Flipkart, the Indian e-commerce big, has emerged as a number one participant on the planet of on-line buying. With its modern enterprise mannequin and strategic income streams, it has achieved exceptional success in a brief span of time. Let’s delve into understanding the Flipkart income mannequin and the way it achieved its present market standing.

The corporate’s development trajectory is attributed to its distinctive enterprise mannequin and strategic alliances. It raised $1 million from Accel India in 2009, adopted by $10 million and $20 million in 2010 and 2011, respectively, from Tiger International. The most important turning level got here in 2018 when Walmart, the multinational retail company, acquired Flipkart for a staggering $16 billion.

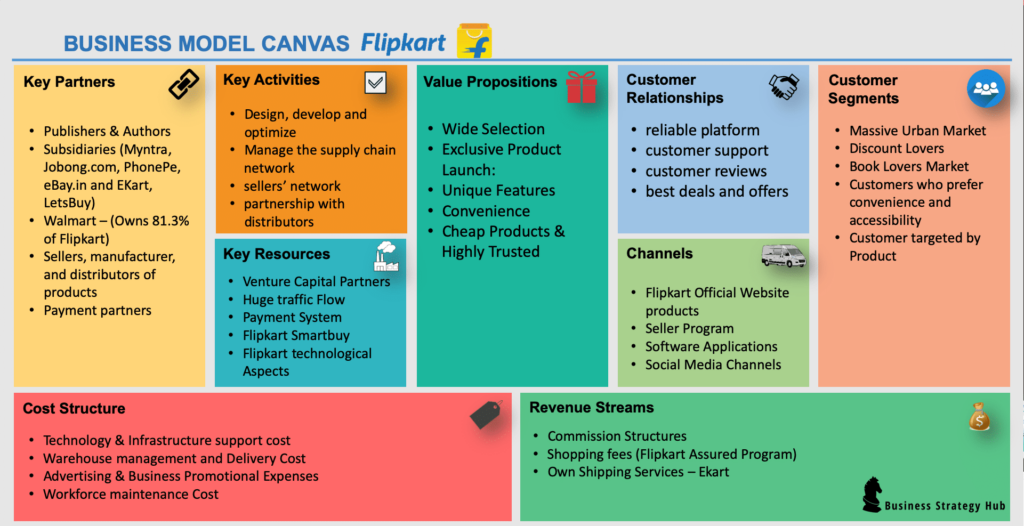

Understanding the Flipkart Enterprise Mannequin

The Market Mannequin

Flipkart operates on a market mannequin, connecting sellers to potential clients. It facilitates transactions between consumers and sellers throughout a number of product classes, together with electronics, clothes, furnishings, and extra. This business-to-consumer (B2C) mannequin has helped Flipkart cater to a large buyer base, providing quite a lot of merchandise at aggressive costs.

Income Era

The first supply of Flipkart’s income is the fee it prices from sellers on its platform. The fee fee varies primarily based on the product class and the vendor’s ranking. Moreover, Flipkart additionally prices a minimal comfort charge from sellers for sooner supply providers.

Moreover, Flipkart has its personal logistics service, E-kart, which offers supply providers to sellers. This provides one other income stream to the corporate.

Promoting and Promotions

Commercial is one other important income supply for Flipkart. It offers promoting house to sellers and types on its platform, enabling them to extend their product visibility and increase gross sales.

Subscription Providers

Flipkart Plus, the corporate’s subscription-based loyalty program, offers a number of advantages to its members, equivalent to free supply, early entry to gross sales, and unique offers. This not solely improves buyer retention but additionally contributes to the corporate’s income.

Monetary Providers

Flipkart additionally affords varied monetary providers by its subsidiary, Flipkart Monetary Providers. This consists of working capital loans, insurance coverage, and bill financing for sellers, producing further income by charges and curiosity prices.

Flipkart’s Digital Advertising Technique

Flipkart’s digital advertising and marketing technique performs a vital function in its success. It makes use of varied channels to advertise its merchandise, interact with clients, and drive gross sales.

Social Media Advertising: Flipkart has a robust presence on social media platforms like Fb, Twitter, and Instagram, utilizing them to advertise merchandise, share buyer opinions, and have interaction with followers.

Search Engine Optimization (search engine optimization): Flipkart invests closely in optimizing its web site for search engines like google and yahoo, making certain increased visibility and higher rating on search engine outcomes pages.

Electronic mail Advertising: Flipkart makes use of customized emails to maintain clients knowledgeable about new merchandise, affords, and promotions, thereby bettering buyer engagement.

Influencer Advertising: Flipkart collaborates with social media influencers and celebrities to advertise its merchandise and construct model consciousness.

Efficiency Advertising: Flipkart makes use of superior concentrating on strategies in its search and show promoting to achieve the proper viewers and drive gross sales.

Extra Income Sources

Other than the first income streams, Flipkart additionally generates income by varied different channels:

- Internet Portal: Flipkart prices a fee from sellers who use its platform to promote their merchandise.

- Itemizing & Comfort Payment: Flipkart prices an inventory charge from sellers and a comfort charge from consumers for quick supply.

- Logistics: Flipkart prices sellers for transport their merchandise by its logistics service, E-kart.

- Digital Media: Flipkart sells promoting house to sellers and types on its platform.

- Subsidiaries: Flipkart’s subsidiaries, like Myntra, contribute to its general income.

Key Takeaways and issues to notice from Flipkart Income Mannequin

Right here’s a abstract and checklist of the income streams and issues to notice from the Flipkart income mannequin.

On-line Market: The core of Flipkart income mannequin is its on-line market, which connects sellers and clients. Flipkart doesn’t personal the merchandise however offers a platform for third-party sellers to achieve an unlimited buyer base. It earns a fee on every sale made by its platform, which varies relying on the product class and different components.

Logistics and Supply Providers: Flipkart generates substantial income from its logistics and supply providers. The corporate ensures well timed and environment friendly supply of merchandise offered by its platform, charging a charge to sellers for this service.

Promoting: Flipkart additionally monetizes its platform by providing promoting providers to sellers. Sellers pays to advertise their merchandise, thereby rising their visibility to potential clients.

Non-public Labels: Flipkart has diversified its income stream by launching its non-public labels throughout varied classes, promoting merchandise beneath its personal model. This transfer not solely boosts profitability but additionally helps to regulate product high quality.

Subsidiaries and Monetary Providers: Flipkart has expanded its enterprise by buying a number of subsidiaries, together with trend portal Myntra, digital funds platform PhonePe, and Flipkart Wholesale. These subsidiaries contribute considerably to Flipkart’s general revenues. Moreover, the corporate affords varied monetary providers to its sellers by Flipkart Monetary Providers.

Unique Product Launches and Distinctive Options: Flipkart differentiates itself from rivals by providing unique product launches and distinctive options. Its worth propositions embody a wide array of merchandise, comfort, and accessibility. These components appeal to a big buyer base, thereby driving gross sales and income.

Gross Merchandise Quantity (GMV): Flipkart’s GMV, which is the full worth of merchandise offered over a selected interval, has been spectacular. For example, throughout one occasion, the corporate achieved a GMV of US$300 million. The biggest volumes got here from trend gross sales, indicating the corporate’s sturdy place on this sector.

Acquisitions: Flipkart has grown organically and thru acquisitions. By buying completely different on-line platforms like Myntra and Jabong, the corporate has expanded its product portfolio and buyer base. These acquisitions not solely contribute to income development but additionally strengthen Flipkart’s place within the e-commerce market.

Investments: The corporate has attracted substantial investments, most notably from Walmart, which purchased a 77% stake in Flipkart for US$16 billion. Such investments present monetary backing for Flipkart income mannequin to increase its providers, innovate, and keep competitiveness.

Conclusion

Flipkart income mannequin and monetization methods are distinctive and dynamic, providing precious insights for e-commerce corporations worldwide. The corporate primarily generates earnings by commissions, promoting, digital media, and personal label merchandise. Its potential to diversify earnings streams, improve buyer expertise, and adapt to altering market tendencies has significantly contributed to its sustained development.

Flipkart’s success underscores the significance of modern, customer-centric approaches within the e-commerce sector. It’s a excellent instance of a enterprise leveraging digital applied sciences and knowledge analytics to maximise profitability whereas offering worth to its clients. The learnings from Flipkart’s income mannequin can encourage new and present e-commerce companies to innovate and adapt within the ever-evolving digital market.