It’s not a simple time for anybody to be navigating the world proper now – what with financial, social and environmental headlines continuously reminding us of the instability of issues. It’s much more troublesome for Gen Zs; people who’ve skilled setbacks and missed out on milestones due to the pandemic however nonetheless must face the realities of gaining a stable footing in life and establishing a path in the direction of monetary independence. A commonality seen throughout each Canada and the US is that Gen Zs, (the era roughly outlined as being born between 1997-2012) usually tend to report experiencing stress and anxiousness than older generations.

Whereas 18-26-year-olds throughout the border share on this similarity, Canadian Gen Zs usually tend to report that they really feel a way of management over their psychological well being than their American counterparts. What’s driving this distinction? Naturally, it needs to be acknowledged that the social on-goings similar to coverage adjustments within the US undoubtedly are a contributing issue. Exterior of the social surroundings, nevertheless, Mintel’s analysis finds that spending duty might also be a contributing cause. Particularly, Canadian Gen Zs usually tend to report holding major duty for spending on their very own leisure actions and hobbies than American Gen Zs. Being answerable for one’s personal purchases in classes that the cohort leans on to spend their free time and categorical themselves is probably going giving them a higher sense of management over their very own lives and a higher sense of independence.

So what areas are Canadian Gen Zs centered on? When awarded a hypothetical $500 spending spree, clothes and consuming out have been the highest areas they might spend in. What’s vital to notice right here is that as a result of Canadian Gen Zs usually tend to be making these purchases themselves, manufacturers and corporations in these sectors maintain the potential to attach with Canadian 18-26-year-olds extra deeply than with American ones. The important thing to doing so is to assist them concentrate on themselves and to offer choices that match into the place they’re at proper now.

Diving into the Gen Z mindset – the Me Mentality

Mintel’s International 2023 Development Me Mentality discusses how for the final two years, shoppers have needed to put their very own wants on the again burner in favor of a neighborhood mindset. Keep in mind, this mindset got here at a value for Gen Zs – they missed out on main milestones like proms, misplaced jobs attributable to being extra extremely represented within the service sector, and even missed out on internships as kick-starters to careers whereas firms reduce on operations. All at a stage in life the place they’re making an attempt to ascertain themselves and set themselves up for future success. There’s a actual sense that Gen Zs really feel that life isn’t going as deliberate. Now greater than ever, they’re eager to make up for misplaced time and desirous to re-focus on themselves. Manufacturers that acknowledge their hardships, make them really feel like they’re doing okay proper now, and empower them with instruments and sources to take concrete steps to maneuver ahead and obtain future successes would be the ones that win.

3 methods for advertising to Canadian Gen Z shoppers

Finally, Gen Zs want to achieve again a way of management and stability within the rapid time period, they usually have to be arrange with instruments that may empower them heading in the right direction to attain success sooner or later. Listed here are three methods to think about.

1. Rejoice small wins to reassure them they’re doing okay

Whereas finishing on a regular basis mundane duties could seem to be no huge deal, bringing consideration to the completion of such duties would assist to focus on to the section that there are achievements being made every day. In a way, these small accomplishments are small indicators of success – one thing that might maintain significance when the longer term feels unsure and issues really feel uncontrolled proper now. Manufacturers that may be there to assist have a good time these small successes will assist present a way of reassurance that they’re doing okay and assist them to be ok with the place they’re at proper now.

2. Actually, put some management of their palms by way of personalization/customization

Being eager customers of social media, Gen Zs are extra seen to others than ever. They’re not simply passively on social media however actively selling themselves and their pursuits, as seen with 42% of Gen Zs creating content material of their free time (eg TikTok movies, or recording a podcast). Which means outward expression of individuality and uniqueness is a continuing level of consideration for Gen Zs. Certainly, Mintel knowledge confirms this because the section is extra possible than older generations to depend on their bodily look to showcase who they’re and categorical their individuality.

It is very important observe that personalization can go effectively past clothes and meals. For instance, dermatologist-recommended skincare model, Cetaphil, launched a complete pores and skin analyzer to assist shoppers to make extra knowledgeable choices about their skincare routine. The consumer takes a selfie after which the Cetaphil AI Pores and skin Evaluation makes use of AI know-how to match the selfie to a database of 70,000 numerous pores and skin pictures. The device then creates a customized report for the consumer offering details about their pores and skin kind, pores and skin issues and proneness to varied pores and skin circumstances. This degree of personalised understanding permits customers to make decisions extra confidently that may enable them to greatest improve their outward look.

3. Financial uncertainty now necessitates instruments to assist them achieve management of funds beginning proper now

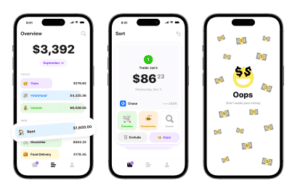

As they give the impression of being in the direction of the longer term, financial uncertainty and inflationary circumstances could make attaining future monetary plans like homeownership really feel extra daunting and out of attain. The truth is that Gen Zs and Millennials are taking longer to realize these monetary milestones. Whereas funding apps are aplenty, empowering them with instruments to learn to set up stable monetary footing now’s key. This implies beginning with the fundamentals – issues like finances administration, constructing credit score, and understanding the implications and penalties of utilizing options that make it simpler to purchase issues now like BNPL (Purchase Now Pay Later) choices. Sensible instruments just like the user-friendly budgeting app Oops, a monetary app that went viral on TikTok for permitting individuals to mark once they make an impulse buy and holistically get a way of how a lot they spend on impulse, can be key to serving to younger shoppers finances and preserve observe of their funds.

What we expect

Whereas the instructed methods are broad, the principle factor to think about is that Gen Zs are distinctive and have skilled unprecedented circumstances at a really informative time of their lives, rendering playbooks of older generations much less related. Because the cohort seems to construct themselves up in the direction of a profitable maturity, it have to be acknowledged that challenges can be distinctive to every and the tip targets can even fluctuate accordingly. Which means extra customization and personalization are wanted to assist them be the celebs of their very own present, and with a lot uncertainty, work have to be achieved to assist present the instruments that meet them the place they’re at.

For extra shopper knowledge and analysis on Canadian Gen Z shoppers, contact us at present.