Manic melt-up in most shorted shares like CVNA,W, and MSTR has lastly discovered some semblance of sanity with a sell-off.

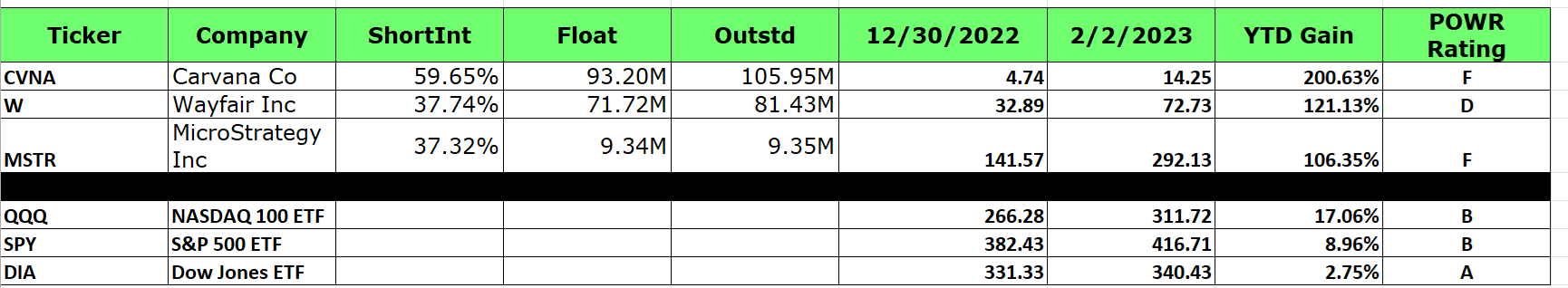

It has positively been a rip-roaring begin to 2023 for shares. As of the shut on February 2, the NASDAQ 100 (QQQ) was up an astounding 17.06%. The S&P 500 (SPY) tacked on practically 9%. The decrease beta Dow Jones Industrials (DIA) gained solely 2.75%.

Spectacular beneficial properties to say the least. Certainly, it was the perfect begin to a yr since 2001 for QQQ. But the loopy beneficial properties to start out the yr in essentially the most shorted shares makes the outsized beneficial properties within the QQQ appear tame compared.

The highest 10 most closely shorted shares by brief curiosity had a very mind-boggling common acquire of 75.28% from January 1 to February 2. The highest 3 most shorted shares by brief curiosity (Carvana, Wayfair, and MicroStrategy) all had beneficial properties of properly over 100% in that very same timeframe. Carvana rose over 200%.

The desk under exhibits that efficiency, together with the comparative efficiency of the key inventory ETFs.

Fascinating to notice that every one three of those huge outperformers weren’t solely closely shorted, but additionally carried extraordinarily low scores from a POWR scores perspective. CVNA and MSTR have been Robust Promote (F rated) shares, whereas W was a Promote (D rated) inventory. Much more purpose to be cautious of the red-hot rally.

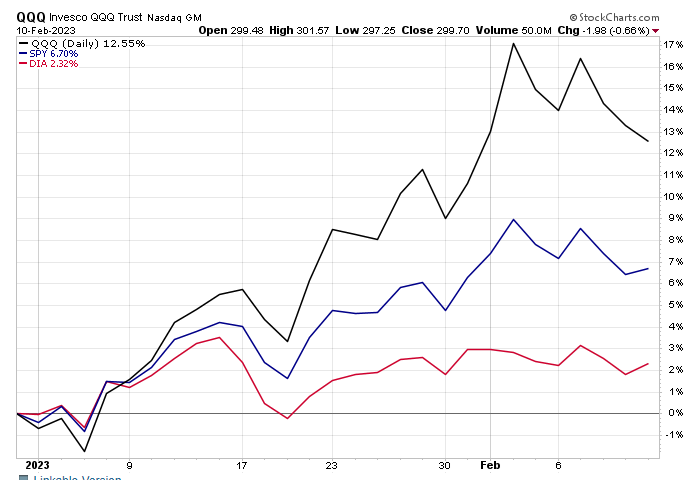

Quick ahead to the most recent shut on Friday and you may see that the largest outperformer (QQQ) to start out 2023 has develop into the largest underperformer over the previous week. NASDAQ 100 dropped 4.5%, S&P 500 gave up simply over 3% whereas the Dow Jones Industrial have just about traded sideways with a loss properly below 1%. Imply reversion is starting. The relative efficiency hole is beginning to slender.

The ridiculous red-hot rally within the excessive beta Nasdaq names in paying homage to 2001 in efficiency. As talked about earlier, 2023 was the perfect begin to the yr since 2001. There is a caveat, although. In 2001, the Nasdaq (QQQ) fell 20% within the remaining 11 months. An amazing begin to a yr does under no circumstances assure easy crusing.

That is readily evident within the current efficiency of the highest brief squeeze shares. All reached extraordinarily overbought ranges on a technical foundation earlier than beginning to crater.

The three most closely shorted names that beforehand led the insane brief squeeze rally increased have lastly fallen again to earth in an enormous approach. Under is a fast synopsis of every.

Carvana (CVNA)

Carvana has dropped 24% since making the February 2 shut of $14.25. Shares truly traded all the way in which up $19.87 on that day solely to reverse course and end close to the lows. The sort of value motion known as a key reversal day and is many occasions a dependable indication of a prime within the inventory. The consumers have gotten exhausted, and the sellers are again in cost.

Wayfair (W)

Comparable value sample for Wayfair. Inventory has fallen over 28% prior to now week. Made an intra-day excessive at $74.25 on February 2 solely to shut a lot decrease on the day. One other key reversal day.

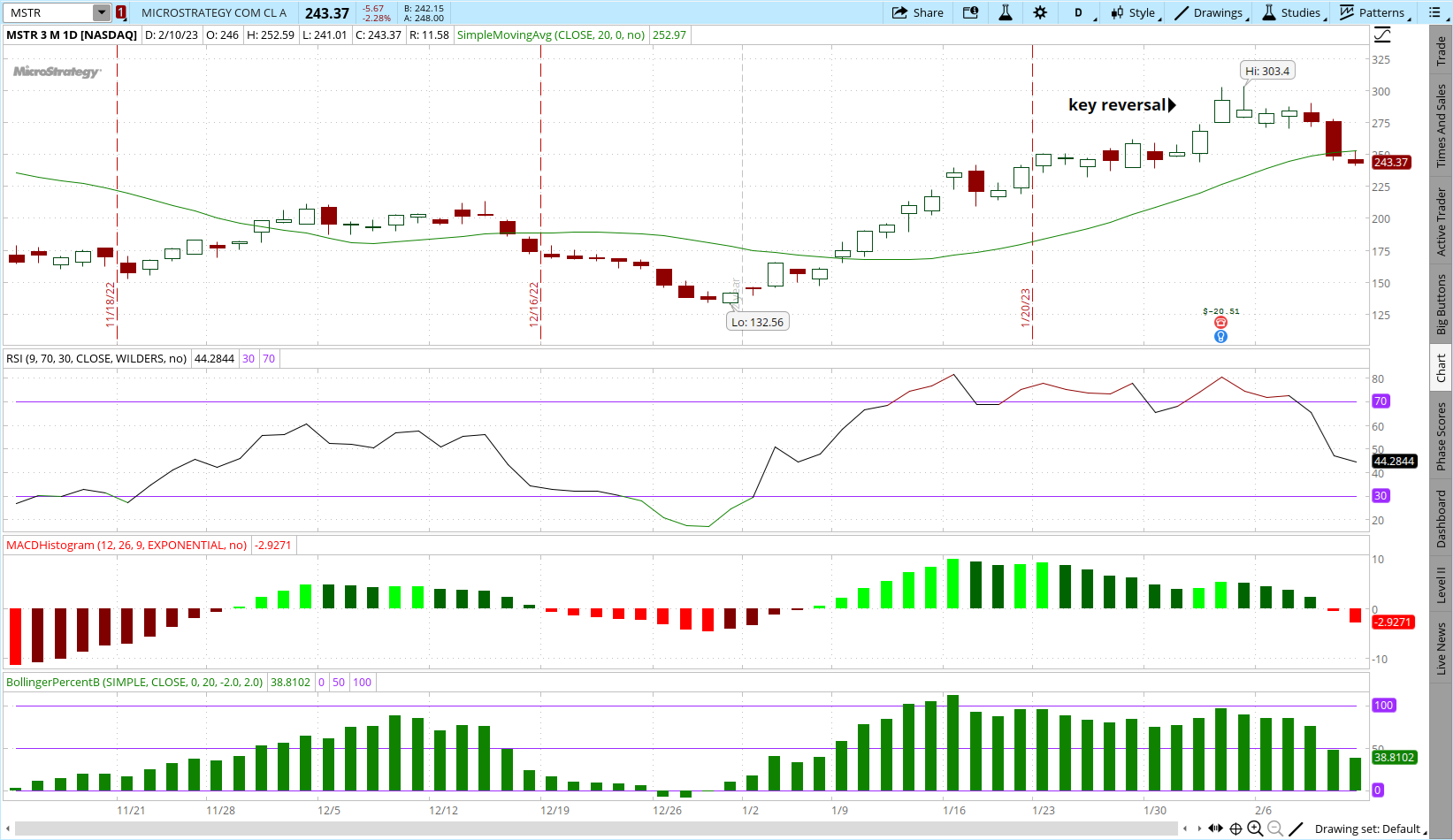

MicroStrategy (MSTR)

As soon as once more, chasing manic momentum on low rated names by no means appears to pay. MSTR has dropped 16.69% for the reason that highs on February 2. One more poster youngster for a key reversal technical sample.

Now that the rally is being to stall, I anticipate the upper high quality, decrease beta names to outperform the decrease high quality, increased beta (and speculative names) over the approaching months.

It can seemingly be a market to select the perfect shares, not simply choose any shares. Do not struggle the Fed has develop into extra of a legal responsibility than an asset for the bulls.

That’s the place the POWR Rankings present an enormous edge. Since inception, the very best A rated Robust Purchase shares have overwhelmed the S&P 500 by greater than 4x since 1999.

After all, shorting shares to benefit from conditions like we now have simply seen could be expensive-and dangerous.

Fortunately, POWR Choices offers a simple and easy answer. Shopping for places on the low rated and over-extended shares like CVNA, W and MSTR offers an outlined danger method to enlarge your returns at a low cost-just $500 or so per commerce. Plus we anticipate the market to let you know when the rally has run out earlier than initiating a brief place.

The POWR Choices portfolio did such a commerce on one among these brief squeeze names only recently with good success to this point.

POWR Choices

What To Do Subsequent?

In case you’re in search of the perfect choices trades for as we speak’s market, it is best to try our newest presentation How one can Commerce Choices with the POWR Rankings. Right here we present you the way to persistently discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

How one can Commerce Choices with the POWR Rankings

All of the Finest!

Tim Biggam

Editor, POWR Choices Publication

MSTR shares closed at $243.37 on Friday, down $-5.67 (-2.28%). Yr-to-date, MSTR has gained 71.91%, versus a 6.70% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit The Finest Manner To Quick The Most Shorted Shares appeared first on StockNews.com