Studying Time: 11 minutes

Over the previous twenty years, banks have utterly modified how they work together with clients and ship value-added companies.

In the present day, clients can withdraw money via ATMs, use on-line banking portals to view their account exercise, handle transactions, and extra. The entry of cell banks has additionally made it a lot simpler for purchasers to handle routine banking duties. All of this allows clients to handle their funds anytime, from anyplace, when this was beforehand solely doable at bodily financial institution branches.

As banks proceed to embrace this omnichannel strategy, delivering a constant and steady expertise throughout all channels is necessary. It’s important that each buyer interplay is handy, versatile, and cohesive.

That is the place an omnichannel banking platform turns into necessary.

Right here we are going to assist you perceive how an omnichannel banking platform is essential to delivering a seamless banking expertise.

Let’s dive in.

What’s Omnichannel Banking?

In the case of channels, as we speak’s clients are spoilt for selection. They will go to bodily banks, ATMs, or money deposit machines. They will additionally use banking portals, web sites, cell functions and even SMS.

Omnichannel banking ensures that the communication on all these channels is stitched collectively so that each buyer’s journey stays interconnected, constant, and cohesive. It is because data and context are shared throughout channels, making certain that clients don’t have to repeat themselves or obtain inconsistent updates. As an example, a buyer might provoke a dialog on dwell chat after which later transition to a telephone name with out having to reiterate particulars of their question.

With omnichannel banking, banks can ship customized companies and multi-device help across the clock. This additionally contributes to a holistic banking expertise that retains buyer comfort at its core.

In reality, in response to the World Retail Banking Report by Capgemini Analysis Institute, practically 80% of consumers choose an omnichannel banking expertise.

5 Advantages of Omnichannel Banking

Omnichannel banking is difficult to excellent, however when executed proper, it yields unbelievable outcomes which are properly definitely worth the effort. Listed below are a few of the key advantages of this strategy:

1. Improved buyer expertise

Conventional banking requires clients to go to a financial institution’s bodily branches to handle all account-related actions. The financial institution’s branches are the first channel for buyer interactions, and this poses loads of limitations, akin to lengthy wait instances and geographical constraints.

With omnichannel banking, clients can handle their transactions throughout any channel of their selection. Additionally, since channels are interconnected, information and context are shared uniformly in order that the client receives the identical degree of service and data. This ensures that regardless of the touchpoint, the client feels as if they’re part of an built-in advertising and marketing and buyer expertise program.

The omnichannel strategy additionally permits clients to entry banking companies from anyplace, across the clock in response to their comfort. This contributes to elevated buyer satisfaction scores.

2. Elevated engagement

Omnichannel banking helps to enhance buyer engagement as a result of it means that you can attain the client throughout a number of touchpoints which are tied along with buyer information.

Let’s assume a buyer is trying to find a financial institution to create their financial savings account in on Google and browses via a number of choices, together with XYZ Financial institution. Then once they log into their Fb account, an advert from XYZ Financial institution pops up, highlighting the advantages of making a financial savings account with them, such because the rate of interest supplied and zero-fee banking. The shopper recollects the model identify and clicks on the advert enabling them to obtain the app from a Play Retailer. After they open the app, an in-app message pops up that’s customized with the client’s identify and mentions unique financial savings account options supplied by the financial institution. As soon as the client clicks on the message, one other in-app message pops up that guides the client on the way to arrange their account on-line in a number of easy steps.

Do you see how seamless your entire course of was and the way it engaged the client at each step of the way in which?

3. Larger operational effectivity

Conventional banking operations and communications are siloed, as there are separate techniques in place to take care of totally different channels and features. Therefore, pulling up related buyer information could be fairly tough, and with out this, it will possibly grow to be difficult to realize insights into how clients are interacting together with your model.

Omnichannel banking, alternatively, leverages automation to intelligently phase clients on a granular degree. As an example, you possibly can phase clients based mostly on their lifecycle stage, transaction habits, engagement degree, and their channel preferences. This lets you well allocate assets, drive focused advertising and marketing campaigns, handle churn dangers, and optimize channels.

4. Higher cross-selling alternatives

Omnichannel banking provides loads of alternatives to cross-sell. Banks can leverage information from numerous channels to grasp buyer preferences and habits. Analyzing a buyer’s transaction historical past, on-line interactions, demographic data, and so forth. can assist establish cross-selling alternatives. This information additionally means that you can arrange customized suggestions for particular person clients.

That is inconceivable with conventional banking just because most interactions happen both on the financial institution or via only a few channels. This leaves much less room to collect buyer information which is vital to establish cross-selling alternatives.

5. Better aggressive benefit

An omnichannel presence provides a greater aggressive benefit to banks because it’s simpler to draw and retain clients. Omnichannel banking additionally makes it simpler for banks to adapt to altering buyer expectations and be the place their clients and prospects are. That is particularly necessary in as we speak’s world the place shoppers have grow to be tech-savvy.

With conventional banking, alternatively, clients wrestle with restricted accessibility and fragmented experiences. It makes it tougher for banks with conventional methods to face out within the face of competitors and guarantee a excessive buyer lifetime worth.

Omnichannel Banking Platform Analysis Standards: Methods to Select One

To be able to efficiently implement an omnichannel banking technique, you want an omnichannel banking platform. Nonetheless, choosing the proper one requires you to rigorously consider a number of points. It should align together with your financial institution’s key aims, price range, scalability, and different components.

Listed below are a few of the key options it’s essential to contemplate:

1. Integration capabilities

The omnichannel banking platform you select ought to have the ability to combine together with your financial institution’s current tech ecosystem. This consists of your web site portals, cell functions, buyer information platforms, information warehouses, analytics instruments, and so forth. Make sure you search for a platform with versatile omnichannel API and sturdy integration capabilities.

| Why it is a key criterion:

Integration capabilities are necessary as a result of they permit vital information akin to buyer data, transaction particulars, and account particulars to be up to date and accessible in actual time throughout all channels. This improves operational effectivity and likewise ensures a easy banking expertise in your clients. |

2. Personalization options

Your omnichannel banking platform wants to have the ability to offer you insights into how clients work together with totally different channels and messaging. These insights can assist you ship messages which are tailor-made to the kind of channel(s), time slot, and use circumstances every buyer is more than likely to interact on.

Let’s say that the insights gathered out of your omnichannel banking platform point out {that a} ‘Worth Delicate’ buyer constantly interacts with push notifications between 8-9 PM on the weekends. You need to use this data to arrange a promotional advertising and marketing marketing campaign that entails sending offer-based push notifications at 8 PM twice per week. This may enhance the chance of the client interacting together with your messaging, as it’s catered to their desire.

When evaluating an omnichannel banking platform, search for options that may assist you with hyper-personalization akin to buyer segmentation, dynamic content material supply, AI, system synchronization, and analytics dashboards that get up to date in real-time.

| Why it is a key criterion:

Personalization is essential to participating clients and delivering monetary merchandise/companies that really resonate with them. It additionally fosters buyer loyalty and improves buyer retention. Apart from this, personalization can unlock upselling and cross-selling alternatives to drive income development in your financial institution. |

3. Unified buyer view

One other key function your omnichannel banking platform ought to have is a centralized dashboard that provides you a unified view of your clients. This provides you a complete perception into every of your buyer’s interactions, channels used, transaction historical past, and extra.

| Why it is a key criterion:

A unified buyer view dashboard consolidates information from totally different sources, channels, and techniques to raised perceive your buyer’s journey. That is key to enabling proactive decision-making by figuring out points earlier than they come up. Insights from such dashboards are additionally necessary to arrange focused advertising and marketing campaigns that may be optimized to raised resonate with totally different buyer segments. |

4. Strong analytics and reporting capabilities

Analytics performs an necessary function in serving to you monitor the efficiency of your buyer engagement methods and campaigns in real-time. It additionally lets you analyze buyer habits to grasp utilization patterns and preferences related to sure monetary services or products. As an example, you possibly can analyze metrics just like the variety of clients utilizing your product, the variety of subscribers, or profitable conversions, to enhance service personalization and establish cross-selling alternatives.

You can even leverage analytics to grasp how clients are utilizing your cell banking software or web site. And in case you spot that sure clients have a excessive danger of churn, then you possibly can instantly consider the way to re-engage.

| Why it is a key criterion:

An omnichannel banking platform helps you collect extra information in regards to the buyer on issues like demographic data, channel preferences, transaction historical past, product decisions, engagement patterns, and extra. All this information is consolidated so that you just get an entire image of your clients and their habits. This lets you make extra knowledgeable choices rapidly. It additionally performs an necessary function in mitigating buyer churn dangers and attaining strategic banking aims. |

5. Vendor help

Whereas technically not a function, vendor help is vital when evaluating omnichannel banking platforms. Any newly launched platform to your tech stack can take a while to arrange. It’s also fairly regular for these platforms to have some related downtime now and again, particularly throughout scheduled upkeep actions. The necessary factor right here is to have dependable vendor help always.

| Why it is a key criterion:

An omnichannel banking platform with good vendor help will present 1:1 implementation help, coaching and onboarding companies, and immediate technical help. Its proficient buyer success staff can assist banks configure their communication techniques correctly to make sure a constant and cohesive expertise for all its clients. Well timed vendor help additionally permits quicker decision of points, minimizing downtime with out impacting the shoppers’ banking expertise. |

6. Safety and compliance options

The omnichannel banking platform you select will take care of an enormous quantity of extremely delicate buyer information. That is exactly why selecting a platform that adheres to safety and compliance protocols is essential. When evaluating, examine for options akin to encryption, multi-factor authentication (MFA), id verification, entry controls, and audit trails, to call a number of.

| Why it is a key criterion:

In omnichannel banking, buyer information turns into extra centralized and simple to entry. Whereas that is necessary for information evaluation, it additionally signifies that from a safety perspective, a single breach can have far higher ramifications. That is exactly why your omnichannel banking platform ought to provide sturdy safety and compliance options. It protects buyer information, maintains confidentiality by masking personally identifiable data, permits banks to ship immediate alerts when detecting fraudulent transactions, and ensures clients can belief their banks to supply safe and dependable companies. |

7. Flexibility and scalability

Banks develop and scale in response to altering financial situations, market panorama, and developments in know-how. Your omnichannel banking platform ought to be versatile sufficient to accommodate your financial institution’s communication and engagement wants because it grows. Options akin to cloud infrastructure, modular parts, and omnichannel API-driven integrations are necessary for making certain that your banking platform could be scaled with out inflicting a major disruption.

| Why it is a key criterion:

Scalability is vital to make sure that your omnichannel banking platform can course of an enormous quantity of messages throughout totally different channels (be it e mail, SMS, or dynamic in-app messaging) with out compromising on the standard of buyer expertise. |

Greatest Omnichannel Banking Platform: Key Options

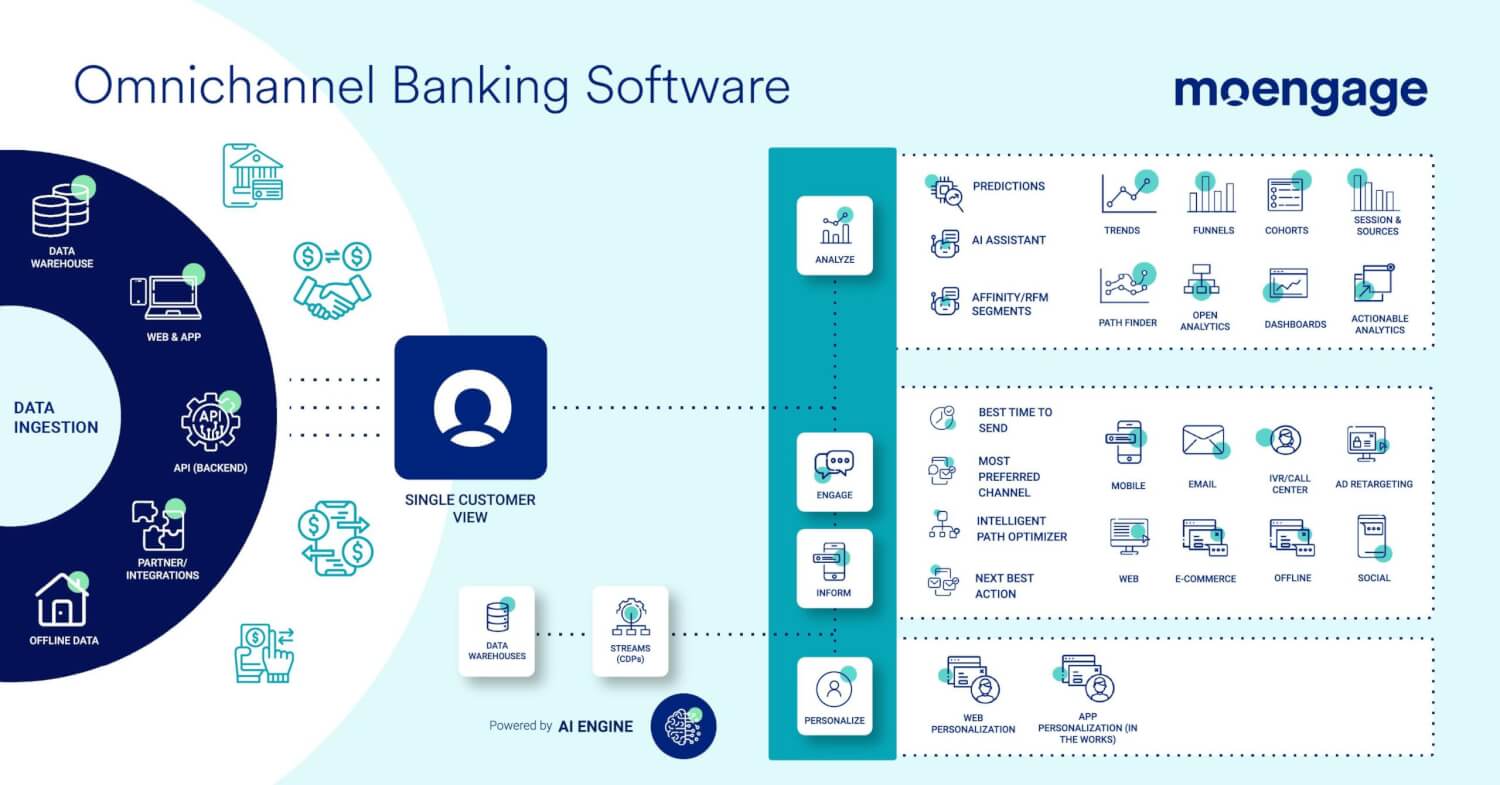

An omnichannel banking platform like MoEngage provides a number of sturdy options that may allow seamless banking experiences in your clients.

Here’s a fast overview of MoEngage’s omnichannel options and the way they can assist you:

| Omnichannel Banking Platform Wants | MoEngage Characteristic | How This Helps |

| Built-in channels to ascertain as many buyer touchpoints as doable for a steady and linked banking expertise | MoEngage’s omnichannel capabilities allow you to work together with clients throughout channels akin to e mail, SMS, in-app messaging, push notifications, and so forth. |

|

| Buyer journey mapping to optimize a buyer’s interactions throughout the totally different touchpoints a financial institution might have | Buyer journey orchestration leverages AI to construct tailor-made experiences in response to your buyer’s habits and preferences |

|

| Strong analytics and reporting to realize actionable buyer insights, enhance personalization, and optimize channel engagement | MoEngage’s highly effective buyer insights and analytics offer you an in depth view of your buyer’s habits, conversion charges, churn charges, and extra |

|

| Dependable and well timed vendor help for coaching and onboarding help, and to reduce disruptions throughout downtime | MoEngage was the best-rated vendor and the Prospects’ selection per Gartner’s Peer Insights in 2022. It is because the platform provides immediate technical help, complete coaching, common workshops, and resolution consulting for purchasers |

|

Methods to Create An Omnichannel Banking Expertise

Constructing an omnichannel banking expertise entails integrating numerous channels via which clients can work together together with your financial institution. The purpose is to supply a cohesive expertise throughout all of the totally different touchpoints in a buyer’s journey.

Here’s a step-by-step information to constructing an omnichannel banking expertise:

1. Consider your present banking operations

Conduct a radical analysis of your present banking processes, techniques, technological infrastructure, and buyer expertise. Determine what’s working and what processes are inflicting bottlenecks. This may assist you perceive the challenges in migrating to an omnichannel mannequin.

As an example, you may begin by evaluating the effectiveness of your ATM community, bodily branches, and web site portals. You can even ship surveys to clients to get their suggestions on banking habits and channel preferences. This evaluation can assist you establish alternatives to raised your digital choices and combine extra related channels into your banking ecosystem.

2. Set clear aims

The following step is to obviously outline the outcomes you’re in search of, from transitioning to an omnichannel banking technique. Keep in mind to maintain these aims achievable and measurable. Some examples embrace:

- Bettering buyer expertise and CSAT scores

- Bettering operational effectivity and decreasing time taken to launch campaigns

- Bettering message supply time

- Rising conversions and income

- Reducing churn charges

Your omnichannel banking strategy might change based mostly in your aims. As an example, in case your goal is to enhance buyer expertise, you’ll must combine extra channels throughout numerous touchpoints. Equally, in case your goal is to enhance operational effectivity, your strategy should additionally concentrate on including self-service choices and data bases to cut back your workers’ workload.

3. Spend money on the precise know-how

When you’ve recognized your aims, you’ll must spend money on the precise know-how infrastructure to help your omnichannel banking wants. You’ll want a platform that provides a number of communication channels, insightful analytics, buyer view dashboards, and AI capabilities.

As an example, MoEngage’s Buyer Engagement platform provides a number of sturdy options that will help you ship seamless and customized banking experiences at scale. The perfect half is that you would be able to ship these experiences with out worrying in regards to the complexities of a legacy system.

4. Combine your channels

The following most necessary a part of constructing an omnichannel banking expertise is integrating totally different channels to make sure continuity. What this implies is that it’s essential to implement techniques that allow information synchronization and communication between channels to supply constant banking experiences.

As an example, MoEngage means that you can construct linked buyer experiences throughout your most impactful channels. That is essential in enhancing buyer engagement for Fintech firms and banks.

It enables you to neatly consolidate buyer information from numerous techniques and sources right into a single dashboard. This provides you an in depth overview of your buyer’s way of life, demographics, decisions, and extra. Additionally, you need to use this information to construct tailor-made banking experiences.

5. Encourage digital adoption

When you’ve invested in know-how, it’s essential to guarantee each clients and workers undertake these channels.

You are able to do this by offering complete coaching, highlighting the advantages, and delivering ongoing help to workers.

With clients, you possibly can provide incentives to undertake your newly launched channels. As an example, in case you have a newly launched cell banking software, you possibly can provide a 20% low cost on the primary invoice cost made via the app.

It’s all the time a good suggestion to supply in-depth academic assets, guides, movies, and tutorials to assist each clients and workers transition from conventional banking to omnichannel banking channels.

6. Measure and iterate

Measuring the ROI of any new technique you’ve applied is necessary. Be sure that you always monitor and measure key metrics akin to channel engagement, buyer satisfaction, and transaction volumes to get an image of how your technique is rolling out.

Continually analyzing these metrics may even assist you establish any challenges together with your omnichannel strategy and make room for enchancment.

Present the Greatest Omnichannel Banking Expertise to Your Prospects with MoEngage

MoEngage’s cutting-edge buyer engagement platform helps monetary companies firms have interaction with clients, personalize interactions, and drive significant interactions with ease. The platform’s no-code capabilities, enriched with AI, allow banks to ship easy buyer experiences with a number of easy clicks.

Should you’re curious to know the way MoEngage can elevate your banking to new heights, merely join a free demo, and our buyer engagement consultants will assist you discover tailor-made options to sort out your ache factors.

The publish Omnichannel Banking Platform: The whole lot You Have to Know appeared first on MoEngage.