A fast stroll via of tips on how to enhance the percentages of success and the magnitude of return with a current low value name purchase in Caterpillar (CAT).

POWR Choices employs a fusion method to commerce thought technology. It combines elementary, technical and volatility evaluation to establish potential trades which have the possibilities of their favor.

All of it begins with the POWR Rankings. StockNews does the heavy-lifting for you by combining 118 various factors to seek out the shares with the very best likelihood of success (A and B rated) for bullish name buys. It additionally identifies the shares with the most important probability of failure (D and F rated) for bearish put buys.

Let’s take a stroll via the method utilizing our most up-to-date commerce in Caterpillar name choices.

Elementary Evaluation

Caterpillar (CAT) was a Robust Purchase (A-Rated) inventory within the POWR Rankings. Additionally ranked close to the very prime at quantity 8 out of 78 within the Robust Purchase (A-Rated) Industrial Equipment Business.

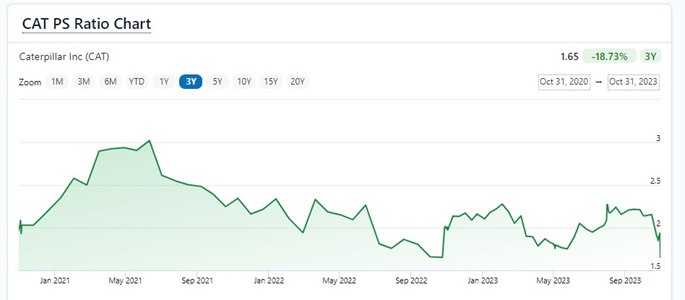

Present Value/Gross sales (P/S) ratio was additionally nearing a three-year low at simply 1.65x. The final time it was at such a cheap a number of was October 2022-which preceded a powerful rally in CAT inventory worth.

Technical Evaluation

CAT inventory reached oversold readings on a technical foundation. 9-day RSI was underneath 20 and on the lowest ranges of the previous 12 months. MACD at the same detrimental excessive as effectively. Bollinger % B turned detrimental. Shares have been buying and selling at an enormous low cost to the 20-day transferring common. Earlier instances all these indicators aligned in a similar way marked vital lows in Caterpillar. CAT additionally held main assist on the $225 space.

Implied Volatility Evaluation

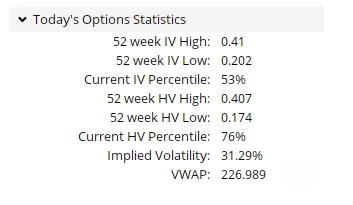

Implied volatility (IV) was buying and selling at simply the 53rd percentile put up earnings, even after the sharp drop in CAT inventory. This implies possibility costs have been just about common. Pricing was even cheaper, nevertheless, when in comparison with the historic volatility (HV) of 76%. Plus, it is very important keep in mind that the VIX, an total measure of implied volatility for S&P 500 shares usually, was buying and selling at simply off the current highs.

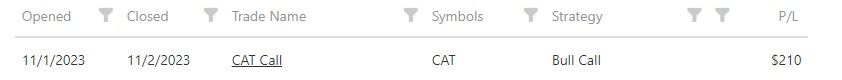

POWR Choices purchased the bullish CAT February $260 name choices on 11/1 simply after the market opened. Paid $4.10 to get in-or $410 per name.

Closed them out only a day in a while 11/2 for a fast one-day achieve of $210 as CAT inventory rallied properly. Shares did certainly bounce off the $225 assist line. 9-day went again above 30. Bollinger % B regained constructive territory and MACD improved as effectively.

This equates to only over a 50% achieve in in the future on the preliminary value of the decision of $410. Commerce outcomes proven beneath.

So, whereas CAT inventory did rally 4.5% from $225 to $235, our February $260 calls gained greater than 50%-or larger than 10x the quantity the inventory rose.

The price of buying and selling CAT inventory versus CAT choices would have been a lot larger, too. 100 shares of Caterpillar inventory would require an preliminary outlay of about $22,500 (100 shares instances $225 inventory worth). Even totally margined the inventory would have tied up effectively over $10,000.

The acquisition of the decision possibility, which controls 100 shares of CAT inventory, value solely $410 up front-or solely about 2% of the inventory buy.

This highlights the facility of options-and the facility of the POWR Choices method.

Definitely, not all trades will work out this shortly or this effectively. Utilizing the POWR rankings together with the POWR Choices fusion method can put the percentages in your favor.

On the finish of the day, buying and selling is all about possibilities and never certainties.

POWR Choices

What To Do Subsequent?

For those who’re on the lookout for the perfect choices trades for right this moment’s market, it’s best to try our newest presentation Commerce Choices with the POWR Rankings. Right here we present you tips on how to constantly discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you need to study extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Commerce Choices with the POWR Rankings

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

CAT shares closed at $240.75 on Friday, up $1.63 (+0.68%). Yr-to-date, CAT has gained 2.55%, versus a 14.93% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up No Catcalls On These One Day Surprise CAT Calls appeared first on StockNews.com