Model and enterprise leaders are assured going into the brand new 12 months that they’ve a deal with on delivering private experiences, which has been one in all their main obstacles within the post-pandemic age. New analysis from enterprise buyer knowledge platform Treasure Knowledge reveals that three-quarters (76 %) of leaders really feel positive they’re reaching a complete buyer 360-view to ship these experiences. Nevertheless, the outcomes additionally discover {that a} mere 25 % of shoppers share this sentiment concerning their favourite manufacturers, revealing a big notion hole.

The agency’s new report, Knowledge Pushed Insights: Navigating the Client Panorama in 2024, primarily based on its survey of 1,500 B2C C-level executives and 6,000 shoppers, reveals this massive divide between C-suite confidence and shopper expectations. The road of division could originate with the standard of brand name content material—a staggering 88 % of shoppers imagine that lower than half of the content material they obtain from manufacturers is related.

“As 2023 involves a detailed, it’s value reflecting on shopper expectations and taking an trustworthy evaluation of tips on how to greatest meet their ever-evolving wants,” stated Mark Tack, chief advertising officer at Treasure Knowledge, in a information launch. “This analysis paints a transparent and regarding image: Regardless of manufacturers’ greatest efforts, they battle with messy, advanced buyer knowledge challenges that restrict their skill to know and have interaction shoppers successfully. As manufacturers search to stage up their buyer experiences in 2024 and past, it’s crucial to spend money on individuals, processes, and applied sciences to chart a greater path ahead.”

Different key findings embrace:

Buyer loyalty woes

Virtually half (44 %) of shoppers don’t see any worth from being a long-standing buyer, and 64 % imagine solely new clients obtain one of the best offers and buyer expertise. This exhibits a majority of shoppers really feel undervalued for his or her loyalty, impacting their notion of brand name worth and growing their probability to churn.

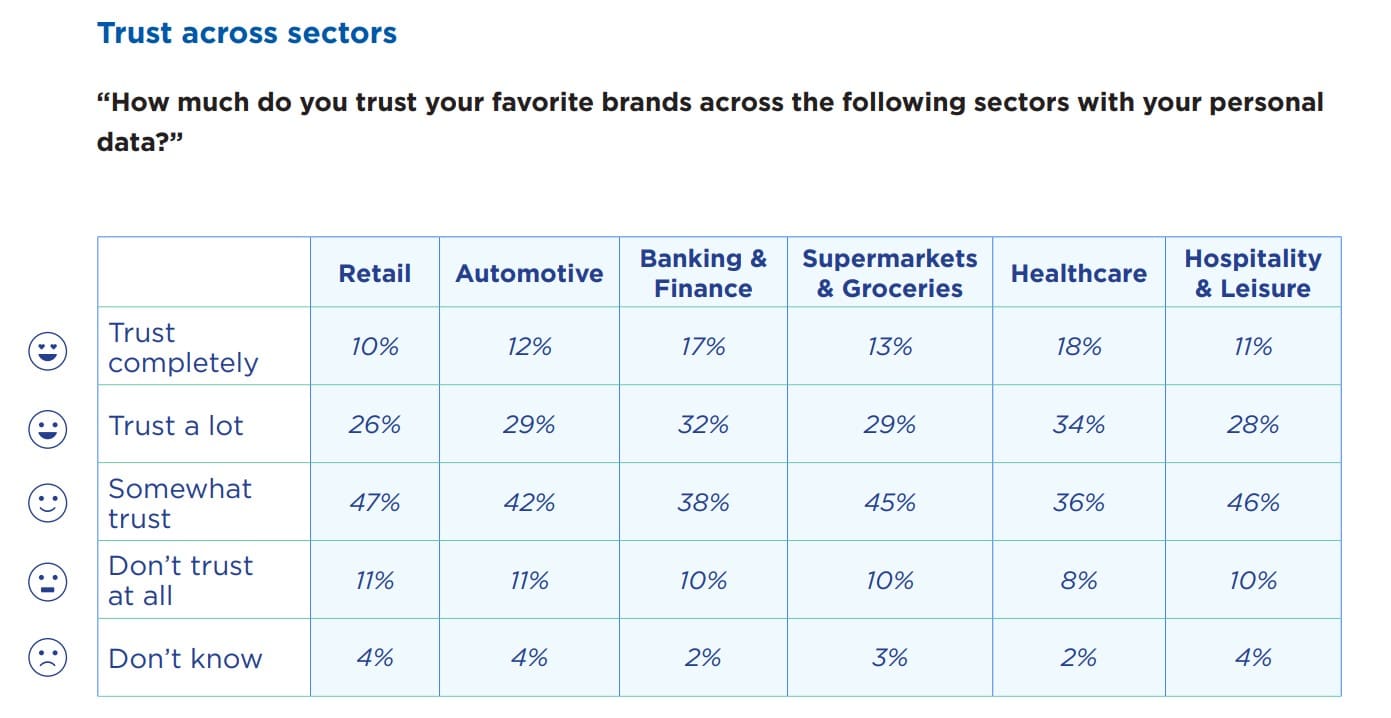

Client belief and anonymity

Whereas over half of shoppers welcome advertising, 49 % of shoppers specific a desire for remaining nameless to manufacturers. Concurrently, 48 % intentionally withhold their private knowledge from companies. This underscores the pressing want for manufacturers to bolster belief in how they gather and use knowledge from most of the people.

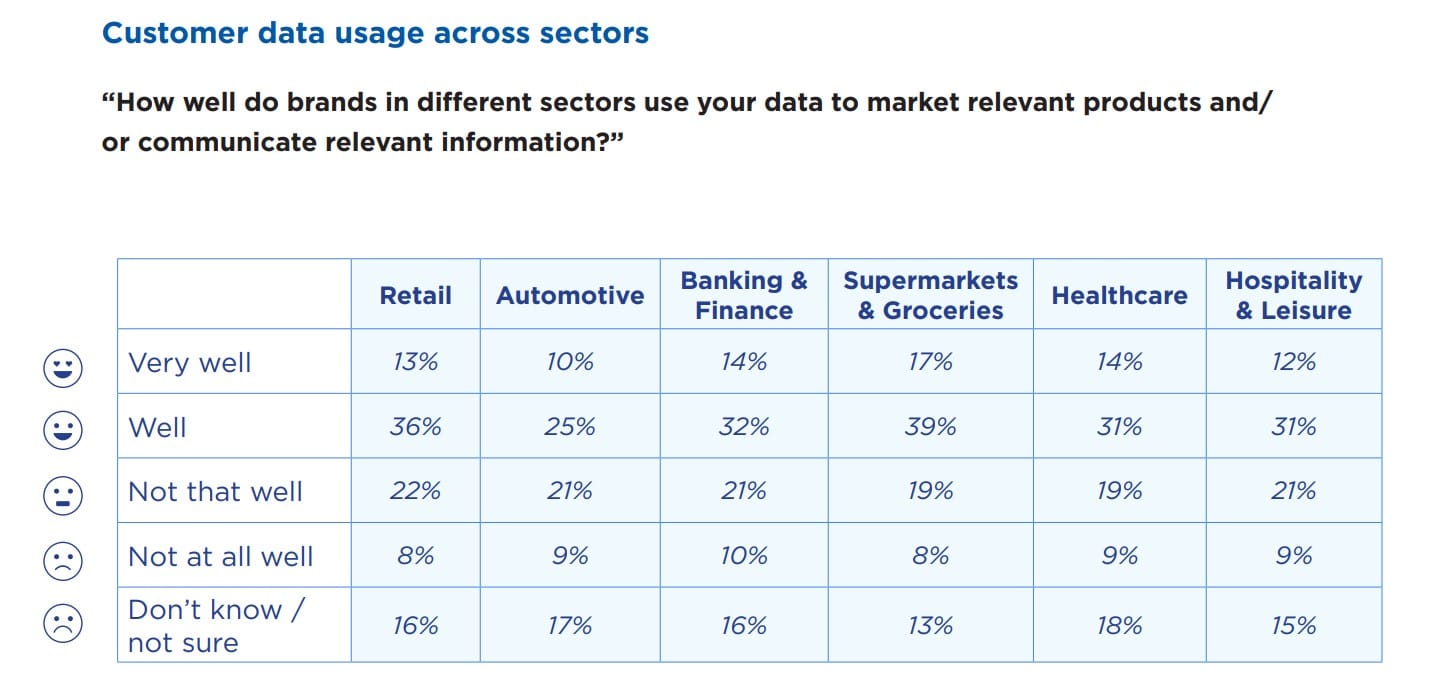

Knowledge competence doubt

A 3rd (33 %) of senior executives specific doubts concerning the knowledge competence of most of their C-suite colleagues, whereas one other 32 % imagine their group collects good high quality knowledge however lacks the abilities to interpret and use it successfully. This means a possible danger of main manufacturers falling behind within the quickly evolving panorama of data-driven buyer insights.

CX & AI funding surge

Sixty-two % of execs plan on investing extra in buyer expertise over the subsequent two years and greater than half (57 %) of organizations plan to take a position extra in AI, with massive companies main at 70 %, emphasizing a speedy surge in AI funding throughout industries. The substantial dedication to AI acknowledges its potential affect on buyer expertise, knowledge analytics, and general financial viability.

As corporations navigate 2024, this report bridges gaps in understanding, and strategically embracing the technological and customer-centric shifts that outline success in an ever-evolving enterprise panorama.

Obtain the total report right here.

Treasure Knowledge’s analysis was primarily based on two surveys, performed by Opinium. The primary surveyed consultant samples of two,000 adults from France, the US and UK – 6,000 respondents in whole – with the information collected between 25 September – 4 October 2023. The second polled 500 C-suite determination makers in B2C corporations from France, the US and UK – 1,500 respondents in whole – with the fieldwork performed between 25 September–4 October 2023.