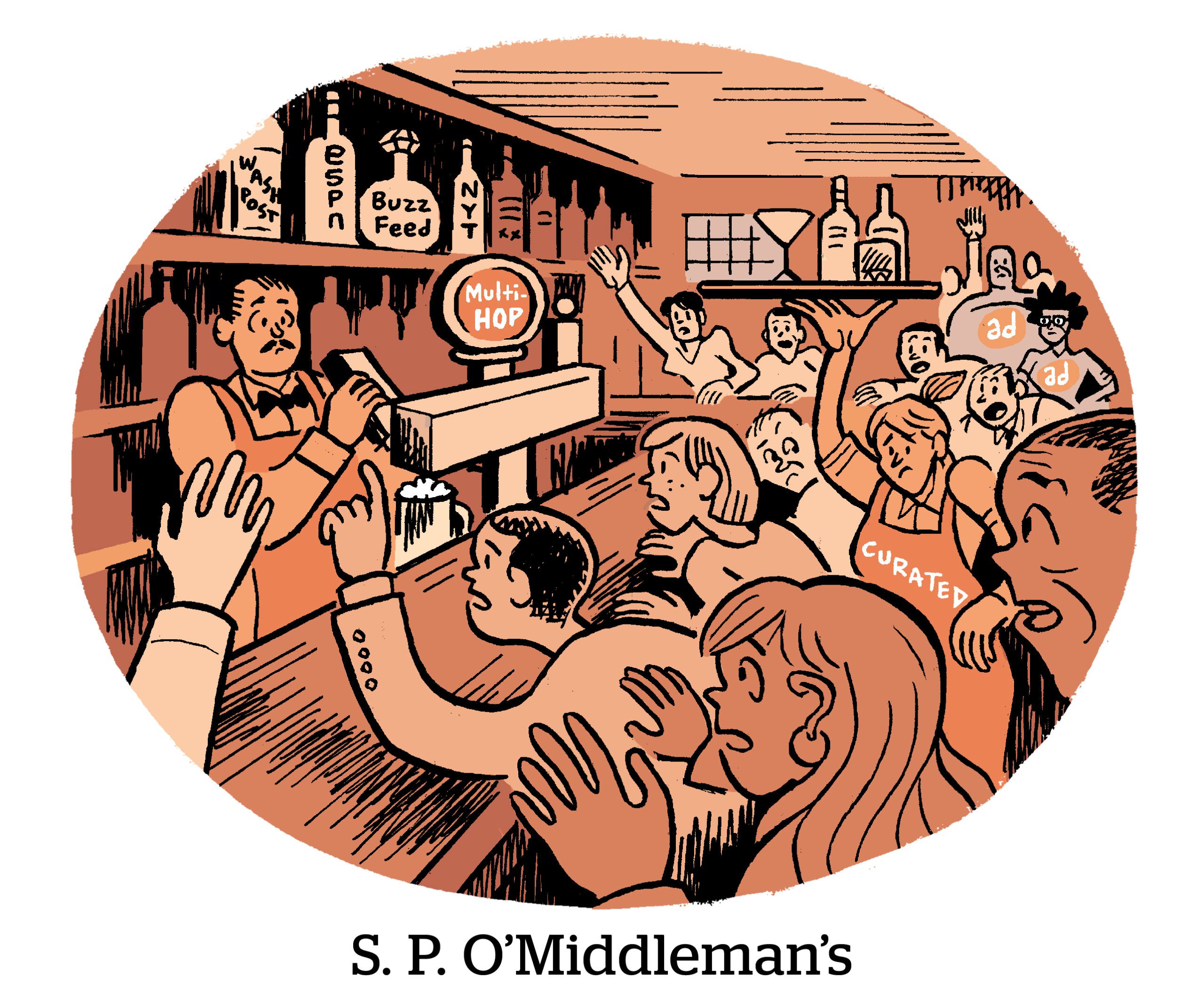

Disintermediation is within the air.

If The Commerce Desk’s OpenPath cuts out SSPs (whereas claiming to not), Magnite’s ClearLine cuts out DSPs (whereas claiming to not).

ClearLine will enable businesses to purchase video stock straight from Magnite. GroupM, Camelot, and MiQ are the launch companions.

“There was a market ask” from consumers for a video-specific direct-buy product, stated Sean Buckley, chief income officer at Magnite.

The corporate examined its current supply-side expertise and located they may repurpose its current tech, notably round its SpringServe video advert server, for consumers.

A buyer-direct platform required “actually minimal adaptation” of current instruments, which had been supplied to consumers who had been all for, say, dealing with their conventional direct gross sales, activating “actually delicate first-party information that sits on the provision facet” or structuring carriage offers with media homeowners to handle stock sharing.

By solely utilizing an SSP to purchase video stock, consumers can decrease their tech tax.

As video budgets migrate to the programmatic streaming ecosystem, Buckley stated, “consumers are actually targeted on maximizing working media.” There’s larger demand for an auditable, environment friendly provide chain.

Shopping for direct presents different advantages in addition to lowered charges, famous Andrew Meaden, international head of funding at GroupM. The direct connection to publishers supplies a laundry checklist of advantages: extra transparency, a diminished danger of advert fraud, precedence entry to publishers’ stock and decrease expertise prices. With ClearLine, GroupM pays one negotiated price, somewhat than fielding charges from each a DSP and an SSP.

“Our goal is to not take away the DSPs from the programmatic equation however to offer extra shopping for choices to suit the wants of our purchasers,” Meaden stated.

Magnite says it’s nonetheless firmly staking its declare in SSP territory, however adhering to the market pattern the place DSPs and SSPs join with consumers and publishers, as an alternative of only one facet of the ecosystem. “Should you take a look at all the main gamers, it’d be onerous to search out somebody who doesn’t present some kind of service to each consumers and sellers,” Buckley stated.

Magnite says its loyalties stay to the promote facet: “We view every part, together with the event of ClearLine, by the lens of serving to make our supply-side prospects profitable of their promoting enterprise,” Buckley stated.

The launch of ClearLine exemplifies how, in recent times, Magnite has pivoted towards CTV, prioritizing the fast-growing channel over cell and desktop. The SSP partnered with streaming firm Brightcove in January and cultivates a long-running partnership with Disney. It formally merged with Telaria in 2020, then acquired video SSP SpotX in February 2021 and SpringServe in July 2021.

And final June, the corporate inked a cope with LG Advertisements to turn into LG’s most popular SSP and advert server, which additionally netted its consumers entry to ACR information from LG’s good TVs. This primary-party viewership information, “all housed and refined on the provision facet,” in line with Buckley, permits consumers to raised plan and measure their campaigns programmatically. By way of ClearLine, LG can allow and share its ACR information to convey publishers and advertisers nearer collectively.

A buyer-to-SSP product might have felt unprecedented a number of years in the past, however the winds of change are blowing within the programmatic area.

Instances have been robust currently for SSPs. The Commerce Desk’s OpenPath direct-to-publisher product probably cuts out SSPs, which now not have unique direct connections to publishers.

Up to now this yr, Yahoo disbanded its SSP and EMX filed for chapter as collectors got here knocking. Magnite laid off 6% of its workforce in January and reported slowed income progress in its This autumn earnings in February.