

Traditionally, holding, submitting, and reviewing paper receipts was a time-consuming job. (My mother used to pay 10-year-old me to prepare receipts by date and spotlight the seller and complete quantity … now I perceive why.)

As we speak’s entrepreneurs have it a lot simpler. Software program, apps, and cloud-based bookkeepers have made it a breeze to trace bills and never must hold tons of of receipts mendacity round. Take a look at options like Rydoo, Expensify, Zoho Expense, and Shoeboxed to assist handle your bills.

Now, let’s talk about the bills and supporting documentation you’ll be managing. Whereas we will’t cowl each doable deduction, listed here are a handful it’s best to undoubtedly hold a file of. (Why? As a result of they’re straightforward to combine up with private bills … and the IRS is aware of it.)

- Promoting and advertising bills, akin to paid social media adverts, web site internet hosting charges, and enterprise playing cards

- Enterprise journey, akin to airplane tickets, accommodations, and rental automobiles

- Dwelling workplace bills, akin to WiFi, gear, and cell phones

- Car-related bills, akin to mileage and fuel

- Meals and leisure, akin to journeys to espresso retailers, cafes, or live shows (until you don’t attend these occasions … then they’d be thought-about Presents)

In case it is advisable to assist these bills, we advocate that you simply hold the next paperwork. (Rule of thumb: When unsure, hold every part.)

- Receipts (paper and digital)

- Financial institution and card statements

- Payments (for utilities, cellphone, web, and so on.)

- Canceled checks

- Invoices and paperwork exhibiting proof of fee

- Monetary statements out of your bookkeeper or bookkeeping software program

- Tax returns from earlier years

- Any W-2, W-4, W-9, and 1099-MISC types

One other widespread strategy to handle your bills is by separating working bills from promoting, common, and administrative (SG&A) bills.

Working and SG&A Bills

Some firms determine to mix working (OPEX) and SG&A bills, whereas some separate them (they are often mixed on an earnings assertion). Both choice is completely effective — it is about desire.

Here is what it is advisable to learn about OPEX versus SG&A bills:

- Working bills embody prices associated to your every day bills and are sometimes nearly all of a enterprise’s bills (which is why many firms select to mix these bills).

- OPEX aren‘t included in COGS — they’re the prices concerned within the manufacturing of products and providers akin to hire, utilities, insurance coverage, stock prices, salaries or wages, property taxes, or enterprise journey.

- SG&A bills are incurred as every day enterprise ops and are included in earnings statements (below “bills”).

- SG&A bills aren‘t included in COGS (since they’re not related to a selected product) and are not assigned to your manufacturing prices.

- If separated from OPEX, SG&A covers elements like accounting and authorized bills, adverts and promotional supplies, advertising and gross sales bills, utilities and provides that are not associated to manufacturing, and company overhead (if there are government assistants and company officers).

3. Adhere to all earnings, employment, and excise taxes.

Ah. If solely bookkeeping meant hoarding the paperbacks I overbuy from my native bookstore — I’d be actually good at that.

Sadly, bookkeeping isn’t at all times as enjoyable. It’s one other necessary account time period that refers back to the day-to-day recording, categorizing, and reconciling of transactions. Mainly, bookkeeping retains you from spending and earning money with out monitoring it.

Bookkeeping is an ongoing job. Technically, try to be doing it day by day, however everyone knows life can get in the way in which. Ideally, it’s best to full your bookkeeping each month so you may hold a thumb on the heart beat of your earnings, bills, and total enterprise efficiency.

Earlier than we dive into how to do your bookkeeping, let’s cowl the two major bookkeeping strategies.

Money Technique

The money technique acknowledges income and bills on the day they’re truly obtained or paid. This technique is the best for small companies as a result of it doesn’t require you to trace payables or receivables and displays whether or not or not your cash is definitely in your account.

Accrual Technique

The accrual technique acknowledges income and bills on the day the transaction takes place, no matter whether or not or not it’s been obtained or paid. This technique is extra generally used because it extra precisely depicts the efficiency of a enterprise over time.

The one factor it doesn’t present is money circulate — a enterprise can look worthwhile however have zero {dollars} within the financial institution. If a enterprise’s annual income exceeds $5 million, it’s required to make use of the accrual technique.

Now, let’s speak about how you are able to do your bookkeeping.

- You may hold your individual books with a spreadsheet (like Excel or Google Sheets). This technique is finest for people or small companies with low budgets. Obtain a bookkeeping template for those who need assistance structuring your information.

- You may outsource your bookkeeping to a contract bookkeeper or bookkeeping service.

- You may rent a full-time bookkeeper in case your finances and bandwidth enable it.

- You may use bookkeeping and accounting software program like Bench, Supervisor.io, Quickbooks, Freshbooks, or Xero. (Don’t fear — there are many free accounting software program choices, too.)

4. Arrange a payroll system.

Do you propose on hiring staff or contractors? Maybe you’re managing by yourself for now however are contemplating increasing sooner or later. Regardless, you’ll want to know and safe a payroll system.

Payroll is one other tedious but required a part of accounting. Fortunately, there’s loads of software program that may aid you. (Hallelujah for modern-day know-how, proper?

Workers and unbiased contractors are categorised otherwise and provides what you are promoting totally different tax deductions. Right here’s tips on how to deal with each.

Payroll For Workers

You’ll be able to deduct worker wages (salaries and fee bonuses), worker schooling bills, and worker advantages (accident and well being plans, adoption help, life insurance coverage, and extra) out of your taxes.

You too can deduct payroll taxes, that are employment taxes paid on behalf of your staff (like Social Safety and Medicare, in addition to federal and state unemployment taxes).

Workers ought to submit a W-4 type, so you know the way a lot tax to withhold. In trade, it’s best to present staff with a W-2 type, which summarizes their yearly gross pay. They use this to pay private taxes.

Payroll For Impartial Contractors

Impartial contractors embody freelancers, consultants, and different outsourced specialists who aren’t formally employed by what you are promoting. With contractors, you don’t pay advantages or withhold taxes on their behalf.

Due to that, contractors ought to submit a W-9 type, so you’ve their enterprise info (akin to their SSN or EIN), and it’s best to present a 1099-MISC type in trade (for those who pay them greater than $600 per 12 months).

A 1099 type tells the federal government how a lot you spent for his or her providers — so you may write this quantity in your tax return, and to allow them to assume the tax burden on their return.

5. Establish the precise fee gateway in your wants.

We’ve talked about your technique of paying staff and contractors. Now, let’s speak about the way you’ll obtain cash in your items and providers. (This feels like extra enjoyable, huh?)

Your technique of amassing cash is sometimes called your fee gateway. Whether or not you present freelance providers, arrange store at an area farmer’s market, or run a world e-commerce enterprise, you want a straightforward (and authorized) strategy to acquire what you’ve earned.

Relying on the character of what you are promoting, the way you acquire cash will fluctuate. Let’s go over some choices.

Fee Gateway For Service Supplier

As a contract author, I hardly ever work with shoppers in individual. Actually, I’ve solely ever formally met certainly one of my shoppers — the remaining I work with purely over e mail. Due to that, I acquire most of my funds via a web based gateway.

PayPal is a well-liked alternative for amassing funds. You too can use software program like Wave, Xero, or Bench. Not solely are you able to bill shoppers via these packages, however you may also conduct bookkeeping, payroll, and different accounting duties. These cost charges, although, so think about that when making your resolution.

One other strategy to acquire fee is thru cell functions like Venmo or Sq. Money — simply remember to ship an bill as proof of fee. Lastly, you may at all times acquire fee by way of test — it simply takes a bit longer than a web based switch. (Ship an bill with this technique, too.)

Fee Gateway For Storefront Enterprise

Accumulating cash in individual (at a storefront, market, and so on.) can get expensive. Between gear, bank card charges, and dealing with bodily money, it may be a problem. Fortunately, Sq. and PayPal make it straightforward to just accept card funds utilizing your smartphone or pill. These packages additionally ship your clients’ receipts, reconcile your transactions, and deal with returns if obligatory.

When you count on a excessive inflow of every day purchases, we advocate selecting a extra sturdy POS system and extra dependable gear (like a register and devoted card reader).

Each Sq. and PayPal provide this feature, too. With this feature, you’ll have to arrange a service provider account together with your financial institution. (This account acts as a center floor between your POS system and major checking account.)

Fee Gateway For Ecommerce Enterprise

Ecommerce platforms like Shopify, BigCommerce, and WooCommerce typically present built-in fee gateways. These are at all times the simplest to undertake as they’re already built-in together with your web site. You may additionally use third-party fee options like Stripe.

6. Perceive the tax obligations in your sort of enterprise.

Taxes are inescapable. Fortunately, they’re straightforward to arrange for. One of the simplest ways to take action is to coach your self on what you are promoting’s tax obligations, hold correct data, and put aside income (or pay forward in quarterly taxes).

Paying taxes as a small enterprise is barely extra sophisticated than it’s as a person. The quantity and sort of taxes you file will depend upon a couple of issues: what you are promoting’s authorized construction, in case you have staff (and what number of), and for those who acquire gross sales tax.

This a part of accounting — tax obligation and assortment — is especially tedious. We extremely advocate that you simply work with knowledgeable to at the very least guarantee what you are promoting is following the right procedures and legal guidelines.

7. Often evaluation and consider your strategies.

Just like different processes and methods throughout what you are promoting, you‘ll wish to consistently evaluation and consider your accounting strategies. You must at all times have a managed course of in place for what you are promoting accounting — as a result of, as you’ve discovered all through the above sections, it‘s a fully essential facet of your organization’s total well being.

The frequency by which you evaluation and consider your strategies is certain to be distinctive to your particular enterprise. Nonetheless, it‘s regular (and really useful) to audit your course of on the finish of each month, quarter, and 12 months. This manner, nothing slips via the cracks or turns into an issue that’s too giant to bounce again from.

If the character of what you are promoting is seasonal, you may tailor various factors, just like the frequency of your analysis, to this cycle. As an example, you may require extra evaluations of your accounting course of throughout excessive season and fewer throughout slower months.

8. Contemplate knowledgeable service or CPA.

As necessary as it’s to know how enterprise accounting works, you don’t must do it alone. That’s the place skilled accounting providers and CPAs are available in.

In case your finances permits, we extremely advocate hiring knowledgeable to assist together with your accounting. Right here’s how one can go about doing so.

- Ask for a referral from a trusted pal or one other entrepreneur. When you’re a part of any enterprise teams or networks, ask for suggestions there, too.

- Use the CPA listing.

- Use Yelp for native professionals.

Whomever you select, remember to learn loads of evaluations and testimonials about your potential accountant. Inquire about their expertise in your business, charges, and providers, and be sure you’re snug with how and the way typically you’ll talk together with your accountant earlier than you signal something. Set all expectations upfront.

Additionally, in case you have the funds, hiring an in-house accountant is at all times an choice. This individual could be liable for what you are promoting’s accounting solely and be a contractor or full-time worker.

Be taught Enterprise Accounting to Develop Higher

Enterprise accounting may seem to be a frightening mountain to climb, nevertheless it’s a journey nicely value it. Accounting helps you see your complete image of your organization and might affect necessary enterprise and monetary choices.

From working towards calculations to understanding your organization’s tax obligations, studying the self-discipline of accounting can solely assist what you are promoting develop higher.

Even for those who choose to make use of accounting software program or rent knowledgeable, use the guidelines we’ve reviewed on this information to know accounting fundamentals. Your online business will thanks.

Editor’s be aware: This publish was initially revealed in Might 2019 and has been up to date for comprehensiveness.