Your B2B pricing performs a key function in shaping your organization’s income. Set your pricing too low and also you’ll have to seize an unlimited dimension of your complete addressable market to hit your targets. Go too excessive and also you alienate clients on smaller budgets. Conceal your pricing so you’ll be able to promote to any kind of buyer, and other people could lash out.

When promoting in B2B, you’ll have to set the perfect costs to ensure buyer acquisition and retention. This may occasionally appear difficult at first look, but it surely doesn’t must be.

On this publish, you’ll study:

What’s B2B pricing?

B2B pricing includes setting the prices of merchandise offered by one enterprise to a different enterprise. These companies may very well be startups that serve SMBs or enterprise corporations that promote to the Fortune 500.

It’s vital to be conscious of the totally different pricing fashions, methods, suggestions, and errors to keep away from when establishing your B2B costs. We’ll talk about every of those beneath.

B2B Pricing Fashions (With Professionals and Cons)

A B2B pricing mannequin is the framework and construction in your pricing technique. It determines the way you’ll cost different companies after they make a purchase order. For instance, whereas some companies cost by utilization quantity, others cost a flat fee or use tiered pricing.

Listed below are 4 of the most well-liked B2B pricing fashions.

1. Consumer-Primarily based Pricing

Consumer-based pricing expenses companies based mostly on the variety of customers who could have entry to or use your product. Costs are increased if there are extra customers, and decrease if there are fewer.

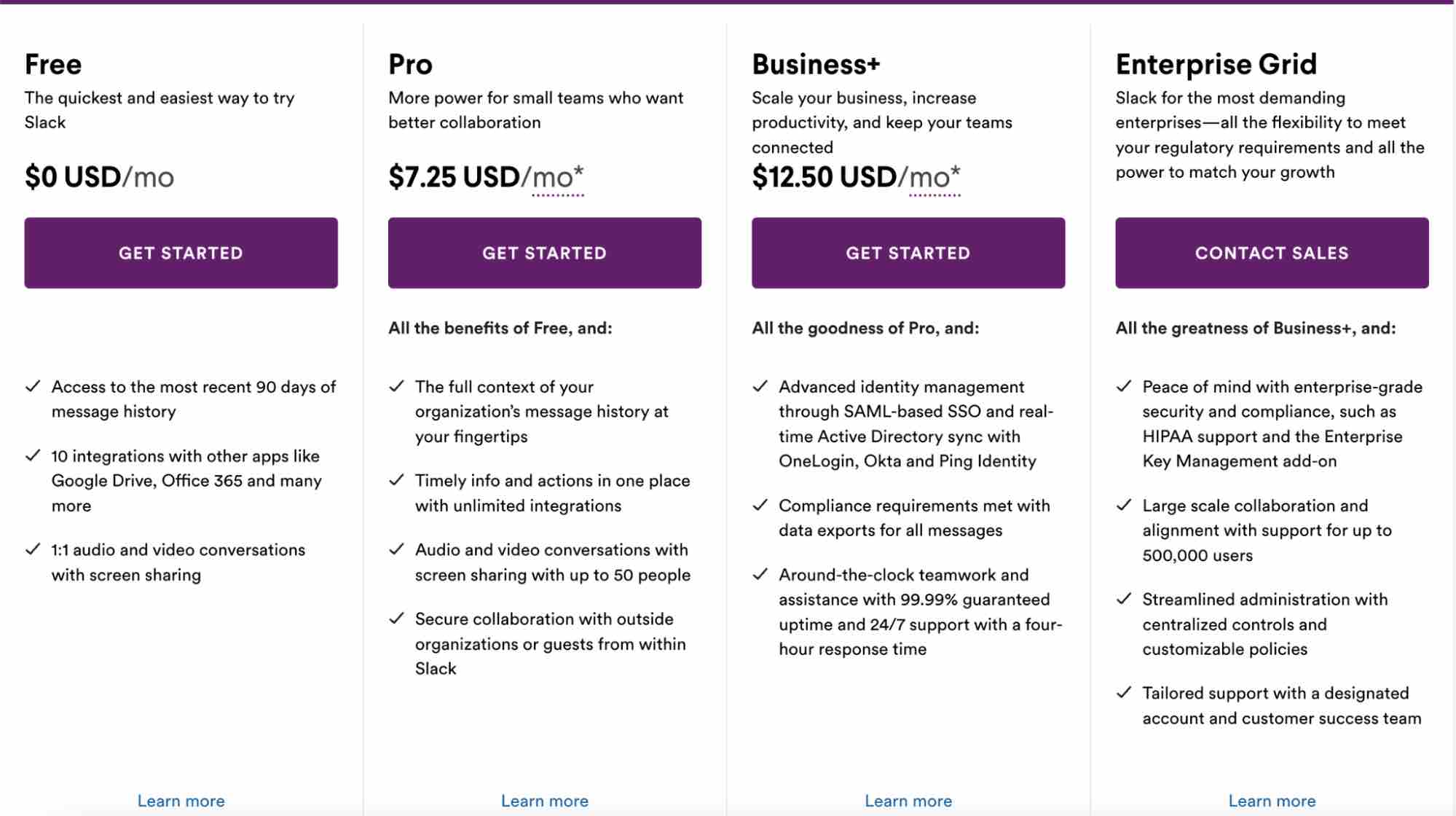

As an example, Slack expenses per consumer.

|

Professionals of Consumer-Primarily based Pricing |

Cons of Consumer-Primarily based Pricing |

|

It is a simple, easy mannequin for promoting. |

Shopping for corporations could share a single login for a number of customers to keep away from increased prices. |

|

Consumers perceive what they’re paying for upfront, so there could also be much less time between discovery and buy. |

You might lose useful income that comes from promoting by the worth you present. |

2. Utilization-Primarily based Pricing

Utilization-based pricing expenses companies based mostly on how a lot they use your product, so extra utilization means increased prices. This enables buying companies to stay answerable for how a lot they spend, as they know what the prices shall be.

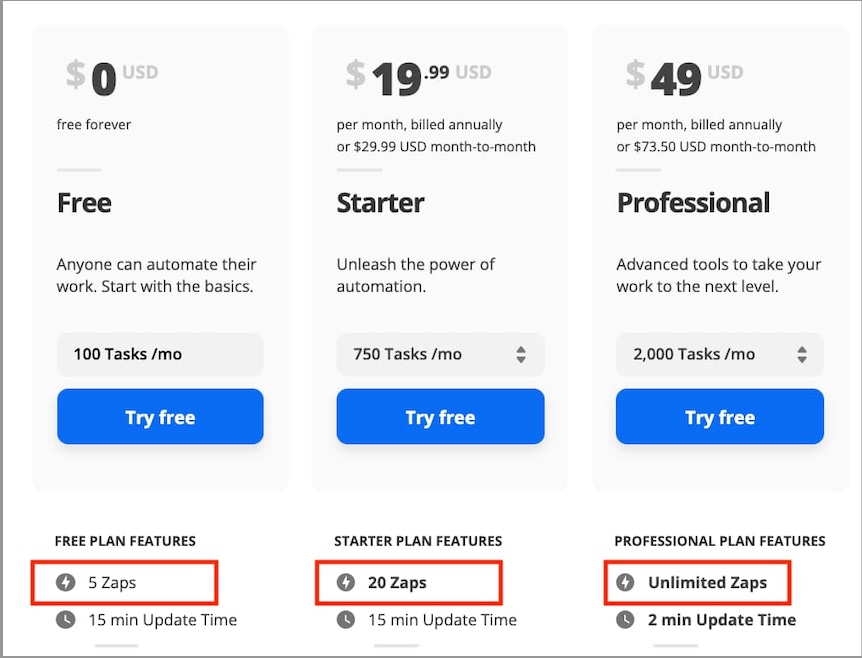

Zapier is an instance of a enterprise that runs on usage-based pricing. The corporate expenses clients based mostly on the variety of Zaps and duties they run per 30 days. Right here’s how their pricing appears.

|

Professionals of Utilization-Primarily based Pricing |

Cons of Utilization-Primarily based Pricing |

|

This mannequin appeals to buying companies as a result of they will anticipate prices. |

Clients could change into pissed off if month-to-month utilization modifications and payments differ. |

|

Clients pay extra after they want your services or products essentially the most, so you might expertise income spikes. |

Companies could use your product much less throughout particular durations, inflicting income disparity and an incapacity to do correct gross sales forecasts. |

3. Tiered Pricing

Tiered pricing sells your product at totally different worth factors relying on the options included at every degree. The bottom price usually includes the least quantity of options, whereas the very best contains essentially the most.

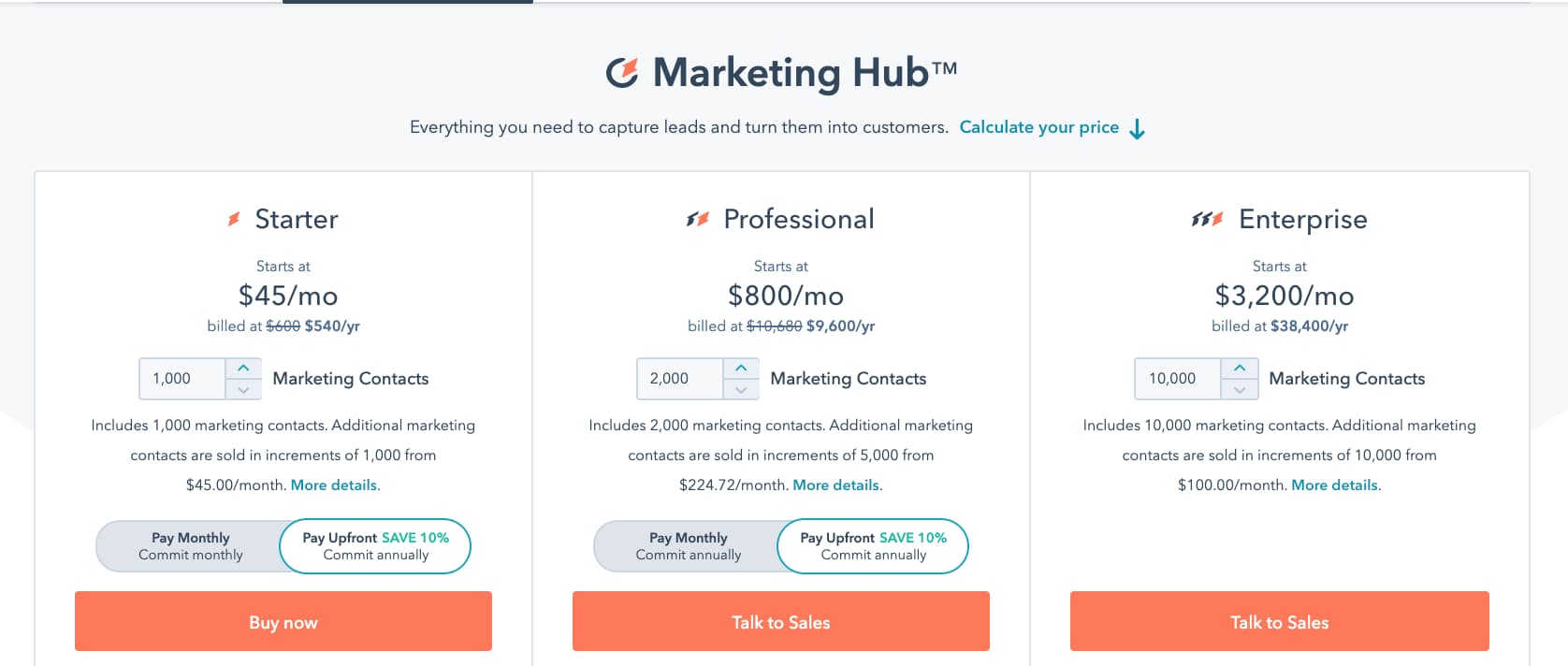

HubSpot makes use of a tiered pricing technique, as proven beneath.

Companies usually mix this mannequin with a value-based pricing technique. You probably have product options which might be extra useful than others and value extra to supply, you’ll be able to make sure you cost the proper quantities.

|

Professionals of Tiered Pricing |

Cons of Tiered Pricing |

|

You’ll be able to adequately worth options that took extra time to create or present extra worth by inserting them in increased tiers. |

It is difficult to pick the options to incorporate in every tier. |

|

Clients can select the plan that works greatest for them, so you’ll be able to entice certified companies for every tier. |

Going overboard by creating greater than three tiers could cause cognitive overload, making it tough for prospects to determine on an appropriate tier. |

|

Upselling is enticing to the buying companies as a result of they could scale and need extra options. |

You’ll be able to’t gather additional income if customers of your top-most tier exceed their service utilization. |

4. Flat Charge Pricing

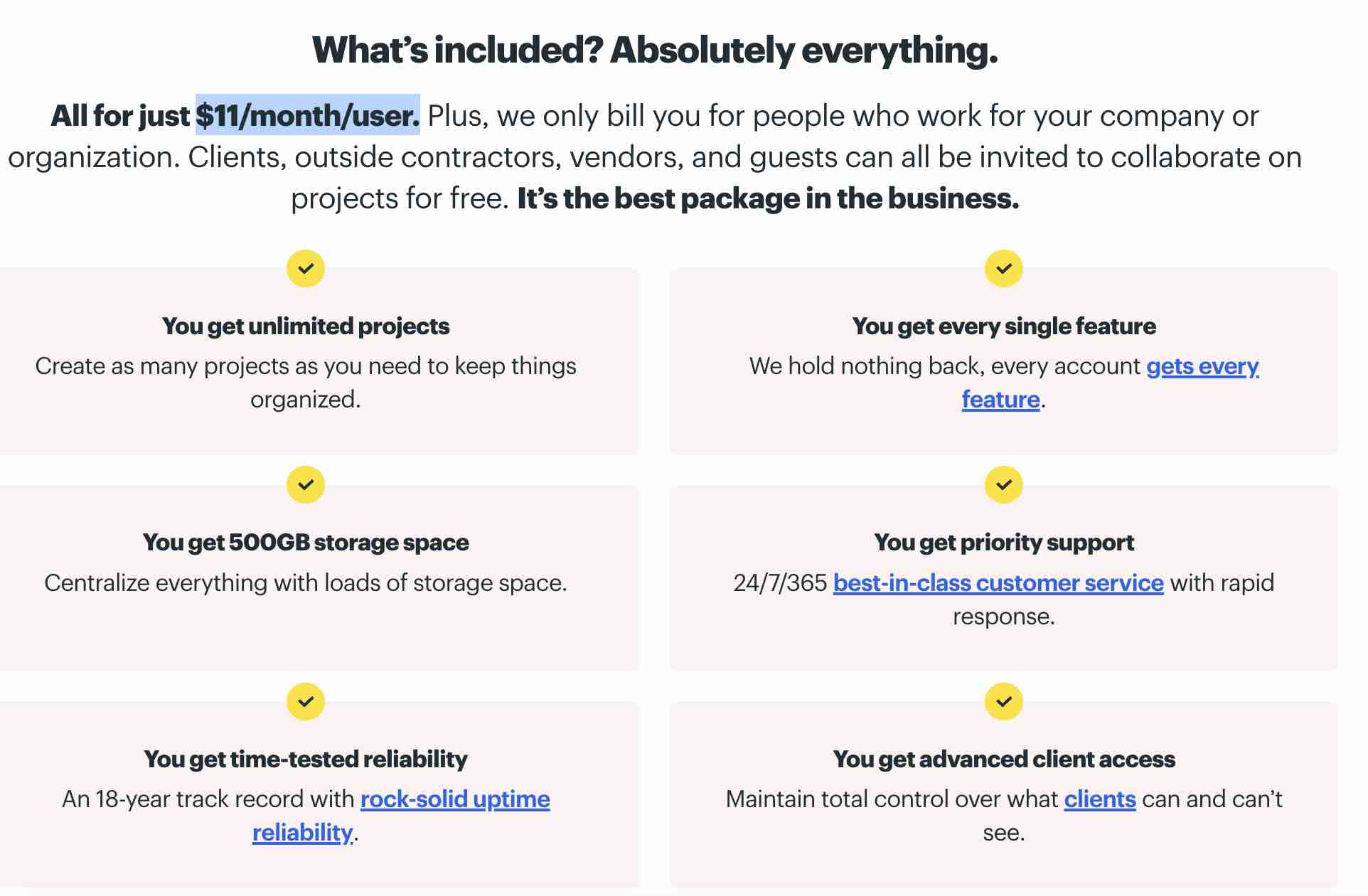

Flat fee pricing means you provide one product and embody all options at one worth. Basecamp, a venture administration instrument, makes use of the flat fee pricing mannequin.

|

Professionals of Flat Charge Pricing |

Cons of Flat Charge Pricing |

|

It’s a easy mannequin in your clients as a result of they know they’ve limitless entry to all product options. |

You lose clients who can’t afford your flat-rate worth. |

|

Prices are predictable for purchasing corporations. |

In case your product is useful to solopreneurs, SMBs, and enterprise corporations, you’ll miss out on income, as the worth that every use case will get out of your product shall be totally different. |

|

Gross sales forecasting is straightforward with this pricing mannequin. |

You might miss out on income in the event you don’t worth your product based mostly on the variety of customers. Basecamp probably had this problem, in order that they switched from a flat fee of $99 per 30 days for limitless customers to $11 per consumer. |

When you’ve chosen the mannequin that works greatest for you, it’s time to choose a pricing technique that may mean you can maximize earnings.

B2B Pricing Methods (Together with Their Professionals and Cons)

Earlier than adopting any B2B pricing technique, it is advisable think about your targets.

For those who’re new available in the market, it might be believable to cost your product for limitless customers. However after you’ve nailed your model consciousness, you might need to swap to per-user pricing. Along with your aim found out, you’ll be able to simply determine worth your merchandise utilizing any of those methods.

1. Worth-Primarily based Pricing

Worth-based pricing is a wonderful method to assess the perceived worth of your product versus what clients are keen to pay in your product. Patrick Campbell, Founder and CEO of ProfitWell places this one other means, “Your worth is an change fee on the worth you’re offering.”

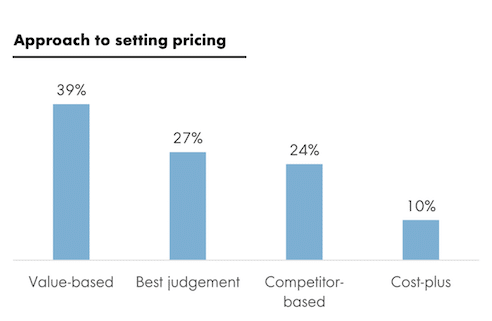

In 2021, 39% of B2B SaaS corporations set their product’s price utilizing value-based pricing.

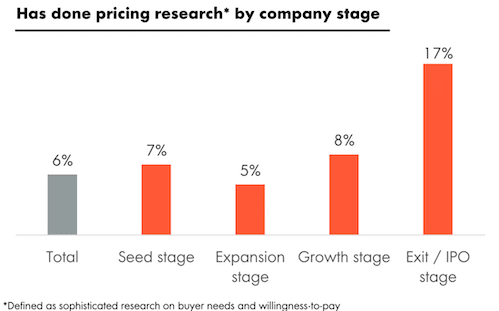

For those who go for this pricing mannequin, you’ll have to do your homework. Speaking to clients may help you identify how a lot they’re keen to pay and the place they discover essentially the most worth in your providing. Plus, you could have a bonus. Many corporations skip this vital step.

Speaking to your clients helps you perceive how customers really feel about your product. With this perception, you’ll be able to set a value-based worth that’ll provide help to develop your income and maintain clients enthusiastic about utilizing your product.

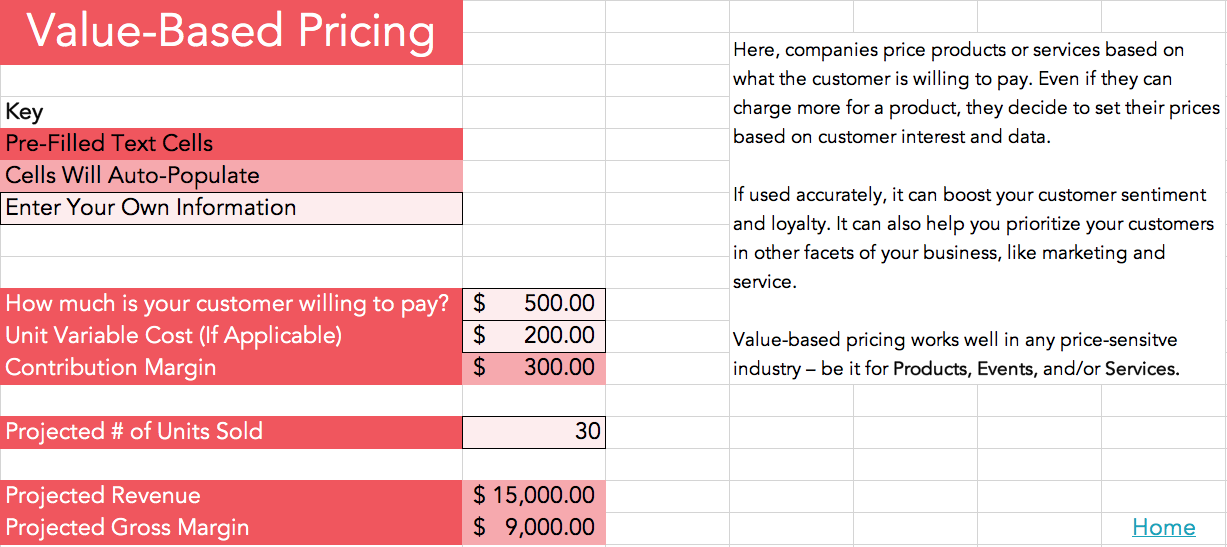

Professional tip: Plug suggestions and numbers from clients right into a pricing calculator. This spreadsheet will provide help to keep organized as you calculate pricing.

Featured Useful resource: Worth-Primarily based Pricing Calculator

Obtain this Template for Free

|

Professionals of Worth-Primarily based Pricing |

Cons of Worth-Primarily based Pricing |

|

It’s simple to be aggressive in your trade since you cost based mostly in your clients. |

Calculating worth might be tough, because it requires important time to grasp your audience and collect enterprise knowledge. |

2. Price-Plus Pricing

Price-plus pricing (additionally known as markup pricing) is a pricing technique the place you add a set proportion of manufacturing prices to a unit of what you promote. For instance, in the event you break down your product’s prices and uncover the price of improvement is $15, labor is $30, and miscellaneous is $10, including a 25% markup means your cost-plus worth is $68.75.

This technique is straightforward to implement because it focuses much less on client calls for and competitor pricing. Nonetheless, solely 10% of B2B corporations use this technique. Nonetheless, this mannequin could lead you to over-price a product in a weak market and under-price in a powerful market. Assess the market worth for comparable merchandise earlier than choosing cost-plus pricing.

|

Professionals of Price-Plus Pricing |

Cons of Price-Plus Pricing |

|

This mannequin is straightforward to calculate. |

You might overprice your merchandise and lose out on gross sales if costs are too excessive. |

|

It is a clear technique, as consumers perceive what goes into your pricing. |

SaaS companies could miss out on earnings as a result of the worth of your product could outweigh its manufacturing prices. |

3. Competitor-Primarily based Pricing

Competitor-based pricing facilities on utilizing the going market fee for comparable merchandise and charging beneath, at, or above the trade fee. For those who run a comparatively new B2B firm, you should utilize this technique as a result of current manufacturers have already assessed what clients need to pay for a product like yours.

To make use of this technique, you’ll be able to generate a listing of your rivals from in style overview platforms like G2, GetApp, and SourceForge. Afterward, try their costs and determine on a worth level in your product.

|

Professionals of Competitor-Primarily based Pricing |

Cons of Competitor-Primarily based Pricing |

|

Competitor-based pricing requires fast analysis into your rivals’ pricing methods. |

In case your merchandise change into extraordinarily in style, you might lose income by sticking to this pricing technique. |

|

Basing costs on the going market fee helps clients perceive what to anticipate and your costs gained’t scare them away. |

This methodology doesn’t think about manufacturing prices. Which means, you might put extra effort into creating your product however generate minimal income. |

|

You’ll be able to regulate costs based mostly available on the market; in case your rivals change, so are you able to. |

This technique could show to clients that your product isn’t totally different from what’s available in the market. In different phrases, with out differentiation, clients will query why they need to purchase your product as an alternative of an alternate. |

4. Dynamic Pricing

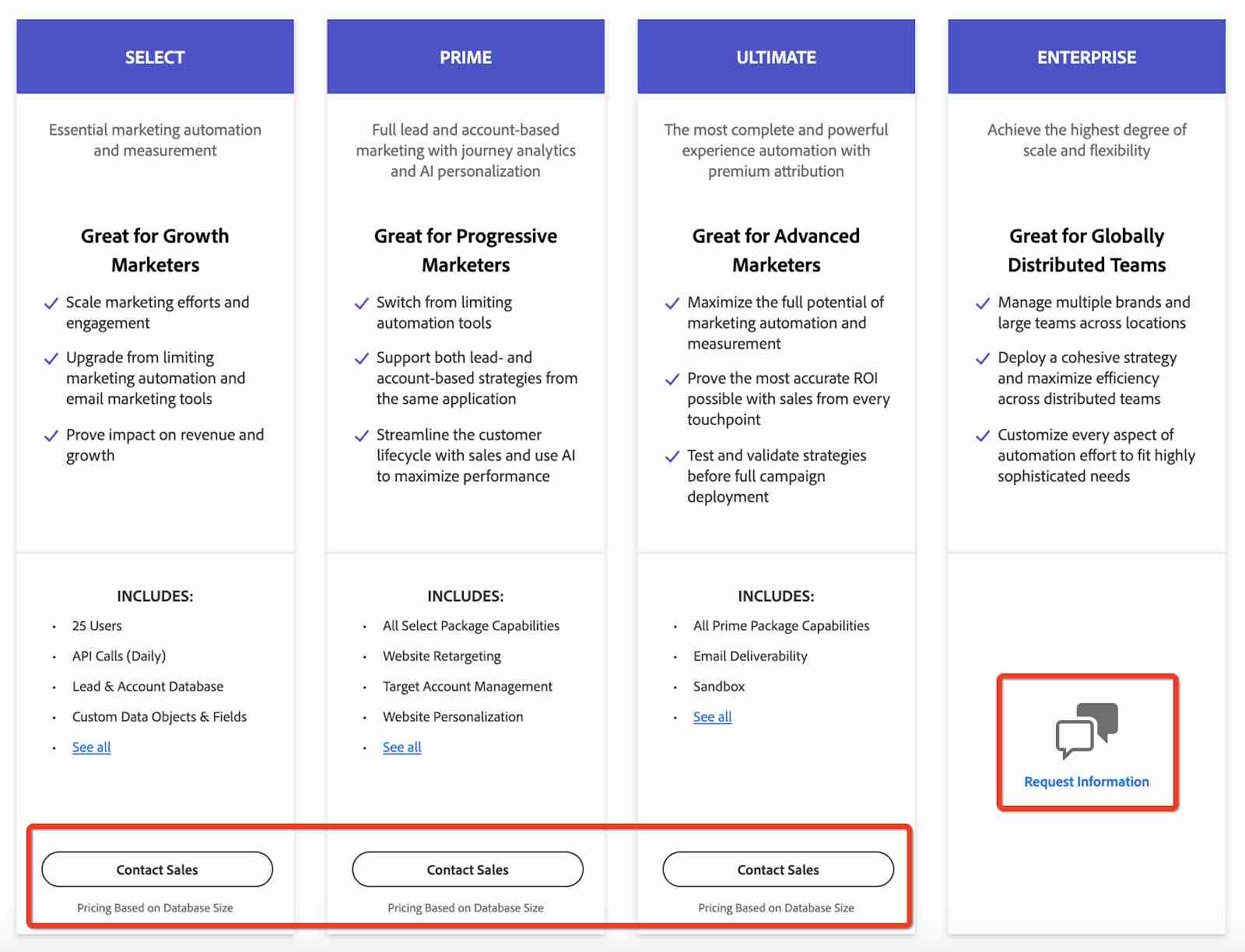

Many B2B corporations use the segmented dynamic pricing technique to promote their merchandise to totally different clients. They do that by requesting customers to contact their gross sales staff for all or sure product tiers.

Right here’s an instance.

Utilizing this technique permits companies to create personalized options for each consumer, cost based mostly on the product’s worth, and regulate costs as market traits and circumstances change.

Nonetheless, this technique is that it turns off potential customers. When customers land in your pricing web page, they need to see the worth of your product, not “contact gross sales.” Kieran Flanagan, our Senior VP of Advertising at HubSpot, echoes this level about pricing transparency.

“If Elon could make pricing for Rocket Ships clear, then B2B corporations can put their pricing on the web site. pic.twitter.com/DwEpGjjOlm”

— Kieran Flanagan 🤘 (@searchbrat) August 17, 2021

|

Professionals of Dynamic Pricing |

Cons of Dynamic Pricing |

|

You’ll be able to apply guidelines to particular enterprise teams based mostly on their traits and market circumstances, guaranteeing you could have an appropriate possibility for all viewers segments. |

Costs that fluctuate due to market circumstances could make customers upset if the product turns into unaffordable. |

|

You’ll be able to simply regulate to competitors worth modifications. |

Worth fluctuation with the market could make income unsure. |

How do B2B pricing fashions and techniques come collectively?

As they appear fairly comparable, it might be useful to achieve a remaining understanding of how B2B pricing fashions and B2B pricing methods work collectively, so we’ll go over an instance.

Say you’re a B2B enterprise that expenses different corporations based mostly on the variety of customers that may have entry to what you’re promoting. That is your pricing mannequin.

As you promote in a aggressive market, you need to give you a worth related to your rivals’ costs. You then cost a worth between your two most important rivals. That is your pricing technique.

To sum it up, you’re charging companies per consumer (pricing mannequin), and the precise costs you cost them are based mostly on the costs your rivals are charging (pricing technique).

B2B Pricing Errors to Keep away from

When setting costs in your product, be looking out for frequent B2B pricing pitfalls that may hinder your progress. Listed below are three frequent B2B pricing errors to keep away from.

Mistake 1. Setting Costs With out Speaking to Clients

No quantity of analysis is best than speaking to your clients. Your clients would be the customers of your product. Chatting with them will provide help to uncover insights into the perceived price of your resolution.

As Tyler Gaffney, CEO of Zenhub places it, “Founders should get out of their bins — laptop display, workplace, metropolis block — and meet with clients.”

Professional tip: Holding no less than three conferences with a few of your clients is a wonderful begin.

Mistake 2. Failing to Regulate Costs

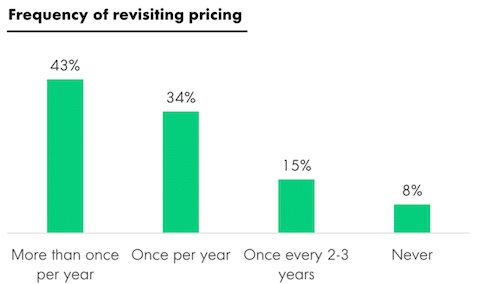

Many consider clients will stroll if costs go up. This isn’t all the time the case. As your product will get higher, its worth will increase, and your clients will discover. That’s why as much as 77% of corporations revisit their pricing no less than as soon as yearly.

Picture Supply

Alt: Frequency of revisiting pricing: Over as soon as per yr 43%, As soon as per yr 34%, Each 2-3 years 15%, By no means 8%

IMG title: b2b-pricing-revisit.png

This strategy prevents corporations from placing a cap on their income. In truth, a survey of 512 corporations by Worth Intelligently reveals a 1% change in pricing plan can enhance the underside line by as much as 12.70%.

Everytime you regulate your worth, one method to take a look at its effectiveness is to benchmark your earlier lifetime worth (LTV) and buyer acquisition price (CAC) with the brand new one. In case your LTV is increased and CAC is decrease, that’s a hit.

Mistake 3. Pricing Too Low

Undervaluing your product is without doubt one of the greatest B2B pricing errors to make. You didn’t pour sources into constructing your product, solely to accept the crumbs. Getting all the loaf is a psychological play as a result of folks understand higher-priced merchandise to be of higher high quality. The alternative can be true.

So earlier than deciding on the worth factors in your product, suppose onerous about the way you need clients to understand your product.

It’s additionally vital to keep in mind that your product’s introductory worth will play a major function in your income for years to return.

You may need heard in regards to the boiling frog syndrome. It’s the identical along with your introductory worth. If a frog is in a pot of boiling water, it is going to instantly leap out to evade loss of life. However in the event you place the frog in heat water and lift the temperature slowly, the frog will constantly regulate to the altering temperature.

The ethical of the story is obvious: A gradual change in worth is best than sudden will increase. Set low costs, and also you’ll take longer to extend your charges sooner or later.

Choose a B2B pricing mannequin, undertake a method, and keep away from errors.

The pricing of your B2B product is essential to the quantity of income your organization can generate.

Now that all in regards to the fashions, methods, and errors to keep away from, it’s very important you prioritize pricing in your group.

Bear in mind, folks pay for merchandise due to how useful they understand them and what they assist their organizations obtain. With this in thoughts, set your worth, and constantly iterate on each your B2B product and your pricing.