Studying Time: 6 minutes

Nothing is ‘As It Was’ on the earth of economic providers. Many components are consistently altering, from buyer expectations to mandates from regulators and policy-makers.

Up to now 5 years, monetary establishments have strived arduous to grasp digital channels like apps, web and cellular banking, e-wallets, and chatbot options. Nevertheless, monetary establishments have additionally realized that the disparity between the shopper expertise throughout channels is widening. Additionally, the extent of personalization skilled in in-person interactions has been diluted by including new channels to the combo.

Monetary establishments are cognizant of what stands between them and their prospects: their present martech stack which consists of a number of instruments that solely improve the complexity and time required to execute.

This begs the query: How can monetary establishments present a seamless, frictionless buyer expertise throughout channels and units in 2024?

It’s inconceivable to color a whole image of the monetary service {industry}’s state with out discussing the significance of knowledge safety and privateness in all areas. Entrepreneurs throughout the monetary service {industry} are searching for new-age martech instruments constructed with information safety in thoughts.

Rising Pains From A Bloated Martech Stack

Operational inefficiencies and dependencies on exterior groups and businesses shackle entrepreneurs within the monetary service {industry} from offering buyer experiences that each buyer wants and deserves.

Whereas the necessities for monetary service manufacturers in 2024 are for a versatile and agile martech stack, legacy instruments solely improve dependencies and issues for even a easy process equivalent to automating an onboarding marketing campaign.

Some generally confronted challenges by monetary service manufacturers embody:

1) Incapability to Leverage New-Age Channels Seamlessly:

The trendy buyer would like to be engaged by channels past emails and SMS, particularly push notifications, WhatsApp messages, pop-ups, and so forth. With a bloated martech stack with quite a few level options for every channel, the shopper expertise shall be removed from seamless.

2) Siloed Promotional and Service Messaging:

A number of instruments that ship promotional and transactional messages solely end in a damaged buyer expertise. With out a unified view of the transactional and promotional messages a buyer has obtained, it’s arduous for groups to determine if the shopper has already obtained a essential alert on one channel and cease the identical message from occurring to different channels.

3) Longer Time and Effort to Execute Campaigns:

With a fragmented stack consisting of quite a few options that aren’t appropriate with one another, duties that must be accomplished in minutes take days and weeks. To not point out the reliance on exterior implementation companions and businesses to finish the only duties.

4) Incapability to Interact Clients within the Second:

Obscurity round marketing campaign efficiency and buyer conduct makes it tough for monetary service manufacturers to have interaction with prospects in actual time.

The results of these bottlenecks is lackluster efficiency on digital channels, pointless spending, and pissed off groups.

Why Ought to Monetary Providers Modernize Their Tech Stack?1) Effectivity vs. Bloat: Examine the steps required to realize your purpose with the shopper engagement platform (CEP) vs. with out. If the variety of steps and complexities reduces with the addition of a CEP, and if the platform integrates with different instruments within the martech ecosystem, then it’s an indication that it is best to modernize your tech stack with purpose-built CEP options. 3) Pace vs. Time-consuming: Think about the implementation time and the diploma of involvement required from exterior consultants, builders, and businesses. The extra exterior stakeholders are concerned, the extra time it takes to execute campaigns. If that is your scenario, then it’s a transparent signal that it is best to spend money on a contemporary tech stack. 4) Ease of use vs. Pointless Complexity: Automating cross-channel workflows is a vital functionality a buyer engagement platform requires within the monetary service {industry}. The best CEP ought to make organising your buyer journey simple, whether or not the use case is onboarding or reactivation. |

Monetary Industries Wants a Digital Transformation Catalyst

After working intently with 200+ main monetary establishments worldwide, together with international behemoths like Customary Chartered, Citi Financial institution, and Ally Financial institution, we at MoEngage understood what impedes monetary establishments’ capability to offer simple and frictionless buyer experiences—the culprits: lack of agility, flexibility, and safety.

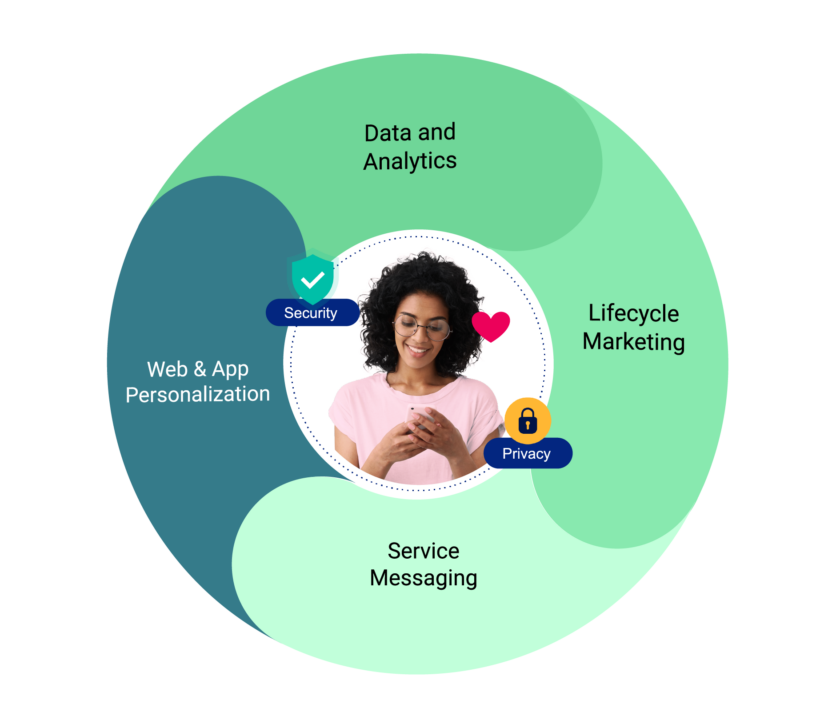

Monetary manufacturers want entry to real-time and actionable buyer information with out compromising agility and safety. With MoEngage for Monetary Providers, monetary manufacturers can construct digitization flywheels that drive development and improve buyer experiences.

MoEngage for Monetary Providers: The Solely Function-Constructed

Answer to All Buyer Engagement Woes

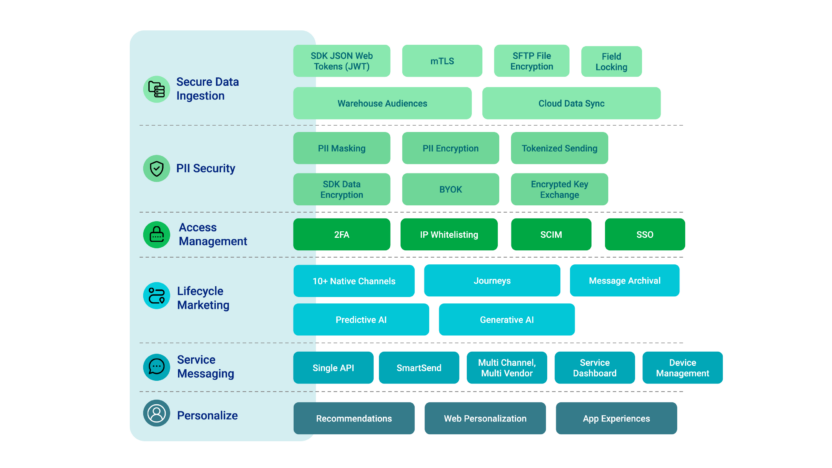

MoEngage for Monetary Providers is constructed to revolutionize your monetary service model’s presence on this digital-first world. With an agile, security-first, versatile resolution, it’s time monetary service manufacturers bid farewell to dependencies and overheads related to redundant legacy expertise platforms.

With MoEngage for Finserv, you may:

-

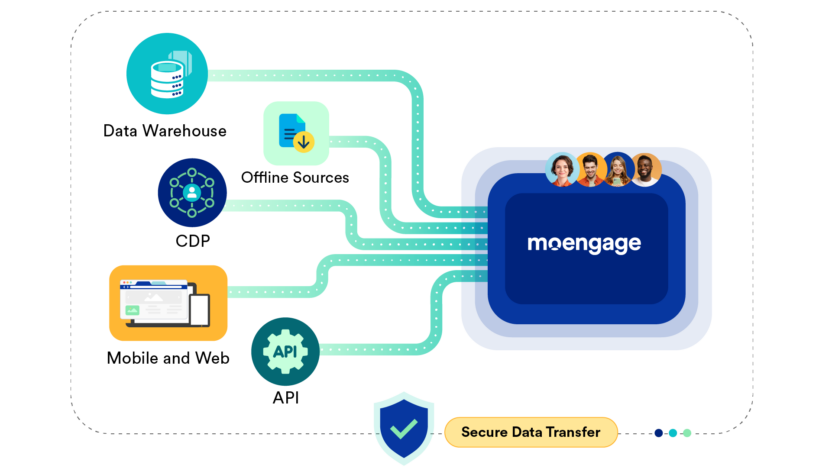

Safely Ingest, Retailer and Entry Your Knowledge

MoEngage for Monetary Providers comes with industry-first options that allow quicker information ingestions by direct connections with information warehouses and strong safety by PII Masking, PII Encryption, and SDK Encryption. These options be sure that your buyer information stays protected by adhering to international and regional information privateness and safety requirements.

-

Leverage Knowledge to Uncover Insights with Actionable Analytics

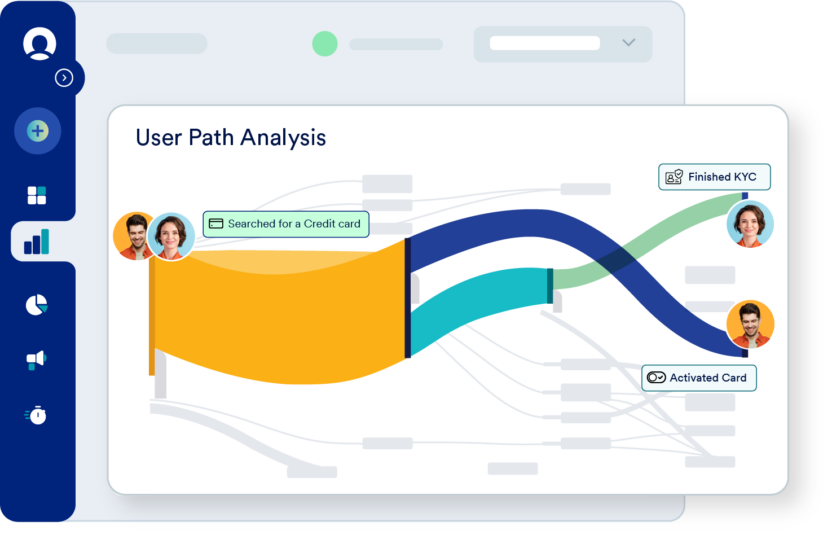

Get full readability on buyer conduct throughout channels and units with MoEngage’s strong analytical options. Perceive how your prospects navigate by app or web site with person paths, determine friction areas in app/ web site that trigger drop-offs with actionable funnels, uncover the fitting buyer segments with cohort evaluation and RFM, and get AI-driven insights with Proactive Assistant.

-

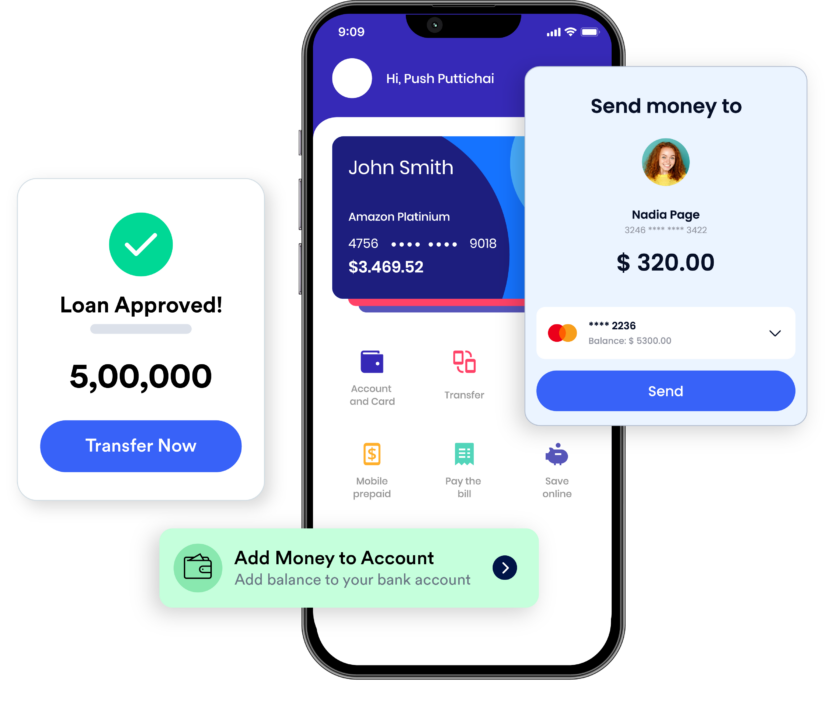

Automate Buyer Journeys Throughout 10+ Channels

With MoEngage’s PII Tokenization, monetary establishments can ship promotional messages with out storing buyer PII information. MoEngage’s omnichannel capabilities will assist monetary establishments to make the most of channels past e mail and SMS like push notifications, on-site, web site, in-app, and messaging apps. Optimize and iterate campaigns successfully utilizing Sherpa’s Predictive AI and Merlin’s Generative AI.

-

Unify Promotional and Service Messaging Successfully

Lower by the siloes relating to promotional and repair messaging with MoEngage’s Inform that helps manufacturers to construct, handle, and scale service messaging throughout channels by a single API. Additionally, scale back prices and guarantee deliverability by SmartSend.

-

Enhance Conversions Throughout Web site and Cell App

MoEngage’s linked experiences and speedy experimentation capabilities permit monetary manufacturers to increase the private contact throughout all digital banking platforms like web site and cellular app. Now monetary establishments can personalize experiences based mostly on preferences, affinities, and conduct in actual time. The consequence: Enhance in new buyer acquisition and conversions.

Need to know the way ‘MoEngage for Monetary Providers’ may help speed up your model’s development and digital transformation? Discuss to our monetary providers skilled right here.

Associated Studying:

- Your One-Cease Store To All Assets Associated to Monetary Providers

- Maintain Buyer Knowledge Confidential with PII Masking

- Web site Personalization For BFSI Manufacturers: How To Tailor Personalised Monetary Net Experiences For Clients

- How Banks Can Use Buyer Engagement Platforms to Enhance LTV and CX Whereas Decreasing Prices in a Safe Surroundings