Hello, readers!

That is James Hercher along with your weekly Commerce Media dispatch. Right now, we’ll check out the latest IPO of an organization that straddles the road between a tech enterprise and a client model.

Name it an Oddity.

New child on the inventory

The aptly named Oddity Tech, an Israeli DTC model operator, doesn’t match neatly in a single class.

On one facet, it’s a make-up and skincare product producer. Oddity owns two manufacturers – Il Makiage and SpoiledChild – and its complete income comes from the web gross sales of these merchandise.

However being a straight-up DTC ecommerce firm is now not shiny sufficient to persuade traders {that a} new model can exchange old-school incumbents.

“We’re a client tech platform,” is the opening line of Oddity’s pre-IPO SEC submitting from June.

And Oddity – Oddity Tech, that’s – emphasizes all through that it isn’t a skincare model, however reasonably a tech and information firm that, in the mean time, operates a few cosmetics strains.

In response to the submitting, 40% of Oddity’s workforce are “technologists.”

What do they do?

“We deploy algorithms and machine studying fashions leveraging person information in search of to ship a exact product match and seamless procuring expertise,” write the founders.

Oddity does have precise scientists, because it acquired the biotech firm Revela for $100 million. However that’s a lab for skincare and wellness product improvement, which is typical for a cosmetics producer and alien for a tech firm.

What’s the issue?

Being data-driven is nice. However there are critical prices when DTC and rising corporations place themselves as tech and information corporations when they aren’t.

There are prices by way of the misrepresentation of the enterprise. To not evaluate Oddity’s legitimately sturdy and rising client enterprise too intently to the WeWork fiasco, however WeWork was among the many first and most notable data-driven beginner sorts to symbolize itself as a tech and information firm and, thus, deserving of some type of multiplier on its worth much like different SaaS and information corporations.

However WeWork was and is an workplace reserving and administration firm, and the trouble to current itself as a tech firm utilizing a convincing façade value it a whole bunch of hundreds of thousands of {dollars}. WeWork spent greater than $100 million on Conductor, a digital mar tech and website positioning startup that was resold at a loss lower than two years later, and beefed up on engineers and information scientists who have been principally laid off even earlier than the pandemic.

Once more, Oddity isn’t an analog for WeWork – apart from the truth that they each IPO’d as ostensible tech platform companies.

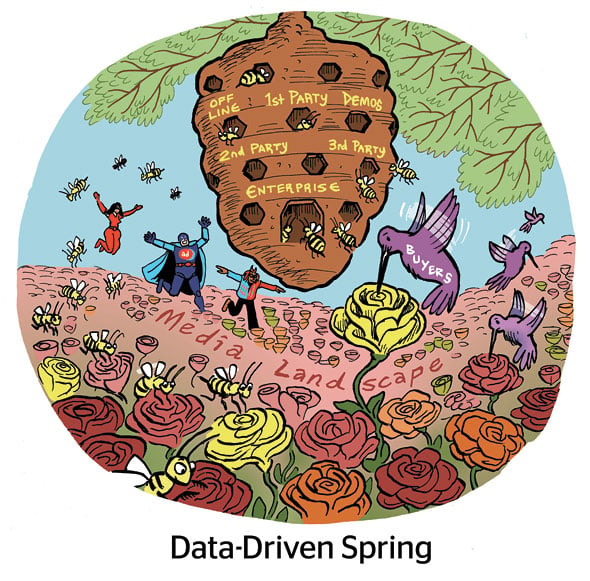

Oddity frames its tech-first strategy because the antithesis of the trade commonplace mannequin. The place others depend on offline and wholesale companies, Oddity is digital and DTC. Rivals depend on outsourced tech and are “efficiency-centric,” in keeping with a visible within the firm’s SEC submitting, whereas Oddity builds its personal stack and is “data-centric.”

However DTC companies that emerge with a powerful differentiating edge – tech and information chops, for instance, in addition to sustainability or seemingly irreplicable advertising (Hiya, Liquid Dying, which is getting ready a possible IPO) – usually find yourself regretting not taking an efficiency-first strategy.

The paths not taken

The paths not taken

Think about Allbirds, which IPO’d in 2021 and is one other DTC star that has struggled recently.

Allbirds didn’t symbolize itself as a tech or information firm. However its differentiator was sustainability, which is also primarily advertising, similar to the framing of Oddity as a tech firm.

And people varieties of advertising stances are pricey.

Allbirds sneakers are 50% to 60% costlier than comparable trainers that aren’t made with the identical commitments to sustainability. Sneakers additionally merely don’t final as lengthy after they’re made out of merino wool or eucalyptus tree fiber, reasonably than artificial supplies constructed to final for professional runners.

Sure, the Allbirds eco dedication units it other than manufacturers like Nike and Adidas. However Nike and Adidas are worthwhile corporations.

The manufacturers that Allbirds competes with may also simply use sustainability as a advertising tactic themselves. Once they shut outlets in malls, for instance, they’re capable of tout their vitality financial savings. They will purchase carbon credit and pitch themselves as carbon impartial. And all of the whereas their sneakers can be cheaper, last more and work higher.

Oddity, likewise, might stay dedicated to the DTC mannequin and the data-driven acquisition of on-line clients that it pitched in its IPO prospectus. Nevertheless it additionally has a tech firm’s disregard of old-school approaches, like wholesaling, retail retailer distribution and offline advertising.

And when the tech and information shine put on off, wholesaling and retail gross sales are going to look fairly cool.