Manufacturers and companies have realized that good sustainability practices usually are not simply the precise factor to do, however may also be a bottom-line-boosting initiative. New analysis from the Infosys Data Institute, the thought management and analysis arm of next-generation digital companies agency Infosys, affirms that elevated ESG funding correlates with increased income.

The agency’s newly launched report, ESG Redefined: From Compliance to Worth Creation, identifies actions that corporations ought to take now to attain ESG objectives and generate monetary returns throughout sustainability initiatives.

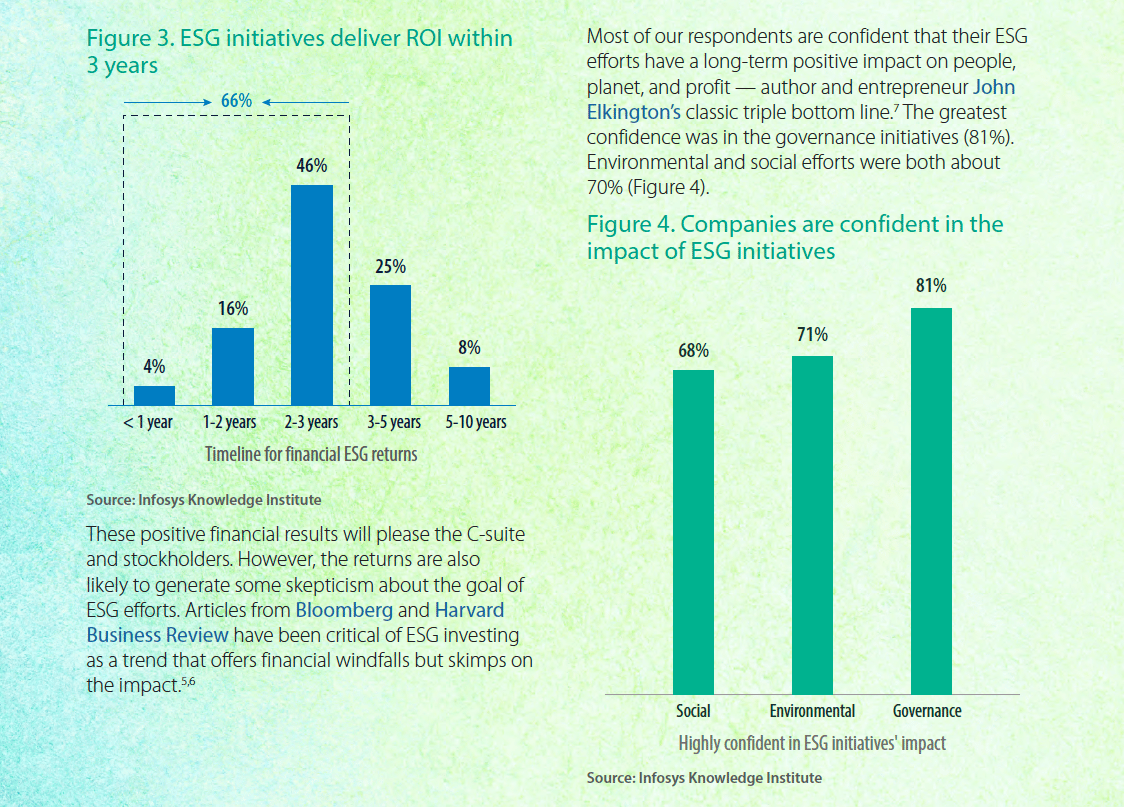

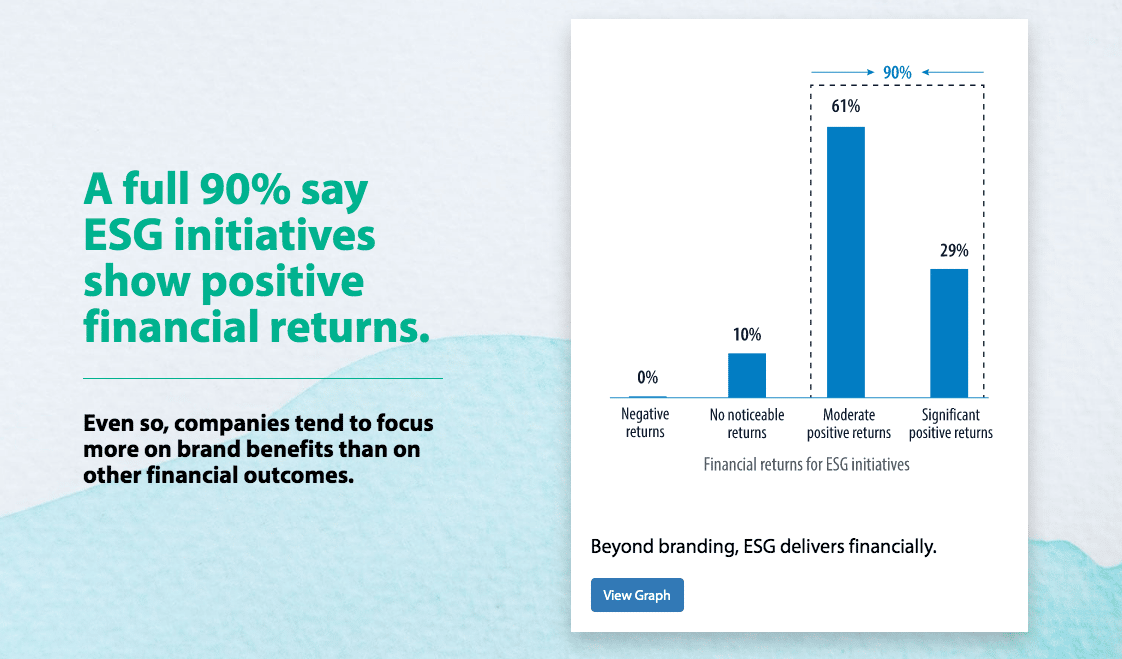

The analysis reveals that just about all (90 p.c) executives mentioned their ESG spending led to average or vital monetary returns

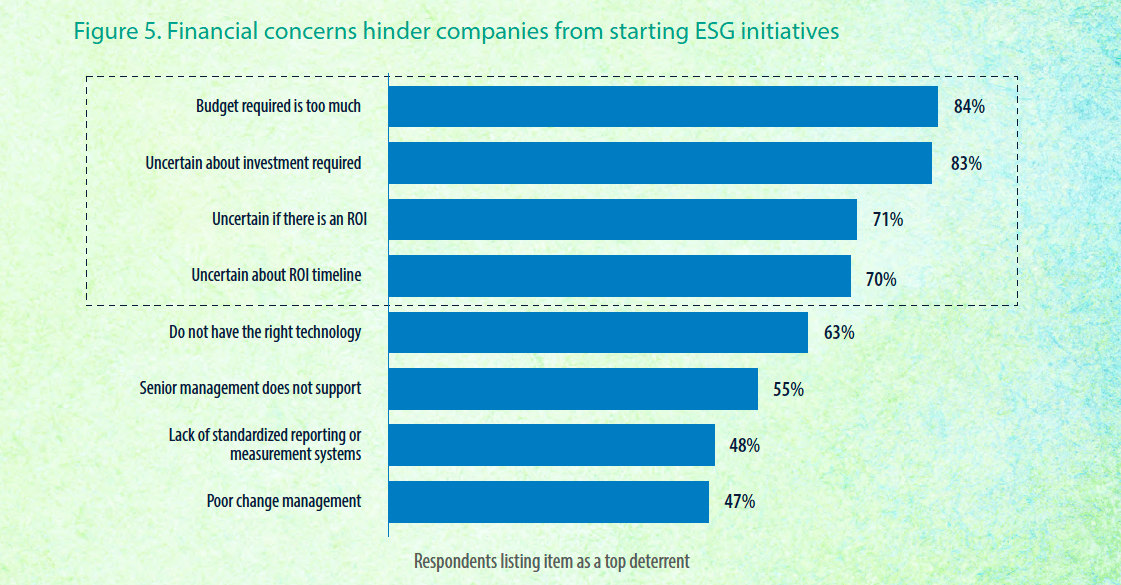

Most respondents (66 p.c) skilled ESG returns inside three years. The report acknowledges that regardless of ESG’s clear hyperlink to revenue progress, budgets are prone to be an impediment within the present financial system. That is worrisome, as corporations want extra monetary assets and working mannequin modifications to attain ESG objectives and maintain revenue progress.

“There may be nothing novel about the concept you need to spend cash to generate income. Nonetheless, though 90 p.c of respondents in our research say ESG offers ROI, there’s nonetheless a lag in making use of technique to ESG as it’s executed for different elements of their companies,” mentioned Mohit Joshi, Infosys president, in a information launch. “Corporations should shift views to acknowledge ESG as a price creator to reap the monetary advantages of ESG investments and to attain most impression in creating a greater, extra sustainable world.”

Technique alignment and execution will permit companies to speed up their ESG initiatives with larger payoff. The researchers revealed a number of insights to information corporations to speed up ESG’s monetary rewards:

ESG is a confirmed moneymaker

The report discovered {that a} 10-percentage-point improve in ESG spending correlates with a 1 proportion level improve in revenue progress. An organization that at present spends 5 p.c of its price range on ESG can anticipate a one proportion level revenue improve if it aligns working or capital price range to extend ESG spending portion to fifteen p.c.

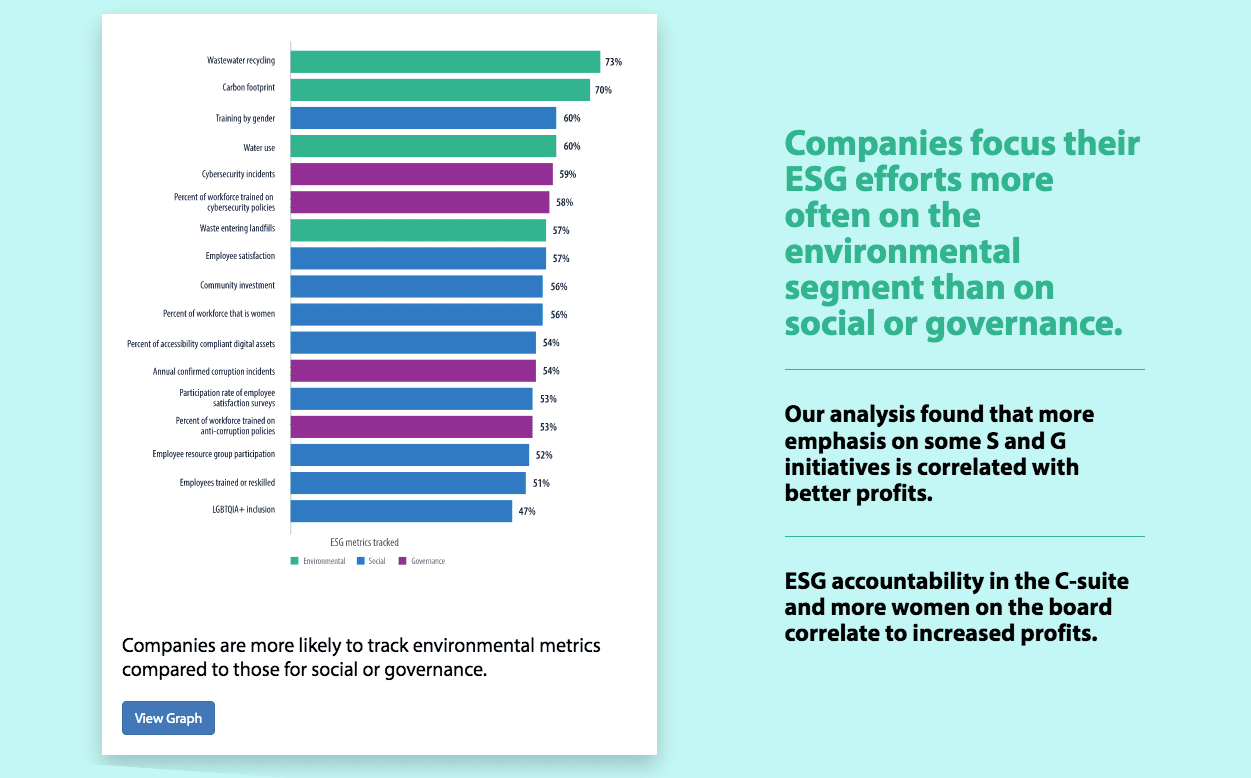

Overlooking the ‘S’ and ‘G’ in ESG reduces profitability

Many corporations focus ESG efforts on the environmental phase with commitments to carbon neutrality, internet zero, and decreasing greenhouse fuel emissions. Nonetheless, there are additionally alternatives to enhance monetary outcomes by social and governance initiatives. Analysis information exhibits social initiatives like board variety correlate to improved profitability.

ESG management technique correlates with a 2-percentage-point improve in revenue and income progress

Corporations carry out higher financially after they display all the next: a chief variety officer (CDO), chief sustainability officer (CSO), ESG committee on the board, and likewise when the CSO clears capital expenditures for ESG initiatives. Nonetheless, solely a couple of quarter (27 p.c) of these surveyed say their firm has all 4 elements in place. The survey information evaluation additionally discovered that the C-suite and prime government ranks had been the most uncared for areas for ESG modifications. Solely 19 p.c of respondents say their firm ties government compensation to ESG objectives, and simply 30 p.c say their companies place accountability for ESG with the C-suite.

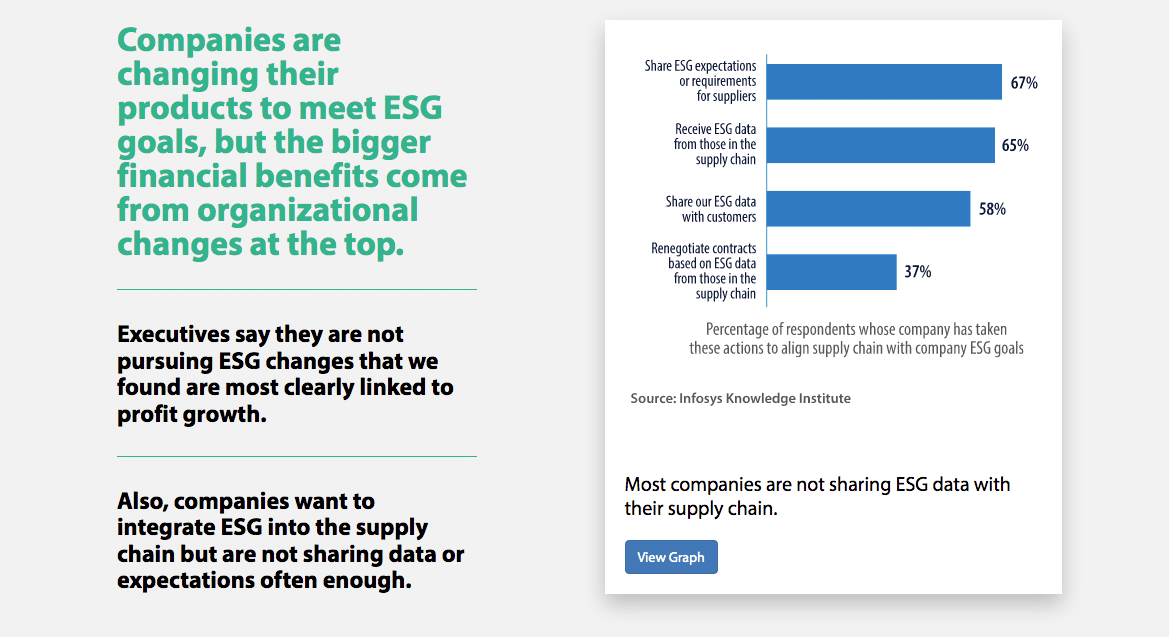

Provide chain transparency issues

Analysis discovered that the majority corporations are desirous about aligning their ESG objectives with their provide chain, particularly as extra corporations are anticipated to account for his or her scope 3 greenhouse fuel emissions. Nonetheless, lower than one-third share ESG expectations or necessities for suppliers. Solely 16 p.c say they renegotiate contracts based mostly on ESG information from these within the provide chain—indicating a transparent want for extra management within the provide chain and incentives to share ESG information, whether or not it’s assembly new contract necessities or making themselves extra interesting to others within the provide chain.

Obtain the total report right here.

Infosys used an nameless format to conduct an internet survey of two,500 enterprise executives throughout industries throughout the US, UK, France, Germany, the Nordics, Australia, New Zealand, China, and India. To achieve extra, qualitative insights, the researchers interviewed subject material consultants and enterprise leaders.