Studying Time: 13 minutes

Till a decade in the past, Buyer Lifetime Worth (CLV) was the center baby of promoting and buyer engagement. Primarily overshadowed by the eldest baby (Buyer Acquisition), who has all the time been essentially the most trusted and the brand new favourite child on the block, just like the social media follower depend.

The unconventional digital transformation that got here with the pandemic and the worldwide financial downturn additionally modified buyer spending habits and behaviors. This modification additionally meant the significance of holding present and constant clients engaged elevated multifold. That stated, buyer acquisition and buyer retention has grow to be an costly affair. Therefore, it turns into essential to take a position, firstly, within the buyer relationships which might be most profitable to the model. It’s critical to know these relationships’ intricacies and have interaction with them with the precise message by means of the correct channels on the proper time.

It begins with specializing in metrics like buyer lifetime worth and making it the inspiration of an environment friendly engagement and advertising technique.

What’s Buyer Lifetime Worth?

Buyer lifetime worth predicts the quantity or the income a buyer might usher in from shopping for your model’s product or paying on your providers for the entire period of their relationship with you. It’s a metric that’ll allow you to gauge buyer loyalty, how efficient your buyer acquisition is, and buyer satisfaction.

Why is Buyer Lifetime Worth Necessary?

This metric has a major influence on buyer loyalty and buyer retention. It helps manufacturers higher perceive their buyer base and direct their advertising efforts in direction of their most dear clients to extend future income. Optimizing their buyer lifetime worth would imply higher monetary viability and regular progress for manufacturers.

However how does it influence the “massive image” metrics?

It helps you enhance income progressively.

It’s easy: the longer the complete buyer lifecycle, the extra income the model earns.

CLV will assist manufacturers select their most loyal clients from their whole buyer base, those that spend essentially the most and have the best common buy worth. When you determine your finest clients, you possibly can enhance engagement and pinpoint upsell alternatives by providing them a customized buyer expertise.

It helps you take away buyer journey friction factors that enhance model loyalty

A dedication to analyzing this metric additionally helps you draw patterns and developments from buyer information. It permits manufacturers to know the place clients are falling by means of and rectify these friction factors of their journey to make sure optimum engagement. This offers you an edge over your campaign-centric rivals.

It helps you determine the most effective clients

This metric helps you simply construct buyer segments with the next common buy frequency fee, spending patterns, and habits. As an alternative of spending the majority of your advertising funds on new clients that finally churn, you possibly can make investments your assets in constructing customized campaigns for higher-value clients.

Conditions to Measure Buyer Lifetime Worth

Now that we perceive the influence of a excessive buyer lifetime worth, let’s have a look at another metrics you’ll must have useful earlier than you get to a buyer lifetime worth system.

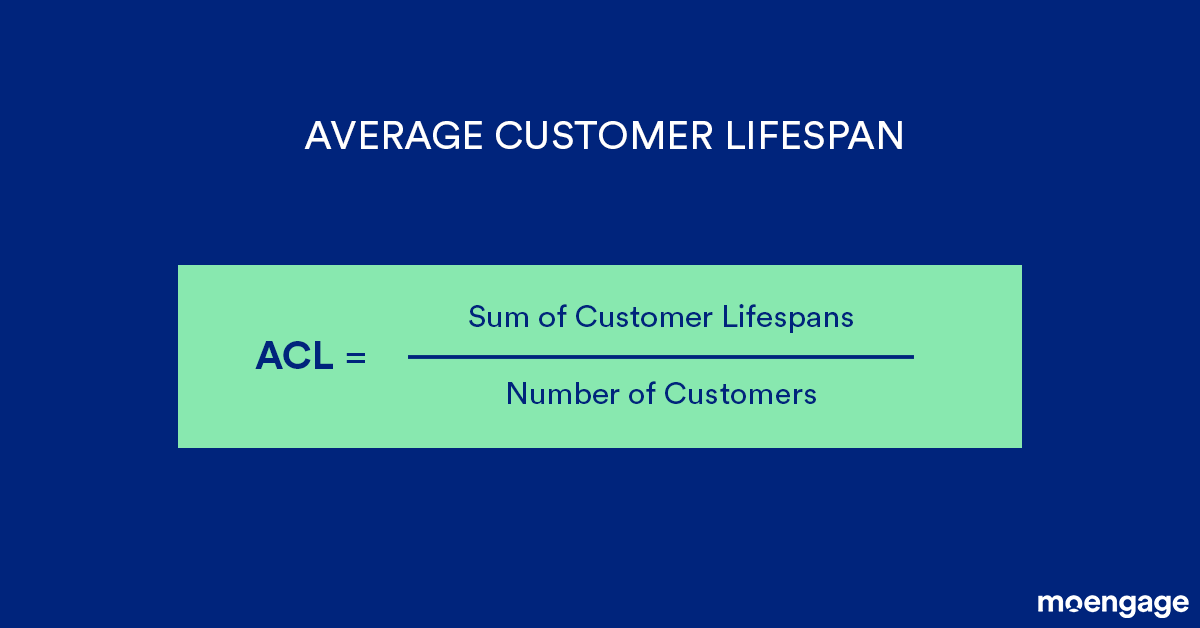

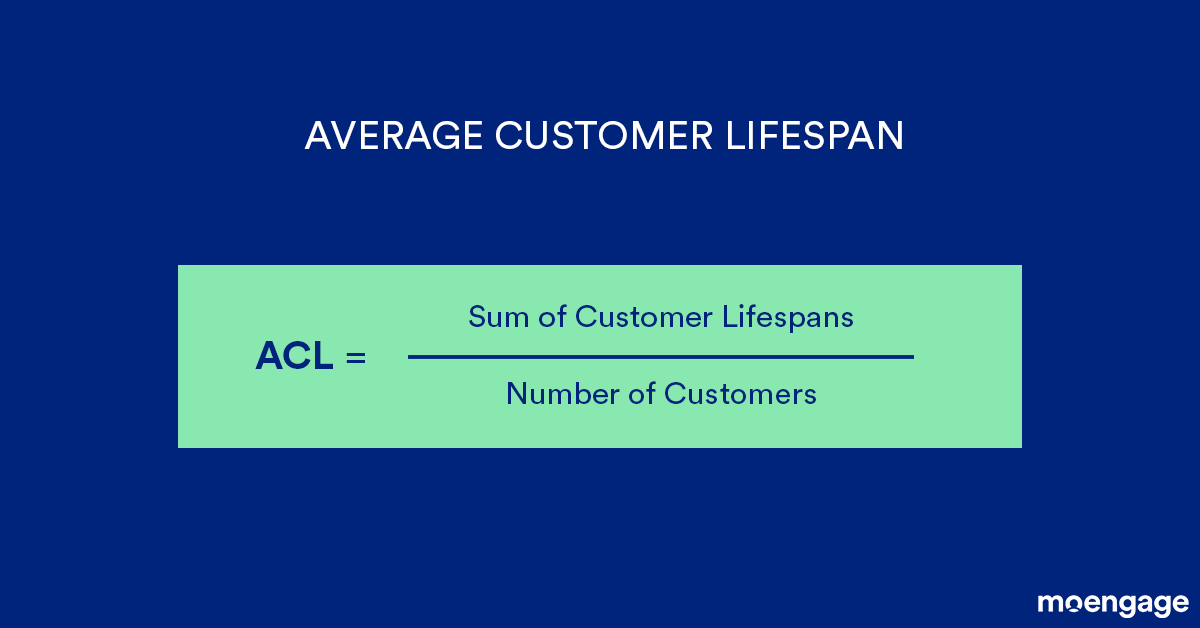

Common buyer lifespan:

Common Buyer Lifespan (ACL) is calculated by including your entire buyer lifespans and dividing by the entire variety of clients you’ve.

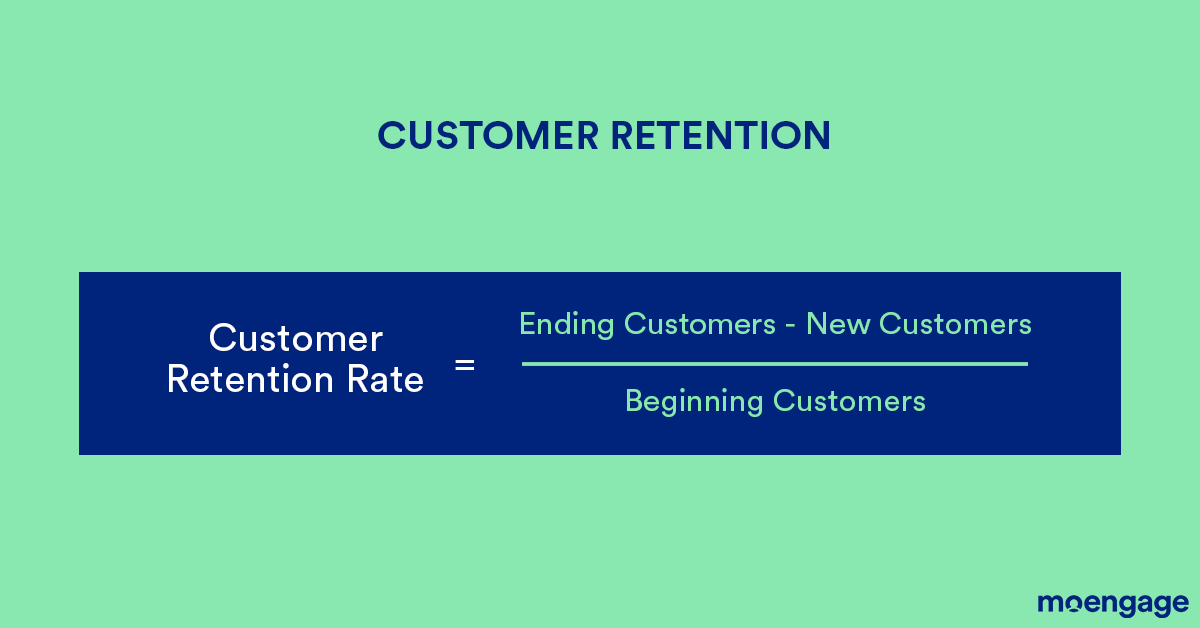

Buyer Retention

Buyer retention refers to an organization’s potential to show clients into repeat consumers and stop them from switching to a competitor.

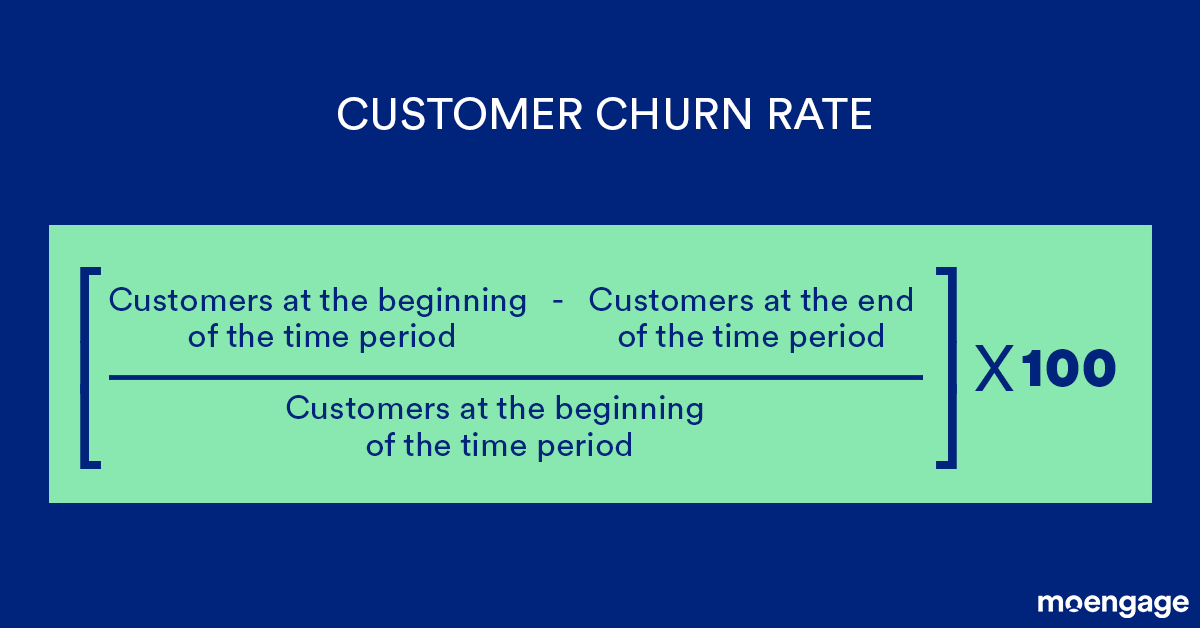

Buyer Churn Fee

The churn fee, or the speed of attrition or buyer churn, is when clients cease doing enterprise with an entity. It’s mostly expressed as the share of service subscribers who discontinue their subscriptions inside a given time interval.

Common revenue margins (per buyer)

Put merely, the revenue margin represents the entire share of gross sales that end in a revenue.

How To Calculate CLV: Buyer Lifetime Worth Formulation

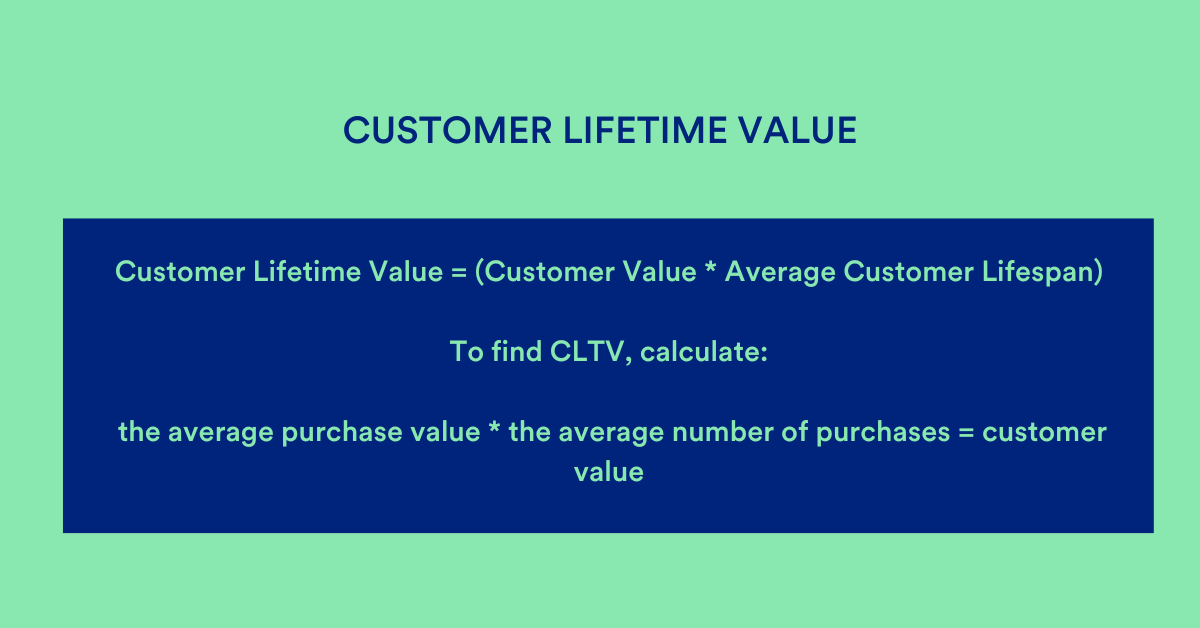

Now that we now have all the weather, let’s have a look at the essential system that can assist you calculate buyer lifetime worth.

When you calculate the typical buyer lifespan, you possibly can multiply that by buyer worth to find out buyer lifetime worth.

Buyer Lifetime Worth Fashions

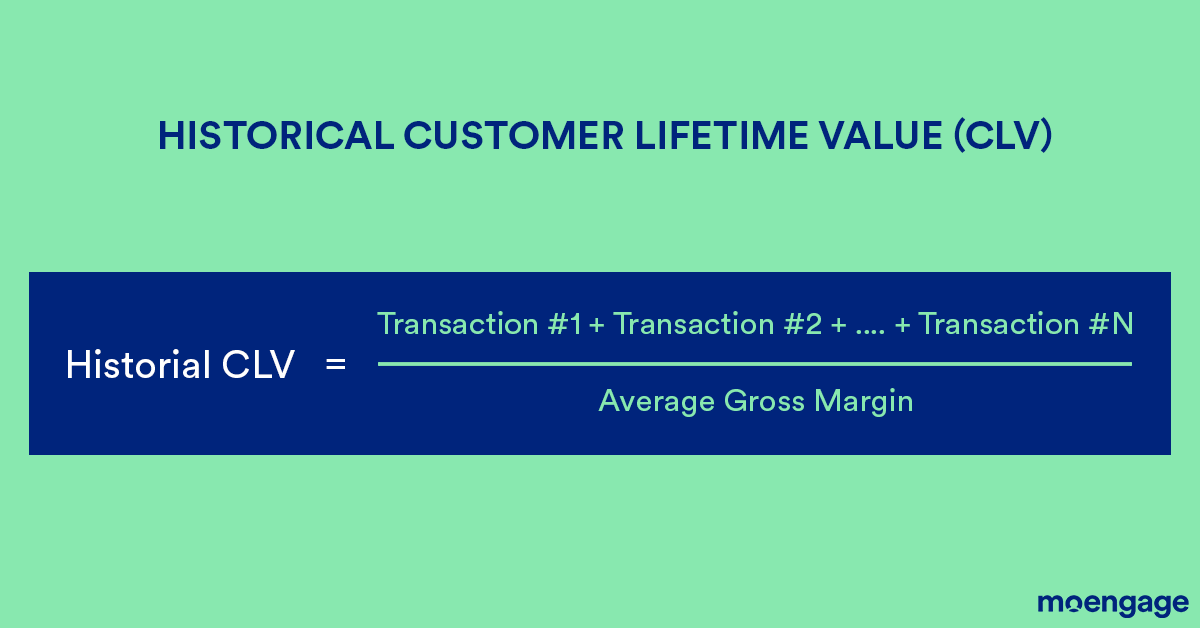

Historic buyer lifetime worth (CLV)

Historic CLV is the sum of all of the gross revenue from a buyer’s previous purchases. To calculate it, it’s essential to add all of the gross revenue values as much as the final transaction (N) a buyer made. Measure CLV primarily based on the web revenue to get the precise revenue a given buyer generates. This includes service prices, return, advertising, acquisition, and so forth.

The draw back is that you just might need to do some sophisticated math on the particular person degree to have essentially the most up-to-date information. Nonetheless, gross margin CLV offers you a radical understanding of your clients’ profitability.

The place: AGM = Common Gross Margin

In precept, this methodology is useful if clients share the identical preferences and work together in the identical method together with your model over roughly the identical time.

Keep in mind that calculating historic CLV means placing all clients, previous and new, into one basket. That is likely to be difficult as a result of they’ll differ with regards to habits and preferences. Variations between shoppers can have an effect on CLV.

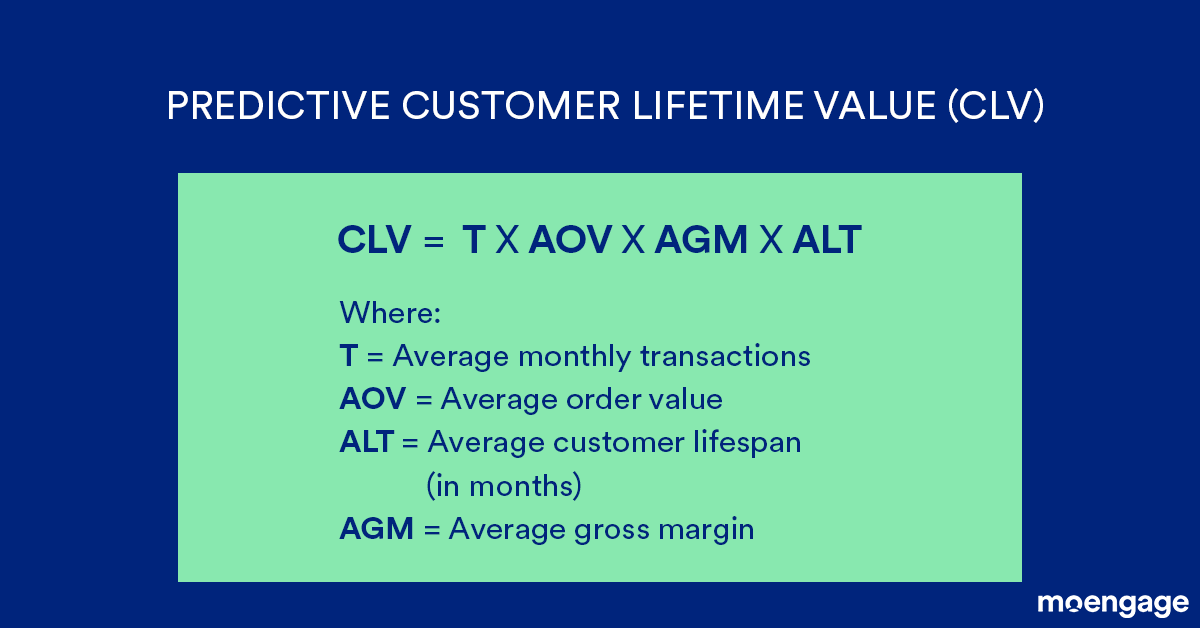

Predictive buyer lifetime worth (CLV)

Predictive CLV goals to mannequin your clients’ transactional behaviors to forecast what actions they may take sooner or later. It’s an excellent indicator of CLV, higher than historic CLV.

The predictive mannequin makes use of algorithms to generate a exact CLV whereas predicting a buyer’s complete worth. It really works primarily based on a historical past of previous transactions and the shopper’s actions.

Once more, you possibly can select from completely different CLV formulation. We’ll give attention to a easy one for readability’s sake.

Right here’s the system:

The place:

T = Common month-to-month transactions

AOV = Common order worth

ALT = Common buyer lifespan (in months)

AGM = Common gross margin

| PRO TIP

An analytics platform with a CDP can shortly combine together with your CRM to provide you simple calculations for AOV and ALT. Nonetheless, keep in mind that this method is a prediction, so it gained’t all the time be 100% correct. To enhance accuracy, you must regulate CLV calculations to the particular business you use in. Precision in your CLV offers you a device for creating sound advertising methods. |

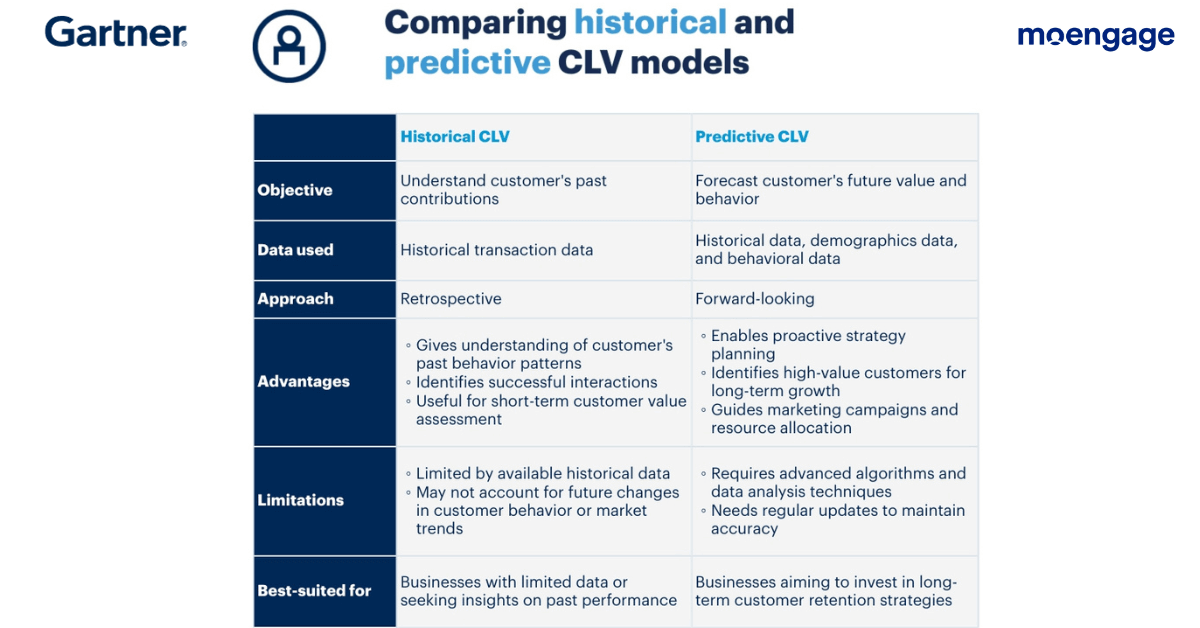

Calculating Buyer Lifetime Worth V/S Historic and Predictive CLV Fashions

Whereas each the Historic and the Predictive buyer lifetime worth fashions could appear fairly comparable of their function or finish purpose, the principle distinction between them is that the historic mannequin is finest utilized for understanding your present efficiency however might show to be rather less correct at predicting the long run than predictive CLV fashions are. Let’s see how they’re each completely different and which mannequin would fit your model finest.

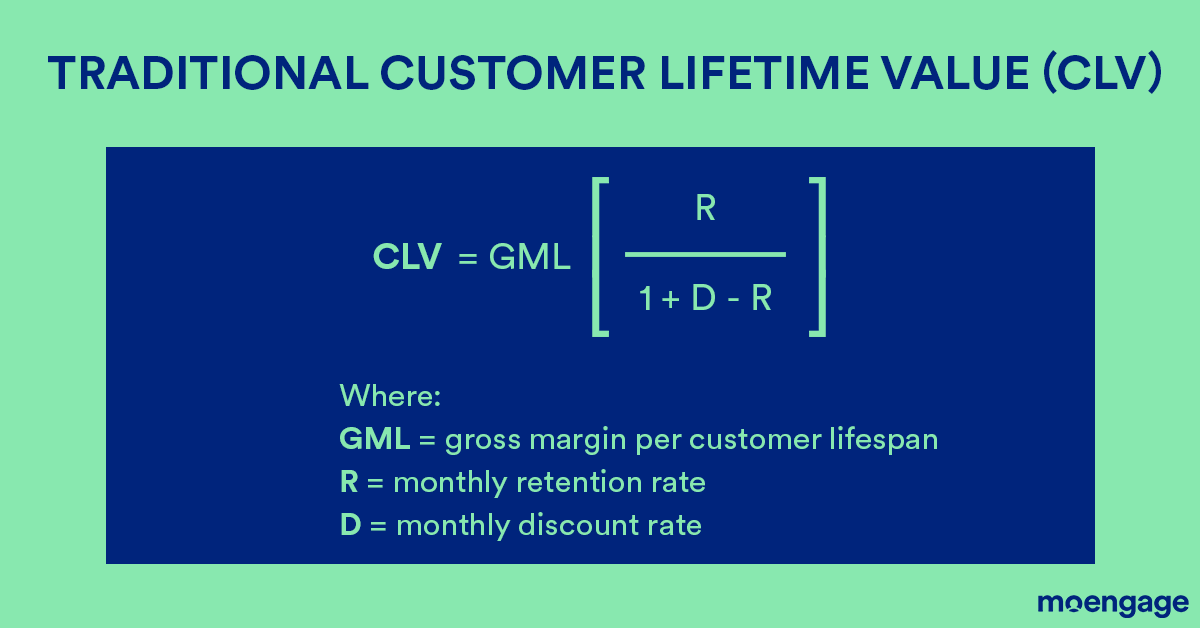

Conventional buyer lifetime worth (CLV)

Typically, a extra conventional however in-depth CLV system may work higher, particularly when your yearly gross sales aren’t flat. In such conditions, it’s important to think about the {discount} fee, common gross margin per buyer lifespan, and retention fee.

Right here’s what your last system will appear like:

The place:

GML = gross margin per buyer lifespan

R = month-to-month retention fee

D = month-to-month {discount} fee

This system seems to be at potential adjustments in buyer income all through a time frame, and annually is corrected by a reduction fee to account for inflation.

The best way to Go About Bettering Buyer Lifetime Worth

Now that we perceive the intricacies of measuring buyer lifetime worth, let’s have a look at what manufacturers might do to enhance buyer lifetime worth.

1. Enhance Buyer Onboarding

One of many primary causes for buyer churn is the shopper needing to know and understand the worth of your providing. A very good onboarding course of might instantly assist remedy this drawback. A seamless onboarding course of can enhance buyer expertise proper on the onset of their enterprise relationship with you. It can encourage clients to interact together with your model constantly and encourage model loyalty.

It’s at this stage that the shopper actually engages together with your model, which is why that is the place you can also make a powerful optimistic influence on the shopper relationship.

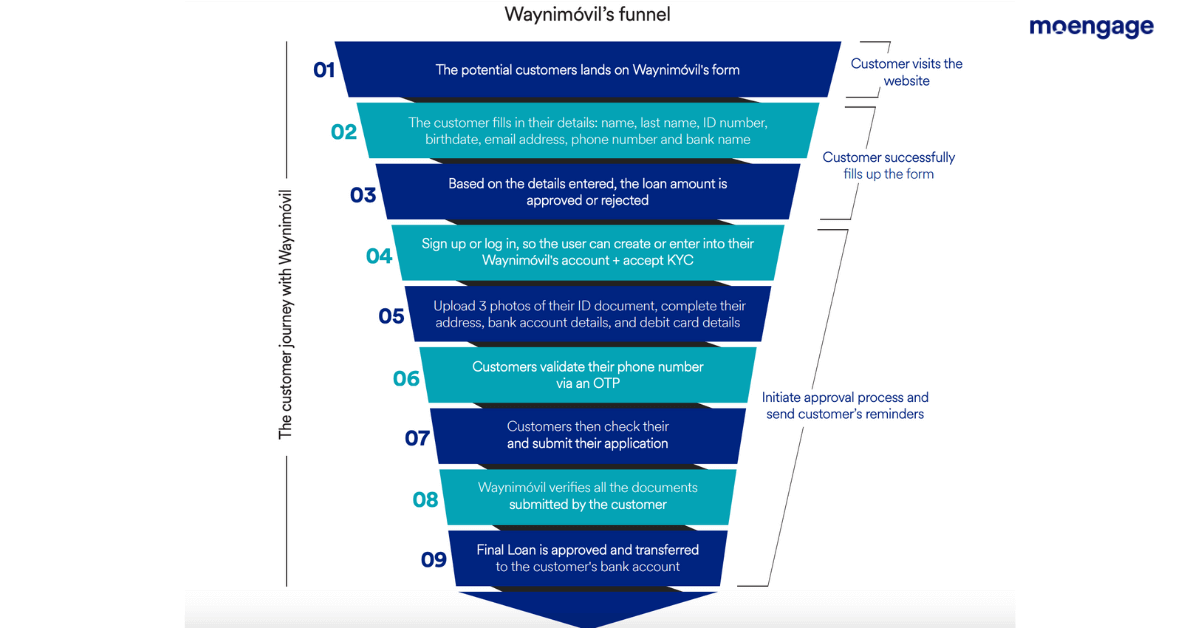

A fantastic instance of a model that centered its advertising efforts on making a seamless journey for its new clients is Waynimovil.

How MoEngage Flows Helped Waynimóvil Improve The Variety of Loans Issued By 2.5x

Waynimóvil’s thorough course of for his or her clients to use for a mortgage contains 9 steps which might be as listed:

Enterprise Problem

As witnessed in most main monetary providers manufacturers, for the reason that course of to get a mortgage consists of a number of steps, Waynimóvil wished to proactively optimize the shopper journey and assist them transfer ahead from the primary contact level of touchdown on the web site to click on the CTA “¡Solicitá tu préstamo”, to start the mortgage utility course of.

MoEngage’s Answer

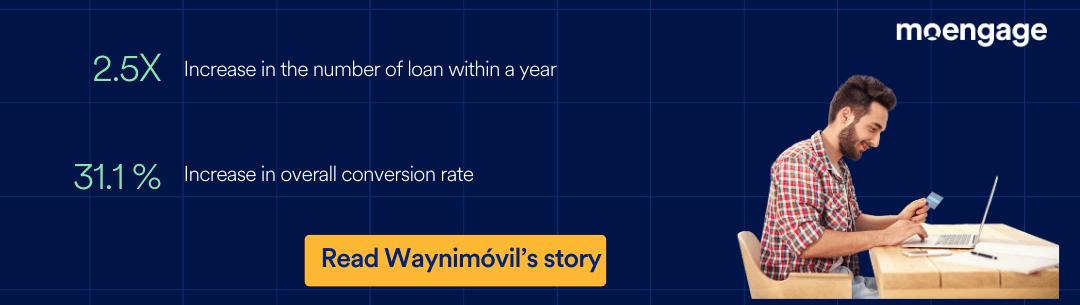

Utilizing MoEngage Flows, Waynimóvil optimized their buyer’s journey from Step 1 to Step 8. To make sure optimum effectivity from their onboarding move, Waynimóvil employed MoEngage to automate the method and arrange pre-requisite situations to interact with high-value clients. This resulted in a 31.1% enhance of their general conversion fee.

2. Cease and Hearken to Buyer Suggestions

To make sure that your present buyer base is glad and engages together with your model constantly, listening to their suggestions and incorporating it into your technique is important. Hearken to their suggestions and analyze what drives them and what they want. To do that, make each touchpoint of their journey a straightforward alternative for them to work together with you. You too can deploy on-site surveys to succeed in and get real-time suggestions out of your web site guests. One other, much less direct method to get buyer suggestions could be to A/B check.

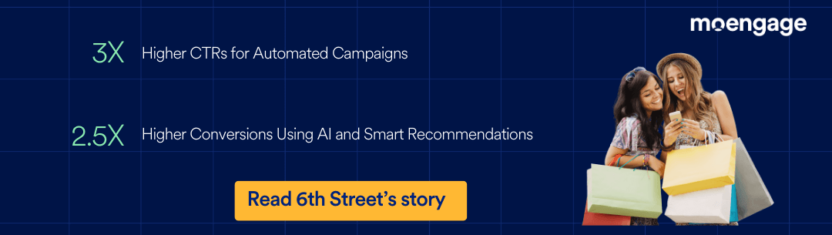

A model that noticed huge success with this method was sixth Avenue.

Enterprise Problem

sixth Avenue, an E-commerce style model with 1000+ worldwide manufacturers for patrons to select from, wished to check the best approaches to finest timings, content material, and journeys to nudge clients from inactivity to searching, to “add to cart” and at last in direction of buy.

MoEngage’s Answer

6thStreet.com used Sherpa optimization to do A/B testing, which enabled them to drive curated communication that labored finest for various segments of consumers. The model additionally leveraged Clever Time Delay to know the most effective time to speak with every buyer. The dedication from the model in direction of letting buyer suggestions and choice dictate their engagement technique helped them obtain a 24% increase in repeat purchases throughout Black Friday.

3. Pay Consideration to Retention

With buyer acquisition prices reaching new peaks every day and elevated consciousness and warning on how a lot clients care to spend, specializing in significant buyer relationships turns into more and more important. As per Semrush, 44% of companies give attention to buyer acquisition, whereas solely 18% give attention to buyer retention.

The phrases ‘optimistic’ and ‘seamless’ are essential once we discuss engagement as a result of 67% of the purchasers cite dangerous buyer expertise as the explanation for churn.

An enormous issue is that customers have a tendency to purchase from manufacturers they belief. That is why changing a brand new buyer takes much more effort than holding on to present clients. 89% of firms say that wonderful buyer expertise considerably impacts buyer retention. To see an influence on buyer lifetime worth, sending clients customized, value-packed content material throughout each channel your present clients are current on is essential.

Merely put, buyer retention issues!

Let’s look at how a powerful retention focus helped customer-centric manufacturers develop their present buyer base.

Sweatcoin Observes a 15% Uptick in Buyer Retention Utilizing Superior Analytics

Enterprise Problem

Sweatcoin was already rising phenomenally in 2022; they knew they may purchase clients at scale. Their purpose was to retain clients at scale; that is the place MoEngage’s Analytics got here in.

MoEngage’s Answer

The Sweatcoin advertising crew onboarded MoEngage to know their clients on a deeper degree and automate all handbook buyer engagement processes. MoEngage’s Superior Analytics helped them get detailed, actionable insights on buyer habits and marketing campaign efficiency. The platform additionally boosts productiveness by eliminating handbook work throughout a number of groups.

4. Upsell and Cross-Promote to Loyal Prospects

Partaking with buyer segments with whom you’ve constructed an excellent buyer relationship is way more efficient, as they’re extra prone to buy, transact, and stream your providing. Prospects who already belief you and have discovered worth from earlier purchases want to purchase from you once more. However to make sure their continued engagement within the type of cross-sell and upsell, manufacturers should perceive their buyer’s journeys and personalize cross-sell and upsell campaigns primarily based on these insights.

Many profitable manufacturers obtain this by onboarding a martech platform that not solely helps them construct a unified buyer profile wealthy with insights from throughout completely different engagement channels, but in addition helps with efficient and deep-level segmentation.

How GIVA Elevated Its Repeat Buy Charges by 50%

Enterprise Problem

Right here’s a glimpse on the challenges that the GIVA crew was going through:

- Discovering related methods to interact clients: With the heavy inflow of consumers that GIVA was buying, there wasn’t a exact and related method to interact with them

- Low repeat buy charges: The chance of consumers coming again to the app to make repeat purchases was additionally comparatively low

MoEngage Answer

Within the jewelry business, many of the purchases occur through the birthday months of consumers, and the GIVA crew wished to capitalize on that. Utilizing multichannel, Birthday-related Flows by MoEngage, GIVA knowledgeable the purchasers that there was a shock jewelry present for them by way of push notifications and WhatsApp. The crew additionally used Dynamic Product Messaging to counter the excessive cart abandonments by sending emails and push notifications with the picture of the precise product that has been left of their carts.

5. Develop Your Engagement With An Omnichannel Technique

Reaching your clients the place they’re will make them really feel valued and enhance their spending and recurring income. Right this moment’s buyer is hyper-connected and engages with varied channels on the day by day. Your model should create attractive and constant experiences for every touchpoint — whether or not it’s a social advert, an e-mail, an SMS marketing campaign, or an in-store buy.

Prospects interacting throughout a number of completely different channels have a 30% larger lifetime worth. They count on manufacturers to interact with offers, promos, and suggestions and attain them the place it’s most handy. And this checks out within the lengthy sport that’s buyer lifetime worth. While you take away boundaries between channels and combine all these touchpoints to kind an omnichannel technique, you allow the purchasers to interact together with your model on their phrases, wherever and each time it fits them finest. It makes it a lot simpler to work together, repeat a purchase order, transact, stream and grow to be a loyal buyer.

Manufacturers who’ve aced the execution of an omnichannel technique have seen nice ROI from their omnichannel campaigns. Let’s delve deeper into how Oswald, a Unilever model, benefitted from their omnichannel technique.

How Oswald, a Unilever Model, Makes use of MoEngage to Energy Omnichannel Engagement

Enterprise Problem

As a model dedicated to constructing an omnichannel technique that spans offline and on-line channels, Oswald’s present martech stack didn’t enable them to unify information from these channels and construct unified buyer profiles. Along with these functionalities, they wished to onboard a platform that might assist them with segmentation and highly effective analytics capabilities.

MoEngage Answer

Oswald onboarded MoEngage for its 360-degree buyer information unification, highly effective predictions mannequin, and segmentation capabilities. Oswald makes use of MoEngage’s highly effective analytics and segmentation capabilities to optimise on-line engagement and assist area gross sales representatives use these insights to personalize their communication.

6. Obtain Your Private(ized) Greatest in Engagement

Personalization in engagement has shortly gone from a “good-to-have” to “dropping clients in case you don’t have”.

We’ve moved past operating campaigns with variable tags that appear like “<hi_firstname>” and name it a job effectively completed. Prospects understand that manufacturers gather their information to construct higher high quality experiences customized to their liking. Martech platforms have additionally began providing clever instruments that assist entrepreneurs section and personalize higher. These instruments might embrace ones that allow you to section primarily based on the recency, common buy frequency fee and financial (RFM segmentation), affinities, widespread habits traits and different customized behaviors.

Manufacturers that do it proper witness extra significant buyer relationships, improved buyer retention, elevated lifetime worth and better complete income.

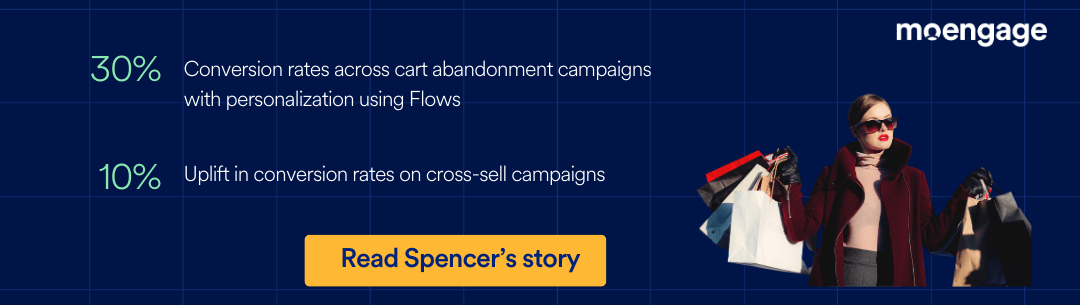

Spencer’s Makes use of Insights-led Personalization to Drive 30% Conversion Throughout Cart Abandonment Campaigns

Enterprise Problem

Spencer’s was scuffling with low ranges of information transparency owing to the restricted capabilities of the prevailing martech resolution. For a model with ambitions of offering customized omnichannel experiences, having an clever platform able to offering a 360-degree view of the shopper profile was crucial.

MoEngage Answer

Utilizing MoEngage, Spencer’s drives customized, omnichannel buyer experiences by segmenting them primarily based on their attributes and actions taken on the web site or the app. Spencer’s Retail additionally utilized superior segmentation (RFM mannequin) to divide clients into loyal, promising, about-to-go dormant cohorts. This helped the crew push related communication to every section, thus lowering the churn fee and enhancing retention (crucial for a retail model), particularly within the present macroeconomic local weather. Utilizing the superior segmentation, Spencer’s noticed a major transition between segments, from hibernating or about-to-go dormant segments to loyal (or potential) segments.

How Ought to You Not Suppose About Buyer lifetime worth

Now that we’ve learn loads about the precise method to buyer lifetime worth, let’s have a look at some widespread misunderstandings round it. These errors nearly carry down the worth of a lifetime value-focused technique.

“Reductions is my fail-safe resolution to extend buyer lifetime worth and complete income.”

Reductions are tempting, time-tested and efficient (not less than short-term). Reductions encourage clients to purchase extra from you. Nonetheless, manufacturers providing too many reductions might find yourself loosing much more than the shopper gained by means of the {discount} marketing campaign may usher in.

In a current webinar speaking about “No-Fuss Retention Methods: The best way to Retain Vacation Customers” , one of many audio system, Sam Pazner, Director of Business Technique (Talon.One) acknowledged, “Reductions are tempting as a result of they enhance buyer purchases. However these are extremely pushed by reductions, who might not store with you in any other case. These clients might find yourself costing your model greater than they create in. Asos is a very good instance, 6% of their clients value them 100 million kilos a yr. To rectify this, the model despatched out customized suggestions to draw long-term clients as a substitute of one-time discount-motivated consumers. This made their order profitability enhance 35% year-on-year.”

We’re saying all this to say that discounting might entice impulse consumers or clients however will most of the time be a long-term buyer relationship.

“Phew, lastly, we now have the one metric we have to make advertising and engagement choices.”

That’s not it. Whereas buyer lifetime worth sums up the anticipated turnovers from a buyer inside a sure time frame, which might differ from a number of weeks as much as a number of years in keeping with utility and business, it could possibly positively not be the only real foundation for all of your advertising choices. This metric helps you consider the effectiveness of your distribution channels and of engagement campaigns, but it surely can not exchange the older metrics.

“So, in future we’ll focus our measures on clients with a very excessive buyer lifetime worth.”

Whereas this may occasionally look like the way in which to go, simply because a selected buyer section CLTV could also be excessive, it is not going to point out that additional campaigns will enhance it. It might nonetheless allow you to analyze what are the explanations for the excessive CLTV on this section and the way you may replicate it throughout others.

The submit What Buyer Lifetime Worth is and Methods to Increase It appeared first on MoEngage.