Being a social media influencer is usually a enjoyable and profitable endeavor—till you’re hit with an surprising tax invoice, that’s. Understandably, influencer tax obligations can really feel fairly overwhelming, particularly in the event you’re new to self-employment.

Merely put, in the event you generate a revenue of $400 or extra from sponsored content material, affiliate hyperlinks, endorsements, and so on., then within the eyes of the IRS, you’re self-employed. This implies you want to file a tax report even when your revenue stream is simply part-time or irregular.

However what taxes apply to social media influencers? Are there any deductible enterprise bills? How can creators streamline the tax course of to make all of it rather less hectic?

Don’t let your influencers wait till tax season to seek out out. Share this weblog along with your creator roster to point out them why being proactive about tax season is so essential, and supply some suggestions for staying forward of the sport.

The significance of proactive tax planning for influencers

Surprising tax payments can put you right into a monetary disaster—however that’s not the one cause it’s best to proactively plan for tax season.

For those who don’t file your tax stories—or in the event you file them incorrectly—you would find yourself in sizzling water with the IRS. Tax fraud, evasion, and failure to file all have extreme penalties starting from fines to jail time.

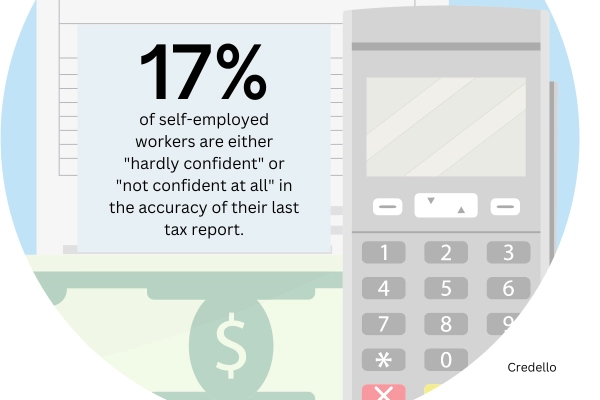

For those who’re confused or frightened about your influencer tax obligations, you’re not alone. 25% of self-employed employees are involved about being audited because of an unintended error on their tax return. Seventeen p.c are “hardly assured” or “not assured in any respect” relating to the accuracy of their final tax report.

Information through Credello

However, there are two key methods you’ll be able to obtain proactive tax planning effectivity.

The primary is to automate your invoicing course of utilizing billing software program. Together with eliminating the danger of human error and making certain your invoices are correct, billing software program shops all of your knowledge in a centralized location, prepared for tax season.

So, no extra scrambling round looking for misplaced invoices or operating into auditing issues due to a billing error.

Secondly, you want to brush up in your influencer tax obligations. This entails understanding what taxes you’re required to pay and why. Lots of people run into tax points just because they don’t understand they’re required to pay a particular tax.

That will help you perceive your tax obligations a bit higher, let’s now talk about an important guidelines that apply—no matter whether or not you classify your self as a content material creator or influencer.

Figuring out tax obligations

These are the principle tax obligations for social media influencers, YouTubers, bloggers, or every other kind of on-line influencer.

Self-employment taxes

Self-employment tax is paid by people who work for themselves. It consists of social safety and Medicare taxes.

For those who’ve ever been employed, you’ll know that social safety and Medicare taxes are calculated and withheld by your employer. So, they’re just about out of sight, out of thoughts. However in the event you’re self-employed, it’s a must to calculate and pay these your self within the type of self-employment tax.

At the moment, you’re obliged to pay self-employment tax in the event you generate a revenue of $400 or extra from self-employment in any given tax yr.

Reporting revenue

Being self-employed, you’re solely answerable for reporting any revenue you make out of your influencing actions. Failing to take action with 100% accuracy can land you in sizzling water do you have to get audited. Monitoring your revenue and bills all year long (as an alternative of leaving it till the final minute) reduces the danger of errors and is far much less hectic.

Paying estimated quarterly taxes as an alternative of 1 lump sum in April is a good suggestion for a similar causes.

So, how do you go about reporting your revenue? There are two necessary kinds you want to know: Schedule C and Type 1099.

Each little bit of revenue you generate, from sponsored posts to affiliate marketing online commissions, have to be reported to the IRS. That is executed through a Schedule C (Type 1040) tax type. Schedule C stories the amount of revenue or loss you generated as a sole proprietor.

The following related type is Type 1099. You’ll obtain one in all these from each model you’re employed with that pays you $600 or extra. These can even be despatched to the IRS, however you want to maintain your particular copy for auditing functions.

Simply notice that even in the event you don’t obtain a 1099 type (since you have been paid lower than $600), you continue to should report this revenue to the IRS.

Precisely recognizing income and reporting your revenue is easy sufficient whenever you solely work with one or two manufacturers. However as your buyer rely will increase and your contracts develop extra refined, issues turn into extra complicated.

instance of that is in the event you start to create your personal content material on platforms like Patreon. It will require you to undertake a subscription income accounting mannequin, which may complicate your income calculation and tax planning processes.

The extra complicated your income mannequin turns into, the extra necessary it’s so that you can automate your accounting and tax submitting course of to submit correct tax stories.

Deductible bills

Deductible bills discuss with any bills incurred by what you are promoting which might be—as outlined by the IRS—“strange and mandatory.” You’ll be able to write off these bills on the finish of the tax yr to scale back your tax invoice.

This can lead to some critical financial savings, however what bills are you able to deduct? Listed below are a couple of examples:

- Dwelling workplace or studio house, so long as it’s used solely for work.

- Dwelling workplace or studio decor, so you’ll be able to create the proper backdrop on your content material.

- Software program, akin to a photograph editor, social media scheduler, or content material administration instrument.

- Promoting. This pertains to self-marketing actions akin to merchandise created for giveaways, on-line adverts, and web-hosting charges.

- Journey bills, offered you’re touring for enterprise causes solely.

- Skilled charges, so you’ll be able to write off providers akin to bookkeeping or a headshot photographer.

- Gear and electronics. So long as they’re used solely for enterprise, you’ll be able to deduct issues akin to cameras, rig lights, smartphones, computer systems, and microphones.

State and native taxes

Influencers should additionally pay state and native taxes (SALT), the sum of which differs relying on location and revenue supply. Liberal states, for instance, will usually implement greater tax obligations than conservative states.

Paying SALT is necessary because it’s used to fund important public providers akin to schooling, hospitals, highway development, regulation enforcement, and so on.

SALT is deductible for any self-employed taxpayer who itemizes their deductions. At the moment, the deduction is capped at $10,000 yearly (or $5,000 in the event you’re submitting individually as a married couple).

Taxes eligible for deduction embody revenue tax, some service taxes, and property taxes.

Worldwide concerns

Probably the greatest issues about being an influencer is that you don’t have any geographical limitations—you’ll be able to work wherever you want. Equally, you’ll be able to work with manufacturers primarily based all around the globe.

However in the event you stay exterior your property nation or work with a global model, you could have to abide by worldwide tax legal guidelines.

Tax deductible bills and influencer freebies, for instance, are handled otherwise around the globe. Some nations impose excessive taxes on all freebies, whereas others resolve how taxable freebies are primarily based on their financial worth and whether or not they got in return for a product evaluate or promotion.

Gross sales and use taxes

Gross sales tax is a consumption tax that the vendor provides to the worth of an merchandise on the level of sale (POS).

For those who, the vendor, acquire gross sales tax from the client at POS, you then remit it to state and native governments. For those who don’t acquire gross sales tax at POS—since you’re working in a state that doesn’t levy it—it turns into use tax as an alternative. This implies it’s the duty of the client to remit the tax to the federal government.

So, how does this work for influencers? Nicely, each state has various legal guidelines that differentiate taxable providers and non-taxable providers. Whether or not or not promoting is a taxable service in your state will decide whether or not you want to pay gross sales tax (or whether or not the model you’re working with must pay use tax).

Carry out a nexus research to get a greater concept of tips on how to navigate gross sales and use tax for what you are promoting.

Tax for hiring staff or contractors

As what you are promoting grows, you could want to rent staff or contractors to do the belongings you don’t have time for.

Hiring staff comes with fairly sophisticated tax obligations. You must receive an employer identification quantity (EIN), withhold federal revenue tax out of your worker’s wages, pay unemployment tax, and extra.

Enlisting the providers of a freelancer or contractor doesn’t include as many tax-heavy obligations, and you may deduct the price of their providers as bills.

So, for instance, you’ll be able to deduct the prices of the freelance video editor you employed to professionally edit your YouTube movies or the online developer you used to construct a promotional web site.

Equally, you’ll be able to deduct the prices of authorized, accounting, and bookkeeping providers.

Don’t overlook to make use of automated accounting software program to streamline this course of. The much less time you spend submitting taxes, the extra time you’ll be able to spend on growth-driving actions, akin to making an attempt out a few of the newest Instagram reel traits.

Be ready for tax season.

Turning your on-line passion right into a fully-fledged enterprise is an thrilling journey, however when the {dollars} begin to roll in, so do your tax duties.

By making certain you’re clued up in your influencer tax obligations, you’ll be able to keep away from any nasty surprises and stresses when tax season comes round. And, as a bonus, you’ll be able to even take pleasure in tax financial savings by deducting enterprise bills—sure, even that fancy new ring gentle you’ve had your eye on. Simply bear in mind to maintain your receipts.