Hey readers, welcome to the AdExchanger Commerce publication.

This week, we study the three massive vacation buying tendencies this yr: markdowns, enormous reductions and main gross sales offers.

See what I did there?

Significantly, although, many forces are driving down costs this vacation season, and this pricing stress may have main penalties for ecommerce advertisers.

Macro-gloom

Take Goal.

Though its inventory surged Wednesday primarily based on profit-margin enhancements, the retailer set a really low bar for vacation gross sales, citing low discretionary spend for shoppers, who aren’t shopping for as a lot electronics, furnishings, dwelling items and garments.

And don’t overlook that The Commerce Desk inventory briefly tanked final week after it reported earnings and likewise warned traders of a pullback in advert spend this season, citing auto, media and shopper electronics as classes the place advertisers are tightening their belts in This fall. Since TTD represents many of the world’s largest advertisers, it sees early indicators when sure verticals are in a droop, CEO Jeff Inexperienced informed traders.

To be honest, what’s dangerous for some (specifically, promoting corporations) isn’t essentially dangerous for everybody.

Customers can pay much less for items this yr. And a few corporations win throughout recessions.

Amazon and Walmart have a tendency to learn from decrease shopper spending as a result of they catch buyers on the lookout for the bottom costs.

The platform push

Therefore the stress that advert platforms are placing on advertisers to hype offers this vacation season.

Google, for example, is introducing new buying search outcomes with merely huge inexperienced labels connected to discounted merchandise.

Walmart is doing the identical. A latest seek for vacation pantry gadgets on Walmart.com returned a row of organic-ish placements that aren’t sponsored placements (i.e., adverts) however did earn that prime spot attributable to discounted costs displayed in a daring inexperienced format. The second row is all sponsored placements. The third row finds the primary natural placement and not using a particular low cost (massive ups to Ocean Spray cranberry sauce).

Meta, in the meantime, quietly resumed a 20% low cost for North American customers making an in-app buy for the primary time – shortly after TikTok began providing 40% reductions for first-time in-app purchases.

However greater than some other platform, Amazon treats value and advert spend as two sides of 1 coin. Amazon solely cares about driving the sale, and providing a reduction can improve gross sales greater than promoting – probably with a greater revenue margin, regardless of the worth reduce.

Amazon’s rating system, due to this fact, is extra delicate to high quality merchandise at a reduction than to a model with excessive advert bids.

And this yr, the Amazon algo appears to be favoring reductions greater than ever.

Easy Trendy, which makes drinkware and is an Amazon model that’s now carried in Goal, started providing cart value-based reductions final yr, stated Bryan Porter, the corporate’s co-founder and chief ecommerce officer, talking throughout a latest webinar.

Moderately than providing a web 30% off one merchandise, buyers fill a cart to $75, say, to get a $25 low cost. The worth efficiencies to ship a number of gadgets collectively, mixed with decreased advert spend (bear in mind, the Amazon algo needs reductions greater than advert income) means Easy Trendy’s margins on the gross sales stay the identical, regardless of the low cost.

The web impact

The web impact

In brief, platforms which can be already pay-to-play media are forcing reductions on manufacturers.

Easy Trendy and different manufacturers can discover artistic methods to low cost and retain margin, but it surely’s getting more durable.

Google, for example, has a brand new search web page tab this season displaying solely discounted merchandise. It has a Chrome device, too, that prompts customers to a reduction buying web page. However generally the proper product isn’t on sale – even when it’s the higher match or doesn’t value extra.

Some manufacturers don’t run main reductions. As an alternative, they use the cash to supply a comparatively low value for many of the yr and have higher-quality items (a minimum of that’s the concept). However Google, Amazon, Walmart and different main buying hubs are displaying extra reductions and downranking normal-priced merchandise.

What’s good for Temu – the king of low-priced merchandise – shouldn’t be good for many product sellers.

Give and take

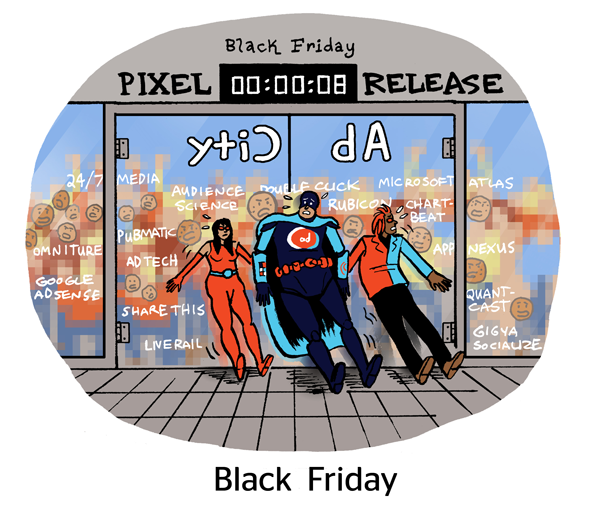

This yr’s discounting bonanza divides entrepreneurs. Some run gross sales all season, whereas others maintain the road till the Thanksgiving weekend.

On the one hand, pushing gross sales early helps the data-driven advert machine optimize towards probably or potential prospects when individuals begin buying later. One other tactic is to supply early reductions, which Easy Trendy’s Porter defends as a result of prospects acquired in early November have the next common lifetime worth – they’re really buying as a result of they just like the model, not simply as deal-seekers.

“I’m courageous sufficient to confess it,” tweeted Nate Lagos, head of selling for watch model Unique Grain, about starting its Black Friday sale on November 1. He touted related LTV enhancements on pre-Black Friday gross sales, but in addition stated Meta, specifically, wants the time and early buyer acquisition knowledge to run successfully when the large buying surge hits after Thanksgiving.

The flip aspect is that buyers anticipate massive gross sales throughout, nicely, the Large Gross sales. If manufacturers providing reductions now should slash their costs once more come Black Friday, their margins will undergo.

Many entrepreneurs are anxiously watching a flat line on purchases tied to their November promo gross sales proper now. Their hope is that the Thanksgiving push will present this yr regardless of a depressing outlook on shopper spending.

“It’s coming. Cling on,” tweeted Taylor Vacation, CEO of ecommerce advert company Frequent Thread Collective. “A number of extra weeks.”