Here is why rates of interest will increase and decrease implied volatility make Apple a possible good pullback put play.

Shares total appear to be stalling out a serious resistance. $4200 continues to be a wall for the S&P 500.

The most important market cap inventory, Apple, is actually no exception. Apple inventory is the place it was again then a yr in the past. Whether or not it heads even increased now’s the query.

Here’s a fast comparability of then (April 2002) versus now in Apple. And why now you might wish to take into account a comparatively low cost put purchase.

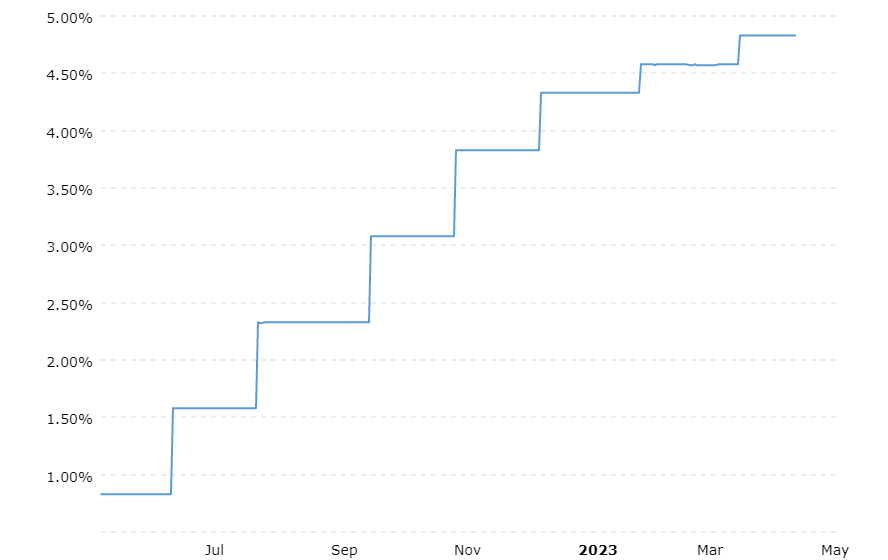

Curiosity Charges

The Fed has raised charges dramatically over the previous 12 months. At present, the Fed Funds price stands at 4.75% to five%. This time final April the Fed Funds price was nicely beneath 1%.

10-year Treasury yield can be a lot increased right this moment than a yr in the past. Again then it yielded beneath 2.75%. At present it’s over 3.5%. Unquestionably a big rise in rates of interest. But shares like Apple do not appear to care.

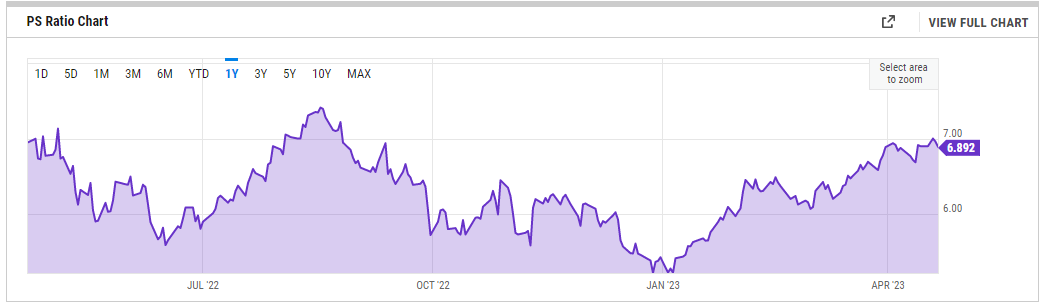

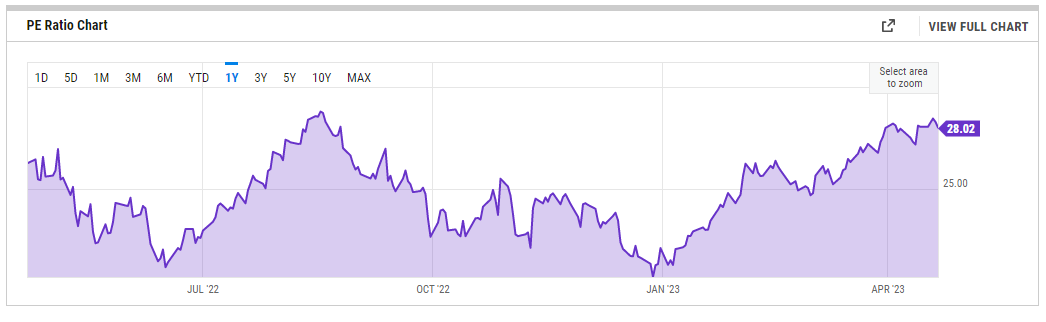

Valuations

This magnitude of improve in rates of interest ought to make valuation metrics corresponding to Value/Earnings (P/E) and Value Gross sales (P/S) noticeably contract. As a substitute, the AAPL P/E ratio is up a full level from 27 to twenty-eight. The P/S ratio for Apple stands at nearly the identical place from a yr in the past at just below 7.

APPL inventory is again to related multiples that signaled tops prior to now. The final time P/E was this wealthy round 28 was final August-right earlier than a punishing pullback.

On condition that the Fed has signaled it’s unlikely to chop charges anytime quickly, a continued enlargement of valuation multiples is unlikely from these present lofty ranges. This can present a substantial headwind to AAPL inventory value over coming months. Plus fascinating to notice that the magnitude of the present rally equates nearly exactly to the magnitude of the earlier main rally that resulted in August-as seen within the chart.

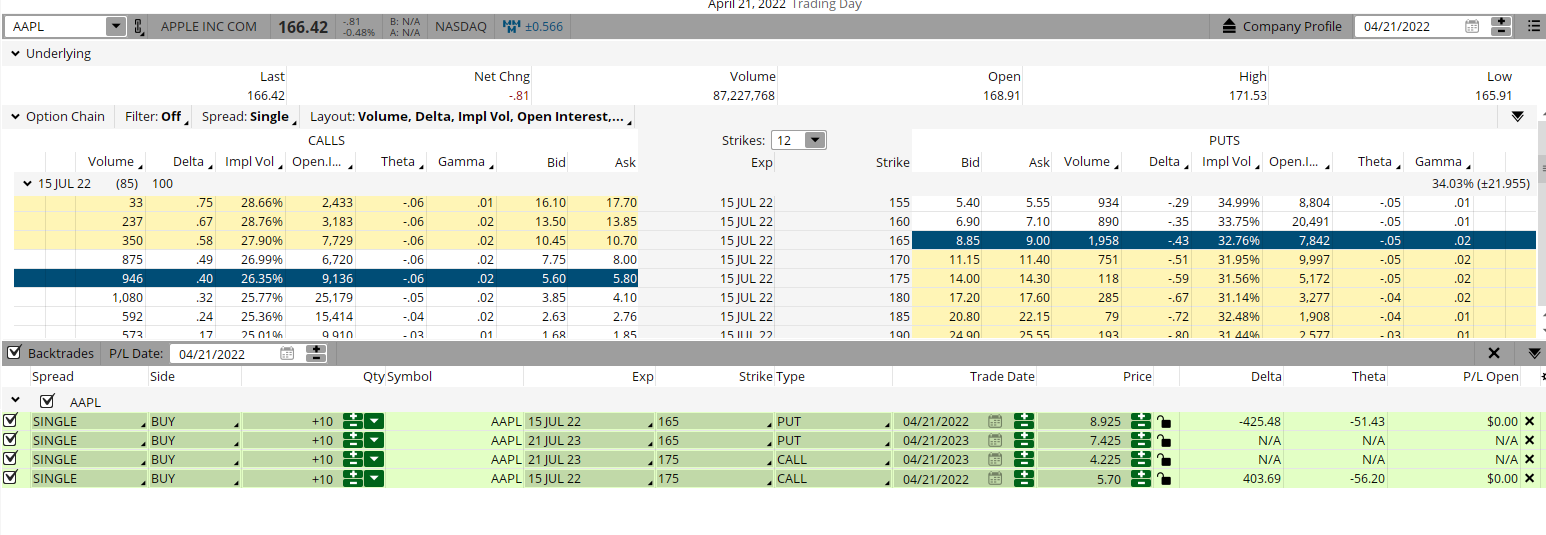

Implied Volatility (IV)

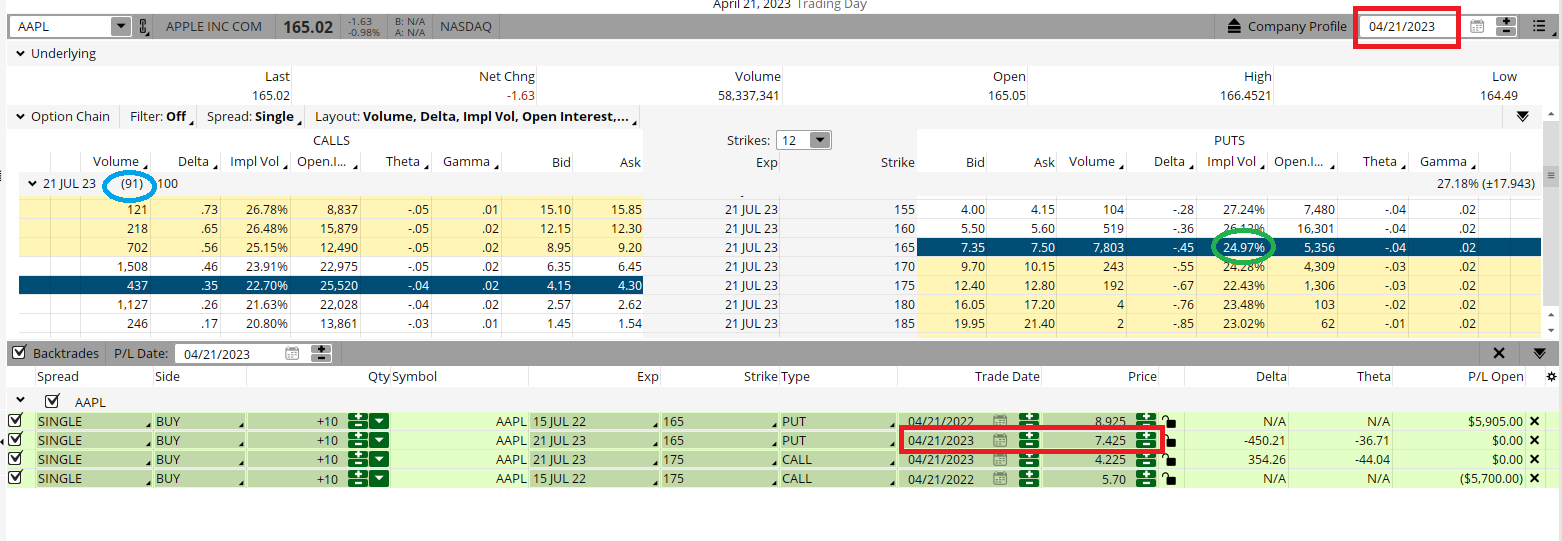

Implied volatility has dropped significantly in Apple choices from a yr in the past. Again then, at-the- cash July $165 places carried an IV just below 33. At present, related at-the-money places commerce with an IV of roughly 25. This 25% drop in IV signifies that possibility costs are less expensive now than 12 months earlier (for each calls and places).

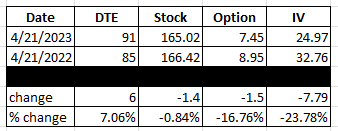

How less expensive? The desk under places issues all collectively.

Now and Then

- Now the July $165 places have 91 days till expiration (DTE). Then the identical places had 85 DTE. All the pieces equal, the places right this moment ought to be extra a little bit dearer since they’ve 6 days extra till expiration (7.06% higher)

- Now AAPL inventory closed at $165.02. Then Apple closed at $166.42. All the pieces being equal, the places right this moment ought to be a little bit dearer for the reason that inventory is $1.40 decrease (0.84%)

- Now the AAPL July $165 places are priced at $7.45. Then the AAPL July $165 places have been priced at $8.95. Why are the places right this moment a lot cheaper (16.76%) than the places a yr in the past?

- Now IV is at 24.97. Then IV was at 32.76. So, the large drop (23.78%) in implied volatility makes what ought to be a little bit dearer now based mostly on extra DTE and decrease inventory value so much cheaper now based mostly on a lot decrease IV.

Buyers and merchants trying to take a brief place in shares like Apple can be smart to think about the advantages of shopping for low cost places. Defining the danger and decreasing the price to play for a pullback makes extra sense now than it has at any time prior to now 12 months.

POWR Choices

What To Do Subsequent?

Should you’re searching for the very best choices trades for right this moment’s market, it is best to try our newest presentation Commerce Choices with the POWR Scores. Right here we present you the best way to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

shares closed at $412.20 on Friday, up $0.32 (+0.08%). Yr-to-date, has gained 8.20%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit Apple Inventory Is Unchanged From A Yr In the past, However Some Issues Have Modified appeared first on StockNews.com