Learn how to energy up the POWR Pairs Trades to decrease danger and enhance return in a wide range, no change market setting.

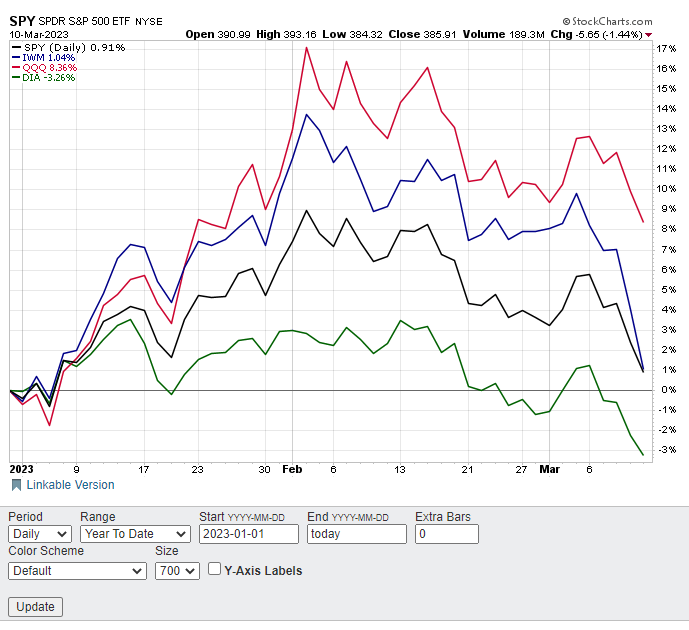

After a rip-roaring begin to 2023, shares have come crashing again to just about unchanged on the yr.

The NASDAQ 100 (QQQ) nonetheless is up properly to this point in 2023 at a little bit over 8%, however that’s greater than a 50% drop from the highs in early February. The S&P 500 (SPY) and Russell 2000 (IWM) have fallen additional and are clinging to slight features for the yr. The Dow Jones Industrials (DIA) are actually firmly in unfavorable territory in 2023.

The roles have been reversed in 2022 with the DIA being by far the very best performer (down just below 14%) of the 4 indices whereas QQQ (down over 25%) was the worst.

This sort of big selection, no change market setting makes shopping for shares tougher and places a particular premium on inventory selecting. Utilizing the POWR Scores to uncover the very best shares to purchase and the worst shares to promote shall be a fair determined edge in 2023.

That is precisely the strategy we’ve got used with nice success in POWR Choices. A POWR Pairs Commerce to coin the time period.

We begin by taking a look at bullish calls on the best rated shares and bearish places on the bottom rated shares. This eliminates a lot of the general market publicity and distills the relative efficiency right down to the ability of the POWR rankings. Increased rated shares outperform decrease rated shares to a big diploma as proven within the chart under.

Then we establish conditions the place the decrease rated inventory has out-performed the upper inventory in an enormous means and is able to revenue from the anticipated convergence of the 2 again to a extra traditionally conventional relationship. Up to now, we invariably used this pairs philosophy with two shares in the identical trade to additional dampen danger.

We additionally at all times contemplate implied volatility (IV) in each buying and selling determination. POWR Choices buys comparatively low-cost choices to additional put the general odds in our favor.

In our newest POWR Pairs Commerce, nevertheless, we determined to forego the identical trade requirement and simply take a look at shopping for good shares doing awful and shorting dangerous shares doing too good.

It ended up being a really viable further strategy to our pairs buying and selling philosophy. A fast walk-through our newest POWR Pairs Commerce will assist shed some gentle.

Whereas not a “conventional” pairs commerce, for the reason that two shares are in several industries, it nonetheless is a POWR Scores efficiency pairs commerce.

Shopping for bearish places on the a lot lower-rated however significantly better performing Alcoa (AA) and shopping for bullish calls on the a lot higher-rated however a lot decrease performing Bristol-Myers Squibb (BMY).

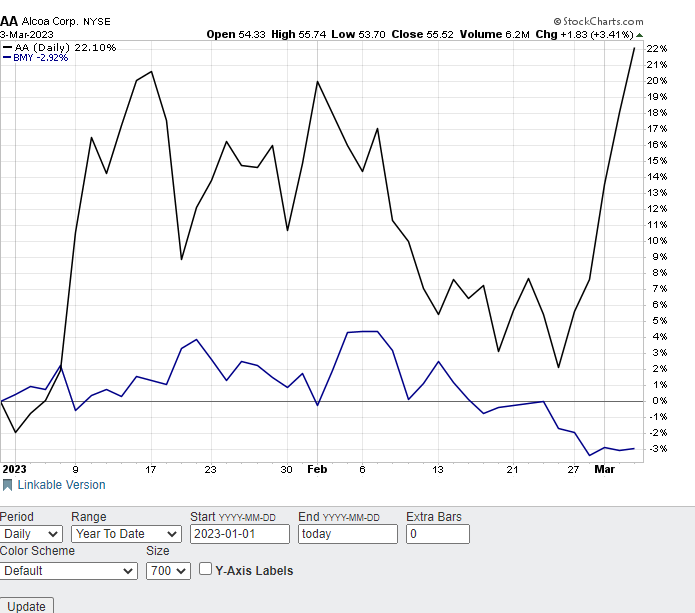

D rated -Promote- Alcoa (AA) is buying and selling at yearly highs for 2023, up 22%.

A rated -Robust Purchase-Bristol Myers (BMY) is simply off the yearly lows, down about 3% year-to-date.

The chart under exhibits the comparative efficiency to this point in 2023. Be aware how AA did drop sharply in February whereas BMY hugged the flatline. For the reason that finish of February, nevertheless, AA has exploded larger as soon as once more whereas BMY has drifted decrease. Efficiency differential bought to 25%.

Search for AA to be a relative underperformer to BMY over the approaching weeks as the worth efficiency between the 2 shares converges because it has prior to now.

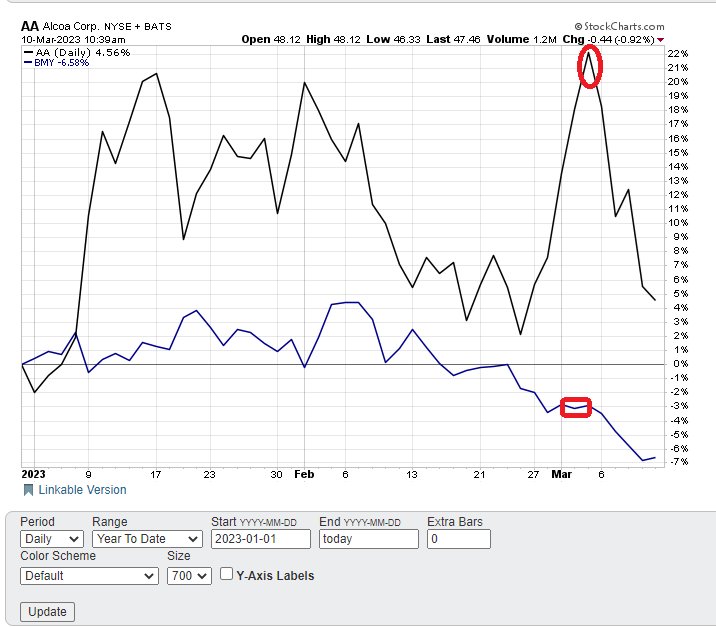

On March 3, The POWR Choices portfolio purchased the AA June $50 places for $3.90 ($390 per choice) and on the similar time purchased the BMY June $67.50 requires $4.20 ($4.20) per choice. Complete mixed outlay was $810.

Quick ahead to Friday March 10. You may see how AA has dropped over 17% for the reason that pairs commerce was initiated (highlighted in pink). BMY has fallen as properly, however solely a little bit over 3.5%.

This led to closing out the pairs commerce for the reason that unfold had converged dramatically. The unique efficiency differential of over 25% on March 3 shrank, or converged, by greater than half to simply over 11% on March 10.

Simply as importantly, implied volatility rose in that timeframe. This gave a carry to each our lengthy places on AA and lengthy calls on BMY. The AA places went from a 53.81 IV to a 56.30 IV. The BMY Calls rose from a 21.14 IV to a 22.28 IV.

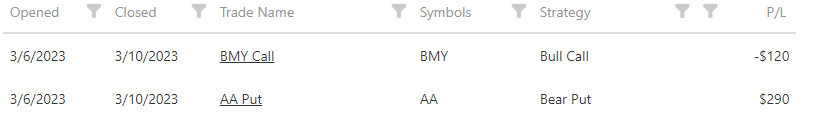

Exited the bullish BMY requires a lack of $120. Received out of the bearish AA places for a achieve of $290. Web total achieve was $170 ($290 -$120). Precise commerce knowledge seen under.

Web proportion achieve on the commerce was simply over 20% ($170 internet achieve/ $810 preliminary mixed outlay). The holding interval was only a week. In on Monday, out on Friday.

Traders and merchants trying to generate related low-risk however stable short-term returns might wish to think about using the POWR Pairs Commerce strategy to considerably cut back the draw back however nonetheless depart loads of upside open for grabbing features.

What To Do Subsequent?

Whereas the ideas behind choices buying and selling are less complicated than most individuals understand, making use of these ideas to constantly make successful choices trades is not any simple process.

The answer is to let me do the arduous be just right for you, by beginning a 30 day to my POWR Choices publication.

I have been uncovering the very best choices trades for over 30 years and with the quantitative muscle of the POWR Scores as my place to begin I’ve achieved an 82% win fee over my final 17 closed trades!

Throughout your trial you will get full entry to the present portfolio, weekly market commentary and each commerce alert by textual content & electronic mail.

I will be including the subsequent 2 thrilling choices trades (1 name and 1 put) when the market opens this Monday morning, so begin your trial at the moment so you do not miss out.

There isn’t any obligation past the 30 day trial, so there’s completely no danger in getting began at the moment.

About POWR Choices & 30 Day Trial >>

This is to good buying and selling!

Tim Biggam

Editor, POWR Choices E-newsletter

shares closed at $385.91 on Friday, down $-5.65 (-1.44%). 12 months-to-date, has gained 0.91%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Higher To Be Bullish Or Bearish? Being Each Is The Greatest Strategy appeared first on StockNews.com