How one can Dissolve an LLC in Kentucky

In the event you plan to finish your enterprise and dissolve your LLC (Restricted Legal responsibility Firm) you’ve most likely thought in regards to the course of and the significance of that call for some time. Nonetheless, you possibly can’t simply resolve to close your enterprise down with out following the appropriate course of. The State of Kentucky has particular necessities to shut down your LLC and it’s important that you just implement that course of the appropriate method.

Right here, we’ll check out the explanations you may need for dissolving your Kentucky LLC, what forms of LLC dissolution choices you may have, and the steps and necessities so that you can try this in Kentucky. Then, you possibly can really feel assured that you just’re doing issues the appropriate method and gained’t have regulatory repercussions sooner or later.

Fundamentals of LLC Dissolution

Dissolution, particularly, is the method by way of which you formally dissolve your LLC with the state the place it’s registered. An LLC dissolution removes the unbiased authorized standing of your LLC with the Kentucky Secretary of State. This cancelation of your LLC might be both voluntary or involuntary.

To be able to make certain that your state chooses to simply accept your software for enterprise dissolution you’ll have to comply with the appropriate steps. That features notifying your collectors, in addition to native and federal authorities companies that relate to your enterprise. You’ll additionally have to pay any excellent money owed you may have and embrace a certification concerning the standing of your account. That certificates will point out that you just don’t personal cash and your LLC is at present in good standing.

By following the correct dissolution procedures you’ll be capable of dissolve your LLC successfully and defend your self from liabilities sooner or later.

Forms of LLC Dissolution

There are three fundamental classes of LLC dissolution, that are judicial, administrative, and voluntary. The process it is advisable comply with to dissolve your LLC will rely upon which one of many three sorts applies to you. Right here’s what to learn about the differing types and the way they work.

Administrative dissolution

When there’s an administrative dissolution the State of Kentucky will take away your LLC’s powers, authority, and rights since you didn’t comply together with your obligations. A few of the causes this might occur to an LLC are:

-

Not paying correct taxes inside their allotted time-frame. -

Not submitting annual experiences by their due date or in any respect. -

Not sustaining a registered agent on file with the Kentucky Secretary of State.

Judicial dissolution

A judicial dissolution isn’t the identical factor as an administrative dissolution, but it surely’s nonetheless thought of involuntary as a result of the proprietor(s) of the LLC didn’t select it. One of these dissolution is sometimes called the company dying penalty, and it’s a course of whereby the court docket orders that your LLC be dissolved. A few of the fundamental causes for a judicial dissolution embrace:

-

Breaching fiduciary responsibility -

Mismanagement or fraud -

Inside member disagreements -

A member who dies or turns into mentally ailing and can’t fulfill their duties

Voluntary dissolution

In the event you and another members of your LLC vote to dissolve the enterprise that counts as a voluntary dissolution. Chances are you’ll want a majority vote to do that, relying on what number of members are a part of the LLC. There are two ways in which this sort of dissolution can happen:

-

Members vote to dissolve the LLC resulting from monetary points or inner disputes. -

Members have set dissolution triggers inside the working settlement, similar to departure or dying of a member.

Dissolving Your LLC in Kentucky

If you wish to know methods to dissolve an LLC in Kentucky these are the steps it is advisable comply with.

Step 1: Vote to dissolve the LLC

In the event you resolve to dissolve your LLC, that’s the method of voluntary dissolution. When there are a number of LLC members, although, they should vote in favor of it for it to undergo. And not using a majority determination you usually gained’t be capable of shut down your LLC.

Nonetheless, one exception to it is a pre-agreed set off for dissolution in your LLC working settlement. For instance, your working settlement may say that the dying of an LLC member is a set off for dissolving the enterprise. LLCs that don’t have working agreements, or people who don’t have data on voluntary dissolution, must comply with the default provisions of the the Kentucky state statutes.

Single vs multi-member LLC dissolution

The one actual distinction between multi-member and single-member LLC dissolution is that multi-member dissolution requires the companions to solid a majority vote. In the event that they don’t, the LLC can’t be voluntarily dissolved.

Dissolution guidelines in your LLC working settlement

It’s a good suggestion on your working settlement to have inner guidelines for operating your LLC but additionally details about dissolving it. Referring to the working settlement is the appropriate approach to set off your LLC dissolution, permitting you to be sure that every thing complies with the phrases you created at the start of your enterprise journey.

The foundations in an working settlement may embrace:

-

The proportion (or required quantity) of members that must approve a dissolution. -

How the LLC plans to discharge and tackle its liabilities and money owed. -

Any procedures for closing and settling the actions of the LLC. -

The best way belongings might be divided, money owed dealt with, and contracts canceled.

Kentucky-Particular Guidelines for Voting to Dissolve Your LLC

At the very least two-thirds of the members of your LLC should vote for dissolution to ensure that it to maneuver ahead. That’s true with most states, and Kentucky isn’t any exception.

Step 2: Wind up all enterprise affairs and deal with another enterprise issues

“Winding up” your LLC and its affairs is an important a part of shutting issues down and ensuring you’re legally complying with every thing required by the state. For instance, you must anticipate to:

-

Notify any registered agent you have employed. -

Let prospects and suppliers know you are closing. -

Cancel any permits or enterprise licenses. -

Cease gross sales or companies. -

Inform workers and deal with any issues associated to them. -

Shut the LLC’s financial institution accounts.

Step 3: Notify collectors and claimants about your LLC’s dissolution, settle present money owed and distribute remaining belongings

Although having an LLC means legal responsibility safety for the members based mostly on any money owed the enterprise accrues, dissolving the LLC doesn’t take away the duty for the enterprise to pay these money owed.

Whenever you’re dissolving your Kentucky LLC it is advisable let claimants and collectors know. You additionally have to repay any loans or bank cards your enterprise had earlier than the dissolution might be thought of ultimate. Your obligations on this space embrace:

-

Notifying collectors and claimants that you will dissolve your LLC. -

Assembly monetary obligations like paying excellent invoices, bank cards, and enterprise loans. -

Liquidating your belongings by way of promoting or splitting them based mostly on the working settlement.

Step 4: Notify Tax Businesses and settle remaining taxes

Earlier than you might be allowed to dissolve your LLC in Kentucky it is advisable present proof that each one of its state and federal taxes have been paid. When you’ve proven that you just’ve taken care of excellent enterprise points you will get able to file the paperwork that may formally shut your LLC.

Step 5: File an announcement of dissolution with the Secretary of State

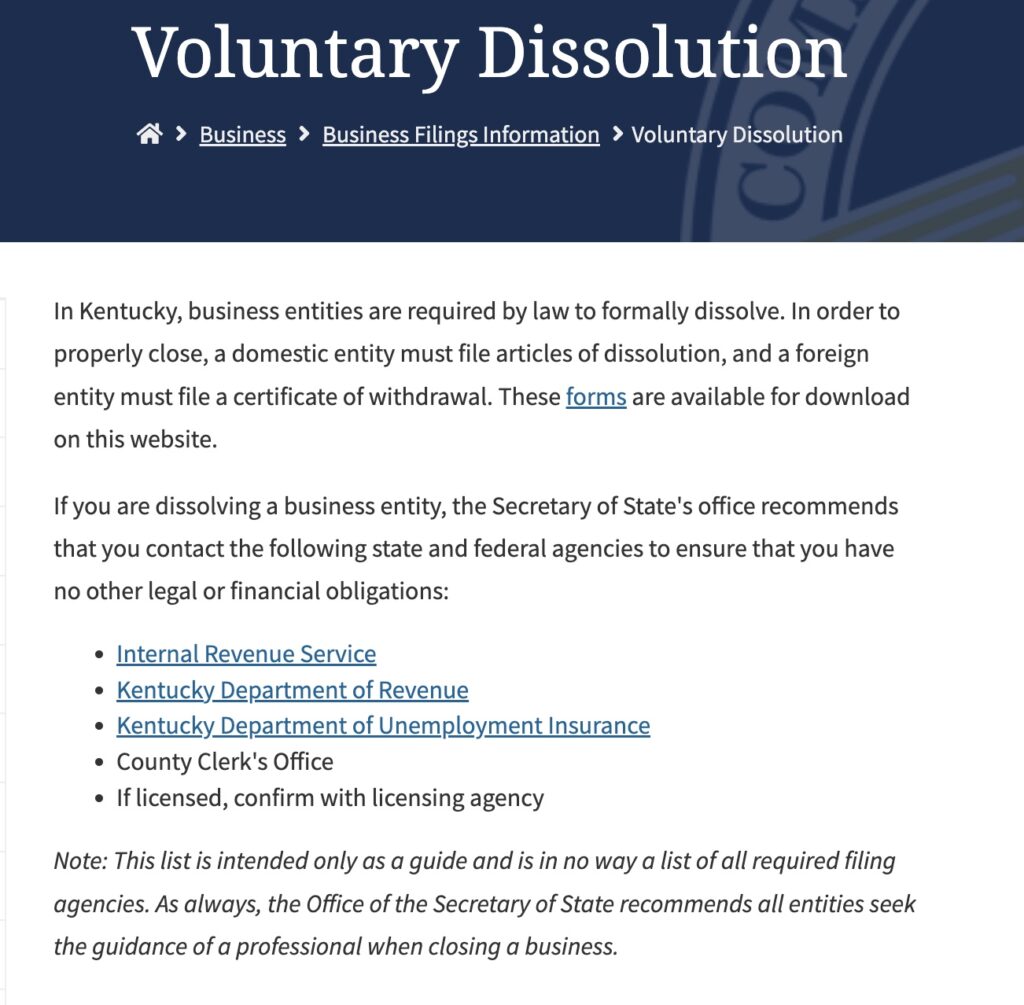

To file articles of dissolution with the Kentucky Secretary of State you’ll wish to go to the Voluntary Dissolution web page positioned below Enterprise Submitting Info.

On that web page you will discover a hyperlink to the varieties it is advisable fill out. Hyperlinks to the IRS, the Kentucky Division of Income, and the Kentucky Division of Unemployment Insurance coverage are additionally supplied, so you possibly can attain out on to these entities and be sure that you’re in compliance with them and don’t owe taxes or different charges.

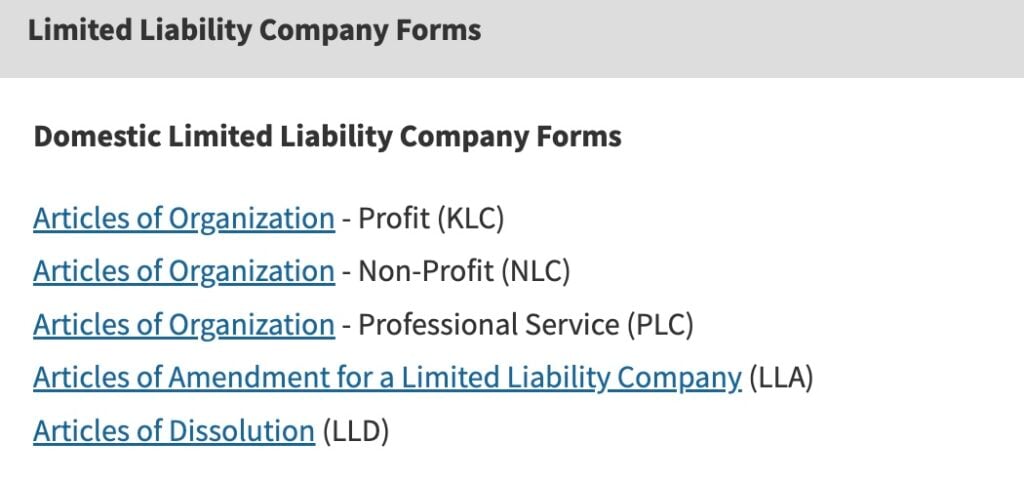

When you click on on the hyperlink for the varieties, select the + signal subsequent to Restricted Legal responsibility Firm Kinds. That can take you to this display:

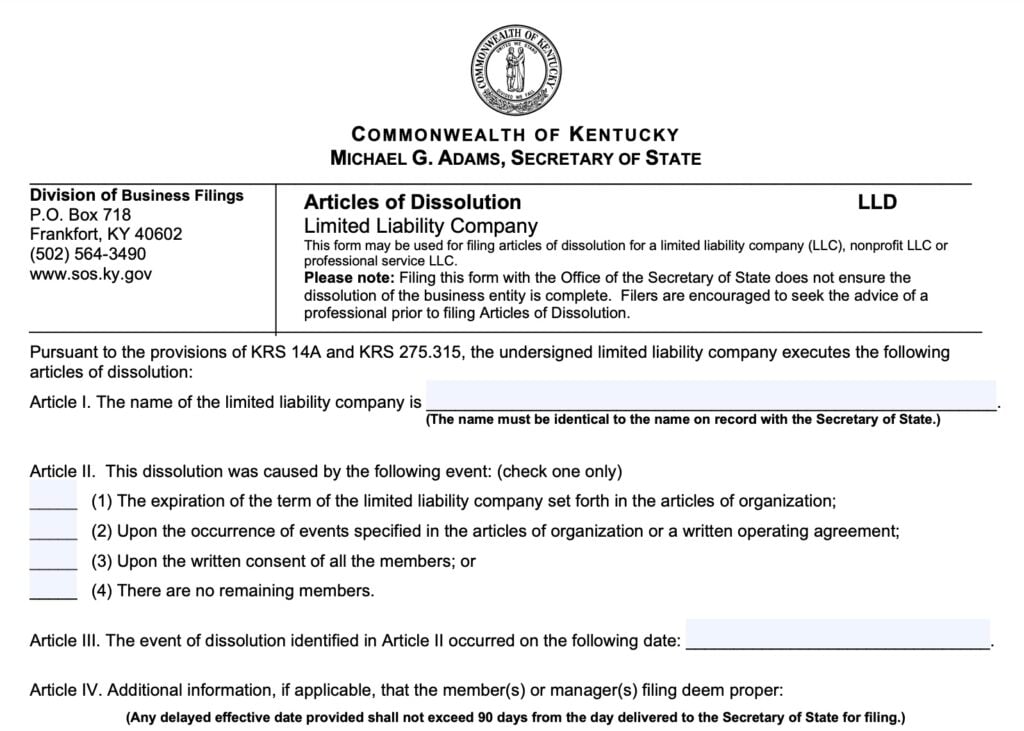

Select the hyperlink for articles of dissolution, which is able to open a pdf doc with highlighted areas to fill out. That is the primary a part of that kind:

When you’ve crammed in all of the required areas, it’s time to print the shape and mail it. There’s a set of directions in the identical pdf that gives you with the tackle for mailing and in addition offers you steering on methods to fill out the shape appropriately.

Conclusion

When you file articles of dissolution it’s a really simple course of to shut your enterprise with the state. That’s as a result of a lot of the work that goes into shutting down and dissolving your LLC might be executed earlier than the articles are literally filed. It’s not essentially straightforward to say goodbye to a enterprise you’ve put your coronary heart and soul into, however you can too give attention to the concept that it’s a brand new starting for you.

Taking every thing you realized by way of the creation and operation of your restricted legal responsibility firm is a good way to make use of that data on one thing new. Experiences aren’t wasted in the event you take them with you and apply the data you’ve gained to new ventures.

FAQs

There are a number of the reason why you may resolve to dissolve your LLC, however some are extra frequent than others. Inside disagreements between the members, rising prices or competitors, merging with one other enterprise, money movement or accounting points, and transferring to a different state are all large causes so that you can select LLC dissolution.

The submitting price for articles of dissolution is $40.

You possibly can’t dissolve your Kentucky LLC on-line, however you possibly can get the appropriate varieties on the Secretary of State’s web site. Then, you may be required to mail these to the tackle listed within the kind’s directions.

After the articles of dissolution are filed it usually takes one to a few days for a Certificates of Dissolution.

In the event you do not formally dissolve your Kentucky LLC it’s possible you’ll find yourself with liabilities similar to taxes, annual charges, and different bills. You may be in violation for not submitting annual experiences or different required documentation.

You may find yourself with double taxation in case your LLC is registered in multiple state. Some states have tax credit score agreements, however not all of them do. In the event you’re transferring your LLC to a brand new state it is higher to dissolve it within the state that you just’re leaving, normally.

This portion of our web site is for informational functions solely. Tailor Manufacturers will not be a legislation agency, and not one of the data on this web site constitutes or is meant to convey authorized recommendation. All statements, opinions, suggestions, and conclusions are solely the expression of the writer and supplied on an as-is foundation. Accordingly, Tailor Manufacturers will not be liable for the data and/or its accuracy or completeness.

The put up How one can Dissolve an LLC in Kentucky appeared first on Tailor Manufacturers.