Insurance coverage gross sales is a extremely profitable business. Paul Moss, Founding father of HeyDriver and a 14+ years insurance coverage veteran, says, “There’s loads of cheddar to feed the mouths of insurance coverage professionals.” He provides that the business is definitely accessible to anybody.

With a diploma, you can begin working as an insurance coverage salesperson. Keep lengthy sufficient, and you can get large outcomes. Take Cody Askins, for example. He began working within the insurance coverage business at simply 20 years outdated. He made a aim to make 6-figures throughout his first yr, and in solely eight months, Cody remodeled $117,000.

The kicker: success on this business doesn’t come simple. Like Cody, you’ll get extra “no” than “sure.” However in the event you can deal with many “no” with out faltering, you’ll do nice on this business. On this information, we’ll discover the whole lot about beginning a profession in insurance coverage gross sales, together with the professionals, cons, and ideas that will help you succeed.

Desk of Contents

As a licensed skilled, you possibly can work as a captive or unbiased agent. Captive brokers promote insurance coverage for just one firm. Unbiased brokers signify a number of insurance coverage firms.

The Execs of Working in Insurance coverage Gross sales

Tony Caldwell, writer, speaker, and mentor within the business, says, “Working in insurance coverage presents super alternatives to construct a worthwhile, difficult, and satisfying skilled profession.” Here is why.

Limitless Incomes Potential

Many insurance coverage gross sales brokers get commission-based earnings. So what you select to earn is fully as much as you. Offered you’re dedicated, you possibly can set your earnings bar at 5, six, seven, or eight figures. You can too earn passive earnings from the coverage renewals of shoppers.

Noble Career

Working as a salesman within the insurance coverage business allows you to make an actual distinction in folks’s lives. “Regardless of how shy you’re about promoting insurance coverage, you assist folks in methods they’ll by no means know until they get right into a life-changing accident,” says Paul Moss, Founding father of HeyDriver.

Glorious Work-life Stability

Many insurance coverage firms provide versatile work preparations that provide you with work-life stability. This helps you obtain elevated productiveness, makes you much less confused, and offers you adequate time on your private or household life.

Job Safety

So long as folks drive automobiles, want medical care, make use of staff, run companies, and have a life, they’ll want insurance coverage. And which means your job is safe even throughout recessions.

Cons of Working in Insurance coverage Gross sales

The insurance coverage gross sales business isn’t all sunshine and rainbows. Rejection is one component that makes this occupation effing tiring. However listed here are others:

Fee-based Pay

Many insurance coverage gross sales brokers work as unbiased contractors. Working as one means you’ll file your taxes, pay your medical health insurance and advantages, and purchase your work instruments. Plus, you hardly ever have a base wage. Even in the event you’re fortunate to get a base wage, you need to nonetheless hit your quotas. These underscore why realizing an organization’s compensation plan earlier than working with them is important.

Numerous Paperwork

Documentation is critical to point out the proof of a contract. And in insurance coverage gross sales, you’ll be doing plenty of it.

Tony Caldwell, writer and creator of 250+ insurance coverage businesses, says, “Insurance coverage gross sales require you to maintain up with administrative duties like paperwork.”

Although important, paperwork can also be time-consuming, and plenty of nice salespeople battle to maintain up. “Fortuitously, tech instruments can simplify the method so you’ve gotten extra time to construct consumer relationships, as a substitute of punching in information,” provides Caldwell.

Excessive Failure Price

In accordance with Investopedia, over 90% of recent life insurance coverage brokers stop inside the first yr. The speed will increase to over 95% when prolonged to 5 years. Insurance coverage segments like well being should not have these excessive stop charges.

Generally, brokers stop as a result of they get burned out making an attempt to transform firm leads {that a} half-dozen ex-agents might have pitched. Different occasions, they fight laborious to seek out unique leads by strategies like cold-calling.

To enhance your likelihood of success on this business, Veronica Moss, an insurance coverage dealer since 1999, recommends you completely know the way the business works. “If you do not know, ask for assist,” provides Veronica.

Entry Degree Insurance coverage Gross sales Roles

In case you’re contemplating a profession in insurance coverage gross sales, exploring the assorted entry-level positions within the business could be useful. These roles present a stable basis to develop your gross sales expertise, construct relationships with shoppers, and contribute to the expansion of insurance coverage firms.

This part highlights three entry-level insurance coverage gross sales jobs and descriptions their duties, {qualifications}, and common salaries.

By gaining perception into these roles, aspiring you possibly can higher perceive the alternatives that await you within the insurance coverage gross sales business and make knowledgeable choices about your profession path.

1. Insurance coverage Gross sales Agent

Duties

- Figuring out potential shoppers and reaching out to them to supply insurance coverage insurance policies

- Conducting wants assessments and recommending appropriate protection choices to shoppers

- Explaining coverage options, advantages, and premium fee particulars

- Customizing insurance coverage packages to fulfill particular person consumer wants

- Producing leads by networking, referrals, and chilly calling

- Constructing and sustaining relationships with shoppers to foster loyalty and retain enterprise

{Qualifications}

- Highschool diploma or equal (some employers might choose a bachelor’s diploma)

- Sturdy communication and interpersonal expertise

- Proficiency in gross sales strategies and negotiation

- Good understanding of insurance coverage merchandise, insurance policies, and rules

- Capacity to work independently and meet gross sales targets

Common Wage: In accordance with the U.S. Bureau of Labor Statistics (BLS), the median annual wage for insurance coverage gross sales brokers was $49,840 as of 2021. Nevertheless, salaries can differ primarily based on components similar to location, expertise, and fee construction.

2. Insurance coverage Buyer Service Consultant

Duties

- Helping shoppers with inquiries, coverage adjustments, and claims processing

- Offering distinctive customer support by addressing issues and resolving points

- Educating shoppers about coverage particulars, protection limits, and declare procedures

- Processing coverage renewals, endorsements, and cancellations

- Collaborating with insurance coverage brokers and underwriters to make sure correct coverage data

- Sustaining consumer data and updating databases

{Qualifications}

- Highschool diploma or equal (some employers might choose an affiliate‘s or bachelor’s diploma)

- Glorious customer support and problem-solving expertise

- Sturdy verbal and written communication talents

- Familiarity with insurance coverage terminology and insurance policies

- Proficiency in utilizing pc methods and related software program

Common Wage: The common wage for insurance coverage customer support representatives varies relying on components similar to location, expertise, and firm measurement. In accordance with wage information from PayScale, as of 2021, the common annual wage for this position ranged from $31,000 to $53,000.

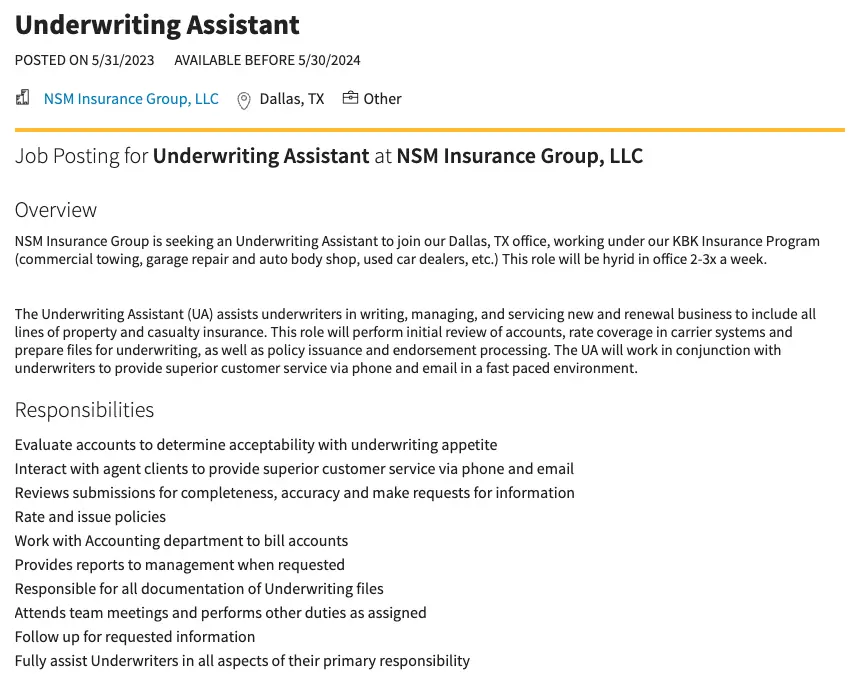

3. Insurance coverage Underwriting Assistant

Duties

- Helping underwriters in evaluating insurance coverage purposes and figuring out threat ranges

- Amassing and analyzing applicant data, similar to monetary data and medical historical past

- Conducting analysis and gathering information to assist underwriting choices

- Getting ready quotes, insurance policies, and endorsement paperwork

- Reviewing coverage paperwork for accuracy and completeness

- Speaking with brokers, brokers, and shoppers to acquire obligatory data

{Qualifications}

- Bachelor’s diploma in enterprise, finance, or a associated area (some employers might settle for related work expertise in lieu of a level)

- Sturdy analytical and significant considering expertise

- Consideration to element and accuracy in information evaluation

- Proficiency in utilizing underwriting software program and instruments

- Information of insurance coverage business rules and insurance policies

Common Wage: The common wage for insurance coverage underwriting assistants varies relying on components similar to location, expertise, and firm measurement. In accordance with information from Wage.com, as of 2021, the median annual wage for this position ranged from $45,543 to $58,226.

6 Suggestions for Working in Insurance coverage Gross sales

That can assist you begin a profession within the insurance coverage gross sales business, comply with these tricks to improve your odds of success.

1. Discover ways to construct relationships.

Individuals must belief you earlier than shopping for your insurance coverage product. Being pushy with the sale received’t reduce it. As an alternative, constructing a superb relationship by empathizing with shoppers helps you acquire their belief over time. It additionally makes your work really feel much less of a chore.

When conversing with shoppers, genuinely ask about their skilled and private pursuits. Utilizing this data to spark conversations lets shoppers know you pay attention they usually’ll belief you. This belief can result in the sale of your product and even up-sells and referral alternatives.

Belief additionally helps you finish objections like, “I wish to give it some thought,” “I want to discuss to my enterprise accomplice,” or “I don’t have the price range for this.”

2. Let shoppers take the driving force’s seat.

The power to pay attention is a superpower of closers. When you’d wish to lead the dialogue together with your shoppers, letting them take the driving force’s seat by speaking is finest. It prevents you from turning off shoppers and hindering the sale.

While you pay attention, you’ll know your shoppers’ wants, and also you’d be capable of affect the sale of your product. However realizing your consumer’s wants doesn’t imply they’ll purchase. Why? They might not need your insurance coverage protection straight away. That’s the place asking good questions is available in.

These questions will make it easier to lead the consumer to the end result of not fulfilling their want. However with out listening, you possibly can’t even know these questions since you’ve been doing a lot of the speaking.

3. Grasp storytelling.

Storytelling is a strong device for delivering any message. We are able to’t neglect books like Hamlet by William Shakespeare, Frankenstein by Mary Shelley, and The Odyssey by Homer. In case you don’t need shoppers to neglect about your product in a rush, inform tales.

When making an attempt to promote your product, inform tales of different shoppers who obtained the monetary help they desperately needed. Connecting with shoppers utilizing your individual story can also be acceptable.

This story ought to relate to the destructive consequence of not utilizing your product or the constructive consequence of utilizing your product. Both manner, the consumer will get the message, and also you’ll be one step nearer to successful the sale.

4. Exude confidence.

Confidence comes from information. The extra you understand in regards to the insurance coverage business, the much less the uncertainty, in your phrases. Purchasers choose to purchase from an agent who doesn’t use phrases like “I believe, I assume, possibly, maybe, most likely, or so far as I do know.”

These phrases present a insecurity and may crush a consumer’s belief in you and your product. To repair this, use phrases that present certainty. They show you’re educated in regards to the business.

As Daniel Lettman, Enterprise Improvement Government at Entry Insurance coverage, places it, “Be a sponge. Be taught, develop, and hold growing your expertise.” This may help you alter a consumer’s thought from “I don’t resolve on the primary day of studying about merchandise” to “let’s get my accomplice onboard.”

5. Leverage social proof.

Social proof is an unbelievable phenomenon the place folks assume an motion is appropriate as a result of different folks have taken the identical motion.

Whether or not you’re employed as a captive or unbiased agent, you will get social proof by asking your shoppers to jot down evaluations on your product on third-party evaluate websites like Trustpilot. You’ll be able to go a step additional by asking your organization to function your glad shoppers in a case examine.

When discussing your product, present shoppers these testimonials or case research. In addition to convincing the consumer to make use of your product, these kinds of social proof will increase your confidence since you’re sure your product works.

6. Community with friends within the business.

Networking together with your friends is a superb solution to keep present and study new alternatives. You are able to do this by becoming a member of social media teams just like the Insurance coverage Professionals on LinkedIn or by attending networking occasions.

Websites like Eventbrite and Patch.com make it easier to discover native insurance coverage occasions to socialize with different brokers, share your advertising technique, and refer enterprise to one another. Be sure you attend occasions early so you possibly can meet the organizers, join with them, and comply with them on their most well-liked social media channels.

Making use of for an Entry-level Insurance coverage Gross sales Job

Discovering a job in insurance coverage gross sales is simple. You are able to do this with platforms like Certainly, LinkedIn, and Glassdoor. That stated, it is advisable assess an organization’s monetary well being earlier than accepting a proposal. Websites like A.M. Finest present monetary well being particulars and present the corporate’s ranking primarily based on its measurement.

It doesn’t matter if the corporate is “huge.” Some huge firms might not be the perfect firm.

Your state insurance coverage commissioner‘s web site is one other place to look. It comprises the grievance historical past towards firms you’re contemplating. If an organization has a excessive variety of complaints, keep away from them. Working with an organization that has a poor fame could cause burnout and rapidly grind your profession to a halt.

Beginning Your Insurance coverage Gross sales Profession

In case your aim is to develop into an entrepreneur, you’ll have plenty of room to start a profession in insurance coverage gross sales and succeed. As an illustration, after staying within the insurance coverage enterprise for 14+ years, Paul Moss, the proprietor of Moss Company has efficiently generated over $600 million in premiums and $300 million in income.

Paul has an incredible success story. However right here’s the factor: his first few months within the business have been robust. Yours will likely be as properly. Nevertheless, in the event you can set a aim for your self, roll up your sleeves to construct relationships and deal with rejections with grace, you can begin successful inside a couple of months of becoming a member of the insurance coverage gross sales business.