Studying Time: 6 minutes

Leaders within the monetary service business stand on the crossroads between innovation and custom. There’s an elevated want for customized providers and elevated scrutiny from regulatory our bodies.

Monetary manufacturers can ace buyer engagement on this interval of a ‘nice banking transition’ solely by doubling their preparedness.

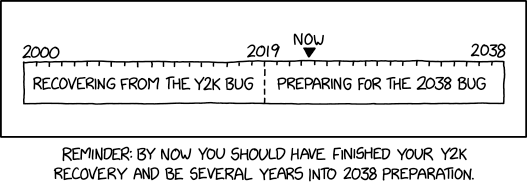

Recovering from the pandemic to being able to thrive within the ‘Nice Banking Transition’ period 😅. Right here’s an XKCD you could relate to:

Concerning the Survey

At MoEngage, we launched into a journey the place we surveyed international leaders, decision-makers, and influencers from the monetary service business to know how ready they’re to fulfill their clients’ ever-evolving expectations and calls for.

The surveyed executives know that shopper conduct and expectations are quickly evolving. They price pace and agility because the golden tickets to assist them reply successfully to altering shopper expectations.

Nonetheless, the trail towards efficient buyer engagement is stuffed with challenges that make them unprepared to face these modifications.

This text will discover the survey’s findings, how monetary manufacturers can thrive throughout the ‘nice transition,’ and what an agile, security-first martech stack ought to appear to be.

Let’s get began.

Our Viewers

Roles: We interviewed people from mid- and senior ranges within the monetary service business, together with C-level executives, Administrators, Center and Senior Administration, and Workforce/ Practical Leaders. Respondents’ domains of experience have been advertising, development, and product.

Group Measurement: 48.5% of respondents characterize organizations with 500-1000 workers, whereas 51.4% characterize organizations with 1001-5000 workers.

International locations Included within the Survey: Australia, Brazil, Canada, Germany, India, Indonesia, Mexico, Philippines, Saudi Arabia, United Arab Emirates, United Kingdom, United States of America

Monetary Service Manufacturers Perceive that Buyer Expectations are Quickly Evolving

60% of senior executives within the monetary service business agreed that shopper conduct, preferences, likes, and expectations are evolving quickly. Technological developments in automation and AI, in addition to elevated cyber dangers, are some elements that affect the fast evolution of shopper conduct and preferences.

Monetary establishments should ship worth past their core services or products (like mortgage disbursement, opening a hard and fast deposit, or establishing a mutual fund) to face out from their competitors. This worth can solely be delivered by means of agile, seamless, customized, and, most significantly, trusted buyer experiences.

Monetary Manufacturers Belief that They Have the Proper Expertise Pool to Adapt to These Adjustments

55% of leaders in monetary service manufacturers agree that their groups have the appropriate abilities and data to have interaction clients in a quickly evolving digital world.

These leaders deemed adaptability (24.5%), customer-centricity (23.1%), and agility (18.4%) to be the highest abilities in 2024. Adaptability means analyzing marketing campaign outcomes, iterating quicker, and always enhancing. Buyer-centricity means understanding information and appearing on the insights, and agility means quickly ideating and interesting with clients based mostly on insights.

Monetary Companies Manufacturers Do Not Really feel Empowered By Their Present Martech Stack to Adapt to These Adjustments

47.2% of senior executives within the monetary service business felt they weren’t effectively ready to adapt to evolving buyer expectations.

There’s a disconnect between the extent of consciousness relating to evolving buyer expectations and the extent of preparedness wanted.

What causes this ‘disconnect’? Learn under to seek out out.

What Does The Present Martech Stack Look Like

62.9% of economic providers enterprise manufacturers use a legacy platform comparable to Salesforce Advertising and marketing Cloud, Adobe Expertise/Marketing campaign Supervisor, or Oracle Responsys to handle advertising automation and cross-channel buyer engagement.

These legacy platforms usually are not buyer engagement platforms (CEP) within the true sense. Beginning as e mail advertising platforms, they’ve, over time, added different channel capabilities like push, in-app, net push notifications, WhatsApp, and so on. Nonetheless, they lack true omnichannel capabilities and fall behind in constructing seamless buyer experiences, hampering enterprise manufacturers’ agility and adaptableness abilities.

Monetary Service Manufacturers Perceive The Significance of Agility

Senior executives globally agree that agility is critical from an effectivity perspective and a non-negotiable for reinforcing income and ROI.

The perceived impression of agility is as follows:

- 20.2% of senior leaders within the monetary service business really feel that being agile helps them keep forward of the competitors.

- 18.1% of senior leaders within the monetary service business really feel that being agile can enhance buyer stickiness and loyalty.

- 13.2% of senior leaders within the monetary service business consider they will cut back bloat of their martech stack and use allotted budgets extra effectively.

Monetary Manufacturers Really feel Unsupported When It Involves Velocity and Agility

68.6% of senior executives within the monetary service business agree that pace and agility are essential to understanding the heartbeat of their clients and responding in accordance.

Nonetheless, 57.2% of Administrators and Senior Administration Workers don’t strongly really feel they’ve sufficient help to be agile and adaptable.

However why this is likely to be the case?

One trigger is the heavy dependency on outdated, clunky martech instruments and platforms, which aren’t purpose-built to know the business’s distinctive safety and agility wants. One other trigger is the redundant workflows that have been constructed to handle activity requests of their legacy methods.

48.6% of senior executives within the monetary service business don’t strongly really feel that organizational processes and workflows allow them to react quick and adapt rapidly to evolving buyer expectations.

Present workflows and SLAs usually are not conducive to monetary service manufacturers’ development. Progress in 2024 for monetary service manufacturers is immediately associated to the perceived optimistic buyer expertise.

Monetary service manufacturers should be agile and quick to fulfill buyer expectations.

Redundant workflows, lengthy SLAs, and excessive dependencies on businesses and consultants usually stand in the best way between manufacturers and clients.

With one in two senior executives stating that current workflows and processes don’t allow them to react rapidly and adapt rapidly, the established order wants to alter.

Monetary Service Manufacturers Take A Month Per Marketing campaign

42.8% of economic service enterprise manufacturers take over 4 weeks to launch a cross-channel buyer engagement marketing campaign. Conversely, 5.7% can go stay with a brand new marketing campaign in below per week.

Concerning reporting, monetary enterprise manufacturers appear to have a tricky time. 58.6% of economic service enterprise manufacturers take over 2 weeks to collect information and insights into buyer conduct, preferences, likes, journeys, and expectations with their present martech stack. The proportion of enterprise manufacturers that take lower than per week is simply 14.3%.

Even on the subject of understanding the efficiency of a single marketing campaign, monetary service manufacturers take over 2 weeks to collect information and insights about marketing campaign performances comparable to attain, clicks, conversions, channel effectiveness, or attribution with their present martech stack. Solely 15.8% of economic service manufacturers can collect this information inside per week.

Monetary Service Manufacturers are Dissatisfied with their Present Tech Stack

Monetary service manufacturers unanimously agree that their present instruments and distributors don’t empower them to fulfill evolving buyer expectations.

65.7% of senior executives in monetary service manufacturers are unhappy with their present martech stack and distributors.

Conclusion

Whereas enterprise monetary service manufacturers perceive that shopper conduct is altering quickly, agility is the necessity of the hour, and they’re geared up with the appropriate groups and abilities, their present stack is anchoring them down.

Their present bloated and inefficient martech hampers their agility and scalability by slowing down marketing campaign velocity and rising the time to have interaction clients with the appropriate message throughout the appropriate channel on the proper time.

And what’s the enterprise impression? There’s a lack of aggressive edge, poor buyer stickiness, and low loyalty.

It’s excessive time that monetary service enterprise manufacturers let go of outdated, clunky tech stacks. Monetary service manufacturers want a contemporary Buyer Engagement Platform (CEP) of their martech stack. They want a unified, agile, safe, and versatile platform constructed particularly for them.

Monetary service enterprise manufacturers want MoEngage.

Need to know the way ‘MoEngage for Monetary Companies’ may help speed up your model’s development and digital transformation? Discuss to our monetary providers skilled right here.

Associated Studying:

- Your One-Cease Store To All Assets Associated to Monetary Companies

- Maintain Buyer Knowledge Confidential with PII Masking

- Web site Personalization For BFSI Manufacturers: How To Tailor Customized Monetary Internet Experiences For Prospects

- How Banks Can Use Buyer Engagement Platforms to Enhance LTV and CX Whereas Decreasing Prices in a Safe Setting