Any enterprise that sells merchandise must know its COGS, or value of products bought.

Why? Merely put, it’s an necessary cog within the wheel of your monetary well being. It’s one of many largest indicators of income, revenue, and enterprise sustainability. You additionally have to calculate COGS with the intention to write it off as a enterprise expense in your taxes.

When you don’t know the very first thing about accounting, don’t fear. On this weblog submit, we’ll dive extra into what the price of items bought is and why it issues, go over the price of items bought method, and offer you just a few ideas for optimizing the price of items bought in what you are promoting.

What is Value of Items Offered?

COGS is a enterprise and gross sales metric that determines the worth of stock bought (and created, when you’re the producer) in a selected time. The method seems to be in any respect prices immediately associated to your stock, together with uncooked supplies, transportation, storage, and direct labor for producers.

As a result of COGS tells enterprise homeowners how a lot it prices to accumulate your merchandise, the quantity ties immediately again to revenue and income. For instance, in case your COGS is identical as or decrease than your income for that interval, it means you’ve damaged even or have misplaced cash and are usually not worthwhile.

To benchmark, companies ought to have a look at their COGS for a selected time interval (a day, 1 / 4, a yr, and many others.) and examine it to a special time interval of the identical size to see how gross sales modified.

Value of Items Offered Components

To calculate COGS, observe this straightforward method: Value of Items Offered = Starting Stock + Bought Stock – Ending Stock

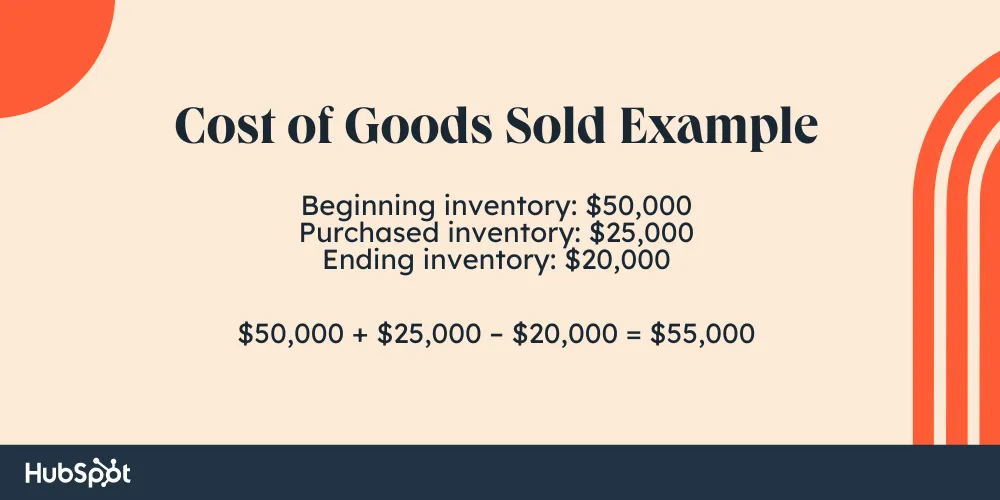

So, let’s think about that you simply’re crunching your quarterly numbers. You began This autumn with $50,000 in stock, and you bought a further $25,000 in stock to maintain up with vacation demand. On the finish of the quarter, you may have $20,000 of stock remaining.

COGS = $50,000 + $25,000 – $20,000

On this case, your COGS for the quarter comes out to $55,000. Calculating COGS varies based mostly on whether or not you’re the producer or the retailer, so let’s stroll by each to make issues clear.

Value of Items Offered Components for Retailers

When you’re a intermediary or retailer, COGS is pretty simple. Consider COGS as your whole prices related to the stock itself. Listed here are gadgets you’ll be able to embody in COGS:

- Direct value of merchandise

- Gross sales tax

- Freight

- Warehousing and storage

- Product labeling and packaging

Bills related to overhead, corresponding to labor, administrative software program, advertising and marketing, and transport to clients, can’t be labeled as COGS.

Value of Items Offered Components for Producers

Product producers have a extra complicated strategy to calculating COGS. The uncooked supplies and overhead along with your manufacturing unit or warehouse all play a task in your manufacturing value, together with:

- Uncooked supplies and elements

- Labor for manufacturing and warehousing

- Packaging and labeling

- Manufacturing unit overhead, together with tools and constructing prices

Like retailers, producers have to exclude sure administrative bills from COGS. Constructing prices, particularly, will be tough as some however not all bills will be counted in COGS. Work with a trusted accountant for particular steering to ensure you get it proper.

Value of Items Offered Calculator

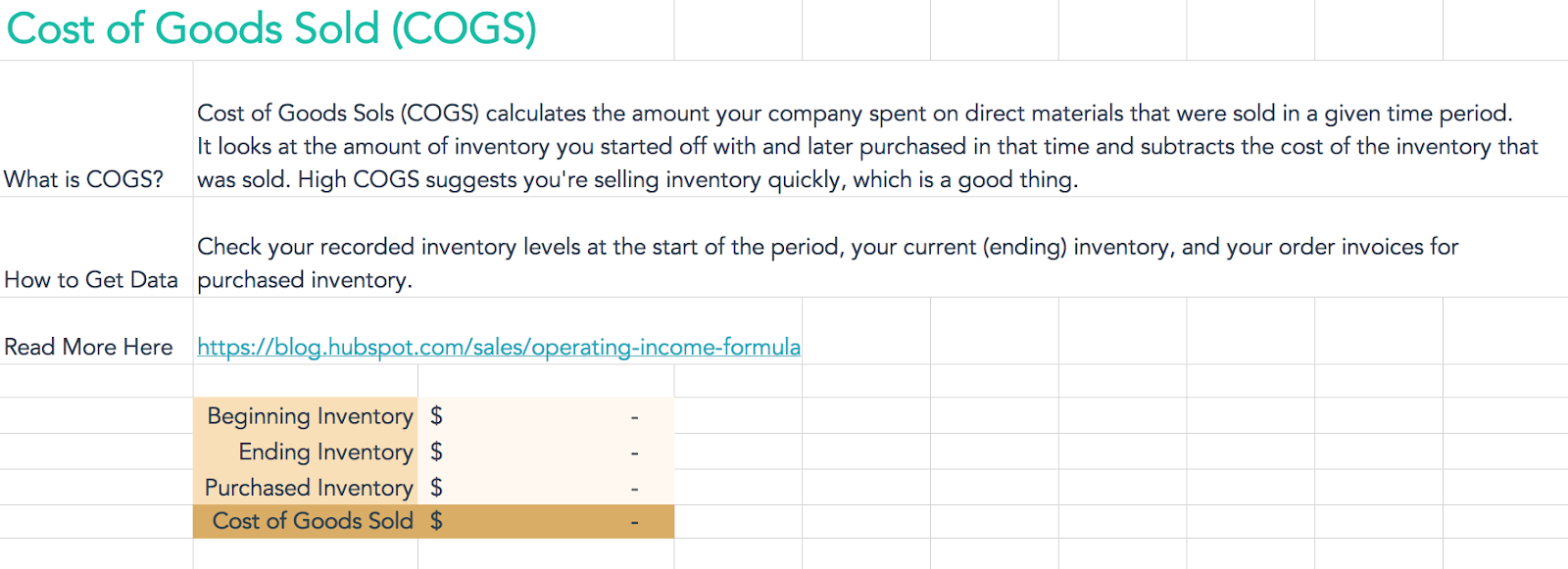

To calculate your COGS quantity with out working sums by hand, use a price of products bought calculator.

HubSpot’s gross sales metrics calculator is a free spreadsheet the place you’ll be able to plug in numbers to see your key metrics, together with COGS, buyer acquisition value (CAC), common win charge, and buyer retention charge.

Obtain this Calculator for Free

Obtain this Calculator for Free

The best way to Report COGS on an Revenue Assertion

One of many main functions of monitoring COGS is as a way to write it off in your taxes. Every time you incur an expense associated to stock, create a journal entry in your books with the proper expense class. While you pull a revenue and loss (P&L) sheet, your COGS will seem on the revenue assertion beneath gross sales.

|

Jan |

Feb |

|

|

Revenue |

||

|

Gross sales |

$10,100 |

$12,250 |

|

Value of Items Offered |

$5,600 |

$5,750 |

|

GROSS PROFIT |

$4,500 |

$6,500 |

On the finish of every quarter or time interval, use your accounting software program or the price of items bought method above to calculate COGS. Re-verify your items bought, items bought, and present stock with the intention to search for loss or theft.

Value of Items Offered Examples

Instance for Retailers

Let’s take the instance of a backpack for a college provide retailer. Say that you simply had $10,000 price of backpacks in the beginning of the month, however it’s the final month of summer time trip, and so the shop shares up on a further $20,000 price of backpacks. On the finish of the month, they’ve simply $2,000 price of backpacks to be bought to their clients.

The variables are:

- Starting Stock = $10,000

- Bought Stock = $20,000

- Ending Stock = $2,000

Time to crunch some numbers!

- Value of Items Offered = Starting Stock + Bought Stock – Ending Stock

- Value of Items Offered = $10,000 + $20,000 – $2,000

- Value of Items Offered = $28,000

Because of this the full quantity immediately traceable to the backpacks the shop needed to spend was $28,000.

The place COGS can get layered for retail shops and distributors is with completely different product strains. Companies like grocery shops and {hardware} shops have hundreds of various merchandise on their cabinets, so tracing what particularly brought about COGS to go up or down will be tough.

Instance for Producers

Let’s think about that as a substitute of promoting backpacks, you manufacture them. Consider every thing that goes into making one: the metallic for zippers, the material, the plastic for securing the straps, the tags, and even the labor hours immediately traceable to manufacturing.

To calculate the COGS in your backpacks on this instance, you should whole the quantity of stock in your possession in the beginning of the time-frame.

Let’s say that it’s a one-month interval. On the primary day of the month, the corporate has a starting stock of backpacks that value $1,000,000 to fabricate from materials and labor.

All through the time interval, the corporate produces a further batch of backpack-making supplies at a price of $700,000, damaged down as follows:

- $400,000 on the material for the backpacks.

- $200,000 on metallic for zippers.

- $50,000 on the plastic for securing the straps.

- $50,000 on the hourly wages of the warehouse staff chargeable for producing the merchandise.

On the finish of the month, the corporate has a remaining stock of backpacks that value $500,000 to make.

So, let’s determine the variables on this scenario:

- Starting Stock = $1,000,000

- Bought Stock = $700,000

- Ending Stock = $500,000

Now, plug them into the price of items bought method:

- Value of Items Offered = Starting Stock + Bought Stock – Ending Stock

- Value of Items Offered = $1,000,000 + $700,000 – $500,000

- Value of Items Offered = $1,200,000

This implies the producer’s whole variety of backpacks bought throughout this month value $1,200,000 to supply.

Value of Items Offered Finest Practices

Since COGS is so essential to what you are promoting, making efforts to optimize it could possibly repay in some ways. Listed here are just a few of our suggestions for controlling your value of products bought.

1. Work out offers with suppliers.

Suppliers are sometimes prepared to barter on the worth of what they promote you if you should purchase in bulk, decide to an unique settlement, or signal onto a long-term partnership. When you’re ready to do that, you’ll be able to decrease the price of this stock and hold the worth to your clients the identical, leading to extra revenue for you and no distinction in value or high quality for patrons.

What we like: It might probably take some time to seek out the proper distributors and construct a stage of belief and partnership. If profitable, these relationships is usually a large cash saver for what you are promoting.

2. Set up COGS by class.

Whereas COGS over time gives clear projections of progress and sustainability of the enterprise, it doesn’t present the chance to get granular. One choice is to take a look at COGS for a selected product or product class to measure gross sales extra particularly.

You’ll should be organized and disciplined to run this evaluation. Develop a system for classification and group that works in your reviews.

What we like: Organizing COGS by class provides clear insights into how sure items contribute to the underside line. With this data, you may make knowledgeable enterprise selections about which classes of merchandise return a wholesome revenue margin — and which you must contemplate slicing fully.

3. Look into automation.

A method for producers to decrease the price of items bought is to contemplate automation. Investing in machines that do the job instead of human staff normally requires a hefty upfront cost, however in the long term, your value of products bought may very well be lowered.

AI-powered instruments may also profit producers by forecasting demand for sure merchandise to assist them decide how a lot to fabricate at a time.

Clearly, automation is a hot-button problem in at this time’s economic system and has a nasty rep for displacing sure staff. Take the time to run not solely a price evaluation but additionally an evaluation of how this might affect the picture of what you are promoting as an entire.

What we like: Implementing automation is a solution to save prices, generate income, and construct infrastructure in an business the place labor is pricey. In a McKinsey report, 55% of producers reported value decreases from AI implementation, and 66% reported income will increase due to AI.

4. Cut back waste and theft.

Waste and theft can create a distinction between the stock you buy and the stock you promote. Prioritize effectivity and oversee employees to make sure every bit of stock goes into the ultimate product, and each remaining product goes to a buyer. This may go a good distance in controlling your value of products bought.

What we like: Waste not, need not. By monitoring your value of products bought in opposition to your income, you’ll be able to monitor variations in your COGS and take motion if waste or theft is happening.

5. Contextualize COGS along with your gross revenue margin.

It’s necessary to control COGS, however hold a fair nearer eye in your gross margin (GM). Discover your GM with the method GM = (Income – COGS) / Income to find what proportion of your income is being transformed to revenue.

A standard disclaimer is that COGS is finest when it’s low. That is true partly. In spite of everything, in case your value of products bought is zero, that both means you’ve acquired your stock for no value in any respect otherwise you bought nothing. If it’s the latter, you’ve earned no revenue. What you wish to do is scale back COGS by decreasing how a lot you spend in your stock.

What we like: By contextualizing COGS along with your GM, you’ll get the massive image of how your value of products is impacting profitability ratios and money circulation in what you are promoting.

The best way to Calculate Value of Items Offered and Develop Your Revenue Margins

Calculating COGS will be complicated, however it’s a vital step in measuring the well being and progress of what you are promoting. Monitoring COGS can assist you monitor bills, decrease your taxable revenue, and calculate how worthwhile what you are promoting is.