Commerce and retail media all of a sudden turned an unbelievable tailwind for internet advertising.

Retail media is now an vital a part of the expansion image painted for traders by The Commerce Desk. And a report revealed by McKinsey final month forecasts that retail media networks (RMNs) will develop from about $45 billion in advert spend to surpass $100 billion in 2026.

“It has the potential to generate over $1.3 trillion of enterprise worth in the USA and create a paradigm shift in digital promoting not seen because the rise of programmatic,” in keeping with the consulting agency.

It’s simple to see the attraction: RMNs join impressions on to purchases, a neat trick that’s helped Amazon develop into an promoting powerhouse. And RMNs are coming into the scene at a time when dependable conversion attribution is evaporating.

However anybody banking on RMNs to energy programmatic progress for years to come back wants a actuality examine. The engaging prospect of potential progress alternatives in retail media masks a class with much less progress alternative for advert tech than might seem within the uncooked numbers.

The consumer silo

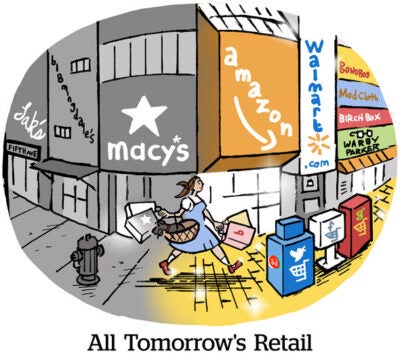

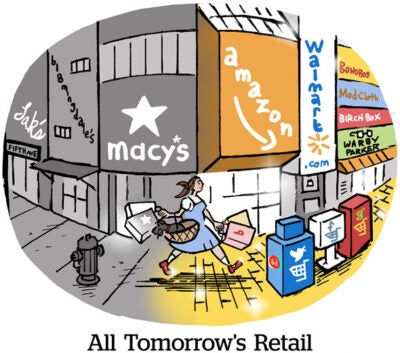

The unbelievable trajectory of retail media from being comprised of Amazon and some marginal enterprise teams at Walmart, Kroger and Goal just a few years in the past to now a broad community of RMNs – Michael’s, Albertsons, Greenback Normal, Macy’s, Greatest Purchase and Petco amongst them – that course of tens of billions of on-line advert {dollars} per 12 months and will double once more in just a few years offers a distorted sense of potential progress.

These RMN budgets, excluding Amazon’s, are nonetheless largely trapped inside shopper advertising siloes. Earlier this 12 months, Walmart and Goal disclosed annual advert income for the primary time. Walmart earned a bit greater than $2 billion in 2021, and Goal Roundel cleared $1 billion. However they’re not going out and successful open programmatic budgets, at the very least not but.

Manufacturers carried by these corporations and different massive retailer chains are contractually obligated to re-spend a p.c of gross sales, usually 5% to 10%, on commerce advertising with the retailer. Traditionally, that cash would go towards coupon offers, in-store model shows or shelf placement. Now it’s packaged into on-line advert platforms.

The relationships between retailers and types, in addition to the budgets themselves, have existed for years and are solely simply transitioning on-line. It’s a really totally different dynamic than with CTV, the opposite huge programmatic tailwind, which introduced 1000’s of completely new sorts of advertisers to TV promoting for the primary time and introduced many tech corporations their first scaled supply of video provide.

The non-endemic non-story?

RMNs have a compelling pitch to flee their commerce advertising siloes.

If advertisers can’t goal primarily based on revenue bracket on Fb anymore (which they’ll’t), and well-liked third-party viewers segments resembling “Excessive Earners” or “Energy Shoppers” lose their luster (which they’ve), retail media might be the next-best choice. A mortgage firm that may not merely goal low-income households or an airline on the lookout for spendthrift customers may use the Greenback Normal Media Community as a proxy. Or if Peloton believes there’s an overlap between its prospects and, say, individuals who purchase sure natural groceries, they’ll goal Kroger and Goal consumers who they know purchase these merchandise. That technique works even when Kroger and Goal don’t promote Peloton bikes.

The issue is that, except for Amazon, non-endemic progress (that means progress amongst advertisers that aren’t carried by the shop) is hypothetical.

Rising a non-endemic base isn’t on the radar for a lot of retailers; even the most important are nonetheless engaged on the fundamentals simply to gather the low-hanging fruit of manufacturers they carry. However even when non-endemic manufacturers have been a precedence, one thing must give for advertisers to leap in.

And we all know what must give: worth.

Retail media CPMs are bonkers. Shopping for impressions on a big-box retailer web site can price as a lot because the shiniest CTV stock, within the $20 to $50 vary.

Retail media CPMs are bonkers. Shopping for impressions on a big-box retailer web site can price as a lot because the shiniest CTV stock, within the $20 to $50 vary.

For non-endemic advertisers, retail media worth factors could also be powerful to swallow. Manufacturers might pay that a lot when advertisements generate direct ecommerce gross sales and might be attributed later to retailer gross sales. However, once more, these manufacturers are obligated to re-spend a p.c of gross sales on retail commerce advertising. There isn’t the identical fixed downward stress on pricing as the remainder of programmatic, the place each greenback should be justified or it’s going elsewhere subsequent time.

The walled backyard evolution

One other retail media progress block for the programmatic business is the potential (to not say inevitable) transformation from primarily open programmatic infrastructure to a walled backyard method.

Retailers, even the most important and most superior, have leaned closely on programmatic companions to help their on-line advert platforms. In June, Kroger launched an API with new advert companions Skai, Pacvue and Flywheel Digital. Every week later, Sam’s Membership rebranded its advert enterprise, now the Member Entry Platform, with companions The Commerce Desk, LiveRamp and Criteo. And previously few months, Walmart Join, the corporate’s advert enterprise, created a accomplice program that now has 14 ad-buying and ad-measurement distributors.

Wait, you may say, didn’t I say this transformation was unhealthy for programmatic distributors?

Sure, and that’s as a result of the present state of retail media will not be the tip state. Programmatic distributors are a present necessity that retailers begrudge.

Expanded accomplice applications, particularly for sponsored product search advert specialists like Skai and Pacvue, are an indication that retailers need assistance sourcing demand for his or her websites. But when in some unspecified time in the future they’ll do it themselves, they’ll drop the middlemen and take the margin.

Amazon Writer Companies as soon as had a Hearth TV stock program that included dataxu (earlier than it was acquired by Roku) and The Commerce Desk and allowed open net advert IDs to be related to Amazon gross sales.

“This settlement is a vital indicator of the place the business goes, and can develop into simply considered one of many, over time,” The Commerce Desk CEO Jeff Inexperienced stated in a memo on the time. “APS [Amazon Publisher Services, the company’s sell-side tech for Fire TV and other media] is supporting the open web, in distinction to different huge tech walled gardens.”

On reflection, Inexperienced doubtless hopes the APS Hearth TV accomplice program will not be an indicator of the place the business goes. As a result of dataxu was kicked out after the Roku deal in 2019, and The Commerce Desk was expelled in 2020.

Now solely the Amazon DSP should buy Hearth TV stock and attribute it to gross sales knowledge.

In some unspecified time in the future, the Walmart DSP dropped at you by The Commerce Desk may be the Walmart DSP.

It’s a greater guess than the probabilities of open programmatic distributors getting a ten-billion-dollar slice of the retail media pie by the point it reaches $100 billion.