Studying Time: 8 minutes

The Monetary Companies trade stands at a singular intersection of custom and innovation.

Our complete survey of 730 entrepreneurs, together with 147 respondents from this house, reveals intriguing insights into how this trade navigates cross-channel advertising and marketing in immediately’s digital-first panorama.

What stands out isn’t just their reliance on trusted channels like e mail and social media, but additionally their strategic method to personalization and the challenges they face with legacy programs.

Surprisingly, they emphasize personalizing the client journey at varied phases, a tactic extra prevalent on this sector than throughout the broader market. But, the trail towards efficient buyer engagement is fraught with technological hurdles, with over half counting on outdated programs or guide processes.

This text will discover these compelling findings, exploring the steadiness monetary companies manufacturers strike between safety, personalization, and innovation.

Let’s dive in.

Who We Surveyed: Methodology + Demographics

Responses We Analyzed:

- All Responses: 730

- Monetary Companies: 147

Roles and Firm Measurement

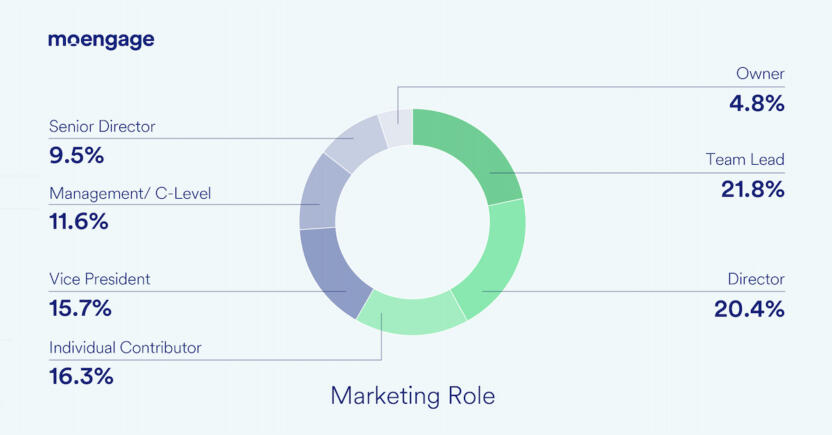

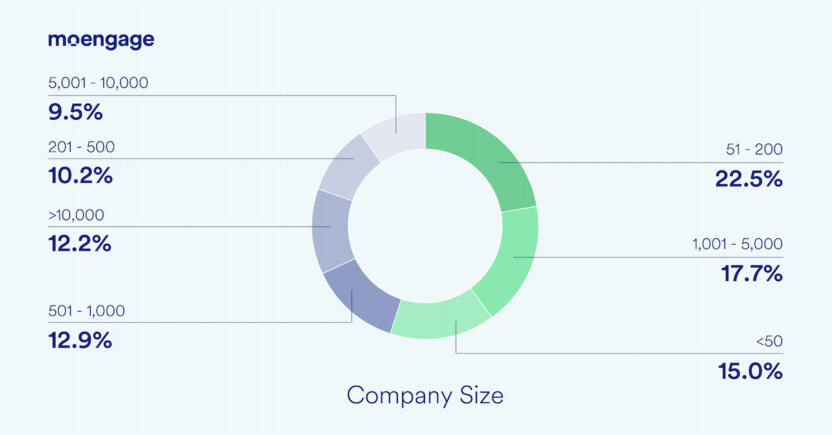

Nearly all of respondents stated they’re a Group Lead (21.8%) with 27.3% saying they’re VP or a C-Degree government. When it comes to firm dimension, 22.5% of respondents characterize organizations with 51 – 200 staff, and 62.5% characterize corporations with greater than 200 staff.

Channels

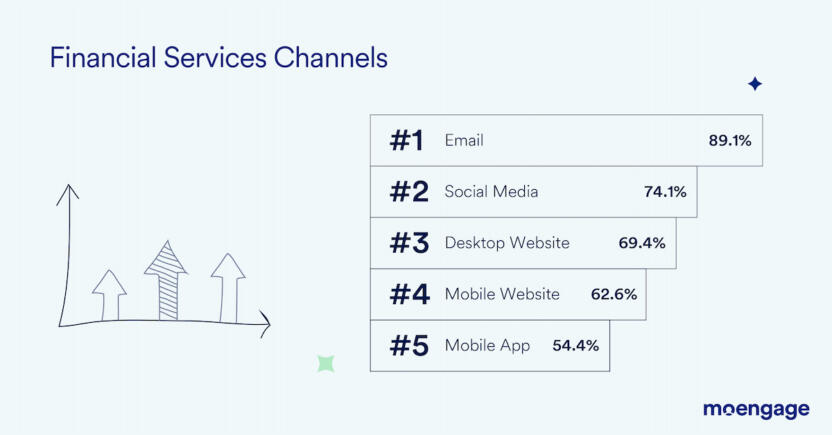

In keeping with our broad set of survey outcomes, the most well-liked engagement channels that B2C entrepreneurs use are:

- Electronic mail (89.6%),

- Social Media (80.3%),

- Desktop Web site (67.1%),

- Cellular Web site (65%),

- Cellular App (49)%

Whereas different industries we’ve explored as a part of this sequence (like Ecommerce & Retail and Meals & Beverage) have differed from the final group of respondents in some areas, when trying particularly on the Monetary Companies trade, we discovered that these manufacturers’ channel utilization mirrors what we discovered within the overarching group.

This may be because of the nature of their viewers’s preferences and the character of their content material. Electronic mail, as the first channel, affords a direct, personalised, and safe solution to talk delicate monetary data, which is paramount on this trade. Social media ranks second, serving as a platform for broader engagement and model consciousness. Desktop and cellular web sites comply with, offering accessible data and companies, whereas cellular apps, although fifth, provide on-the-go comfort for extra engaged customers.

This prioritization displays a steadiness between safety, accessibility, and person engagement particular to the monetary sector’s wants.

Aims

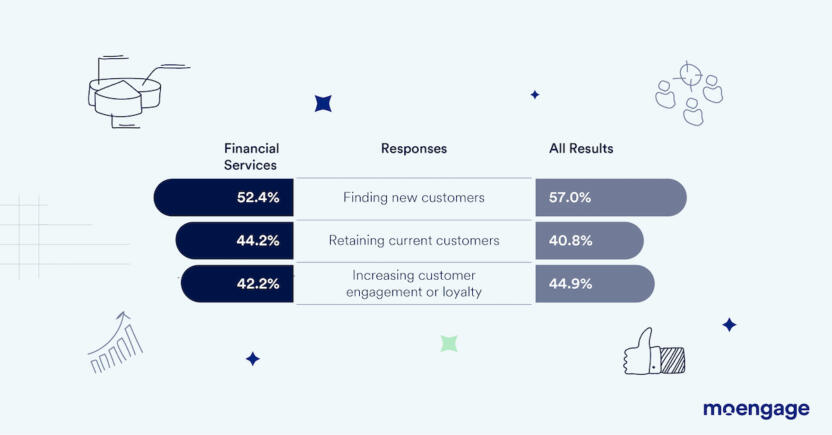

For Monetary Companies manufacturers, attracting new clients is the highest goal for 52.4% of respondents. Nonetheless, sustaining current buyer relationships is deemed extra essential (44.2% vs. 40.8%) than enhancing buyer engagement or fostering loyalty.

That is seemingly as a result of this trade is aggressive and every long-term buyer relationship is very priceless. In fact, attracting new clients is crucial for development and market share growth.

Nonetheless, retaining current clients can also be crucial, because it’s usually cheaper than buying new ones, and dependable clients can present a secure income stream via continued enterprise and potential upselling alternatives. This focus displays the strategic steadiness monetary companies should preserve between development and sustainability, emphasizing the significance of each buying and nurturing buyer relationships for general success.

AI Utilization

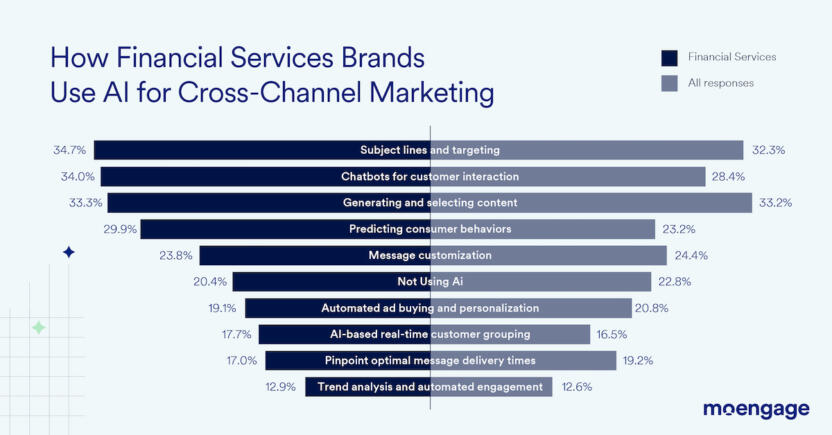

Primarily based on the graph, you possibly can see that in the case of AI in cross-channel advertising and marketing in banking and Monetary Companies, two key use circumstances stand out:

- “AI-enhanced topic strains and concentrating on” and

- “AI Chatbots for immediate buyer interplay”

However why would possibly this be the case?

Nicely, utilizing AI-enhanced topic strains and concentrating on is pivotal as a result of AI’s skill to tailor communications not solely will increase e mail open charges but additionally ensures the correct messages attain the correct clients on the proper time, enhancing the relevance and trustworthiness of monetary advisories or affords.

And concerning using AI Chatbots, their significance lies in offering quick, round the clock help for a variety of monetary inquiries, from account administration to transaction help. This functionality is essential within the monetary sector, the place well timed and correct data can influence clients’ monetary choices and belief of their supplier.

By providing instantaneous help, monetary companies can elevate buyer satisfaction, loyalty, and confidence of their companies, setting a excessive commonplace for buyer expertise in an trade the place belief and reliability are paramount.

Challenges

In Monetary Companies, companies pinpoint delivering personalised experiences as a high problem, with 42.9% highlighting it as a key hurdle, even above funds and useful resource limitations. This concern for personalization is comprehensible given the trade’s deal with managing substantial buyer belongings, which naturally raises the bar for custom-made companies. Nonetheless, navigating the complexities of delicate monetary knowledge to offer these tailor-made experiences isn’t any small feat.

Curiously, monetary constraints are barely much less of a priority, presumably because of the sometimes bigger budgets this trade enjoys. However, there’s nonetheless a pronounced emphasis on deciphering the effectiveness of promoting channels.

In an trade as aggressive as monetary companies, understanding which channels ship the very best bang for the buck is essential. This want is compounded by the strict regulatory surroundings and compliance necessities, underscoring the significance of clear insights into advertising and marketing channel efficiency.

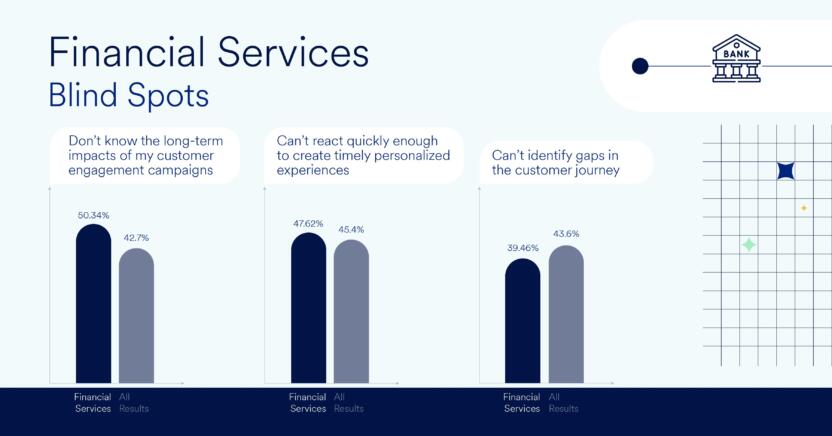

When diving into the first blind spots for Monetary Companies organizations, it’s attention-grabbing to notice that over half of the survey contributors (50%) identified their battle with greedy the long-term results of buyer engagement initiatives—that is in distinction to only 42.7% from the broader group feeling the identical manner.

This means a singular problem on this trade: understanding the enduring influence of their advertising and marketing on buyer loyalty and lifelong worth, which isn’t at all times straightforward to measure over prolonged durations.

On the flip facet, considerations about recognizing weaknesses within the buyer journey appear much less urgent for these organizations, with solely 39.5% flagging it. This may be as a result of the client journey inside monetary companies is commonly well-charted and controlled, providing fewer surprises.

Plus, given the crucial significance of safeguarding monetary data, these companies seemingly have sturdy programs already in place to clean out the client expertise, making vital journey gaps much less of a fear.

This focus displays the trade’s emphasis on cultivating long-term buyer relationships and the built-in measures to make sure a seamless expertise, regardless of the intricate challenges of monitoring long-term engagement outcomes.

Know-how

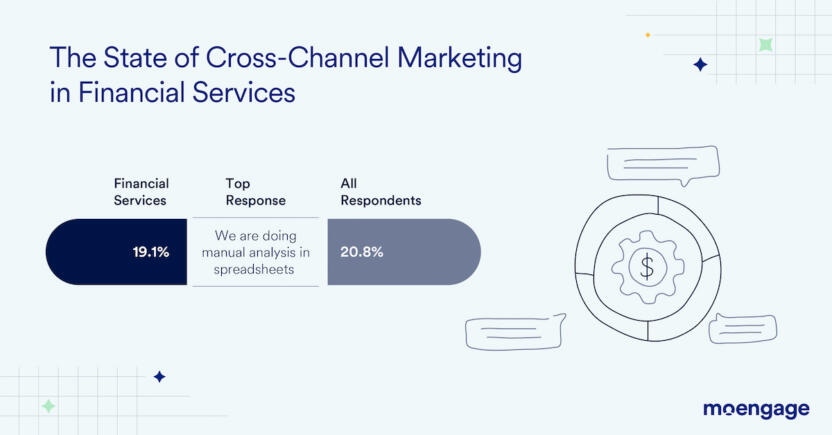

From our survey, we discovered that almost all of Monetary Companies entrepreneurs (53.1%) are both utilizing clunky legacy programs, spreadsheets, or in-house options to handle their cross-channel advertising and marketing packages.

Sadly, there are just a few issues we have to deal with with this martech technique.

Legacy programs usually lack the mixing capabilities wanted to seamlessly join completely different advertising and marketing channels, resulting in siloed knowledge and a disjointed buyer expertise.

Spreadsheets, whereas versatile, are susceptible to human error and might change into unwieldy with complicated campaigns or giant knowledge units. In addition they lack real-time analytics and automation options that trendy advertising and marketing platforms provide.

And in-house options could also be tailor-made to particular wants however will be resource-intensive to keep up and will not preserve tempo with the evolving advertising and marketing expertise panorama.

These challenges can forestall Monetary Companies entrepreneurs from successfully analyzing marketing campaign efficiency throughout channels, personalizing buyer interactions, and adapting to market modifications swiftly. In the end, this may influence the ROI of promoting efforts and the flexibility to compete in opposition to extra superior operations.

Investing in a devoted Buyer Engagement Platform (CEP) is vital to streamlining processes, bettering collaboration, and offering sturdy analytics for higher decision-making and personalised experiences.

Greatest Practices

Once we explored the necessities for a profitable cross-channel advertising and marketing technique, leveraging buyer knowledge analytics for strategic advertising and marketing choices was recognized as the important thing issue throughout all industries.

Digging deep into buyer knowledge sheds mild on important insights concerning shopper behaviors, preferences, and evolving developments. Armed with this information, entrepreneurs are in a first-rate place to plot methods that exactly goal and meet buyer wants.

This method permits the crafting of personalised experiences that not solely resonate deeply with the viewers but additionally encourage their continued loyalty and engagement. It’s about hanging the right steadiness between professionalism and private contact to maintain clients engaged and returning.

Personalization

When it comes to how these organizations are utilizing personalization, one thing that stands out is that 45.6% are customizing communications for various phases of the client journey. Solely 40.2% of common respondents are doing this with the bulk relying solely on probably the most primary type of personalization (identify, age, gender, and so forth).

A small portion of Monetary Companies respondents admitted to not personalizing in any respect (8.8%) versus the final group at 10.1%. Nonetheless, this trade is much less focused on implementing content material that modifications primarily based on person preferences (15% vs. 25.2%) and utilizing AI for product or content material strategies (20.4% vs. 24.4%).

As we famous earlier, entrepreneurs on this house appear to have a deeper understanding of the client lifecycle and journey than entrepreneurs in different industries like Ecommerce & Retail or Meals & Beverage, who expressed difficulties with buyer journey mapping.

The personalization method getting used inside Monetary Companies goes past the fundamentals to tailor interactions primarily based on the place the client is of their journey with the model. It’s a extra strategic use of personalization, recognizing that the wants and pursuits of shoppers evolve as they transfer from consciousness to consideration and decision-making phases.

The truth that a smaller share of monetary companies companies are usually not personalizing in any respect, in comparison with the final group, displays the trade’s recognition of personalization’s worth in constructing relationships and belief. Monetary companies cope with delicate and private issues, so even a small effort to personalize can considerably influence buyer belief and loyalty.

Nonetheless, the reluctance to implement content material that adapts primarily based on person preferences or to closely put money into AI for product or content material strategies would possibly stem from the trade’s nature.

Monetary companies contain complicated merchandise and regulatory constraints that will not lend themselves as simply to dynamic content material personalization or AI-driven strategies. These organizations would possibly prioritize accuracy, safety, and compliance over hyper-personalization, specializing in personalization methods that align with the trade’s regulatory surroundings and the character of their services and products. It’s a steadiness between providing personalised experiences and making certain these experiences meet the stringent requirements of the monetary trade.

Monetary Companies Cross-Channel Advertising and marketing: Closing Ideas

In wrapping up our deep dive into the state of cross-channel advertising and marketing throughout the monetary companies trade, it’s evident that navigating this digital-first panorama requires a nuanced method. Our survey highlighted a sector dedicated to leveraging conventional communication channels like e mail and social media, underscored by a eager deal with safety and direct engagement because of the delicate nature of monetary data.

Key takeaways embody the trade’s emphasis on personalised, journey-specific communications and the challenges confronted as a result of reliance on outdated applied sciences. These insights level to a crucial hole between the will for deeper buyer engagement and the instruments at present at their disposal.

MoEngage affords a variety of options that may assist Monetary Companies corporations shut that hole. With 2.2 billion experiences delivered month-to-month throughout a number of channels, you possibly can be certain that your message reaches your clients successfully.

Schedule a demo immediately to see how MoEngage will help your Monetary Companies enterprise ship wonderful buyer experiences.

The put up The State of Cross-Channel Advertising and marketing in Monetary Companies appeared first on MoEngage.