In at this time’s fast-paced enterprise world, firms are more and more turning to Accounts Payable Automation Software program to streamline monetary operations, scale back errors, and enhance productiveness. Accounts payable (AP) departments historically deal with bill processing, approvals, and funds—a labor-intensive process that may be fraught with errors. Automation software program for accounts payable simplifies these processes, eliminating the necessity for guide entry and permitting companies to deal with strategic duties.

One main good thing about utilizing Accounts Payable Automation Software program is its capability to scale back the danger of errors and fraud. By automating knowledge seize and processing, the software program minimizes human errors frequent in guide AP duties, resembling duplicate entries and missed funds. Moreover, superior software program options use synthetic intelligence (AI) to detect discrepancies and flag potential fraud, guaranteeing a safer and dependable fee course of.

One other benefit of AP automation software program is its real-time reporting and analytics capabilities. Companies can entry up-to-date data on excellent invoices, money circulation, and fee statuses. This visibility permits for higher monetary planning, budgeting, and provider relationship administration. Moreover, automated workflows facilitate quicker bill approvals, which might result in early fee reductions from distributors—an added monetary profit for firms.

Many Accounts Payable Automation Software program options combine seamlessly with present enterprise useful resource planning (ERP) programs, guaranteeing a easy transition to automated workflows with out disrupting present processes. With user-friendly interfaces and customizable workflows, firms of all sizes can undertake automation software program that matches their distinctive wants and improves operational effectivity.

International Accounts Payable Automation Software program Market report states that fashionable choices embrace Tipalti, SAP Concur, AvidXchange, and Invoice.com. These platforms supply numerous options like OCR (optical character recognition), digital bill storage, and cellular entry, enabling finance groups to handle AP duties remotely. As extra companies undertake these options, Accounts Payable Automation Software program is proving to be a worthwhile software in managing monetary workflows, enhancing accuracy, and supporting organizational development. Check out pattern report now for extra inside detais.

High 7 accounts payable automation software program guaranteeing easy and error-free workflows

Based in 1996, SAP Ariba is headquartered in Palo Alto, California, USA. Recognized for its strong cloud-based procurement and provide chain administration options, SAP Ariba allows seamless integration of suppliers and consumers. The platform focuses on streamlining accounts payable processes, providing automation instruments that improve transaction visibility and effectivity, making it a worthwhile useful resource for firms of assorted sizes looking for monetary transparency.

Established in 1981, Sage Software program is predicated in Newcastle upon Tyne, United Kingdom. Sage focuses on accounting, payroll, and fee options for small to medium-sized enterprises. Its accounts payable automation software program is tailor-made to streamline monetary workflows, enhance accuracy, and supply real-time insights. Sage’s user-friendly interface and complete options make it a preferred selection for companies trying to simplify monetary administration.

Based in 2010, Tipalti is headquartered in San Mateo, California, USA. Tipalti focuses on international fee automation, catering to firms with worldwide distributors and suppliers. Its accounts payable automation software program helps companies handle invoicing, compliance, and international funds seamlessly. With built-in fraud detection and tax compliance capabilities, Tipalti ensures safe, environment friendly, and correct monetary processes throughout a number of nations and currencies.

Established in 2003, FreshBooks is predicated in Toronto, Canada. Initially developed for freelancers and small companies, FreshBooks affords a simplified, intuitive accounting platform. Its accounts payable automation options streamline billing, expense administration, and reporting. With a deal with enhancing productiveness and accuracy, FreshBooks is good for entrepreneurs and small companies looking for accessible monetary options to handle day-to-day transactions.

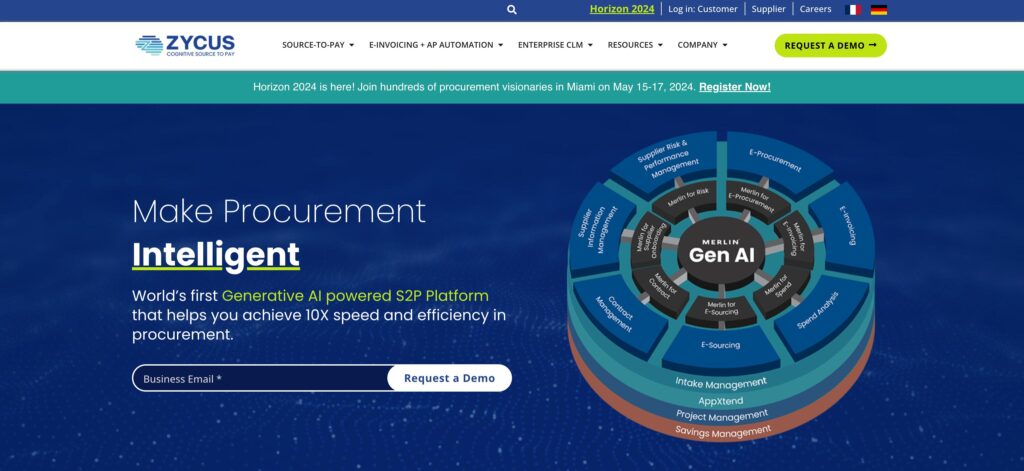

Based in 1998, Zycus is headquartered in Princeton, New Jersey, USA. Zycus gives procurement and accounts payable automation options geared toward bigger enterprises. The platform leverages AI and machine studying to reinforce bill processing, scale back guide entry, and streamline workflow administration. Zycus focuses on delivering end-to-end visibility and management, guaranteeing extra environment friendly monetary operations for international organizations.

Established in 2006 and based mostly in San Mateo, California, USA, Coupa Software program focuses on enterprise spend administration. Coupa’s accounts payable automation software program affords a complete resolution for invoicing, expense administration, and provider funds. Designed to optimize spending and improve compliance, Coupa gives real-time insights and automation, making it a trusted selection for companies aiming to manage prices successfully.

Based in 2009, FinancialForce is headquartered in San Francisco, California, USA. Working on the Salesforce platform, FinancialForce delivers a cloud-based suite of monetary and ERP functions. Its accounts payable automation software program simplifies fee processes, improves knowledge accuracy, and ensures easy monetary workflows. With its Salesforce integration, FinancialForce allows seamless collaboration between finance and operations groups, enhancing decision-making and monetary management.