Hold updated within the ever-changing digital panorama by integrating these 5 tendencies in Monetary Companies digital advertising and marketing into your 2024 advertising and marketing technique

Monetary Companies is each a extremely aggressive and extremely regulated sector. Value per buyer acquisition is excessive, and inspiring buyer loyalty in digitally savvy audiences is difficult provided that new challenger banks, neobanks, and aggregator providers encourage switchers to hunt higher offers.

In 2024, Monetary Companies entrepreneurs should proceed to tweak their digital advertising and marketing methods in keeping with prospects’ emotional motivations for his or her monetary transactions.

If you have not obtained an built-in digital advertising and marketing technique, otherwise you’re struggling to get buy-in, do not miss my explainer 10 causes you want a digital advertising and marketing technique.

All of the tendencies listed beneath provide new alternatives for entrepreneurs to faucet into identified buyer considerations. You may wish to sense-check the beneath, asking the questions on your goal prospects:

- ‘What are their largest ache factors?’

- ‘What are they searching for in a monetary product for the time being?’

- ‘What are their digital expectations?’

Understanding the advertising and marketing communications tendencies at play within the Monetary Companies sector is crucial for all current companies and presents nice alternatives to new startups and challengers. That can assist you carry on high of the most recent developments, I am summarizing these 5 tendencies beneath.

1. Omnichannel Monetary Companies advertising and marketing

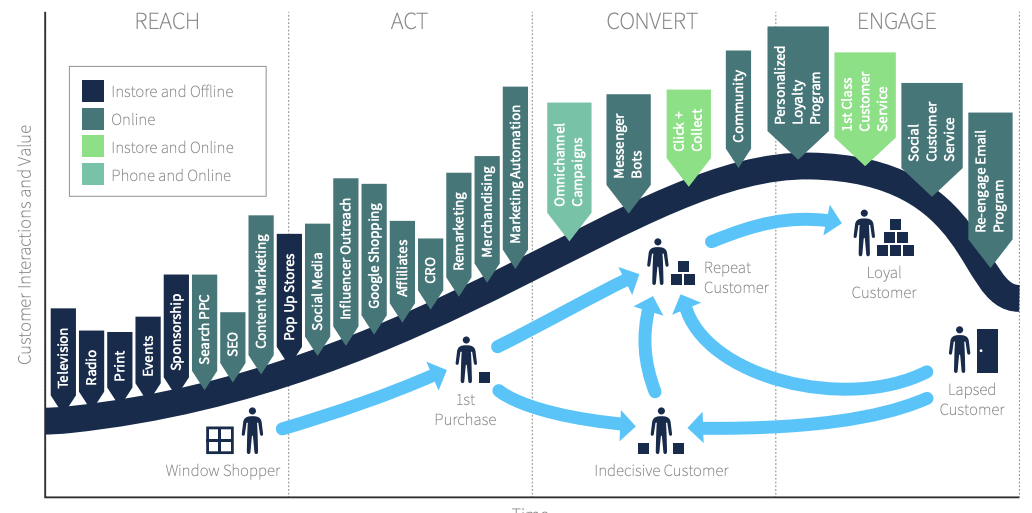

At Good Insights, we outline omnichannel advertising and marketing to incorporate each managing buyer

expertise and advertising and marketing communications:

“Omnichannel means planning and optimizing always-on and campaign-focused advertising and marketing communications instruments throughout totally different buyer lifecycle touchpoints to maximise leads and gross sales – all of the whereas delivering a seamless buyer expertise to encourage buyer loyalty”

The main target right here is making certain that totally different on-line and offline advertising and marketing actions are built-in and complement one another in working in direction of the devoted advertising and marketing goal at that stage in your buyer journey.

The variety of on-line and offline channels that must be orchestrated is proven throughout our RACE buyer lifecycle visible featured right here:

The speedy digitization of Monetary Companies to create comfort and extra touchpoints with shoppers requires intimate digital advertising and marketing planning and understanding of this lifecycle if companies need sustained development within the digital area.

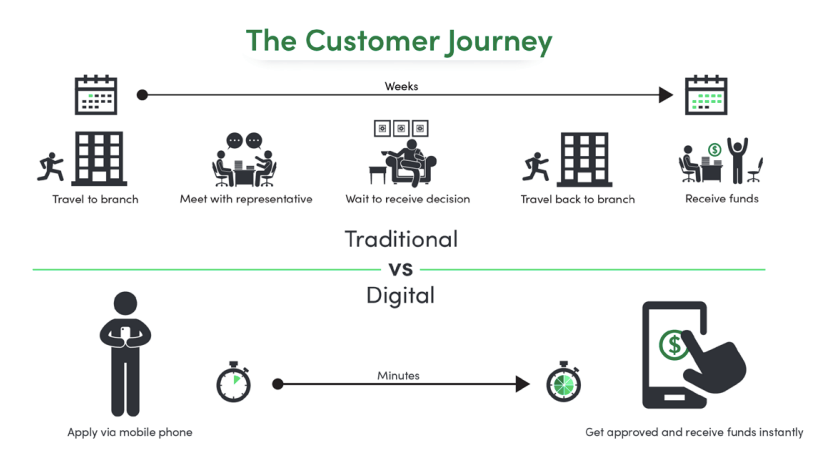

The distinction in buyer expectations is summarized by this visible which reveals buyer expectations in conventional vs digital Monetary Companies.

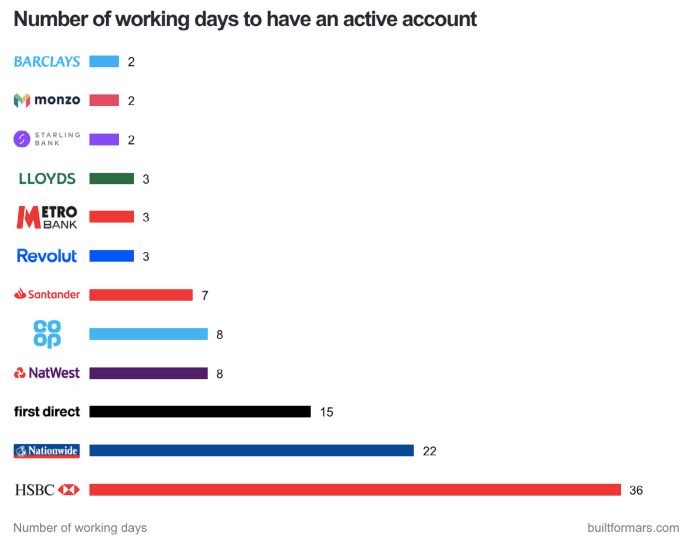

Benchmarking the service expertise in comparison with competitor banks can spotlight the

distinction in expectations as this analysis from Constructed By Mars reveals.

Nevertheless, with a purpose to meet these expectations, a structured strategy to omnichannel shall be vital to your success.

A current McKinsey article, The balancing act: Omnichannel excellence in retail banking, highlights the worth of specializing in omnichannel advertising and marketing in retail banking. The authors clarify:

“As banks proceed to make progress in digitizing the client expertise, they have to additionally do not forget that omnichannel contains the vital human aspect of the equation.

To maximise gross sales, banks should successfully mix digital and human channels to create a seamless omnichannel providing.“

This motion in direction of creating providers and presents which might be extra customized and extra in tune with prospects signifies that being on the forefront of digital advertising and marketing tendencies is extra vital now than ever.

Our free digital advertising and marketing plan template helps digital entrepreneurs plan, handle, and optimize a customer-centric digital advertising and marketing technique.

2. Seasonal content material advertising and marketing in Monetary Companies

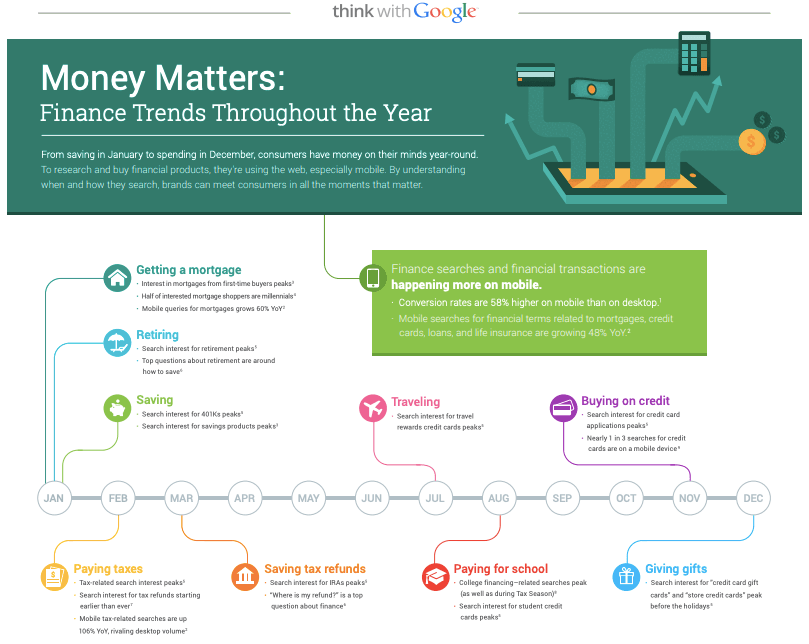

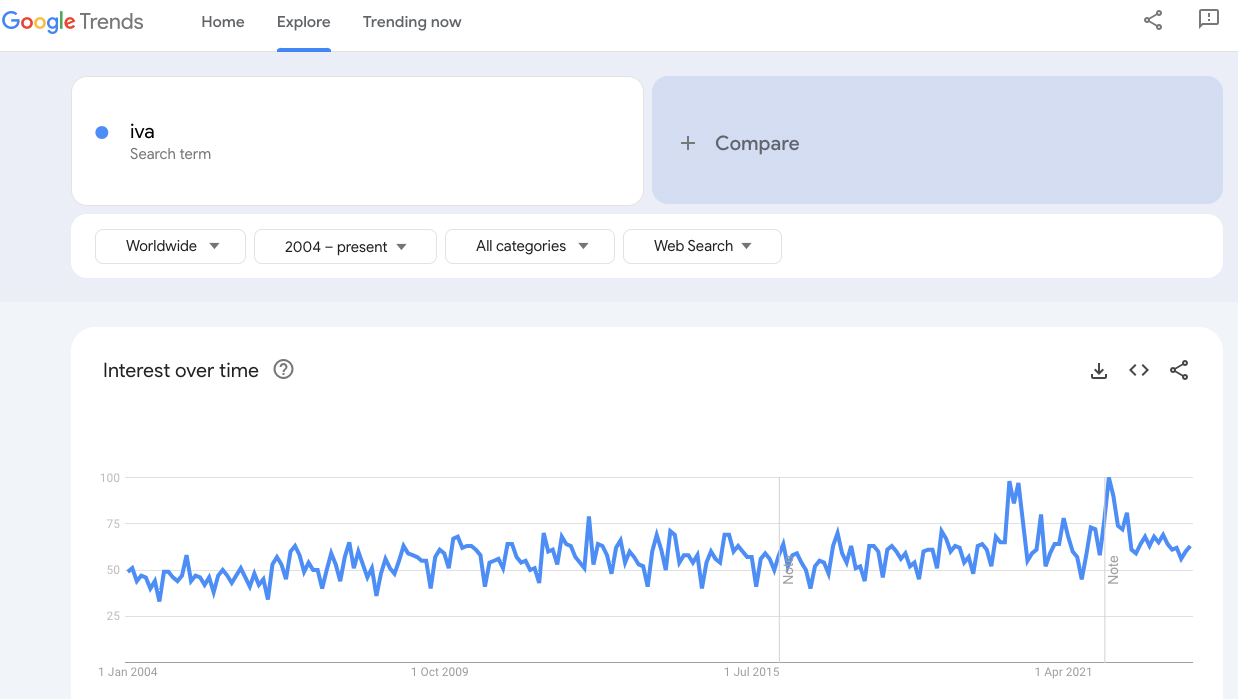

Analysis from Google decided that there have been vital patterns over a calendar yr

when folks had been extra engaged in sure monetary merchandise at sure instances of the yr.

The underlying implication is that whereas cash could also be on everybody’s thoughts for many of the yr, there are occasions when they’re prone to be extra considering particular merchandise or presents.

Equally, Monetary Companies entrepreneurs will do effectively to establish trending subjects of their goal markets and plan content material that may faucet into this.

For instance, digital content material about ‘inflation’, ‘early retirement payout’ and different topical themes have seen elevated search curiosity in keeping with Google.

The search big provides the next recommendation on what this implies for search advertising and marketing:

“As we’re collectively apprehensive in regards to the financial outlook and private funds, it’s vital to offer actual worth to your prospects and the enterprise as an entire.

Customers count on manufacturers to be useful and they’ll additionally place extra significance on corporations exhibiting their worth, for instance with particular presents and reductions.”

So, by transferring your content material advertising and marketing technique to be extra consistent with what shoppers count on and demand, and using an optimized strategic strategy, it is possible for you to to develop your model at an area and world stage. Enterprise Members can full our interactive Studying Path module to search out out extra.

Core Module

Outline a deliberate strategy to content material advertising and marketing

A part of the Content material advertising and marketing Toolkit

Learn to outline an efficient content material advertising and marketing course of for your enterprise and market

3. Conversion Charge Optimization in Monetary Companies

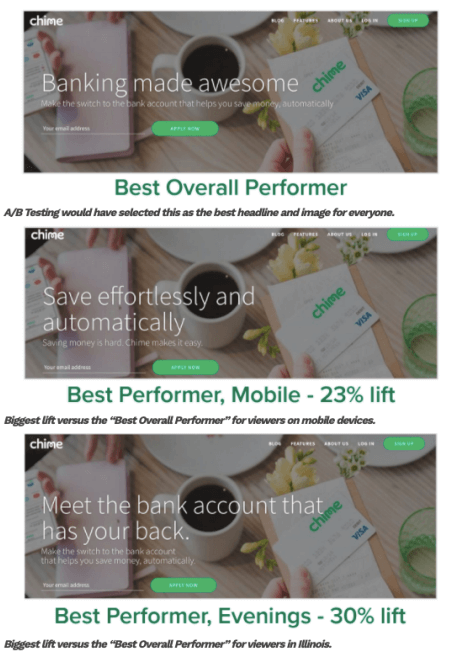

A/B testing imagery and replica variants as a part of conversion fee optimization could make a big distinction in belief, however for some extremely rate-led propositions akin to bank cards, rates of interest could have the most important influence on a lot of functions.

Trying in direction of 2024, we count on the continued development of placing extra useful resource into Conversion Charge Optimization (CRO), which mixes A/B testing, AI personalization, and extra, to enhance digital belongings/experiences.

For instance, US Digital financial institution, Chime has applied predictive personalization on their homepage, the place they use machine studying insights about elements that affect conversion akin to location, gadget and time. They then examined the very best inventive for these segments. They examined 21 totally different concepts and 216 totally different variations of their homepage over a three-month interval. You’ll be able to see that there are vital variations in conversion:

At Good Insights, we outline CRO “a structured testing and optimization course of geared toward enhancing key efficiency indicators for an internet site”. These could embody viewers engagement, conversion charges to steer and sale or income and profitability.

Many websites are solely sometimes up to date, however corporations who’re critical about getting the very best returns from their web sites have a structured programme of testing. Enterprise Members can full our interactive Studying Path module to search out out extra.

Superior Module

Conversion optimization

A part of the Digital advertising and marketing technique and planning Toolkit

Be taught in regards to the rules and greatest practices for organising a easy AB check and a broader CRO programme

4. Conversational engagement by means of advertising and marketing

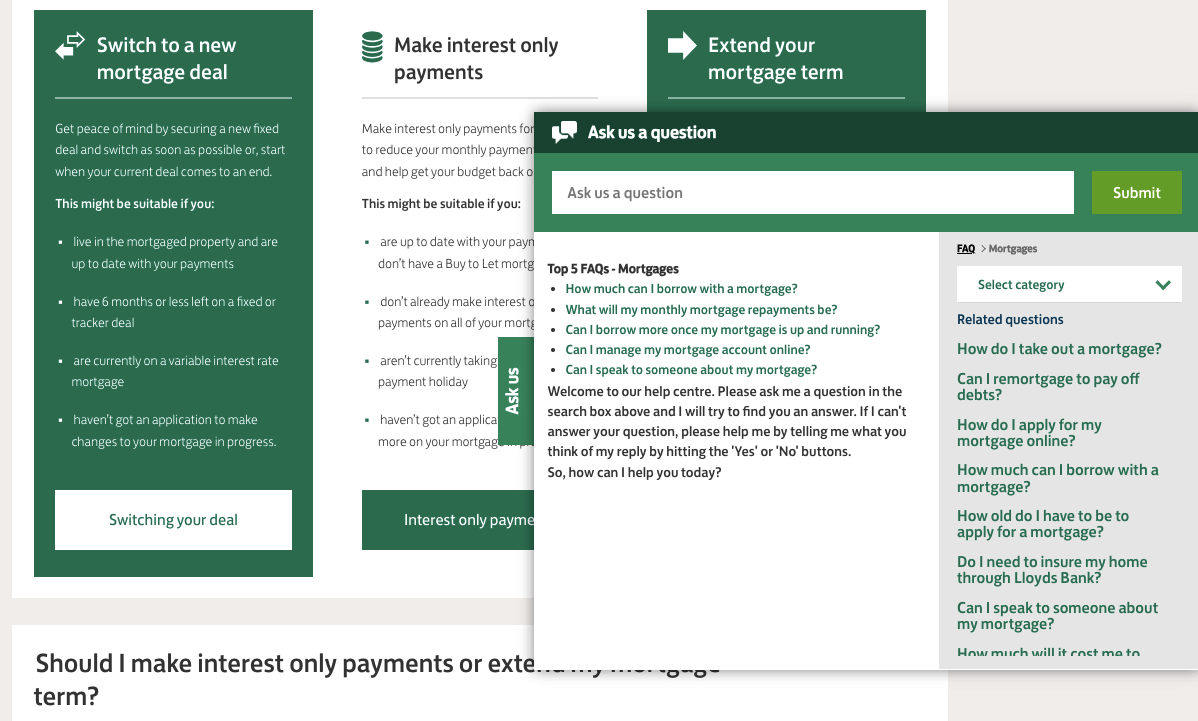

We use the time period ‘conversational messaging’ to encapsulate any know-how that empowers manufacturers and shoppers to work together with one another, akin to chat or messaging, voice help and different pure language interfaces.

Merely put, conversational engagement makes use of pure language to work together with prospects throughout their shopping for journey by offering them with customized assist and suggestions whereas nurturing long-term relationships.

Whereas retailers have used chatbots, many of those with Synthetic Intelligence, for a few years, their utility inside Monetary Companies has solely simply begun to develop into commonplace.

In accordance with a report on conversational commerce, the typical dialog charges in shops vary from round 20-30%, whereas on-line, that fee drops right down to sub 10% relying on the model power. The apparent causes for that might be the wealthy, visible, and tangible expertise that prospects get after they bodily go to a retailer.

Nevertheless, another excuse is the moment buyer help and repair that they obtain inside the shops, making it important for on-line platforms to have the ability to compete with that stage of customer support.

Within the Monetary Companies sector, the place decision-making might be advanced, and the necessity for customized suggestions is much more vital, conversational messaging allows Monetary Companies entrepreneurs to have interaction their prospects on-line.

Our ‘on-line customer support and buyer care’ module contains knowledgeable steerage for managing people-supported customer support processes together with:

- Inbound e mail response by way of contact-us kinds

- Use of net self-service (FAQ and Data bases)

- Dwell chat

- Internet call-backs

- Chat bots

- Social media buyer care (proactive outreach and response)

This interactive module, which sits inside our Social Media Advertising Studying Path will assist Monetary Companies entrepreneurs monitor and enhance their conversational engagement methods.

Core Module

Customer support and success

A part of the Social media advertising and marketing Toolkit

Learn to evaluate the standard of customer support delivered by on-line channels and stability this in opposition to the associated fee to serve

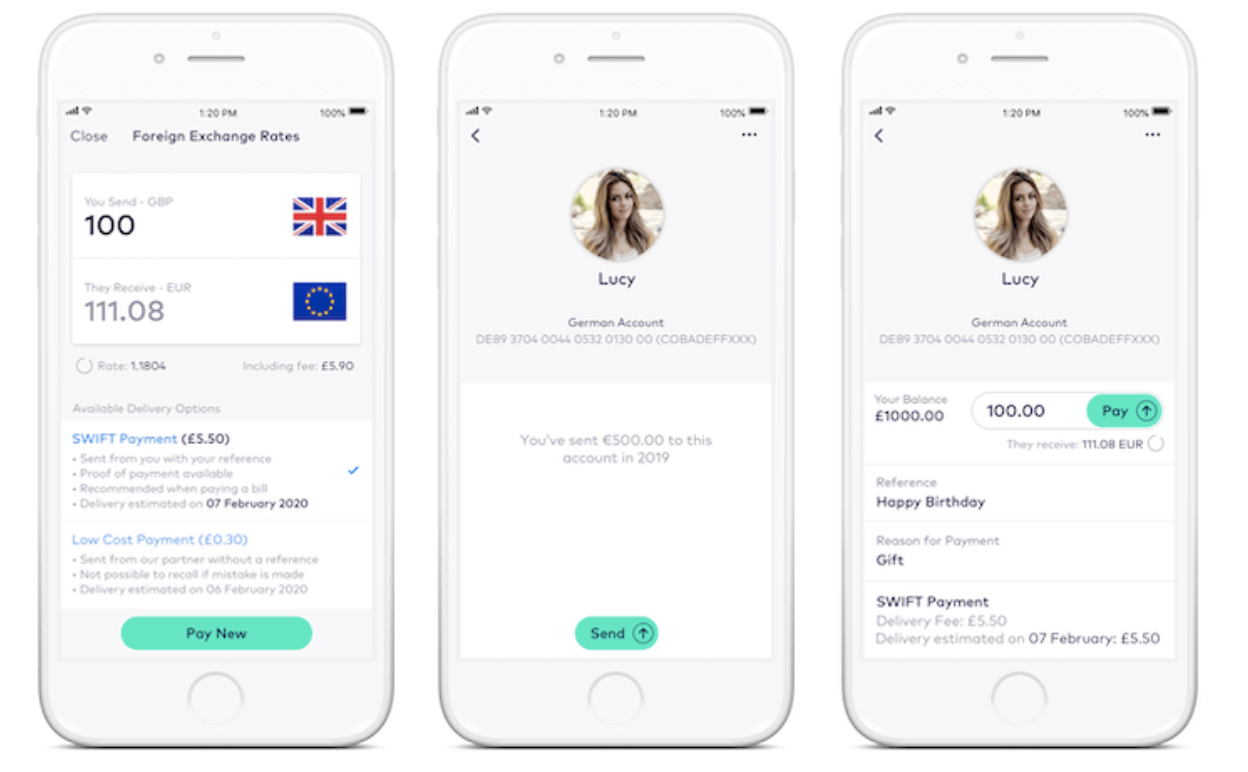

5. Monetary Companies buyer/digital expertise

Maybe essentially the most main change inside digital Monetary Companies is the evolution of UX and product design to allow digital funds.

The Monetary Companies trade has historically created UX and design experiences from an knowledgeable’s standpoint however this has considerably modified with a better understanding of UX being in regards to the digital buyer mixed with a data-driven technique of buyer perception.

As a consequence, banks, insurance coverage corporations, and monetary establishments are actually constructing sturdy in-house design capabilities which might be shaping new product design and improvement.

As on-line competitors has elevated, and extra Monetary Companies prospects migrate on-line, it is usually clear that established Monetary Companies establishments are working in a really dynamic market with a various array of recent entrants and rising applied sciences that’s upending conventional development areas and thus compounding the necessity for UX design on the heart of their digital technique.

“The significance of UX and design has positively modified significantly within the Monetary Companies sector. We now perform intensive analysis earlier than any new digital undertaking is began which is vital for all profitable design.”

– Martin Park, Senior UX Advisor, Previous Mutual

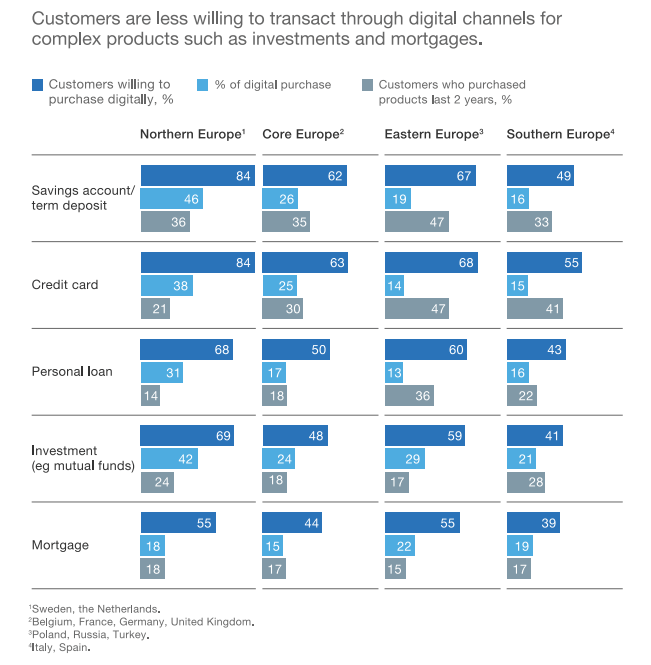

The McKinsey article presents this knowledge exhibiting how, for some easy retail banking propositions like financial savings accounts and bank cards, the overwhelming majority of shoppers in Northern Europe are actually keen to buy digitally. Nevertheless, there’s a decrease choice for digital purchases in southern Europe.

Nevertheless, extra advanced merchandise like loans and mortgages have a lot decrease digital buy charges and a big hole between willingness to purchase on-line and precise buy charges.

This means the chance for rising digital gross sales would require a multi-touch strategy that works seamlessly with buyer preferences for utilizing offline channels to debate the acquisition choice, significantly for extra advanced merchandise.

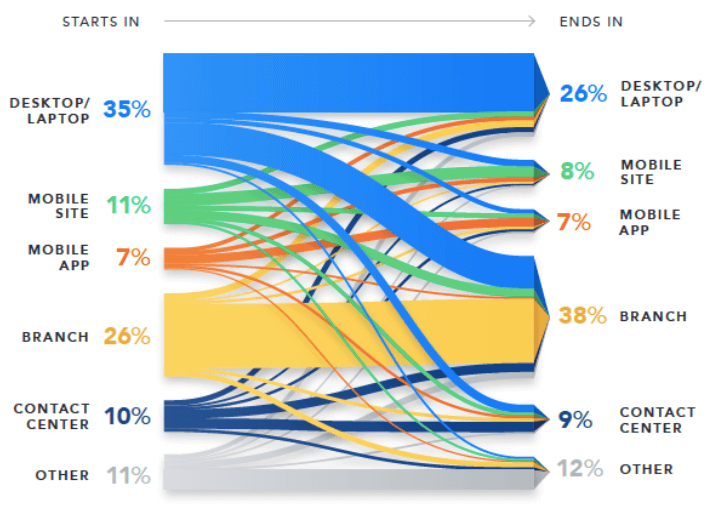

This visualization from the Verint Expertise Index of the client journey for a mortgage product reveals prospects use a number of touchpoints on the trail to conversion.

Because of this folks count on to have the ability to decide up the place they left off no matter gadget or bodily location.

One other level to notice is that bodily attendance in branches for giant choice merchandise continues to be very sturdy. Because of this when you could also be specializing in digitization bear in mind to think about how this can work alongside the bodily expertise in branches – aka ‘phygial’.

Monetary Companies digital advertising and marketing tendencies and takeaways

Everyone knows that cash is a delicate, guarded topic for almost all of individuals. Because the digital advertising and marketing trade has seen by means of the likes of Google’s E-A-T replace, expertise, authority and – maybe most significantly for Monetary Companies advertising and marketing – belief are of paramount significance.

We’re all programmed to keep away from loss and that is additional strengthened by means of cultural approaches to cash as being one thing that wants protecting secure. So, it stands to purpose that persons are naturally cautious – even skeptical – relating to monetary issues.

Therefore, the most important problem for banks and others within the Monetary Companies trade is to beat folks’s belief points by delivering on-line experiences that interact their current and potential prospects.

This makes it crucial that banks and others in Monetary Companies advertising and marketing work to introduce measures that enhance their customers’ perceptions of belief and decrease skepticism and even worry. This could go a protracted technique to rising conversion and the uptake of services and products.

That is why we suggest reviewing these tendencies inside the context of an built-in digital advertising and marketing technique. Take your subsequent steps to Monetary Companies digital advertising and marketing optimization while you obtain our free digital advertising and marketing plan template.