Studying Time: 7 minutes

Jeff Bezos famously wrote in his 2018 annual shareholders letter, “Right this moment’s ‘wow’ turns into tomorrow’s ‘abnormal’ for right now’s divinely discontent clients.”

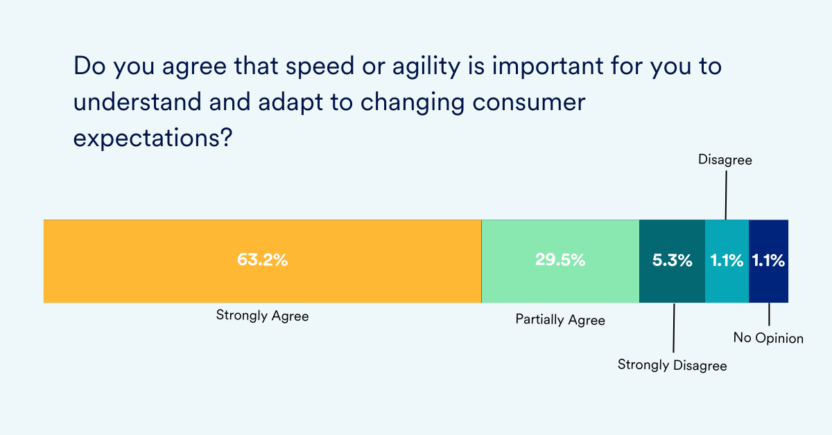

Right this moment’s clients need instantaneous gratification, and retailers perceive that effectively—a whopping 63.2% of retail manufacturers we surveyed agree that agility and velocity are crucial to understanding and adapting to altering buyer expectations.

Nonetheless, not lots of them can obtain this agility and velocity resulting from legacy martech platforms.

This was our goal behind getting ready the Martech Readiness Report this yr. We wished to know how ready retailers are to answer market traits and buyer wants and to what extent their current martech stacks are serving to them be agile and customer-centric.

Concerning the Survey

At MoEngage, we launched into a journey the place we surveyed international leaders, decision-makers, and influencers from the Retail trade to know how ready they’re to satisfy their clients’ ever-evolving expectations and calls for.

The surveyed executives know that shopper conduct and expectations are quickly evolving. They price velocity and agility because the golden tickets to assist them reply successfully to altering shopper expectations.

Nonetheless, the trail towards efficient buyer engagement is stuffed with challenges that make them unprepared to face these adjustments.

This text will discover the survey’s findings, how monetary manufacturers can thrive in the course of the ‘nice transition,’ and what an agile, security-first martech stack ought to appear to be.

Let’s get began.

Our Viewers

|

Roles: We interviewed people from mid- and senior ranges within the retail trade, together with C-level executives, Administrators, Center and Senior Administration, and Workforce/ Useful Leaders. Respondents’ domains of experience had been advertising and marketing, development, and product. |

|

Group Dimension: 48.5% of respondents symbolize organizations with 500-1000 workers, whereas 51.4% symbolize organizations with 1001-5000 workers. |

|

International locations Included within the Survey: India, US, Canada, UK, Germany, Brazil, Mexico, Saudi Arabia, United Arab Emirates, Australia, Indonesia, and the Philippines. |

Legacy Martech Stacks Forestall Retailers from Assembly Buyer Calls for

Retail manufacturers perceive shopper expectations are shortly and continually evolving…

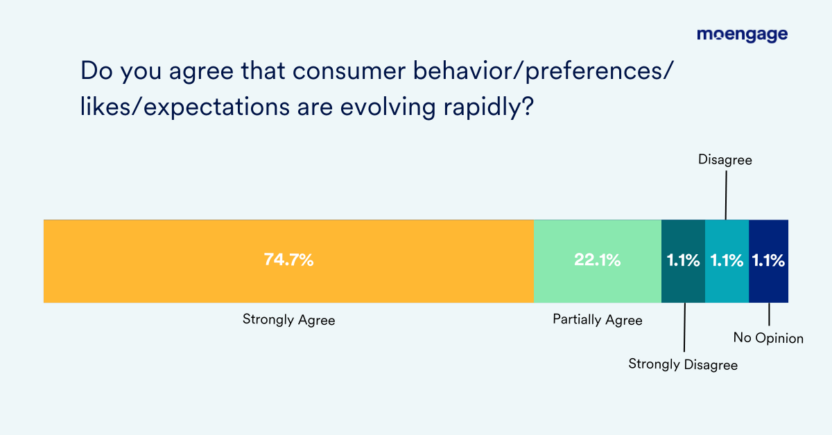

96.8% of retail manufacturers agree that shopper conduct, preferences, likes, and expectations are evolving quickly.

…and only some have the precise groups to satisfy these expectations.

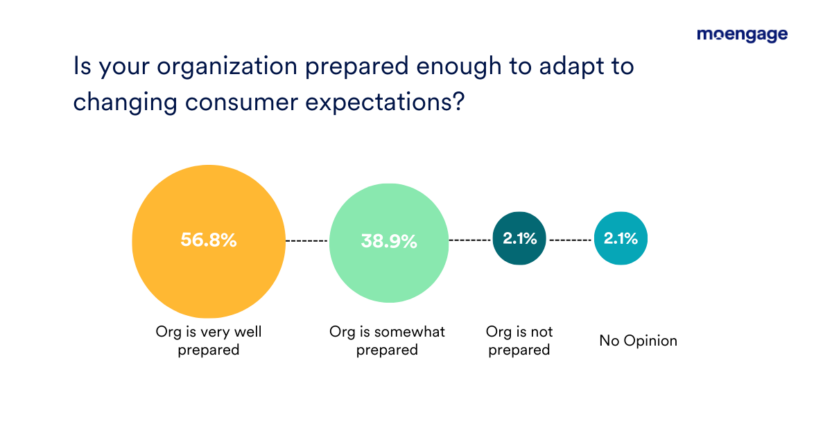

38.9% of retail manufacturers agree that their group is well-prepared to have interaction retail clients in a quickly evolving digital world.

However their present MarTech stack is holding them again!

49.5% of retail manufacturers have the organizational processes and workflows to react quick and adapt to buyer expectations.

55.8% of retail manufacturers use a legacy platform reminiscent of Salesforce Advertising and marketing Cloud, Adobe Expertise/Marketing campaign Supervisor, or Oracle Responsys to handle advertising and marketing automation and cross-channel buyer engagement.

|

And 49.5% of retail manufacturers are solely partially happy with their present MarTech stack because it doesn’t empower them to satisfy evolving shopper expectations. |

Retail manufacturers know that velocity and agility are the necessity of the hour…

63.2% of retail manufacturers acknowledge that velocity and agility are vital for understanding and adapting to altering shopper expectations in 2024.

Are Retailers Ready to Cater to Market Calls for and Buyer Wants?

1. Shopper expectations in 2024

96.8% of retail manufacturers agree that shopper conduct, preferences, likes, and expectations are evolving quickly.

2. Group readiness

Solely 38.9% of retail manufacturers declare they’re very effectively ready to adapt to altering shopper expectations in 2024, whereas 2% declare they don’t seem to be ready in any respect.

3. Significance of velocity and agility

63.2% of retail manufacturers agree that velocity and agility are vital to know and adapt to altering shopper expectations in 2024.

4. Help for velocity and agility

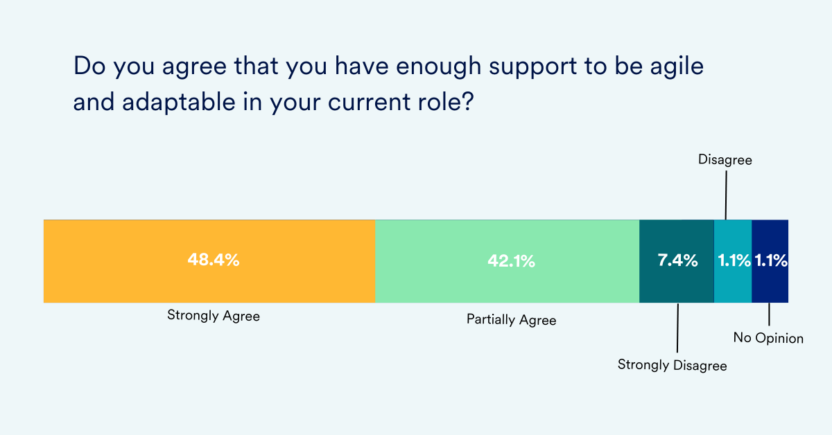

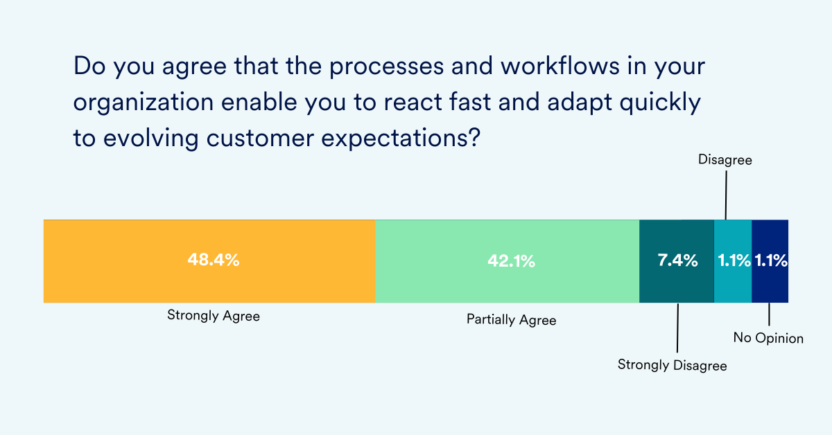

Solely 42.1% of administration strongly agree with the assertion that they’ve sufficient assist to be agile and adaptable in 2024. 7.4% lack that confidence.

5. Organizational processes and workflows

Solely 49.5% of retail manufacturers strongly agree with the assertion that they’ve the organizational processes and workflows that allow them to react quick and adapt shortly to evolving buyer expectations. 9.5% of them lack that confidence.

6. Present state of workforce talent and data

Solely 44.2% of retail manufacturers consider their groups have the precise expertise and data to have interaction clients in a quickly evolving digital world.

7. Essential expertise and data to have interaction clients

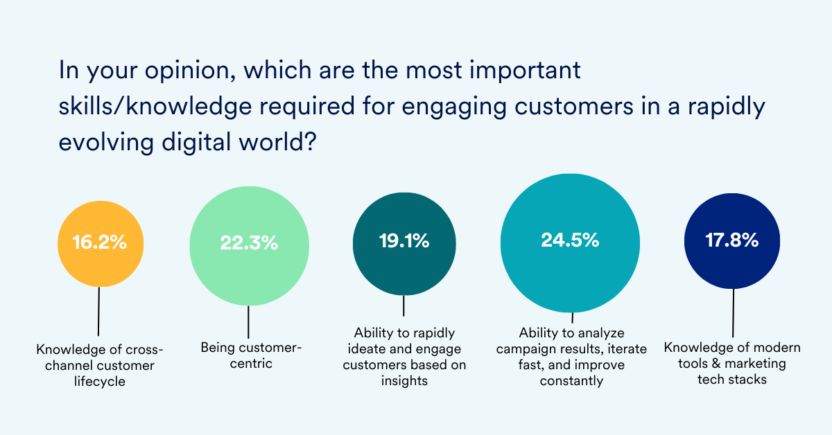

When requested about probably the most crucial expertise wanted to have interaction clients, retail manufacturers replied:

- 19.1% Agility (the power to quickly ideate and interact clients based mostly on insights)

- 16.2% Information of cross-channel lifecycle administration frameworks

- 24.5% Adaptability (the power to research marketing campaign outcomes, iterate quick, and enhance continually)

- 22.3% Buyer-Centricity (the power to know information and acquire actionable insights about clients)

- 17.8% Trendy instruments and advertising and marketing tech stacks

8. State of present MarTech stack in Retail

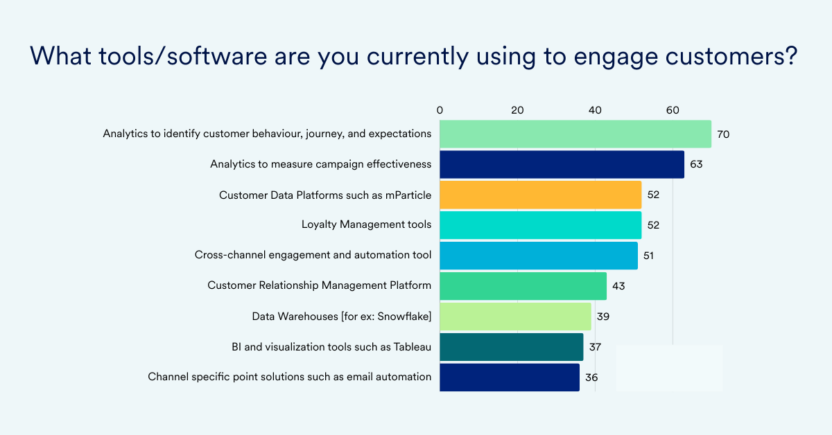

55.8% of retail manufacturers use a legacy platform reminiscent of Salesforce Advertising and marketing Cloud, Adobe Expertise/Marketing campaign Supervisor, or Oracle Responsys to handle advertising and marketing automation and cross-channel buyer engagement, whereas 36.8% use new-age advertising and marketing automation or cross-channel instruments like Braze, MoEngage, and Iterable.

9. Marketing campaign velocity with present MarTech stack

32.6% of retail manufacturers take over 4 weeks to launch a cross-channel buyer engagement marketing campaign with their present MarTech stack, whereas 5.3% take greater than 8 weeks.

Just one.1% of retail manufacturers go stay with a brand new marketing campaign in beneath per week.

10. Time required to assemble buyer insights with present MarTech stack

34.7% of retail manufacturers take greater than 2 weeks to assemble information and insights into buyer conduct, preferences, likes, journeys, and expectations with their present MarTech stack.

Solely 11.6% of retail manufacturers take lower than one week.

11. Time required to assemble marketing campaign insights with present MarTech stack

28.4% of retail manufacturers take greater than 2 weeks to assemble information and insights about marketing campaign performances reminiscent of attain, clicks, conversions, channel effectiveness, or attribution with their present MarTech stack.

Solely 4.2% of retail manufacturers can collect this information in a day or two.

Conclusion

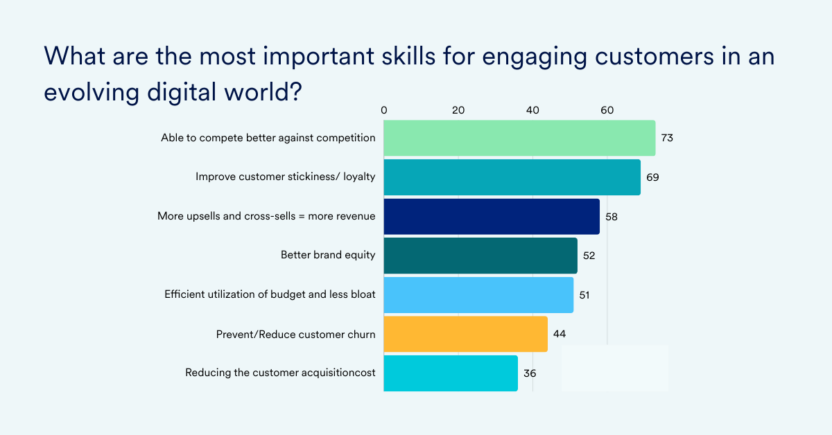

The retail trade should continually meet shopper calls for and supply a seamless expertise to stop churn and thrive in a hyper-competitive surroundings.

They acknowledge that velocity and agility are vital to understanding and adapting to altering shopper expectations in 2024. Nonetheless, legacy platforms are slowing them down and stopping them from accessing the information they should launch cross-channel campaigns and collect insights about buyer and marketing campaign efficiency. In consequence, they discover it exhausting to retain clients.

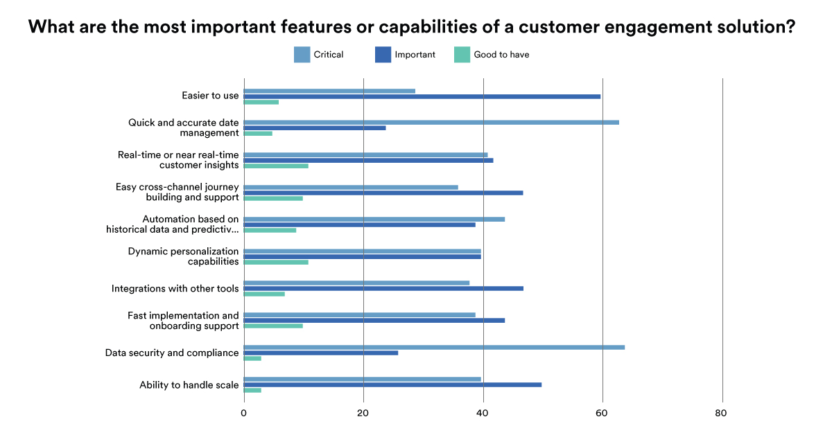

These manufacturers can’t afford these time lags. Plus, they perceive the crucial options and capabilities they’re searching for of their MarTech stack.

The answer?

Retail manufacturers want a contemporary Buyer Engagement Platform (CEP) of their MarTech stack.

With a CEP designed for retail, these manufacturers can mix and streamline all their channels into one unified omnichannel technique that fast-tracks advertising and marketing campaigns, maximizes information perception, and improves buyer engagement.

Therefore, choosing a aggressive Buyer Engagement Platform like MoEngage retail manufacturers can supply a tailor-made engagement to the shoppers. With the MoEngage CEP, advertising and marketing groups can:

- Get buyer insights throughout conduct, journey, and campaigns

- Automate their advertising and marketing campaigns and create workflows in minutes

- Deploy Good Triggers that immediate transactional alerts on the optimum time

- Create customer-centric experiences throughout a number of channels

A fast look at how some Retail manufacturers achieved agility and velocity with MoEngage

Landmark Group: From days to twenty minutes with MoEngage

“MoEngage’s experience in cellular and net capabilities and the benefit of driving even complicated use instances with none developer dependency proved to be a deal breaker for us.”

Domino’s: From 60 minutes to five minutes to setup e mail and push campaigns

“We favor MoEngage over different CEPs used previously as a result of it’s user-friendly and permits us to launch customized omnichannel campaigns at scale with ease, supported by MoEngage’s superior assist workforce.”

Sweatcoin: From 4 days to twenty minutes to launch a number of e mail campaigns

“We will’t consider it solely takes us 20 minutes now, versus the 4 days it used to take us to compile emails alone.”

What to Learn Subsequent?

1. Be taught now what are the High 5 Indicators to Replace Your MarTech Stack Now: A CTO’s Perspective.

2. Perceive the significance of implementation/onboarding for a retail model by studying 7 Components to Think about Whereas Implementing an Engagement Platform for Retail Manufacturers.

3. Right here’s an inventory of 10 Inquiries to Ask Whereas Selecting a Excellent Buyer Engagement Platform.

4. Seeking to migrate out of your present tech stack to one thing extra fashionable? Learn on to know what you must go for: Salesforce Advertising and marketing Cloud Vs MoEngage – What’s Proper for Your Group?

5. Martech Readiness Report 2024: How Prepared Is Your Monetary Service Model to Meet Buyer Expectations?