The US advert market will probably be boring subsequent yr. In a great way.

After the pandemic weirdness of 2020, file advert spending in 2021, ugly comps in 2022 and comparatively simple comps this yr, US advert income will stabilize as we head into 2024 at a low single-digit progress price, Brian Wieser predicts.

“The elements that supported uncommon progress throughout the pandemic should not current anymore,” stated Wieser, principal of Madison and Wall, the strategic advisory agency he launched earlier this yr after leaving his position as GroupM’s lead analyst.

In response to Wieser, the advert market will develop 6% within the third quarter, 8% within the fourth, then even out between 4% to five% progress (excluding political promoting) subsequent yr to hit roughly $392 billion.

These numbers are consistent with what GroupM and Magna are forecasting for the yr forward.

However in case you double-click on Wieser’s numbers, there are a number of attention-grabbing – and considerably disturbing – developments to notice.

Linear’s sluggish decline

Contemplate the plight of nationwide TV promoting.

Wieser believes nationwide TV advert spending will lower by 9% this yr, by simply 2.3% subsequent yr (because of the US presidential election) and by 4.8% in 2025.

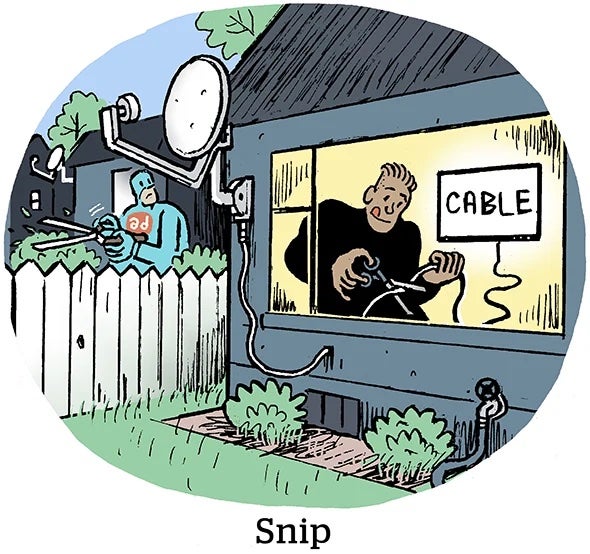

The explanations? Wire-cutting is on the rise, conventional TV networks are cannibalizing cable in favor of producing streaming subscriptions for providers that always haven’t any or only a few adverts and tense carriage disputes are placing much more stress on pay TV bundles, in addition to quashing the long-held perception that stay sports activities is the glue (and the crown jewel) of cable TV.

Living proof: Disney-owned channels, together with ESPN and ABC, are at the moment unavailable to Spectrum cable viewers (and have been since final week) as a result of a monetary disagreement between the businesses over contract charges.

However there are long-term penalties of those disputes past pay TV households lacking out on school soccer or the US Open.

However there are long-term penalties of those disputes past pay TV households lacking out on school soccer or the US Open.

If a deal isn’t reached (and within the interim, even when one is), anybody who desires to observe Disney TV community content material should go the MVPD route. Disney is already utilizing the battle as an excuse to urge Spectrum subscribers to join its Hulu + Reside TV plan.

Total viewing ranges most likely gained’t change that a lot because of this. Individuals who reduce the wire aren’t transferring to a cabin within the woods; they’re simply not watching cable. However these audiences gained’t be reachable at scale by way of tv anymore.

In the meantime, broadcasters are desperately wooing subscribers to their streaming providers regardless of shedding cash on almost each sub.

“Sadly, due to the best way that TV community house owners are positioning themselves,” Wieser stated, “they’re doing their finest to ensure they get a bigger share of a shrinking pie.”

The writer’s burden

Talking of shrinking pies, the open web’s share of advert income will stay comparatively flat.

Wieser defines the open web as any digital advert gross sales outdoors the walled gardens.

“The difficulty right here is that when publishers don’t put money into their companies anymore, it constrains the chance,” he stated, “and we find yourself with a negligible progress price relatively than one thing that’s nearer to the general common for digital promoting.”

Take native journalism. Its demise spiral tremendously accelerated when publishers determined to not put money into native information, he stated. Fewer tales means much less advert stock means fewer journalists means even fewer tales.

It’s the reverse flywheel from hell, and never not like what’s been occurring as broadcasters disinvest in linear TV on a relative foundation, Wieser stated.

“If networks put all of their costly programming on streaming providers,” he stated, “no one must be stunned if linear TV dies.”

However publishers that put money into progress, together with legacy magazines and newspaper publishers, can cease the spiral.

“The open web isn’t going to be as scalable because the ‘content-less’ platforms; search remains to be the best enterprise ever,” Wieser stated. “However the upside to a journalistic property is that they’ll nonetheless construct sturdy manufacturers.”

“The open web isn’t going to be as scalable because the ‘content-less’ platforms; search remains to be the best enterprise ever,” Wieser stated. “However the upside to a journalistic property is that they’ll nonetheless construct sturdy manufacturers.”

Retail media to the rescue

Contemplating these shrinking pies and demise spirals, what’s driving that 4% to five% progress Wieser foresees for subsequent yr?

Digital, after all – together with search, social, YouTube, Apple and retail/commerce media, which can collectively make up a 64% share of all promoting.

Retail media, particularly, is ready to go bananas, accounting for $42 billion in advert income this yr.

To be honest, Amazon dominates the class, however this pie is massive sufficient for others – together with Instacart, Walmart, Criteo, et al. – to take decent-sized slices.

Additionally, retail media is simply a slice of the bigger pie that’s commerce media, which homes all the things from eBay and Uber to Expedia.com.

“Amazon is in one of the best place to seize retail media demand, however there’s plenty of room for different gamers,” Wieser stated. “Numerous stock is getting created on this house, and that makes it extra of a progress space than another class I can level to proper now.”